Many Experts Say Health-Care System Inefficient, Wasteful

“We’re not getting what we pay for,” says Denis Cortese, president and chief executive of the Mayo Clinic. “It’s just that simple.”

“Our health-care system is fraught with waste,” says Gary Kaplan, chairman of Seattle’s cutting-edge Virginia Mason Medical Center. As much as half of the $2.3 trillion spent today does nothing to improve health, he says.

Not only is American health care inefficient and wasteful, says Kaiser Permanente chief executive George Halvorson, much of it is dangerous.

…

The United States today devotes 16 percent of its gross domestic product to medical care, more per capita than any other nation in the world. Yet numerous measures indicate the country lags in overall health: It ranks 29th in infant mortality, 48th in life expectancy and 19th out of 19 industrialized nations in preventable deaths.

One way to reconfigure health spending is to shift large sums into prevention and wellness, said Reed Tuckson, a physician and executive vice president at UnitedHealth Group in Minneapolis. The idea is to tackle the handful of preventable, chronic illnesses such as heart disease and diabetes that account for 75 percent of health-care costs.

…

the Dartmouth team concluded that as much as 30 percent of medical spending — or $700 billion — does nothing to improve care.

I continue to write about this serious problem for the USA. The credit crisis is an immediate crisis (with roots in many bad decisions over the last decade). But the health care crisis is just as deadly. The health care crisis is like a person smoking. It might not kill the economy immediately, but the huge harm down to the economy by the broken healthcare system is like a cancer on the economy.

Previous posts on problems and suggestions for improvement: PBS Documentary on Improving Hospitals – site and books on improving the health care system – International Health Care System Performance – USA Health Care Improvement – Broken Health Care System: Self-Employed Insurance – Excessive Health Care Costs – USA Spent $2.1 Trillion on Health Care in 2006

I believe in the management at Google is doing as good a job as the management at any company. They are not afraid to pursue their convictions even if conventional wisdom says they should not. I believe in Google more than the conventional wisdom. And I have been buying Google stock as it has declined the last 6 months.

I am perfectly happy for Google’s stock price to continue declining: I will continue to buy. I have no intention of selling for decades. Things could change, that would lead me to sell but right now I am firmly a believer in owning a piece of Google for the long term. I am thrilled to have very smart engineers effectively guiding a company (including sustaining a culture where engineers can provide value without the amount of pointy haired boss behavior found elsewhere) to provide value to customers and users of their services while profiting quite nicely. And at these prices the investment opportunity looks great to me. I still believe in following prudent diversification practices (far less than 10% of my investments are in Google stock)

Google CEO defiant in defending energy interests

He was quick to add that Google has a material interest in lower energy costs to help power its crucial data centers. “We’re going to likely consume more [energy], and we’d like the prices to go down,” he said.

…

Schmidt said the bulk of spending on necessary research and development for Google’s ambitious energy plan will have to come from the government. The CEO added that he’s almost certain that an opportunity to tap government largesse is now at hand, as he believes a “stimulus package” will follow the $700 billion Wall Street bailout

I have written about Google’s focus on energy previously: Google Investing Huge Sums in Renewable Energy and is Hiring – Google.org Invests $10 million in Geothermal Energy – Reduce Computer Waste.

With most companies I would be very skeptical delving into area pretty far removed from their core business would likely not prove an effective strategy. But I believe Google can be successful with such efforts. Some will certainly fail but Google will manage that fine and have at least one or two payoff in such a large way that all the investments are paid off quite well.

Related: Google Believes in Engineers – Google’s Underwater Cables – Data Center Energy Needs – 12 Stocks for 10 Years Update – June 2008

Jobless Rate Rises to 6.7% in November

…

The decline, the largest one-month loss since December 1974, was fresh evidence that the economic contraction accelerated in November, promising to make the current recession, already 12 months old, the longest since the Great Depression. The previous record was 16 months, in the severe recessions of the mid-1970s and early 1980s.

