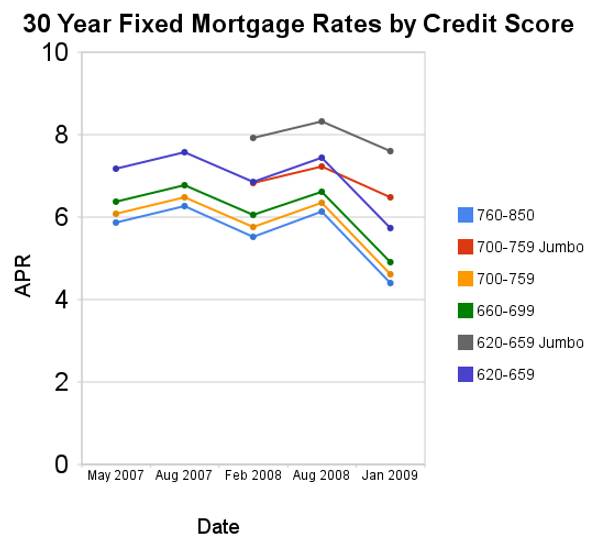

Since August of 2008 conforming mortgage rates are have declined a huge amount. Jumbo rates have fallen a large amount also, but much less (for example for a credit score of 700-759 the jumbo rates declined 73 basis points while the conventional rate declined 172 basis points.

For scores above 620, the APRs above assume a mortgage with 1 point and 80% Loan-to-Value Ratio. For scores below 620, these APRs assume a mortgage with 0 points and 60 to 80% Loan-to-Value Ratio. You can see, with these conditions the rate difference between a credit score of 660 and 800 is not large (remember this is with 20% down-payment) and has not changed much (the difference between the rates if fairly consistent).

Related: Low Mortgage Rates Not Available to Everyone – 30 Year Fixed Rate Mortgage Rate Data – Real Free Credit Report (in USA) – Jumbo Mortgage Shoppers Get Little Relief From Rates – posts on mortgages

Read more

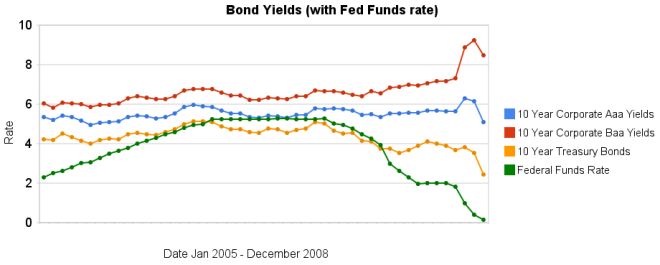

The recent reactions to the credit and financial crisis have been dramatic. The federal funds rate has been reduced to almost 0. The increase in the spread between government bonds and corporate bonds has been dramatic also. In the last 3 months the yields on Baa corporate bonds have increased significantly while treasury bond yields have decreased significantly. Aaa bond yields have decreased but not dramatically (57 basis points), well at least not compared to the other swings.

The spread between 10 year Aaa corporate bond yields and 10 year government bonds increased to 266 basis points. In January, 2008 the spread was 159 points. The larger the spread the more people demand in interest, to compensate for the increased risk. The spread between government bonds and Baa corporate bonds increased to 604 basis points, the spread was 280 basis point in January, and 362 basis points in September.

When looking for why mortgage rates have fallen so far recently look at the 10 year treasury bond rate (which has fallen 127 basis points in the last 3 months). The rate is far more closely correlated to mortgage rates than the federal funds rate is.

Data from the federal reserve – corporate Aaa – corporate Baa – ten year treasury – fed funds

Related: Corporate and Government Bond Rates Graph (Oct 2008) – Corporate and Government Bond Yields 2005-2008 (April 2008) – 30 Year Fixed Mortgage Rates versus the Fed Funds Rate – posts on interest rates – investing and economic charts

More Insurers Raise Fees on Variable Annuities

As SmartMoney has reported, this is one way that annuities are failing to live up to their big promises. The guarantees attached to the products – minimum returns of 6% per year or better, market upside, no chance of loss and a lifetime income stream – were designed to attract people in retirement or close to it.

And it worked, attracting $650 billion in assets in the last five years. But the guarantees are only as good as the insurance company’s ability to hedge them, and even when the markets were rising, some insurance company executives admitted their strategies hadn’t been tested by real-life crisis conditions. Now some estimates suggest that hedging costs have doubled in the last year, and insurers are passing those costs along to their customers.

…

For example, an investor might purchase a $100,000 annuity that pays a guaranteed 6% annual return for 10 years, or market returns — whichever is better. The fees for a product like that might look something like this:

- 1.3% annually on the current balance to cover the underlying investment

- 1% annually on the current balance for the insurance wrapper (called the mortality and expense charge)

- 1% of the original purchase price to cover the guarantee

The fees now rising are all in that last category — charges that cover guarantees. At the Hartford, the fees of three different kinds of guarantees are rising, from the current charge of 0.35% to 0.75%.

