401(k)s are a great way to save. Yes, today those that have been saving money have the disappointment of bad recent results. But that is a minor factor compared to the major problem: Americans not saving what they need to for retirement in 401(k)s, IRAs, even just emergency funds… Do not use the scary financial market performance recently as an excuse to avoid retirement savings (if you have actually been doing well).

The importance of saving enough for retirement is actually increased by the recent results. You might have to re-evaluate your expectations and see whether you have been saving enough. I am actually considering increasing my contributions, mainly to take advantage of lower prices. But another benefit of doing so would be to add more to retirement savings, given me more safety in case long term results are not what I was hoping for.

Now there can be some 401(k) plans that are less ideal. Limited investing options can make them less valuable. Those limited options could include the lack of good diverse choices, index funds, international, money market, real estate, short term bond funds… My real estate fund is down about 2% in the last year (unlike what some might think based on the media coverage of declining housing prices). And poor investing options could include diverse but not good options (options with high expenses… [ the article, see blow, mentions some with a 2% expense rate - that is horrible]).

But those poor implementations of 401(K)s are not equivalent to making 401(k)s un-viable for saving. It might reduce the value of 401(k)s to some people (those will less good 401(k) plans). Or it might even make it so for people with bad 401(k) options that they should not save using it (or that they limit the amount in their 401k). I don’t know of such poor options, but it is theoretically possible.

The tax deferral is a huge benefit. That benefit will only increase as tax rates rise (given the huge debt we have built up it is logical to believe taxes will go up to pay off spending today with the tax increases passed to the future to pay for our current spending).

And if you get matching of 410(k) contributions that can often more than make up for other less than ideal aspects of a particular 401(k) option.

Also once you leave a job you can roll the 401(k) assets into an IRA and invest in a huge variety of assets. So even if the 401k options are not great, it is normally wise to add to them and then just roll them into an IRA when you leave. If the plan is bad, also you can use an IRA for your first $5,000 in annual retirement savings and then add additional amounts in the 401k (if they are matching funds normally adding enough to get the matching is best).

401(k)s, 403(b), IRAs… are still great tools for saving. The performance of financial markets recently have been poor. Accepting periods of poor performance is hard psychologically. But retirement accounts are still a excellent tool for saving for retirement. Using them correctly is important: allocating resources correctly, moving into safer asset allocations as one approaches and reaches retirement…

Read more

George Soros published his most recent book in May 2008 – The New Paradigm for Financial Markets: The Credit Crisis of 2008 and What It Means. Yesterday Bill Moyers Interviewed George Soros:

…

This current economic disaster is self-generated. It was generated by the market itself, by getting too cocky, using leverage too much, too much credit. And it got excessive.

…

The financial system is teetering on the edge of disaster. Hopefully, it will not go over the brink because it very rarely does. It only did in the 1930s. Since then, whenever you had a financial crisis, you were able to resolve it.

…

the sort of period where America could actually, for instance, run ever increasing current account deficits. We could consume, at the end, six and a half percent more than we are producing. That has come to an end.

…

Right now you already have 10 million homes where you have negative equity. And before you are over, it will be more than 20 million.

Related: Soros Says Credit Crisis Will Worsen Before Improving (April 2008) – Warren Buffett Webcast on the Credit Crisis – Rodgers on the US and Chinese Economies – – Personal Investment Failures

I would say the chance of a depression in the next 5 years is very unlikely. The last 2 years have been full of bad economic news but a depression is still not likely, in my opinion. However, much of the public, seems to think it is likely – Poll: 60% say depression ‘likely’

* 25% unemployment rate

* Widespread bank failures

* Millions of Americans homeless and unable to feed their families

In response, 21% of those polled say that a depression is very likely and another 38% say it is somewhat likely. The poll also found that 29% feel a depression is not very likely, while 13% believe it is not likely at all.

…

The economists surveyed by CNNMoney.com said they saw a drop of 2% to 4% in a worst case scenario.

I must say I don’t think those polled don’t really hold their belief very firmly. If you actually see a depression as likely you have to take drastic steps with your finances. I really doubt many of them are and instead think they are casually saying they think it is likely without really thinking about what that would mean.