…

The manufacturing sector has been particularly hard hit, losing more than half a million jobs this year. That is nearly half the 1.2 million jobs lost since employment peaked in December and, in January, began its uninterrupted decline. The cutbacks seem likely to accelerate as the three Detroit automakers close more factories and shrink payrolls even more

…

With all this in mind, and particularly the shrinking employment rolls, economists are estimating that the gross domestic product is contracting at an annual rate of 4 percent or more in the fourth quarter, after a decline of 0.3 percent in the third quarter.

The news was even worse than the anticipated 350,000 losses. And Previous months figures were adjusted from 240,000 losses in October to 320,00 and from 284,000 in September to 403,000. And these numbers are on an already extremely poor job picture the previous 7 years. One of the great strengths of the US economy over the last 50 years has been job creation. We know we are in for serious problems, the question is how serious and how long. One of the most important gages of that will be how many jobs are lost.

When job losses stop and job gains start (in the aggregate, for the entire economy) it will be a very positive sign. Normally jobs are a lagging indicator, meaning job data lags the actual economy. Job losses will not increases until after the economy starts to grow. Of course, economic data doesn’t always fit the conventional wisdom.

This is one more piece of evidence that the economy is not looking good. And 2009 is likely to be a bad year for the economy overall.

Related: Bad News on Jobs (Sep 2008) – What Do Unemployment Stats Mean? – The Economy is in Serious Trouble – Financial Market Meltdown

Continuation of: USA Manufacturing is Healthy

The real problem with the USA economy is that a country cannot live beyond its means forever. Those living in USA have consumed far more than they have produced for decades. That is not sustainable. The living beyond our means is mainly due to massively increased consumption, not shrinking output (in manufacturing or service). One, of many examples, of the increased consumption is average square footage of single-family homes in the USA: 1950 – 983; 1970 – 1,500; 1990 – 2,080; 2004 – 2,349.

In case it isn’t totally obvious to you. You don’t fix this problem by encouraging more spending and borrowing: either by the government or by consumers. The long term problem for the USA economy is that people have consuming more than they have been producing. Personally, as this continues you reach a point where getting another credit card does not work. The same holds true for the collective health of a country. A country cannot solve the problem of having bills come due from decades of living beyond its means by charging more so that they can continue to live beyond their means.

Where the USA is in the continuum, is hard for me to judge. For the sack of illustration, lets say a consumer can get to 10 cards before they finally fail. If the consumer reaches the limit on 2 credit cards they have the choice to continue to the party by getting another credit card. Or they have the choice of addressing the situation they have gotten themselves into. If they decide to become responsible they have a challenge but one they can endure with some hardships.

If they press on to 5 credit cards and then max them out they come to the same decision. Dig themselves deeper in debt to avoid the problem today or live up their past behavior and become responsible. The work they have ahead of themselves is much more challenging than if they had started working on the problem when they only had 2 cards.

If they press on to 9 cards and now have the decision again. The effort to find a solution may be almost impossible. Borrow more to pay for past mistakes while maintaining some expenditures may be possible (but they will have to live on less than they earn). By the time you are this far down the failed path you have so much going to pay for your past bills you can’t spend even close to what you currently earn on current expenses. Letting yourself get to this point is very bad. And most likely as a person you will go bankrupt.

Read more

When looking at the long term data, USA manufacturing output continues to increase. For decades people have been repeating the claim that the manufacturing base is eroding. It has not been true. I realize the economy is on weak ground today, I am not talking about that, I am looking at the long term trends.

The USA manufactures more than anyone else – by far. The percentage of total global manufacturing is the same today it was two decades ago (and further back as well). For decades people have been saying the USA has lost the manufacturing base – it just is not true. No matter how many times they say it does not make it true. It is true since 2000 the USA increase in manufacturing output (note not a decrease) has not kept pace with global grown in manufacturing output (global output in that period is up 47% and the USA is up 19% – Japan is down 10% for that period).