In general I am not inclined to insurance investment products. They are frequently overloaded with fees. Annuities can provide some balance in retirement, so annuitizing a portion of assets at retirement may be reasonable. But I would not use insurance investment products for a significant portion of my retirement assets.

Related: Personal Finance: Long-term Care Insurance – Many Retirees Face Prospect of Outliving Savings – Investor Protection Needed – Retirement Tips from TIAA CREF

We now have the lowest 30 year fixed mortgage rates since data has been collected (37 years) in the USA. Is this due to the Fed cutting the discount rate? I do not think so. As I have said previously 30 year fixed rates are not correlated with federal reserve rates. But this time the government is actively seeking to reduce mortgage rates.

Mortgage Rate Hits 37-Year Low

…

The 15-year fixed-rate mortgage averaged 4.92%, down from last week when it averaged 5.20%. A year ago the 15-year loan averaged 5.79%. The 15-year mortgage hasn’t been lower since April 1, 2004, when it averaged 4.84%.

Homeowners refinance, put savings under mattress

These rates sure are fantastic if you are in the market. I was not in the market, but I am considering re-financing now. You need to be careful and not just withdraw money because you can. If you can refinance and reduce your payments it may well be a wise move though. One problem can be extending the date you will finally be free of mortgage debt. If you re-finance a current 30 year loan, that you got 5 years ago, you will now be paying 5 more years. One option is to see if you can get a 25 or 20 year loan. Or if you can make a 15 year loan work, do that (15 and 30 year fixed rate mortgages are common).

Read more

Scott Adams does a great job with Dilbert and he presents a simple, sound financial strategy in Dilbert and the Way of the Weasel, page 172, Everything you need to know about financial planning:

- Make a will.

- Pay off your credit cards.

- Get term life insurance if you have a family to support.

- Fund your 401(k) to the maximum.

- Fund your IRA to the maximum.

- Buy a house if you want to live in a house and you can afford it.

- Put six months’ expenses in a money market fund. [this was wise, given the currently very low money market rates I would use "high yield" bank savings account now, FDIC insured - John]

- Take whatever money is left over and invest 70% in a stock index fund and 30% in a bond fund through any discount broker, and never touch it until retirement.

- If any of this confuses you or you have something special going on (retirement, college planning, tax issues) hire a fee-based financial planner, not one who charges a percentage of your portfolio.

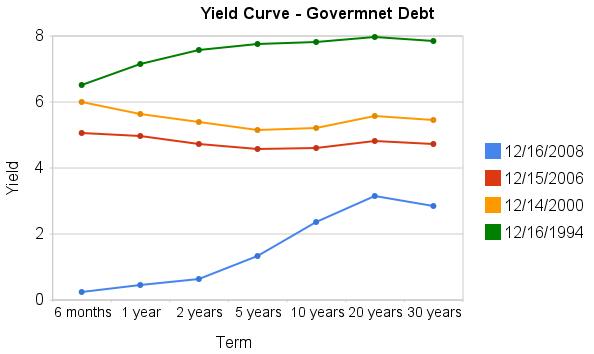

Treasury bills have been providing remarkably low yields recently. And the Fed today cut their target federal funds rate to 0-.25% (what is the fed funds rate?). With such low rates already in the market the impact of a lowered fed funds rate is really negligible. The importance is not in the rate but in the continuing message from the Fed that they will take extraordinary measures to soften the recession.

There are significant risks to this aggressive strategy (and there would be risks for acting cautiously too). But I cannot understand investing in the dollar under these conditions or in investing in long term bonds (though lower grade bonds might make some sense as a risky investment for a small portion of a portfolio as the prices have declined so much).

The current yields, truly are amazing as this graph shows. The chart shows the yield curve in Dec 2008, 2006, 2000 and 1994 based on data from the US Treasury

Related: Corporate and Government Bond Rates Graph – Discounted Corporate Bonds Failing to Find Buying Support – Municipal Bonds After Tax Return – Total Return

The Securities Investor Protection Corporation restores funds to investors with assets in the hands of bankrupt and otherwise financially troubled brokerage firms. The Securities Investor Protection Corporation was not chartered by Congress to combat fraud, but to return funds (with a $500,000 limit for securities and under that a $100,000 cap on cash) that you held in a covered account.

With the recent Madoff fraud case some may wonder about SIPC coverage. What SIPC would cover is cash fraudulently withdrawn from covered account (if I owned 100 shares of Google and they took my shares that is covered – as I understand it). What SIPC does not cover is investment losses. From my understanding Madoff funds suffered both these types of losses.

