Frontline World traveled to Uganda to explore the impact of microfinance and provide some great details on how Kiva is bringing economic opportunity to entrepreneurs. The site includes details and a nice webcast. It is great to see how people can connect directly using Kiva. And it is great to see how people can take small loans and some effort and financial literacy to make a living for themselves. The effort of these entrepreneurs to manage their finances would benefit many people in the rich world plan for retirement…

As I have mentioned before, if you loan through Kiva send me a link to your Kiva page and I can add it to the Curious Cat Kivans page.

Related: Make the World Better Using Capitalism – Helping People Help Themselves – Make the World Better – How Rich are You

…

When you consider that farm income is at record levels (thanks to the ethanol boom, itself fueled by another set of federal subsidies); that the World Trade Organization has ruled that several of these subsidies are illegal; that the federal government is broke and the president is threatening a veto, bringing forth a $288 billion farm bill that guarantees billions in payments to commodity farmers seems impressively defiant.

…

And the government would not need to pay feedlots to clean up the water or upgrade their manure pits if subsidized grain didn’t make rearing animals on feedlots more economical than keeping them on farms. Why does the farm bill pay feedlots to install waste treatment systems rather than simply pay ranchers to keep their animals on grass, where the soil would be only too happy to treat their waste at no cost?

Related: Farming Without Subsidies in New Zealand – Washington Pays Grandchildren’s Taxes to Special Interests Today – USA Federal Debt Now $516,348 Per Household

The Motely Fool is one of the best web sites for learning about investing (it is one of the sites included in our investing links – on the left column of this page). A recent article on the site is worth reading – Ways to Retire Sooner:

Embrace stocks Saving more is great, but there’s only so much you’ll be able to put aside. You have to make the most of what you have. People are often too conservative in their retirement investments. Despite the sometimes-violent ups and downs of the stock market, the long-term return on stocks far exceeds that of less risky investments like bonds and bank savings accounts.

These are not exactly earth shattering recommendation but so many people fail to take even the most basic steps to assure a economically viable retirement the simple advice needs to be re-enforced. No one piece of advice can assure success but by educating yourself about investing and retirement planning and taking steps when you are in your 20s, 30s and 40s you can succeed. You can also succeed without doing anything in your 20s it just means you have to do more work later. Those that get started earlier get a huge advantage.

Related: Saving for Retirement – Retirement Tips from TIAA CREF – Retiring Later, Out of Necessity – investment risks – IRA (Individual Retirement Accounts)

The World Bank compiles a ranking of the easiest countries from which to run a business. The rank counties on categories such as: protecting investors (New Zealand is #1), enforcing contracts (Hong Kong is #1), employing workers (USA and Singapore tied for #1). The overall ranking for 2007:

- Singapore – 2006 #2

- New Zealand – 2006 #1

- United States – 2006 #3

- Hong Kong, China – 2006 #7

- Denmark – 2006 #8

- United Kingdom – 2006 #9

- Canada – 2006 #4

- Ireland

- Australia – 2006 #6

- Iceland

Related: Countries Which are Easiest for Doing Business 2006 – Top 10 Manufacturing Countries – Farming Without Subsidies in New Zealand – Growing Size of non-USA Economies

We posted on Muhammad Yunus and Grameen Bank when he was awarded the Nobel Peace Prize last year. Here is a nice Interview with Mohammad Yunus:

So microcredit can be a social business. I don’t lend money to the poor people to make money myself. I lend money to the people to help them get out of poverty, so I can keep the interest rate low, because I don’t need to make money for myself. As long as I can cover the cost and run the company, that’s good enough. So that’s the idea for social business. So once we include this into the business world, tremendous things can happen in poverty alleviation, in nutrition, in health care, in child care, you name it — whatever problem we see around the world can be framed, can be designed as a social business and address that.

Today we leave everything to the government. Let government solve all the problems. We citizens are free, we’re busy making money. That’s not the way it should be. We citizens, we individuals, are capable people addressing social issues. Maybe address a small social issue within my neighborhood, maybe within my district, within my village. Government has to cover the whole country, that’s the only difference. But I’m more innovative than the government. I’m more enterprising than the government.