I would guess 20 years from today the USA will have a lower percentage of worldwide manufacturing. But I don’t see any reason believe the USA will see a decline in total manufacturing output. I just think the rest of the world is likely to grow manufacturing output more rapidly.

Looking at a year or even 2 or 3 years of manufacturing output data leaves a great deal of room to see trends where really just random variation exists. Even for longer periods trends are hard to project into the future.

Conventional wisdom is correct about China growing manufacturing output tremendously. China has grown from 4% of the output of the largest manufacturing companies in 1990 to manufacturing 16% of the total output in China today. That 12% had to come from other’s shares. And given all you hear from the general press, financial press, politicians, commentators… you would think the USA must have much less than China today, so may 10% and maybe they had 20% in 1990. When actually in 1990 the USA had 28% and in 2007 they had 27%.

Manufacturing jobs are not moving oversees. Manufacturing jobs are decreasing everywhere.

Read more

Diversification overrated? Not a chance by Jason Zweig

For anyone with a sustainable ability to identify the hottest investment of the moment, diversification is a mistake. But if you really believe you’ve got that ability, you’re not just mistaken. You need to be hauled off in a straitjacket to the Institute for the Treatment of Investment Insanity.

Exactly right. As we posted previously Warren Buffett’s diversification thoughts are similar

You have to remember when Warren Buffett says “professional and have confidence” he doesn’t really mean just what those words say. He mean if you are Charlie Munger, George Soros, Jimmy Rodgers and maybe 10 other people alive today (maybe I am too restrictive, maybe he would include 50 more people alive today, but I doubt it).

Related: Dilbert on Investing – investment risks – Curious Cat Investing and Economics Search Engine

Feds Rethink Rules on Retirement Savings

Among the possible changes: allowing taxpayers to delay taking required withdrawals from their individual retirement accounts, 401(k) plans and other similar accounts this year — or at least reducing the amount that must be withdrawn. Also under consideration are various ways to provide tax relief for people who already have made their required withdrawals for this year.

This is silly. Everyone in the situation of having to make a withdrawal has know about the requirement for years. My guess is this has been the law for over 20 years. Yes, the stock market is down. Yes, being forced to sell now would be bad. And how does providing “tax relief” to those who already made required withdrawals make any sense? Why not just have the treasury send checks to every American, who had a loss on an investment this year, equal to the amount of their loss? (By the way this is sarcasm – they should not really do that). These people have lost any sense of what investing, planning, responsibly… are.

First, knowing you have required withdrawals from your IRA, you should not hold those assets in stock (I suppose you could have significant cash assets outside your IRA and chose to just use the next option). Second, you can buy the stock outside your IRA at the same minute you sell them in the IRA. What is the big deal: the cost should be about $20 in stock commission for each stock – you save that much each time you fill up your gas tank lately (compared to prices this summer). All that not having to withdraw funds does is let those wealthy enough not to need a small amount of their IRA or 401(k) savings by the time they are 70 1/2 to keep deferring taxes on their investment gains.

Therein lies one of the major problems. This year’s distributions are based on Dec. 31, 2007, levels — a time when market prices generally were far above today’s deeply depressed values. As a result, “millions of Americans are forced to withdraw larger-than-anticipated amounts from already-depleted retirement funds,” says David Certner, legislative policy director at AARP, an advocacy group that represents nearly 40 million older Americans.

What kind of 1984 newspeak is this? I mean this is absolutely ridicules. You have to withdraw the exact amount you knew on January 1st 2008. Nothing about that has changed in almost a year. How can the Wall Street Journal report this without pointing out the completely false claim.

Read more

For me, giving back to others is part of my personal financial plan. As I have said most people that are actually able to read this are financially much better off than billions of other people today. At least they have the potential to be if they don’t chose to live beyond their means. Here are some of the ways I give back to others.