I don’t see it as likely and don’t see any need to change significantly what made good personal financial sense 2 years ago. The biggest change I see (over the last couple of months) is the importance of taking smart person finance actions has increased dramatically. The smart moves are pretty much the same but the risks to failing to create an emergency fund, abusing your credit card, losing a job… have increased dramatically.

Related: Uncertain Economic Times – Personal Finance Basics: Health Insurance – Financial Illiteracy Credit Trap

Warren Buffett quotes from the interview:

|

- “AIG would be doing fine today if they never heard of derivatives… I said they were possibly financial weapons of mass destruction and they have been, I mean they destroyed AIG, they certainly contributed to the destruction of Bear Stearns and Lehman”

- The biggest single cause was that we had an incredible residential real estate bubble.

- [on consuming more than we are producing] I don’t think it is the most pressing problem at all. We are trading away a little bit of our country all the time for the excess consumption that we have, over what we produce. That is not good. I think it is terrible over time.

Related: Warren Buffett related posts – Credit Crisis Continues – Credit Crisis (August 2007)

The FDIC limit has been raised to $250,000 which is a good thing. The increased limit is only a temporary measure (through Dec 31, 2009) but hopefully it will be extended before it expires. I don’t see anything magical about $250,000 but something like $200,000 (or more) seems reasonable to me. The coverage level was increased to $100,000 in 1980.

What does federal deposit insurance cover?

FDIC insurance covers funds in deposit accounts, including checking and savings accounts, money market deposit accounts and certificates of deposit (CDs). FDIC insurance does not, however, cover other financial products and services that insured banks may offer, such as stocks, bonds, mutual fund shares, life insurance policies, annuities or municipal securities.

Joint accounts are covered for $250,000 per co-owner. The limit is per person, per institution, so all your accounts at one institution are added together. If you have $200,000 in CDs and $100,000 in savings you would have $50,000 that is not covered.

FDIC is an excellent example of good government in action. The Federal Deposit Insurance Corporation (FDIC) was created in 1933 and serves to stabilize banking by eliminating the need to get ahead of any panic about whether the bank you have funds in is in trouble (which then leads to people creating a run on the bank…)

From an FDIC September 25 2008 news release: the current FDIC balance is $45 billion (that is after a decrease of $7.6 billion in the second quarter). The FDIC is 100% paid for by fees on banks. The FDIC can raise the fees charged banks if the insurance fund needs to get increased funds.

Read more

Anyone involved in finance should understand mania in the markets. It is not a shock that financial markets do irrational things. They do so very frequently. Anyone who has not read, Manias, Panics, and Crashes: A History of Financial Crises, should do so. Leverage often is a catalyst that turns bad investments into panics that damage the economy. A previous post on this topic: Misuse of Statistics – Mania in Financial Markets.

Enron was the pit canary, but its death went unheeded

As for the lessons we’ve forgotten, how about this one: financial statements aren’t supposed to be fairytales.

…

when all was booming, Wall Streeters said they deserved their pay because the market said they were worth it. But now things are falling apart, they say the market doesn’t work, and we need to stop short-selling, and taxpayers need to pony up. If there is a tiny bit of good in all this, it’s that Wall Street, although it was complicit in the Enron mess, managed to walk away relatively unscathed. This time, Wall Street has brought itself down.

I think the odds that Wall Street has brought itself down is very low. Even that the ludicrous excesses of Wall Street are at risk is very unlikely. Perhaps for a few years their might be some restraints put on excesses. But most likely politicians will respond to huge payments by arranging favors for those that want to bring excesses back. If this can be prevented that would be great, but I doubt it will.

Related: Investing books – Tilting at Ludicrous CEO Pay – Losses Covered Up to Protect Bonuses

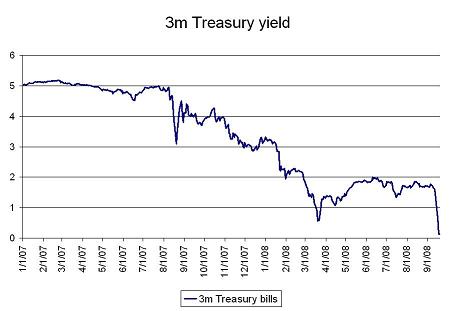

On Wednesday of last week the United States 3 month treasury bill yield reached .03%, yet another remarkable chart from the current crisis.

via: No one wants to hold risk … – “I guess this is what a close to systemic financial crisis in the US looks like”

Daily Treasury Yield Rates show that the rate for Friday the 12th of September 1.49%, Monday the 15th 1.02%, Tuesday .84%, Wednesday .03%, Thursday .23% and Friday .99%.