Related: Harnessing Capitalism to Improve the World – Microfinancing Entrepreneurs – Deming on the Purpose of Organizations

A Washington official dares to tell the truth

…

Walker: The present value of future unfunded liabilities for Medicare, Social Security and other plans is $53 trillion.

Walker: “You’re supposed to leave the country not just the way you found it, but better prepared for the future. The baby boom generation is failing on that.”

Walker: President Bush’s Medicare drug plan and the way it was sold to Congress and the public was “unconscionable.” The true, $8 trillion pricetag “was never calculated, disclosed or debated.”

Walker: The $9 trillion national debt is much more important than the budget deficit. Through the miracle of compound interest on the debt, he says, it will eat up more and more of the country’s resources.

Right. I keep posting on this because it is very important. To understand economics you need to understand the true shape of the economy. And to manage your investments you need to understand the great risk of a rising debt load (whether it is you personally or a country). Charge It to My Kids – USA Federal Debt Now $516,348 Per Household – Why Investing is Safer Overseas – Lobbyists Keep Tax Off Billion Dollar Private Equities Deals and On For Our Grandchildren – Broke Nation

South Korea to Start $22 Billion Fund for Oil, Gas Projects

South Korea needs to catch up to China and India, who have scoured the globe to lock in resources to fuel economic growth. Korea, the world’s fifth-largest importer of oil, buys in 97 percent of its energy and resource needs.

This sounds like the type of news that 3 years later everyone says was the sign of a bubble. Today it is hard to tell whether the boom in oil and commodity prices are a bubble or a sign of a huge demand increase that the cannot be supplied at current costs (combined with the plunging dollar which exaggerates the trends – and maybe by a decrease in supply too). I would have to say I am leaning toward a bubble signal but to what extent? Is the average price over the next 5 years going to be $50 a barrel (versus $93 today) versus say $25 a few years ago? Or is that price $100 or $150? In a few years people will say it was obvious today – what are they saying today?

Related: MIT’s Energy ‘Manhattan Project’ – 10 Stocks for 10 Years Update (Feb 2007)

Record numbers go abroad for health

More than 70,000 Britons will have treatment abroad this year – a figure that is forecast to rise to almost 200,000 by the end of the decade. Patients needing major heart surgery, hip operations and cataracts are using the internet to book operations to be carried out thousands of miles away. India is the most popular destination for surgery, followed by Hungary, Turkey, Germany, Malaysia, Poland and Spain. But dozens more countries are attracting custom. Research by the Treatment Abroad website shows that Britons have travelled to 112 foreign hospitals, based in 48 countries, to find safe, affordable treatment.

My guess is that traveling for health care is going to increase greatly in the future. Health costs in the USA are enormous. Costs in Europe are different – often in wait time (or costs to avoid waiting) but another option is available – travel. Countries would be very wise to focus on building up this industry in my opinion. The economic benefits could be huge. The market is huge and growing. And the rich countries do not appear to be doing very well – especially the USA. The country needs to invest in a rigorous quality assurance system.

It is almost certain the first attack will be attempts to frighten customers by saying your country is unsafe. And those tactics will be used to try and get the governments of rich countries to impose restraints on the ability of their citizens to seek health care in your country. So if you want to be one of the really big winners you will seek high quality first (don’t be drawn into price wars to see which country can be cheapest). That market will be there but will be much less profitable. The huge rewards will go to those countries that provide world class care at prices much cheaper than the inflated prices in the USA.

…

Companies with traditional plans are also taking the initiative. Blue Ridge Paper, which makes the DairyPak brand of packaging, was carved out of the forest-products firm Champion International when its employees bought a few factories that were scheduled to close. But health-care costs are hurting the company. So a Blue Ridge team plans to visit hospitals in India to assess their quality of care. If it gives the green light, Blue Ridge will begin promoting the option to its 2,000 workers.

