Is it cynical to think that politicians want to provide payments from the treasury to those that paid the politicians? More cynical to think the politicians that created huge Wall Street Welfare payments won’t actually do anything except talk about how they think it is bad that those they paid billions to are buying new mansions and yachts? More cynical to think they will continue to provide huge amounts of nearly free cash for those that paid them to speculate with? More cynical to think if any of those speculators lose money they will give them more welfare? More cynical to think those bought and paid for politicians won’t actually take any steps to tax or curtail speculation? I think maybe I am cynical about Washington doing anything other than talk about how they don’t want to provide huge amounts of cash to Wall Street all the while giving their Wall Street friends huge amounts of cash that will be paid back by our grandchildren.

Wouldn’t it be nice if the politicians actually took actions to fund a partial payback of the hundreds of billions (or maybe trillions) of bailout dollars by taxing financial speculation? I doubt it will happen. But maybe I am too cynical. Maybe politicians will not just do what they have been paid to do. But it seems the best predictor of what congress will do is based on what they are paid to do, based on their past and current behavior. Now what congress will say is very different. those paying Congressmen might not love it if the congressmen call them names but through a few billion more and they are happy to be called names while given the cash to buy new jets and sports teams and parties for their daughters.

Making Wall Street pay by Dean Baker

The logic of a financial transactions tax is simple. It would impose a modest fee on trades of stocks, futures, credit default swaps and other financial instruments. For example, the UK puts a 0.25% tax on the sale or purchase of shares of stock. This has very little impact on people who buy stock with the intent of holding it for a long period of time.

…

We can raise more than $140bn a year taxing financial transactions, an amount equal to 1% of GDP.

…

Since the financial sector is the source of the country’s current economic and budget problems it also makes sense to have this sector bear the brunt of any new taxes that may be needed. The economic collapse caused by Wall Street’s irrational exuberance has led to a huge increase in the country debt burden. It seems only fair that Wall Street bear the brunt of the clean-up costs. A financial transactions tax is the way to make sure that this happens.

One challenge of understanding the state of the economy is we don’t have clear measures. We attempt to gather accurate data but there is quite a bit of inaccuracy in the data (both from preliminary estimates – before all the data is in, which can take months, or longer – and just plain items we have to estimate no matter how long we have).

Related: Manufacturing Data – Accuracy Questions – Why China’s Economic Data is Questionable – What Do Unemployment Statistics Mean? – Manufacturing Jobs Data: USA and China – The Long-Term USA Federal Budget Outlook – Is China’s Recovery for Real?

Economists Seek to Fix a Defect in Data That Overstates the Nation’s Vigor

The problem is particularly acute in manufacturing. Imported components constitute an ever greater share of the computers, autos, appliances and other finished merchandise that roll off assembly lines in the United States – and an ever greater share of all of the nation’s imports.

…

The stated goal, among those at the conference, is to repair the statistics, but that requires several years, lots of money (from Congress) to gather more information about what companies are doing, and whole new procedures for measuring imports. Much of the conference was devoted to an analysis of the gap between existing data and reality, and ways to close that gap.

The Measurement Issues Arising from the Growth of Globalization conference has thankfully provided open access to papers from the conference including:

Offshoring Bias: The Effect of Import Price Mismeasurement on Manufacturing Productivity Read more

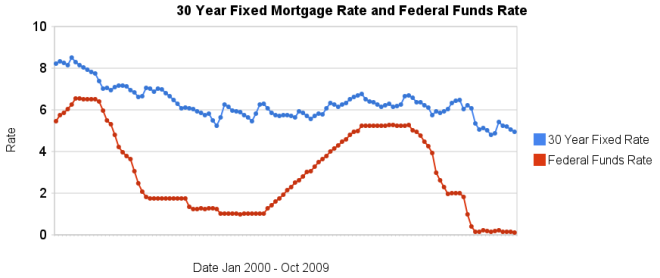

30 year fixed mortgage rates have declined a bit over the last few months and remain at very low levels.

