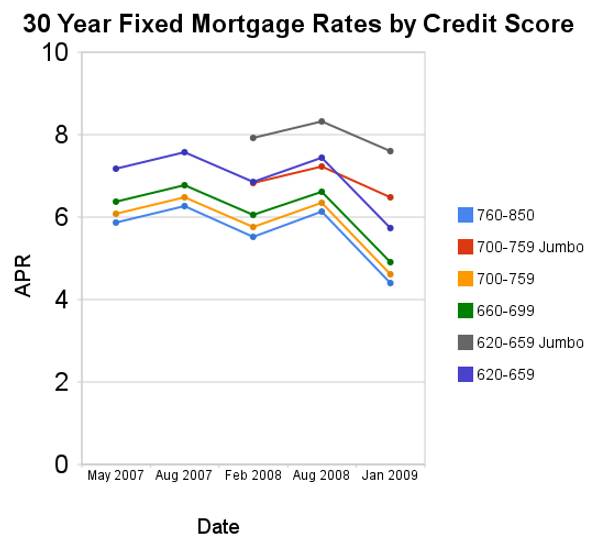

Since August of 2008 conforming mortgage rates are have declined a huge amount. Jumbo rates have fallen a large amount also, but much less (for example for a credit score of 700-759 the jumbo rates declined 73 basis points while the conventional rate declined 172 basis points.

For scores above 620, the APRs above assume a mortgage with 1 point and 80% Loan-to-Value Ratio. For scores below 620, these APRs assume a mortgage with 0 points and 60 to 80% Loan-to-Value Ratio. You can see, with these conditions the rate difference between a credit score of 660 and 800 is not large (remember this is with 20% down-payment) and has not changed much (the difference between the rates if fairly consistent).

Related: Low Mortgage Rates Not Available to Everyone – 30 Year Fixed Rate Mortgage Rate Data – Real Free Credit Report (in USA) – Jumbo Mortgage Shoppers Get Little Relief From Rates – posts on mortgages

Read more

The health care system in the USA is broken, as I have written about previously: USA Paying More for Health Care, International Health Care System Performance… One of the many problems created by the current system is ruined person finances for millions of people in the USA due to health care costs. The Rising Costs of Care And a Failing Economy Drive More Americans Into Medical Debt

…

Medical debt can quickly snowball. Consumers with unpaid bills can wind up in court defending themselves against lawsuits filed by doctors and hospitals, which typically charge the uninsured full price for care, without the hefty discounts negotiated by health plans. Debtors’ wages can be garnished, liens can be placed on their homes, and their future job and housing prospects torpedoed by bad credit ratings.

…

Unwilling to wait for federal action, a handful of states, most notably Massachusetts, have passed laws designed to expand health coverage or to protect medical debtors. An Illinois law passed last year caps rates that hospitals can charge the uninsured, while a New York statute bars foreclosures intended to pay off medical bills.

Purchasing health insurance against the risk of medical costs is critical to any financial plan. The concept (buying health insurance) is simple but securing that coverage is not as easy as knowing it is required for a sensible financial plan.

Related: Broken Health Care System: Self-Employed Insurance – Resources Focused on Improving the Health Care System – Excessive Health Care Costs

Consumer Credit Falls By Record Amount in November

This is good news. People need to stop spending money they don’t have. I understand perfectly well this means that spending will go down (which will likely lead to reduced economic output – though technically it doesn’t have to, a reduction in imported goods could more than offset the reduced spending and GDP would not decline). Living beyond your means is not a good thing. We should hope that consumer debt continues to decrease. If that means we have some suffering today to pay for living beyond our means for years the “fix” is not to continue to live beyond our means. The “fix” is to accept the consequences of past behavior and build a more sustainable economy now for the future.

Ideally this decrease can be someone gradual, abrupt changes in the economy often cause problems, but far too many economists and policy makers only care about today and the next 6 months. They have been living this way for decades. And it is not sustainable. Consumer debt levels in the USA are far too high. The UK has an even worse personal debt problem. They should come down. Reducing those levels is good for the individuals involved (they gain most of the benefit) and also for the health of the economy (though it does decrease the current economy a bit while making the foundation for future economy much stronger).