Employees who opt for India would get to take along a family member, says Darrell Douglas, vice president of human resources, and the whole experience, including a recuperative stay at a hotel, would be covered. IndUShealth, a medical tourism start-up in Raleigh, N.C., will make all arrangements and coordinate care between U.S. and Indian providers. The sweetener: the company will share with these intrepid employees up to 25% of savings garnered from the outsourcing.

I originally setup the 10 stocks for 10 years portfolio in April of 2005. At this time the stocks in the sleep well portfolio in order of returns -

| Stock | Current Return | % of sleep well portfolio now | % of the portfolio if I were buying today | |

|---|---|---|---|---|

| PetroChina – PTR | 298% | 11% | 7% | |

| Google – GOOG | 210% | 17% | 13% | |

| Amazon – AMZN | 173% | 7.5% | 7% | |

| Templeton Dragon Fund – TDF | 116% | 17% | 13% | |

| Cisco – CSCO | 67% | 6.5% | 8% | |

| Templeton Emerging Market Fund – EMF | 67% | 3.5% | 5% | |

| Toyota – TM | 48% | 7% | 10% | |

| Tesco – TSCDY | 25% | 0% | 10% | |

| Intel – INTC | 18% | 4% | 8% | |

| Yahoo – YHOO | -2% | 4% | 5% | |

| Pfizer – PFE | -9% | 5% | 8% | |

| Dell | -16% | 7% | 10% |

In order to track performance I setup a marketocracy portfolio but had to make some adjustment to comply with the diversification rules. In December of 2006 I announced a new 11 stocks for the next 10 years (9 are the same, I dropped First Data Corporation, which had split into 2 companies and added Tesco and Yahoo). Earlier this year I added Templeton Emerging Market Fund (EMF) and reduced the TDF portion. Tesco also pays a dividend which I am not including in the calculation – that is one reason marketocracy is so nice it keeps track of all those details for you.

I have orders in to sell some of the PTR and TDF if the prices rises a bit more. In the marketocracy portfolio I have several smaller positions. I do this to comply with marketocracy’s diversity rules – I also have about 8% in cash (they still won’t let me buy Tesco). Google, PetroChina and Amazon have had an incredible few months. I am getting a little tired of Yahoo’s failure to deliver. I also think Amazon’s price has gotten a bit ahead of the performance but I think the performance is great and the long term looks strong.

The current marketocracy calculated annualized rate or return (which excludes Tesco – reducing the return, and has a significant cash position reducing the return) is 20% (the S&P 500 annualized return for the period is 13.4% – in addition to the other reductions in the return, marketocracy subtracts the equivalent of 2% of assets annually to simulate management fees – as though the portfolio were a mutual fund). View the current marketocracy Sleep Well portfolio page.

Related: 12 Stocks for 10 Years Update (Jun 2007) – 10 Stocks for 10 Years Update (Feb 2007) – 10 Stocks for 10 Years Update (Dec 2005)

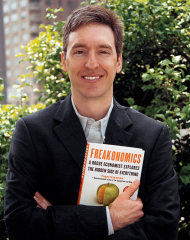

You might be surprised to learn that the National Science Foundation Fellowship program includes Economics. Steven Levitt’s Levitt’s NSF graduate research fellowship profile:

Levitt and his co-author, Stephen Dubner, explored a variety of topics in Freakonomics using analyses of statistics databases. The popularity of this book has made him one of the most well known economists among laymen. It was announced in 2007 that the two authors were working on a sequel.

Levitt’s other awards and honors include: named one of Time magazine’s “100 People Who Shape Our World” in 2006, named the Harry V. Roberts Statistical Advocate of the Year in 2006, the John Bates Clark Medal in 2003, the Garvin Prize in 2003, and the Duncan Black Prize in 2000.

In my full time job I work as an IT program manager for ASEE on, among other things, the NSF Graduate Research Fellowship Program. This blog is my own and not associated with ASEE.

Related: Science Fellowship Directory