Retirement Myths and Realities provides some ideas from former Boeing President, Henry Hebeler:

…

My father used to tell me to save 10 percent of my wages all the time for retirement. And so I did. I never looked at any retirement plan; we didn’t have retirement planning tools in those days.

…

I think the number is closer to 15 (percent) to 20 percent — that’s from the time when you’re a relatively young person, say, 30 years old or something like that.

…

A retiree’s inflation rate is about 0.2 percent higher than the normal Consumer Price Index. When you retire, you have medical expenses that continually increase. You have more need for this service and the unit cost is increasing much faster than inflation.

…

Now, if you’re going to retire at 80 years old, you could actually have a bigger number than 4 percent. If you’re going to retire around 65 or so, 4 percent is not a bad number. Some people are now saying 3.5 percent instead of 4 percent. If you’re going to retire at 55, you’d better spend a lot less than 4 percent because you’ve got another 10 years of life that you’re going to have to support.

He makes some interesting points. I agree it is very important for people to become financially literate and take the time to understand their retirement plans. Just hoping it will work out or trusting that just doing what someone told you are very bad ideas. You need to educate yourself and learn about financing your retirement.

I am not really convinced by his idea that you need to start saving 15-20% for retirement at age 30. But that is a decision each person has to make for themselves. Of course there are many factors including how much risk you are willing to accept, when you plan on retiring, what standard of living you want in retirement…

Related: How Much Retirement Income? – posts on retirement – Saving for Retirement – Our Only Hope: Retiring Later

The lowest 30 Year fixed mortgage rates in 37 years is great news for those looking to buy a house or to re-finance. However, that truth (the lowest rate) masks another truth, that it is available to a somewhat limited pool of borrowers. The rates for jumbo 30 year fixed mortgages and for regular 30 year fixed mortgages, for those with lower credit ratings, are not at the lowest rates they have ever reached. And getting mortgage rates that don’t require a 10-20% down payment and fully documented financial position are not as low as they have ever been. 15 year fixed rates are also low, but are not at all time lows. FHA loans still allow very low down payments, but others have moved away from this practice (which is a wise move).

Current rates, national average, from Bankrate: 30 year fixed 5.26%, 30 year fixed jumbo 6.96% (a full 170 basis points higher rate), 15 year fixed 5.07%. Jumbo rates have been less than 40 basis points higher than conventional rates most of time (based on my memory – I am looking for a source to confirm). The site does not present the credit score but my guess is these rates are based on a credit score of 700, or higher. Last week the jumbo rates increased by 11 basis points and regular 30 year rates fell by 3 basis points.

Related: Jumbo v. Regular Fixed Mortgage Rates: by Credit Score – historical mortgage rate chart – Nearly 10% of Mortgages Delinquent or in Foreclosure – misinterpreting data

Changes in the Market For Jumbo Mortgages

…

On Nov 12, 2008 I shopped for an $800,000 30-year fixed-rate mortgage on Mortgage Marvel, an on-line site that I reviewed earlier in 2008 (see A Look at Mortgage Marvel). The mortgage companies on the site quoted rates of 8.125% to 8.375%. The credit unions and banks, in contrast, quoted rates ranging from 5.875% to 7.875%. I have never before seen rate differences on the same transaction this large. They no doubt reflect wide differences in lender access to funding, which is symptomatic of a market in turmoil.

We now have the lowest 30 year fixed mortgage rates since data has been collected (37 years) in the USA. Is this due to the Fed cutting the discount rate? I do not think so. As I have said previously 30 year fixed rates are not correlated with federal reserve rates. But this time the government is actively seeking to reduce mortgage rates.

Mortgage Rate Hits 37-Year Low

…

The 15-year fixed-rate mortgage averaged 4.92%, down from last week when it averaged 5.20%. A year ago the 15-year loan averaged 5.79%. The 15-year mortgage hasn’t been lower since April 1, 2004, when it averaged 4.84%.

Homeowners refinance, put savings under mattress

These rates sure are fantastic if you are in the market. I was not in the market, but I am considering re-financing now. You need to be careful and not just withdraw money because you can. If you can refinance and reduce your payments it may well be a wise move though. One problem can be extending the date you will finally be free of mortgage debt. If you re-finance a current 30 year loan, that you got 5 years ago, you will now be paying 5 more years. One option is to see if you can get a 25 or 20 year loan. Or if you can make a 15 year loan work, do that (15 and 30 year fixed rate mortgages are common).

Read more

The economy (in the USA and worldwide) continues to struggle and the prospects for 2009 do not look good. My guess is that the economy in 2009 will be poor. If we are lucky, we will be improving in the fall of 2009, but that may not happen. But what does that mean for how to invest now?