The poor economy, Unemployment Rate Reached 10.2%, has the Fed continuing massive intervention into the economy. The Fed is keeping the fed funds rate at close to 0% (.12% in October). They also continue to hold massive amounts of long term government and mortgage debt (in order to suppress interest rates on long term bonds – by reducing the supply of such bonds in the market).

I can’t see how lending US dollars, over the long term, at 5%, makes any sense. I would much rather borrow at those rates than lend. If you have not refinanced yet, doing so now may well make sense. And if you are looking at a new real estate purchase, financing a 30 year mortgage sure is attractive at rates close to 5%.

Related: historical comparison of 30 year fixed mortgage rates and the federal funds rate – Lowest 30 Year Fixed Mortgage Rates in 37 Years – Jumbo v. Regular Fixed Mortgage Rates: by Credit Score – What are mortgage definitions – Ignorance of Many Mortgage Holders

For more data, see graphs of the federal funds rate versus mortgage rates for 1980-1999. Source data: federal funds rates – 30 year mortgage rates

One of the few good recent results of the economy has been a continuous decline in consumer debt. Consumer debt fell for the 8th consecutive month, for the first time, in September, declining by $15 billion.

Consumer debt grew by about $100 each year from 2004 through 2007. In 2008 it increased $40 billion. In 2009 it has fallen over $100 billion so far: from $2,559 billion to $2,456 billion. This still leaves over $8,000 in consumer debt for every person in the USA and $20,000 per family.

The huge amount of outstanding consumer and government debt remains a burden for the economy. At least some progress is being made to decrease consumer debt.

Those living in USA have consumed far more than they have produced for decades. That is not sustainable. You don’t fix this problem by encouraging more spending and borrowing: either by the government or by consumers. The long term problem for the USA economy is that people have consuming more than they have been producing.

The solution to this problem is to stop spending beyond your means by even increasing levels of personal and government debt. Thankfully over the last year at least consumer debt has been declining. Government debt has been exploding so unfortunately that problem has continued to get worse.

As we know, interest rates have fallen a great deal over the last few years. the federal funds rate sits at essentially 0% and money market funds now yield under 1%. However, credit card accounts that are charging interest increase to an interest rate of 14.9% from 13.6% in the 3rd quarter of 2008. In 2004 the credit card interest rate was 13.2%, 2005 – 14.6%, 2006 – 14.7%, 2007 – 14.7%, 2008 – 13.6%. All credit card balances should be paid off every month to avoid these excessive interest rates.

Data from the federal reserve and census bureau.

Related: Consumer Debt Declined a Record $21.5 Billion in July – The USA Economy Needs to Reduce Personal and Government Debt – Let the Good Times Roll (using Credit)

The unemployment rate rose from 9.8 to 10.2% in October, and nonfarm

payroll employment continued to decline (down another 190,000 jobs), the U.S. Bureau of Labor Statistics reported today. The largest job losses over the month were in construction, manufacturing, and retail trade.

In October, the number of unemployed persons increased by 558,000 to 15.7

million. The unemployment rate rose to 10.2%, the highest rate since April 1983. Since the start of the recession in December 2007, the number of unemployed persons has risen by 8.2 million, and the unemployment rate has grown by 530 basis points.

Among the major worker groups, the unemployment rates for adult men (10.7%) rose in October. The jobless rates for adult women (8.1 percent), teenagers (27.6%), African-Americans (15.7%), and Hispanics (13.1%) were little changed over the month.

The number of long-term unemployed (those jobless for 27 weeks and over) was little changed over the month at 5.6 million. In October, 35.6% of

unemployed persons were long-term unemployed.

The civilian labor force participation rate was little changed over the month

at 65.1%. The employment-population ratio continued to decline in

October, falling to 58.5%.

The number of persons working part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed in October at 9.3 million. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.