Kiva is a wonderful organization and particularly well suited to discuss because they do a great job of using the internet to make the experience rewarding for people looking to help – as I have mentioned before: Using Capitalism to Make a Better World. One of my goals for this blog is to increase the number of readers participating in Kiva – see current Curious Cat Kivans. I have also created a lending team on Kiva. Kiva added a feature that allows people to connect online. When you make a loan you may link you loan to a group.

I actually give more to Trickle Up (even though I write about Kiva much more). I have been giving to them for a long time. They appeal to my same desire to help people help themselves. I believe in the power of capitalism and people to provide long term increases in standards of living. I love the idea of providing support that grows over time. I like investing and reaping the rewards myself later (with investment I make for myself). But I also like to do that with my gifts. I would like to be able to provide opportunities to many people and have many of them take advantage of that to build a better life for themselves, their families and their children.

The photo shows Frew Wube, Haimanot and Melkan (brother and two sisters), an entrepreneur that received a grant from Trickle up. Trickle Up provides grants to entrepreneur, similar to micro loans, except the entrepreneur does not have to pay back the grant. They are able to use the full funds to invest in their business and use all the income they are able to generate to increase their standard of living and re-invest in the business.

“I also save every month,” says Frew, who has over $40 stored in a cooperative savings fund. The capital he has saved with other people in his group is used to provide loans to group members at a low interest rate. Frew, now able to access credit thanks to his Trickle Up clothing business, has taken progressively larger loans from the group, including his latest loan of $300 to start a candle business.

Citigroup Saw No Red Flags Even as It Made Bolder Bets

…

Citigroup’s stock has plummeted to its lowest price in more than a decade, closing Friday at $3.77. At that price the company is worth just $20.5 billion, down from $244 billion two years ago. Waves of layoffs have accompanied that slide, with about 75,000 jobs already gone or set to disappear from a work force that numbered about 375,000 a year ago.

…

“They pushed to get earnings, but in doing so, they took on more risk than they probably should have if they are going to be, in the end, a bank subject to regulatory controls,” said Roy Smith, a professor at the Stern School of Business at New York University. “Safe and soundness has to be no less important than growth and profits but that was subordinated by these guys.”

It is sad to see the same story repeated over and over. Give people the change for obscene bonuses. They make up claims that they are making lots of money to get bonuses but actually set the company to go bankrupt. They take huge bonuses because of course they are so smart and successful. The company fails and they say the market is to blame (it isn’t that they are really not that smart and of course they deserve the obscene bonuses they took before the collapse – or even after the collapse). They feel no shame for the horrible mess they leave in their wake that they would paid more than a king’s ransom to manage. They will be on to similar schemes in a few years.

If you are a bank you make money by borrowing for less than you lend. If you are a speculator then you try to out bet the other speculators. Nothing wrong with either choice to me. When you want to say you are a bank but you want to make most of your money from speculating their is a problem. Investment banks used to also make huge amounts from fees they would charge (they still do but not enough to offset the huge speculative losses).

Read more

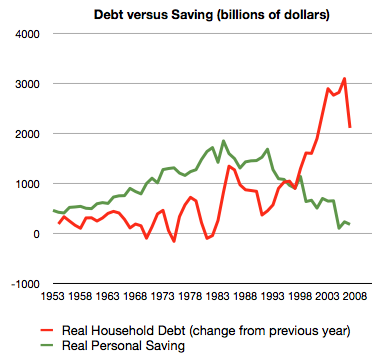

The whole sorry mess in one picture (including chart) by Philip Brewer

…

Starting back in about 2005, the American consumer reached the point that they could no longer service ever-increasing amounts of debt. That led to the housing bubble popping. The result is what you can see in the last datapoint on the graph–less new borrowing in 2007.

Related: $2,540,000,000,000 in USA Consumer Debt – Americans are Drowning in Debt – save an emergency fund – Financial Illiteracy Credit Trap – posts on saving money