I would guess that the stock market (in the USA) will be lower 12 months from now. But I am far from certain, of that guess. I have been buying some stocks over the last few months. I just increased my contributions to my 401(k) by about 50% (funded by a portion of my raise). I changed the distribution of my future contributions in my 401(k) (I left the existing investments as they were).

My contributions are now going to 100% stock investments (if I were close to retirement I would not do this). I had been investing 25% in real estate. I also moved into a bit more international stocks from just USA stocks. I would be perfectly fine continuing to the 25% in real estate, my reason for switching was more that I wanted to buy more stocks (not that I want to avoid the real estate). The real estate funds have declined less than 3% this year. I wouldn’t be surprised for it to fall more next year but my real reason for shifting contributions to stocks is I really like the long term prospects at the current level of the stock market (both globally and in the USA). The short term I am much less optimistic about – obviously.

I will also fully fund my Roth IRA for 2009, in January. I plan to buy a bit more Amazon (AMZN) and Templeton Emerging Market Fund (EMF). And will likely buy a bit of Danaher (DHR) or PetroChina (PTR) with the remaining cash.

Related: 401(k)s are a Great Way to Save for Retirement – Lazy Portfolio Results – Starting Retirement Account Allocations for Someone Under 40

Scott Adams does a great job with Dilbert and he presents a simple, sound financial strategy in Dilbert and the Way of the Weasel, page 172, Everything you need to know about financial planning:

- Make a will.

- Pay off your credit cards.

- Get term life insurance if you have a family to support.

- Fund your 401(k) to the maximum.

- Fund your IRA to the maximum.

- Buy a house if you want to live in a house and you can afford it.

- Put six months’ expenses in a money market fund. [this was wise, given the currently very low money market rates I would use "high yield" bank savings account now, FDIC insured - John]

- Take whatever money is left over and invest 70% in a stock index fund and 30% in a bond fund through any discount broker, and never touch it until retirement.

- If any of this confuses you or you have something special going on (retirement, college planning, tax issues) hire a fee-based financial planner, not one who charges a percentage of your portfolio.

Treasury bills have been providing remarkably low yields recently. And the Fed today cut their target federal funds rate to 0-.25% (what is the fed funds rate?). With such low rates already in the market the impact of a lowered fed funds rate is really negligible. The importance is not in the rate but in the continuing message from the Fed that they will take extraordinary measures to soften the recession.

There are significant risks to this aggressive strategy (and there would be risks for acting cautiously too). But I cannot understand investing in the dollar under these conditions or in investing in long term bonds (though lower grade bonds might make some sense as a risky investment for a small portion of a portfolio as the prices have declined so much).

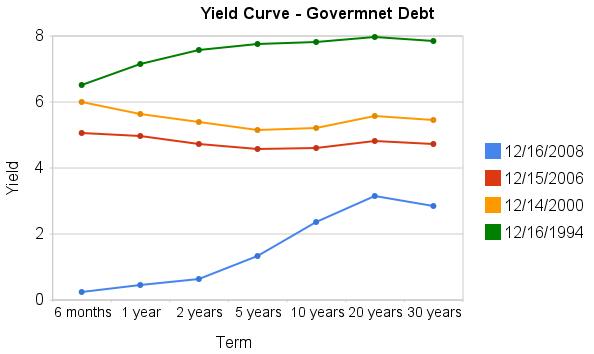

The current yields, truly are amazing as this graph shows. The chart shows the yield curve in Dec 2008, 2006, 2000 and 1994 based on data from the US Treasury

Related: Corporate and Government Bond Rates Graph – Discounted Corporate Bonds Failing to Find Buying Support – Municipal Bonds After Tax Return – Total Return

The Securities Investor Protection Corporation restores funds to investors with assets in the hands of bankrupt and otherwise financially troubled brokerage firms. The Securities Investor Protection Corporation was not chartered by Congress to combat fraud, but to return funds (with a $500,000 limit for securities and under that a $100,000 cap on cash) that you held in a covered account.

With the recent Madoff fraud case some may wonder about SIPC coverage. What SIPC would cover is cash fraudulently withdrawn from covered account (if I owned 100 shares of Google and they took my shares that is covered – as I understand it). What SIPC does not cover is investment losses. From my understanding Madoff funds suffered both these types of losses.

And I am not sure how the Ponzi scheme aspects would be seen. For example, I can’t imagine false claims from Mandoff about returns that never existed are covered. Therefore if you put in $100,000 10 years ago and were told it was now worth $400,000, I can’t image you would be covered for the $400,000 they told you it was worth – if that had just been a lie. And if your $100,000 from strictly a investing perspective (not counting money they fraudulently took to pay off other investors) was only worth $50,000 (it had actually lost value) then I think that would be the limit of your coverage. So if they had paid your $50,000 to someone else fraudulently you would be owed that. Figuring out what is covered seems like it could be very messy.