And I am not sure how the Ponzi scheme aspects would be seen. For example, I can’t imagine false claims from Mandoff about returns that never existed are covered. Therefore if you put in $100,000 10 years ago and were told it was now worth $400,000, I can’t image you would be covered for the $400,000 they told you it was worth – if that had just been a lie. And if your $100,000 from strictly a investing perspective (not counting money they fraudulently took to pay off other investors) was only worth $50,000 (it had actually lost value) then I think that would be the limit of your coverage. So if they had paid your $50,000 to someone else fraudulently you would be owed that. Figuring out what is covered seems like it could be very messy.

Read more

Recent market collapses have made it even more obvious how import proper retirement planning is. There are many aspects to this (this is a huge topic, see more posts on retirement planning). One good strategy is to put a portion of your portfolio in income producing stocks (there are all sorts of factors to consider when thinking about what percentage of your portfolio but 10-20% may be good once you are in retirement). They can provide income and can providing growing income over time (or the income may not grow over time – it depends on the companies success).

…

Strategy #3: Buy common stocks with solid dividends and a history of raising dividends for the long haul. That way you let time and compounding work for you. While you may be buying $1 per share in dividends today with stocks like these, you’re also buying, say, 8% annual increases in dividends. In 10 years, that turns a $1-a-share dividend into $2.16 a share in dividends.

3 of this picks are: Enbridge Energy Partners (EEP), dividend yield of 15.5%, dividend history; Energy Transfer Partners (ETP), 11.2%, dividend history; Rayonier (RYN), yielding 6.7%, dividend history.

Of course those dividends may not continue, these investments do have risk.

Related: S&P 500 Dividend Yield Tops Bond Yield: First Time Since 1958 –

Discounted Corporate Bonds Failing to Find Buying Support – Allocations Make A Big Difference

Pension Funds Beg Congress to Suspend Billions in Contributions

Instead of money, they want legislation to suspend a federal law that would make them pump billions of dollars into retirement plans to offset stock-market losses as many struggle to find enough cash just to stay in business.

So lets see, you minimally fund the pension plan for your workers and make optimistic projections about investing returns. The market goes down, and you are now so far underfunding your pension that the law requires you to add funds to the pension. Your solution, go cry to the politicians. How sad. If Pfizer or IBM are having cash flow problems that is amazing. They really should be able to manage their cash better than that. Their most recent quarterly reports do not indicate cash flow problems. Yes I understand we have a credit crisis so if GM were having problems I wouldn’t be surprised (but you know what – they aren’t, in this area).

…

GM was notably absent from the five-page list of companies and organizations asking Congress for relief from the asset thresholds. GM said its pension plans had a $1.8 billion deficit as of Oct. 31, down from a $20 billion surplus 10 months earlier. At that level, GM’s plans would top the pension law’s 2008 asset threshold.

I think companies need to meet their obligations. If they choose to minimally fund their pensions without understanding that financial market are volatile, then they will have to pay up as required by law. When times are good you see all these CEOs taking advantage of pension fund “excesses” to reward themselves. They need to learn that you don’t raid your pension funds (either by taking cash out or not funding current investments – because you claim the assets are already sufficient). Pension funds are long term investments and you cannot manage as though the target value is the minimum amount allowed by law (unless you are willing to pay up cash every time your investments don’t meet your predicted returns). This is very simple stuff.

Jobless Rate Rises to 6.7% in November

…

The decline, the largest one-month loss since December 1974, was fresh evidence that the economic contraction accelerated in November, promising to make the current recession, already 12 months old, the longest since the Great Depression. The previous record was 16 months, in the severe recessions of the mid-1970s and early 1980s.

…

The manufacturing sector has been particularly hard hit, losing more than half a million jobs this year. That is nearly half the 1.2 million jobs lost since employment peaked in December and, in January, began its uninterrupted decline. The cutbacks seem likely to accelerate as the three Detroit automakers close more factories and shrink payrolls even more

…

With all this in mind, and particularly the shrinking employment rolls, economists are estimating that the gross domestic product is contracting at an annual rate of 4 percent or more in the fourth quarter, after a decline of 0.3 percent in the third quarter.

The news was even worse than the anticipated 350,000 losses. And Previous months figures were adjusted from 240,000 losses in October to 320,00 and from 284,000 in September to 403,000. And these numbers are on an already extremely poor job picture the previous 7 years. One of the great strengths of the US economy over the last 50 years has been job creation. We know we are in for serious problems, the question is how serious and how long. One of the most important gages of that will be how many jobs are lost.

When job losses stop and job gains start (in the aggregate, for the entire economy) it will be a very positive sign. Normally jobs are a lagging indicator, meaning job data lags the actual economy. Job losses will not increases until after the economy starts to grow. Of course, economic data doesn’t always fit the conventional wisdom.

This is one more piece of evidence that the economy is not looking good. And 2009 is likely to be a bad year for the economy overall.

Related: Bad News on Jobs (Sep 2008) – What Do Unemployment Stats Mean? – The Economy is in Serious Trouble – Financial Market Meltdown