Read more

$30.1 trillion in stock market valuation was wiped out last year – Journal of a Plague Year: Faith in Markets Cracks Under Losses:

…

Lehman Brothers Holdings Inc., with assets of $639 billion, filed the largest bankruptcy in U.S. history on Sept. 15. Its creditors may have lost as much $75 billion, the firm’s chief restructuring officer said.

Bear Stearns Cos. was taken over by JPMorgan Chase & Co. in March after a funding crisis triggered by losses from subprime- mortgage investments. Merrill Lynch & Co., facing a crisis of its own, sold itself to Charlotte, North Carolina-based Bank of America Corp. And the last two major investment banks, Goldman Sachs Group Inc. and Morgan Stanley, converted to bank holding companies and got capital injections from the U.S. government.

2008 was quite a memorable year in the markets. What the markets will do this year is hard to know. But the economy is likely to be very weak. Job losses will increase. If we are lucky the economy will be picking up by the end of the year. A huge problem is we have been living well beyond our means for decades. And now we are selling out even more of our children and grandchildren’s future to pay for the extravagance of those last few decades. How costly our credit-card-like financing of government bailouts is going to be is the most important issue I believe.

There is nothing wrong with spending money you saved for a raining day when that day comes. There is a big problem (for your future) taking our more credit cards to spend money you didn’t bother to save. You might have to do so, but the costs you are heaping on your future is very high (and for the economy overall many of those costs will be borne by children not yet born).

Related: The Economy is in Serious Trouble – Crisis May Push USA Federal Deficit to Above $1 Trillion for 2009 – What Should You Do With Your Government “Stimulus” Check? – Over 500,000 Jobs Disappeared in November

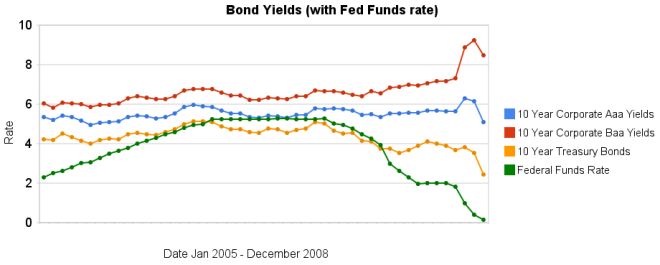

The recent reactions to the credit and financial crisis have been dramatic. The federal funds rate has been reduced to almost 0. The increase in the spread between government bonds and corporate bonds has been dramatic also. In the last 3 months the yields on Baa corporate bonds have increased significantly while treasury bond yields have decreased significantly. Aaa bond yields have decreased but not dramatically (57 basis points), well at least not compared to the other swings.

The spread between 10 year Aaa corporate bond yields and 10 year government bonds increased to 266 basis points. In January, 2008 the spread was 159 points. The larger the spread the more people demand in interest, to compensate for the increased risk. The spread between government bonds and Baa corporate bonds increased to 604 basis points, the spread was 280 basis point in January, and 362 basis points in September.

When looking for why mortgage rates have fallen so far recently look at the 10 year treasury bond rate (which has fallen 127 basis points in the last 3 months). The rate is far more closely correlated to mortgage rates than the federal funds rate is.

Data from the federal reserve – corporate Aaa – corporate Baa – ten year treasury – fed funds

Related: Corporate and Government Bond Rates Graph (Oct 2008) – Corporate and Government Bond Yields 2005-2008 (April 2008) – 30 Year Fixed Mortgage Rates versus the Fed Funds Rate – posts on interest rates – investing and economic charts

As I suspected those (who are not earning minimum wage you can be sure) that have lost money on the Madoff case would expect others to bail them out: well paid lawyers (I am sure) are making their case for just such a bailout of their wealthy clients.

…

The SIPC has little more than $1.6bn of funds and has promised $500,000 to each Madoff victim who had an account with his firm in the past 12 months.