Read more

I don’t actually agree with the contention in this post, but the post is worth reading. I will admit I am more certain of I like the prospect of investing in certain stocks (Google, Toyota, Danaher, Petro China, Templeton Dragon Fund, Amazon [I don't think Amazon looks as cheap as the others, so their is a bit more risk I think but I still like it]) for the next 5 years than I am in the overall market. But I am also happy to buy into the S&P 500 now in my 401(k).

Stocks Still Overpriced even after $6 Trillion in Market Cap gone from the Index

…

Even if we assumed a healthy economy, the price is no bargain. Throw in the fact that we are in recession and you can understand why the S & P 500 is still overvalued. We haven’t even come close to the historical P/E of 15.79 which includes good times as well.

Just to be clear current PE ratios have nothing to do with next year. It would be accurate to say someone making the argument that the S&P 500 is cheap now because of the current PE ratio, is leaving out an important factor which is what will earning be like next year. It does seem likely earnings will fall. But I also am not very concerned about earning next year, but rather earning over the long term. I see no reason to be fearful the long term earning potential of say Google is harmed today.

Related: S&P 500 Dividend Yield Tops Bond Yield for the First Time Since 1958 – 10 Stocks for 10 Years – Starting Retirement Account Allocations for Someone Under 40 – Books on Investing

The percentage of loans in the foreclosure process at the end of the third quarter was 2.97 percent, an increase of 22 basis points from the second quarter of 2008 and 128 basis points from one year ago. The percentage of loans in the process of foreclosure set a new record this quarter, to 1.35 million.

Mortgages are counted as delinquent or in foreclosure (once they are in foreclosure they are not counted as delinquent). So the total percentage of mortgages not being paid by the homeowner is 2.97% (in foreclosure) + 6.99% (delinquent) = 9.96%. That is amazingly bad. In February of 2007 I wrote about this and the delinquency rate was 4.7% which sounded pretty bad to me. Amazingly 4.4% is a historic low for this figure. Can you believe 1/25 mortgages is delinquent and that is as good as we ever get? That is pretty shocking to me.

The seasonally adjusted total delinquency rate is now the highest recorded in the Mortgage Bankers Association survey. The seasonally adjusted delinquency rate increased 41 basis points to 4.34 percent for prime loans, increased 136 basis points to 20.03 percent for subprime loans, increased 29 basis points to 12.92 percent for FHA loans, and increased 46 basis points to 7.28 percent for VA loans.

The percent of loans in the foreclosure process increased 16 basis points to 1.58 percent for prime loans, and increased 74 basis points for subprime loans to 12.55 percent. FHA loans saw an eight basis point increase in the foreclosure inventory rate to 2.32 percent, while the foreclosure inventory rate for VA loans increased 13 basis points to 1.46 percent.

Since loans that would have gone into foreclosure in the past are being kept out of foreclosure due to some programs ( ) the rate or seriously delinquent is a useful measure of serious problems. Seriously delinquent mortgages are 90 days past due. The rate increased 52 basis points for prime loans to 2.87 percent, increased 171 basis points for subprime loans to 19.56 percent, increased 62 basis points for FHA loans to 6.05 percent, and increased 45 basis points for VA loans percent to 3.45 percent.

Compared to a year ago: the seriously delinquent rate was 156 basis points higher for prime loans and 818 basis points higher for subprime loans. The rate also increased 51 basis points for FHA loans and 89 basis points for VA loans.

Related: Homes Entering Foreclosure at Record (Sep 2007) – Foreclosure Filings Continue to Rise – How Much Worse Can the Mortgage Crisis Get? – How Not to Convert Equity

Recent market collapses have made it even more obvious how import proper retirement planning is. There are many aspects to this (this is a huge topic, see more posts on retirement planning). One good strategy is to put a portion of your portfolio in income producing stocks (there are all sorts of factors to consider when thinking about what percentage of your portfolio but 10-20% may be good once you are in retirement). They can provide income and can providing growing income over time (or the income may not grow over time – it depends on the companies success).

…

Strategy #3: Buy common stocks with solid dividends and a history of raising dividends for the long haul. That way you let time and compounding work for you. While you may be buying $1 per share in dividends today with stocks like these, you’re also buying, say, 8% annual increases in dividends. In 10 years, that turns a $1-a-share dividend into $2.16 a share in dividends.

3 of this picks are: Enbridge Energy Partners (EEP), dividend yield of 15.5%, dividend history; Energy Transfer Partners (ETP), 11.2%, dividend history; Rayonier (RYN), yielding 6.7%, dividend history.

Of course those dividends may not continue, these investments do have risk.

Related: S&P 500 Dividend Yield Tops Bond Yield: First Time Since 1958 –

Discounted Corporate Bonds Failing to Find Buying Support – Allocations Make A Big Difference