Nationalities of the 25 richest people:

| Country | Number |

|---|---|

| Russia | 7 |

| India | 4 |

| USA | 4 |

| Hong Kong | 2 |

| Germany | 2 |

| France | 2 |

| Mexico | 1 |

| Sweden | 1 |

| Spain | 1 |

| Saudi Arabia | 1 |

11 Richest in order: Warren Buffett, USA $62Billion; Carlos Slim Helu & family, Mexico, $60B; William Gates III, USA $58B; Lakshmi Mittal, $45B; Mukesh Ambani, India, $43B; Anil Ambani, India, $42B; Ingvar Kamprad & family, Sweden, $31B; KP Singh, India, $30B; Oleg Deripaska, Russia, $28B; Karl Albrecht, Germany, $27B; Li Ka-shing, Hong Kong $26.5B.

Data from Forbes 2008 Billionaires List, using country of citizenship. Using stock values on 11 February, 2008.

Related: Best Research University Rankings (2007) – Top 10 Manufacturing Countries (2006) – How Rich Are You?

Read a nice review of The Budget Deficit, the Current Account Deficit and the Saving Deficit:

- Tax incentives to encourage saving would likely also stimulate investment and lower both the budget deficit and the trade deficit.

- Reducing the budget deficit would reduce the vulnerability of the U.S. economy to foreign creditors; rising deficits could lead to foreigners dumping dollar assets, causing equities to decline, interest rates to spike and the dollar to plunge.

- Reducing the budget deficit doesn’t necessarily mean higher tax rates; marginal rate cuts reinforced by slower government spending growth would be ideal incentives.

Unfortunately, the recent tax “rebates” designed to stimulate the economy dealt a setback to budget discipline. Most people probably understand that. What they probably don’t understand is that the increased budget deficit will also tend to worsen our international balance of payments and weaken the dollar. The hip bone is connected to the thigh bone; so policymakers need to study these interconnected deficits. They need to borrow my boxes.

US banks Citigroup and Merrill Lynch reveal fresh $15bn loss

Merrill will suffer $5 billion of write-downs, analysts say, which would push the bank $2.7 billion into the red. t is expected to knock a further 20% from the value of its sub-prime holdings, in spite of the fact that it announced $18 billion of write-downs only three months ago. The new rash of Wall Street losses and write-downs come in addition to the billions that have already been recorded.

The world’s biggest banks have suffered losses and write-downs totalling almost $250 billion since the beginning of 2007, according to analysts. Last week the IMF shocked markets by saying that global losses from the credit crisis could rise to $945 billion.

The language becomes even more extreme as the losses balloon.

Related: Fed Continues Wall Street Welfare – Credit Crisis (Aug 2007) – Central Bank Intervention Unprecedented in scale and Scope – Soros Says Credit Crisis Will Worsen Before Improving – Volcker: Spendthrift Americans Bred Credit Crisis

Creating a World Without Poverty by Muhammah Yunus (founder of the Grameen Bank and 2006 Nobel Peace Prize recipient). Giving people the opportunity to advance economically is something I see as very important. It is hard to imagine in the USA when those that are seen as poor have air conditioning, indoor plumbing, cars, TVs, electricity… but billions of people would love to approach such material wealth.

When you really have to struggle to put food on your plate or get clean water economic concerns are critically important. Economic progress may well decide whether your children live or not. Muhammah Yunus’ new book is a good read to hopefully encourage more people to realize there really are much more important things than your fourth pair or shoes (to say nothing of you 20th pair) or expensive wine or a newer car or…

Microfinance is a great system where those that have been lucky to receive material wealth can help provide opportunity to others. Loans of $200-$500 can make a huge difference in an entrepreneurs life. Just giving them the chance to use their intellect and hard work to create a life where they can get raise themselves slightly can change their lives, their children’s lives and together with others perhaps their community.

Trickle Up, Kiva and Grameen Bank are three great ways to help give entrepreneurs a chance to improve their lives. As I have mentioned before if you are a Kiva lender add a comment with your Kiva page and I will add a link to: Curious Cat Kiva Supporters. I will say I am happy with the success of this blog in general, the thing that disappoints me is how few links we have on that page.

Related: Microfinancing Entrepreneurs – Interview with Mohammad Yunus – Trying to Keep up with the Jones – Providing a Helping Hand via Kiva – Curious Cat Science and Engineering blog posts on appropriate technology

What Should You Do With a Check Out of the Blue?

The USA government is sending out checks to taxpayers in an effort to encourage spending which in turn will provide stimulus to the economy in the very short term. First, this is bad policy in my opinion. Second, if you support this policy the precondition is you run surpluses in order to pay for it when you want to carry out such a policy. They have not, instead they have run huge deficits. What they have chosen to do is spend huge amounts and have the taxes paid by the children and grandchildren of those the politicians are spending the money on today. I would support Keynesian government spending in a serious recession or depression – just not for a country already with enormous debts and in a very mild recession.

But ok, so the government chooses to spend your children’s taxes foolishly, what should you do now? This is very easy. Whatever is the wisest move for your personal financial situation for any windfall you receive, regardless of the source of that windfall. If all your savings needs are met there is nothing wrong with buying some toy. But most people need to pay off debt, build an emergency fund, save for retirement or something similar not get another toy. Of course would be nothing wrong with donating it Kiva, Trickle Up, the Concord Coalition or your favorite charity.