Related: Unemployment Rate Rises to 8.1%, Highest Level Since 1983 (March 2009) – posts on employment – USA Unemployment Rate Jumps to 9.4% – Unemployment Rate Increases to 9.7%

Read more

There are several factors that need to be addressed relating to the broken health care system in the USA.

1) It is bankrupting the government

2) It is severely handicapping business that must pay for the expensive and poorly performing system

3) It is bankrupting individuals (Employees Face Soaring Health Insurance Costs)

4) It is hampering economic freedom due to the model that ties health care to employment. If I want to go start my own small business, I not only have to worry about all the risks of running a business I have to risk my heath coverage (coverage is expensive and if you get sick you can be dropped, or rates increased so dramatically that they are not affordable – hardly insurance when you are dropped when you need it).

5) social inequity – no other rich country denies basic health care to everyone

6) the results are poor to mediocre (at by far the highest cost of any country)

The idea that a system that is far more expensive than any in the world and performs, at best, in the middle of the pack of rich countries while creating huge economic and human hardships should not be reformed is crazy. Unless you believe the USA is just incapable of performing even at a mediocre level in health care, for some reason, you have to believe they current performance needs to be dramatically improved.

Now there may well be disagreement about which failures are most important. Some may not care about the huge competitive disadvantage companies are put in by the current broken system. Others may not care that millions don’t have basic coverage. Others may not care that sick people go bankrupt. Others may not care that the heath results are mediocre at best – that tens of millions have much less healthy lives than they would. Others may like that they make a great deal of money from the current system. Others may like that they personally get good health care. So in what ways the broken system in place now needs to be fixed is open for debate.

The long term result is very simple to see. The current system is very broken and will not work. Different people suffer differently depending on what solution is adopted. My desire would be to reduce spending on hugely expensive miracle cures (especially for terminal ill patients) and increase spending dramatically on preventative and healthy living (versus spending on managing sickness) but I can see that such a solution is not at all popular. So we are not going to adopt that part of what I would like to see.

But I have no doubt the system will be dramatically reformed. Because if not the economic costs will destroy the economic future of the country. I don’t believe tens of millions without health care will drive action – we have seen that we are perfectly willing to allow that to continue. If the economic costs (say reducing the economic benefit to every person in the USA by $5,000 a year) just stayed at that level, it seems those that are benefiting from the current system are able to hold off improvement. But that figure is increasing each and every year. Eventually the costs grow too large and too many people will demand the broken system be improved.

This hardly constitutes an outright collapse, nor is it necessarily cause for concern. American exporters, whose goods have become more competitive abroad, are happy with their weaker currency. Similarly domestic producers may be cheered that rival, imported goods are more expensive. And European tourists, who can buy more for their euros during weekend shopping excursions to America, may cheer too. However, the continued decline of the dollar does come against a backdrop of ominous murmurs from the likes of China and Russia, who hold much of their reserves in dollars, about the need to shift their reserves out of the greenback. Brazil’s imposition of a 2% levy on portfolio inflows is also a sign that other countries are getting nervous about seeing their currencies rise against the dollar.

…

But it is hard, also, to think of a parallel in history. A country heavily in debt to foreigners, with a government deficit it is making little headway at controlling, is creating vast amounts of additional currency. Yet it is allowed to get away with very low interest rates. Eventually such an arrangement must surely break down, bringing a new currency system into being, just as Bretton Woods emerged in the 1940s.

The absence of a credible alternative to the dollar means that, despite its declining value, its status as the world’s reserve currency is not seriously under threat. But the system could change in other ways. A world where currencies traded within bands, or where foreign creditors insist on America issuing some debt in other currencies, are all real possibilities as the world adjusts to a declining dollar.

The issuance of USA government debt of any significant size in other currencies would be an amazing event, to me. However, that does not mean it won’t happen. In my opinion it is hard to justify the non-collapse of the dollar, and has been for quite some time.