The debate needs to be about what is the proper role for government. Not about this instance. What type of losses do we want secured? How large of payments do we want to insure? That amount has been $500,000 if we are changing the rules after the fact for a few is that really the best course of action)? How should these payments be funded? Do we really want to raise taxes on our grand children (many of which who will earn less than the equivalent of $50,000 today)? I don’t think so. This SIPC fund should be paid for by fees on investments just like the FDIC is paid for based on fees on covered deposits (as the SIPC is now – but no taxpayer funding should occur).

If we decide we want to pay back people several million each then the fees just need to be raised to fund such a system. Just as with the FDIC if we want the government to backstop the fund by guaranteeing they will loan the fund money if it runs short of cash is fine with me. Then the SIPC fund just pays back the taxpayers with interest.

Read more

Here is an interesting article at Bloomberg looks at the Chicago school of economics: Friedman Would Be Roiled as Chicago Disciples Rue Repudiation by John Lippert

By the end of November, the government had committed $8.5 trillion, or more than half the value of everything produced in the country in 2007, to save the financial system.

…

Robert Lucas, a Chicago economist who won a Nobel in 1995 for a theory that argued against governments trying to fine-tune consumer demand, says deregulation may have gone too far. Depression-era laws that separated commercial and investment banks helped depositors decide if they wanted secure accounts or riskier investments. Today, without these distinctions, people can’t be sure if their investments, or those of their customers, are safe.

“I’m changing my views on bank regulation every week,” Lucas, 71, says. “It was an area I saw as under control. Now I don’t believe that.” Lucas says he voted for Obama, the only Democrat besides Bill Clinton he’d supported in 44 years. He concluded the candidate was comfortable talking with professional economists.

…

“The big event of the last 20 years is the success of free markets in India and China,” says McCloskey via telephone from South Africa, where she’s a visiting professor at the University of the Free State in Bloemfontein. “This is more important than any financial crisis and makes it really hard to argue for a return to central planning.”

I believe capitalism is the best system for economic development. Unfortunately, as I have written before, too many decision makers don’t have the slightest clue about economics. They accept simplistic views just like scientifically illiterate people accept simplistic claims that have no merit.

The basics are pretty easy. You want to use the market to guide the economy. You need to regulate in those areas the market alone is know to be weak (negative externalities – including pollution, risks to the public…) anti-market behavior (large players controlling markets for their own benefit, large players paying off politicians for benefits…) and systemic risks (“too big to fail“…). And practical consideration is more important that ideological purity.

One of the most important consistent failures is the continued favoring of large entities that pay politicians large amounts of money. The continued creation of huge organizations that are anti-competitive by their nature and create systemic economic risk have not economic justification. The role of the government should be to enforce competitive markets not allow huge competitors to buyout other huge competitors so that they can further distort the market.

Related: Ignorance of Capitalism – Misuse of Statistics, Mania in Financial Markets – Greenspan Says He Was Wrong On Regulation – Lobbyists Keep Tax Off Billion Dollar Private Equities Deals and On For Our Grandchildren – Treasury Now (1987) Favors Creation of Huge Banks

We now have the lowest 30 year fixed mortgage rates since data has been collected (37 years) in the USA. Is this due to the Fed cutting the discount rate? I do not think so. As I have said previously 30 year fixed rates are not correlated with federal reserve rates. But this time the government is actively seeking to reduce mortgage rates.

Mortgage Rate Hits 37-Year Low

…

The 15-year fixed-rate mortgage averaged 4.92%, down from last week when it averaged 5.20%. A year ago the 15-year loan averaged 5.79%. The 15-year mortgage hasn’t been lower since April 1, 2004, when it averaged 4.84%.

Homeowners refinance, put savings under mattress

These rates sure are fantastic if you are in the market. I was not in the market, but I am considering re-financing now. You need to be careful and not just withdraw money because you can. If you can refinance and reduce your payments it may well be a wise move though. One problem can be extending the date you will finally be free of mortgage debt. If you re-finance a current 30 year loan, that you got 5 years ago, you will now be paying 5 more years. One option is to see if you can get a 25 or 20 year loan. Or if you can make a 15 year loan work, do that (15 and 30 year fixed rate mortgages are common).