Related: Corporate and Government Bond Yields – Curious Cat Investing and Economics Search – Credit Crisis Continues (April 2008)

Example 30 year mortgage rates (from myfico.com – see site for current rate estimates). Previous posts on this topic: Feb 2008 – August 2007 – May 2007. Since the last post both jumbo and conforming mortgages rates are up (and are up most for high credit scores).

| FICO score | APR Aug 2008 | APR Aug 2008 – jumbo | APR Feb 2008 | APR Feb 2008 – jumbo | APR Aug 2007 | APR May 2007 |

|---|---|---|---|---|---|---|

| 760-850 | 6.12% | 7.00% | 5.53% | 6.61% | 6.27% | 5.86% |

| 700-759 | 6.34% | 7.22% | 5.75% | 6.83% | 6.49% | 6.08% |

| 660-699 | 6.62% | 7.50% | 6.04% | 7.12% | 6.77% | 6.37% |

| 620-659 | 7.43% | 8.31% | 6.85% | 7.93% | 7.58% | 7.18% |

| 580-619 | 9.45% | 9.63% | 9.22% | 9.40% | 9.32% | 8.82% |

| 500-579 | 10.31% | 10.49% | 10.20% | 10.37% | 10.31% | 9.68% |

For scores above 620, the APRs above assume a mortgage with 1.0 points and 80% Loan-to-Value Ratio. For scores below 620, these APRs assume a mortgage with 0 points and 60 to 80% Loan-to-Value Ratio.

Since February the premium for jumbo loans has decreased to 88 basis points (from 108) for all credit scores above 620 (the combination of higher down payment and higher regular interest rates below 620 result in very little premium from Jumbo loans, under 20 basis points.

Related: 30 Year Fixed Rate Mortgage Rate Data – Learning About Mortgages – How Much Worse Can the Mortgage Crisis Get? – Real Free Credit Report (in USA)

The Declining Value Of Your College Degree by Greg Ip:

For decades, the typical college graduate’s wage rose well above inflation. But no longer. In the economic expansion that began in 2001 and now appears to be ending, the inflation-adjusted wages of the majority of U.S. workers didn’t grow, even among those who went to college. The government’s statistical snapshots show the typical weekly salary of a worker with a bachelor’s degree, adjusted for inflation, didn’t rise last year from 2006 and was 1.7% below the 2001 level.

…

To be sure, the average American with a college diploma still earns about 75% more than a worker with a high-school diploma and is less likely to be unemployed. Yet while that so-called college premium is up from 40% in 1979, it is little changed from 2001

The job market is more challenging than it was, it seems to me. Counting on being able to steadily progress during your career, without any gaps or times when you must accept much less than you hoped, is risky. This is one more reason why it is so important to spend less and save more in the good times in your career.

Related: What Do Unemployment Stats Mean? – Engineering Graduates Again in Great Shape – USA Job Growth – The IT Job Market

Are You Financially Literate? Do this Simple Test to Find Out by Annamaria Lusardi.

a) More than $102

b) Exactly $102

c) Less than $102

d) Do not know

2) Imagine that the interest rate on your savings account was 1% per year and inflation was 2% per year. After 1 year, would you be able to buy more than, exactly the same as, or less than today with the money in this account?

a) More than today

b) Exactly the same as today

c) Less than today

d) Do not know

3) Do you think that the following statement is true or false? “Buying a single company stock usually provides a safer return than a stock mutual fund.”

a) True

b) False

c) Do not know

…

To be “financially literate” you need to answer correctly to all three questions.

And I would add, just answering those 3 simple questions does not mean you are. But if you don’t answer all 3 correctly you are not financially literate. We provide several resources to help people improve their literacy, including: our blog posts on financial literacy, Curious Cat Investing Dictionary and Curious Cat Investing Books.

Related: Questions You Should Ask About Your Investments – Annual Percentage Rate (APR) – Ignorance of Many Mortgage Holders

Read more