The politicians are acting like a 5 year old that wants a new toy. I can too get the new toy now :-O, Mommy you can use your credit card. So what if you already bought me so many toys you couldn’t afford by using your other credit cards and they won’t lend you any more money. Just get another one. Similar to how congress recently yet again increased the allowable federal debt limit to over $9,000,000,000,000.

The stimulus effect of spending is that if you actually purchase a new toy (say a TV), then the store needs to replace that TV so the factory makes another TV… The store, shipper, factory, supplier to the factory all pay staff to carry this out, those staff can buy new books, dishwasher… and the business may buy a new forklift or computer to keep up…

Read more

U.S. Consumer Borrowing Rose $5.2 Billion in February

$2.54 Trillion seems like a great deal to me. Based on a population of 300 million people that would mean $8,467 for every person in just personal debt. USA GDP = $13 trillion. USA federal debt = $9.4 trillion (based on the USA government accounting – so way understating the true debt). USA federal budget $3 trillion.

Related: Americans are Drowning in Debt – Too Much Personal Debt (UK, £1.3 trillion in 2006 – even more than the USA) – Incredibly Bad Customer Service from Discover Card

I think a country that is more than $500,000 in debt per household should not send out checks to taxpayers to try pretend they are doing something to help the economy. Just as I wouldn’t think some family with $20,000 in credit card debt should fix the problem by taking the family on a new credit card financed vacation. But if you are going to do so, then take Dan Ariely’s advice: Stimulus options should be tested first. His blog post on the topic, Do we know enough to give stimulus packages?

The next question, of course, is which delivery method to select. Here behavioral economics has been instructive as well. In particular, years of research have demonstrated over and over that our intuitions about the relative effectiveness of different approaches are often wrong. Given that the method of delivery could make a large difference, and given that our intuitions about their relative effectiveness could be wrong, what should we do?

One answer is to conduct an experiment, as this is the only method we have for testing what really works and what is likely to fail. In the same way that we force drug companies to test the efficacy of their drugs before rolling them onto the market, shouldn’t we ask the government to first test their ideas before they invest billions of dollars of our tax money on some stimulus packages?

Related: Politicians Again Raising Taxes On Your Children – Charge It to My Kids – Google: Experiment Quickly and Often

The day the dream of global free- market capitalism died

The lobbies of Wall Street will, it is true, resist onerous regulation of capital requirements or liquidity, after this crisis is over. They may succeed. But, intellectually, their position is now untenable.

The intellectually depravity of such claims were obvious well before. Two problems make that truth less important. First, few actually believe in intellectual rigor any longer. Second, huge payments to politicians from those wishing to receive special favors from the government work (not very surprisingly). So given the lack of intellect and the alternative of just rewarding those that pay you huge sums of money it is no surprise politicians turned against capitalism and instead gave favors to a few that paid them well.

Maybe the latest huge bailout will change how things are done. I doubt it. New rules will be put in place. Plenty of people will pay politicians plenty of money to assure their methods of subverting the intent of those rules are allowed to continue. To change things you would need to vastly improve the intellectual rigor of decision making. That is unlikely, but if it happens it will be plenty obvious from how debate is carried out.

Read more

It has long been the case that home owners refuse to accept falling prices and choose to demand higher prices than the market demands in a falling market. Therefore when prices should fall (to find buyers) instead the sales decrease as buyers don’t decrease prices to a level buyers are willing to pay. Be It Ever So Illogical: Homeowners Who Won’t Cut the Price

Three years ago, when the real estate bubble was still inflating, this sort of standoff was the exception. It’s the norm today. Overall home sales have fallen a remarkable 33 percent since the summer of 2005. Home prices, on the other hand, continued to rise until 2006 and are now only 5 to 10 percent below where they were in mid-2005, according to various measures.

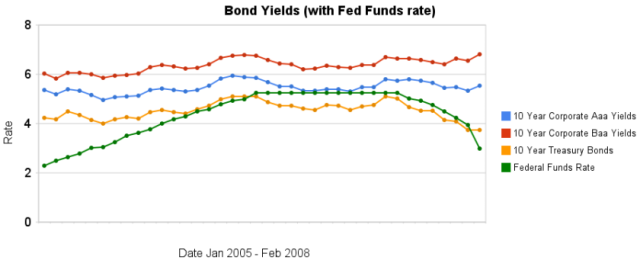

From January 2005 to July 2007 the Federal Funds Rate was steadily increased. The rate was held for a year. Since then the rate has been decreasing (dramatically, recently). As you can see from the chart, 10 year bond yields have been much less variable. The chart also shows 10 year corporate bond yields increasing in February when the federal funds rate fell 100 basis points.

Is the worst over, or just beginning?

…

If rates continue to fall, they could hit not only a new low for the year – the 10-year briefly touched 3.28% in January – but could come close to falling below the 3.07% level they hit in June 2003, which was a 45-year low at the time.

Treasury bond yields are down but a huge part of the reason is a “flight to quality,” where investors are reluctant to hold other bonds (so they buy treasuries when they sell those bonds). Therefore other bond yields (and mortgage rates) are not decreasing (the data in the chart is a bit old – the yields may well decrease some for both 10 year bonds once the March data is posted, though I would expect the spread between treasuries be larger than it was in January).

Data from the federal reserve – corporate Aaa – corporate Baa – ten year treasury – fed funds

Related: 30 Year Fixed Mortgage Rates versus the Fed Funds Rate – After Tax Return on Municipal Bonds