The huge future tax liability imposed over the last few decades along with the failure to save by those in the country creates a hollow economy. Granted the USA had a huge surplus of wealth built up since the end of World War II. The USA has to a great extent sold off that wealth to finance living beyond the productive capacity of the country the last 20-30 years. But that can only go on so long.

The only thing saving the dollar is that other countries do not want the dollar to decline because they don’t want the competition of American goods (either being sold to their country or for the goods they hope to export). So they intervene to stop the fall of the dollar (and buy USA government debt). That can serve to artificially inflate the dollar for some time. However, eventually I think that will collapse. And when it does it will likely be very quick. The idea of the USA issuing debt in other currencies seems crazy now. It could then go from possibility to necessity within months.

You cannot print money forever to live beyond your means and have people accept it as valuable. The government can runs deficits if the citizen’s finance that debt with savings: and still maintain a sound currency. But the recent period, given the macro-economic conditions, don’t justify the value of the dollar. It should have fallen much further a long time ago. The other saving grace for the dollar is few large economies have untarnished economies. The Euro has strengths but is hardly perfect. The Chinese Renminbi is possibly the strongest contender but the economy is still very controlled, financial data is untrustworthy, political freedom is not sufficient… The Japanese Yen does have some strengths but really their long term macro-economic conditions is far from sound.

Related: The USA Economy Needs to Reduce Personal and Government Debt – Let the Good Times Roll (using Credit) – Federal Reserve to Buy $1.2T in Bonds, Mortgage-Backed Securities – Who Will Buy All the USA’s Debt?

FDIC chief: Small banks can’t compete with bailed-out giants

” ‘Too big to fail’ has become worse,” Bair told USA TODAY. “It’s become explicit when it was implicit before. It creates competitive disparities between large and small institutions, because everybody knows small institutions can fail. So it’s more expensive for them to raise capital and secure funding.”

The left-leaning Center for Economic and Policy Research last month found that banks with more than $100 billion in assets paid 1.15% for funds, and all others paid 1.93% late last year and early this year. That amounted to an annual subsidy worth up to $34.1 billion for the 18 biggest bank companies.

Too big to fail is too big to exist. The actions to provide massive taxpayer bailouts to banks deemed too big to fail so that they could pay out billions in bonuses to those who failed so completely in managing their banks has been a continuing example of how bad an idea corporate welfare is. Not only are those given the huge bailouts just looting those payments for their friends much of the rest was just forwarded onto other big financial institutions (that had made bad bets in the unregulated financial markets they lobbied for) to have worthless financial instruments payoff with billions from taxpayer welfare payments to them.

If we allow the continual increase in anti-competitive behavior by financial institution to be encouraged by the politicians they provide with huge payments we are going to have much bigger problems than we have seen so far.

If you have accounts with these mega welfare financial institutions: close them. Move to some other institution that can support itself and does not abuse the taxpayers with support from “your” politician.

Related: Looting: Bankruptcy for Profit – Small Business Owners Angry at Big Banks – Canada’s Sound Regulation Resulted in a Sound Banking System Even During the Credit Crisis – More Outrageous Credit Card Fees

I really like micro-credit as a tool to improve the lives of those willing to put in the effort to build a successful business. I do worry however, that the actual success is less than what is hoped. The idea is so appealing but objective results are not as obvious (for one thing the results, do not seem to be available). I want to find research that indicates what will make micro-credit most effective at improving the economic well being of people. Small change by Drake Bennett

…

They created their controlled experiment by altering the algorithm the bank used to evaluate creditworthiness so that some borderline applicants were randomly denied loans while other otherwise identical applicants had loans approved.

…

Working with a microcredit bank in India that was looking to expand in the city of Hyderabad, the researchers did find some small positive effects. Borrowers who already had a business did see some increase in profit. Households without businesses that the researchers judged more predisposed to start one were found to cut back on spending, suggesting they were saving to augment their loan for a capital business expense like a pushcart or a sewing machine.