Read more

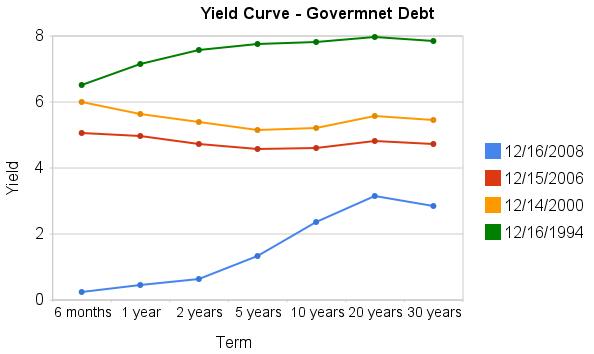

Treasury bills have been providing remarkably low yields recently. And the Fed today cut their target federal funds rate to 0-.25% (what is the fed funds rate?). With such low rates already in the market the impact of a lowered fed funds rate is really negligible. The importance is not in the rate but in the continuing message from the Fed that they will take extraordinary measures to soften the recession.

There are significant risks to this aggressive strategy (and there would be risks for acting cautiously too). But I cannot understand investing in the dollar under these conditions or in investing in long term bonds (though lower grade bonds might make some sense as a risky investment for a small portion of a portfolio as the prices have declined so much).

The current yields, truly are amazing as this graph shows. The chart shows the yield curve in Dec 2008, 2006, 2000 and 1994 based on data from the US Treasury

Related: Corporate and Government Bond Rates Graph – Discounted Corporate Bonds Failing to Find Buying Support – Municipal Bonds After Tax Return – Total Return

The percentage of loans in the foreclosure process at the end of the third quarter was 2.97 percent, an increase of 22 basis points from the second quarter of 2008 and 128 basis points from one year ago. The percentage of loans in the process of foreclosure set a new record this quarter, to 1.35 million.

Mortgages are counted as delinquent or in foreclosure (once they are in foreclosure they are not counted as delinquent). So the total percentage of mortgages not being paid by the homeowner is 2.97% (in foreclosure) + 6.99% (delinquent) = 9.96%. That is amazingly bad. In February of 2007 I wrote about this and the delinquency rate was 4.7% which sounded pretty bad to me. Amazingly 4.4% is a historic low for this figure. Can you believe 1/25 mortgages is delinquent and that is as good as we ever get? That is pretty shocking to me.

The seasonally adjusted total delinquency rate is now the highest recorded in the Mortgage Bankers Association survey. The seasonally adjusted delinquency rate increased 41 basis points to 4.34 percent for prime loans, increased 136 basis points to 20.03 percent for subprime loans, increased 29 basis points to 12.92 percent for FHA loans, and increased 46 basis points to 7.28 percent for VA loans.

The percent of loans in the foreclosure process increased 16 basis points to 1.58 percent for prime loans, and increased 74 basis points for subprime loans to 12.55 percent. FHA loans saw an eight basis point increase in the foreclosure inventory rate to 2.32 percent, while the foreclosure inventory rate for VA loans increased 13 basis points to 1.46 percent.

Since loans that would have gone into foreclosure in the past are being kept out of foreclosure due to some programs ( ) the rate or seriously delinquent is a useful measure of serious problems. Seriously delinquent mortgages are 90 days past due. The rate increased 52 basis points for prime loans to 2.87 percent, increased 171 basis points for subprime loans to 19.56 percent, increased 62 basis points for FHA loans to 6.05 percent, and increased 45 basis points for VA loans percent to 3.45 percent.

Compared to a year ago: the seriously delinquent rate was 156 basis points higher for prime loans and 818 basis points higher for subprime loans. The rate also increased 51 basis points for FHA loans and 89 basis points for VA loans.

Related: Homes Entering Foreclosure at Record (Sep 2007) – Foreclosure Filings Continue to Rise – How Much Worse Can the Mortgage Crisis Get? – How Not to Convert Equity