Overall the article suggests that the data is hard to get. The time of the studies may be too short to see improvement. And the gains seen are small. I do believe we are in danger of creating problems with the rapid expansion of micro-credit. I can understand why, the situation is desperate for billions of people still. And we do not have many good methods for improving economic conditions for the world’s poor. I still strongly support micro-credit but I worry, especially if interest rates are high, that it may not help. We need to study what is working and adopt methods that will bring about improved results.

Related: Creating a World Without Poverty – Capitalism from the Ground Up – MicroFinance Currency Risk – 2006 Nobel Peace Prize to Grameen Bank Founder

Manufacturing is an powerful driver of economic wealth. For years I have been providing data to counter the contention that the manufacturing base of the USA is gone and the little bit left was shrinking. The latest data again shows the USA is the largest manufacturer, and manufacturing in the USA continues to grow. It is true global manufacturing has begun to grow more rapidly than USA manufacturing in the last few years. I doubt many suspect that the USA’s share of manufacturing stayed stable from 1990 to 1995 then grew to 2000 took until 2006 to return to the 1990-1995 levels and then has declined in 2007 and 2008 a bit below the 1990 level and during that entire time was growing (even in 2007 and 2008).

The USA’s share of the manufacturing output, of the countries that manufactured over $185 billion in 2008, 28% in 1990, 28% in 1995, 32% in 2000, 28% in 2005, 28% in 2006, 26% in 2007 and 24% in 2008. China’s share has grown from 4% in 1990, 6% in 1995, 10% in 2000, 13% in 2005, 14% in 2006, 16% in 2007 to 18% in 2008. Japan’s share has fallen from 22% in 1990 to 14% in 2008 (after increasing to 26% in 1995 then steadily falling). The USA has about 4.5% of the world population, China about 20%.

Based on the latest UN Data, for global manufacturing, in billions of current US dollars:

| Country | 1990 | 1995 | 2000 | 2005 | 2006 | 2007 | 2008 |

|---|---|---|---|---|---|---|---|

| USA | 1,041 | 1,289 | 1,543 | 1,624 | 1,712 | 1,756 | 1,831 |

| China | 145 | 300 | 484 | 734* | 891* | 1,106* | 1,399** |

| Japan | 810 | 1,219 | 1,034 | 979 | 927 | 923 | 1,045 |

| Germany | 438 | 517 | 392 | 571 | 608 | 711 | 767 |

| Italy | 240 | 226 | 206 | 295 | 302 | 345 | 381 |

| United Kingdom | 206 | 218 | 226 | 264 | 295 | 323 | 323 |

| France | 200 | 233 | 190 | 255 | 255 | 287 | 306 |

| Russian Federation | 120 | 64 | 45 | 124 | 157 | 206 | 256 |

| Brazil | 120 | 125 | 96 | 137 | 163 | 201 | 237 |

| Korea | 66 | 131 | 136 | 211 | 234 | 260 | 231 |

| Spain | 112 | 104 | 98 | 160 | 170 | 196 | 222 |

| Mexico | 62 | 67 | 133 | 154 | 175 | 182 | 197 |

| Canada | 92 | 100 | 129 | 168 | 182 | 197 | 195 |

| India | 51 | 61 | 69 | 122 | 141 | 177 | 188 |

* I am using the data from last year that separated the manufacturing data (this year the data does not provide separate manufacturing data for China) instead of that shown in the most recent data (which doesn’t separate manufacturing)

** The China data is not provided for manufacturing alone. The percentage of manufacturing (to manufacturing, mining and utilities) was 78% for 2005-2007 (I used 78% of the manufacturing, mining and utilities figure provided in the 2008 data).

I hope to write a series of posts examining global manufacturing data including looking at manufacturing data specifically (excluding mining and utility data).

Read more