Pension Funds Beg Congress to Suspend Billions in Contributions

Instead of money, they want legislation to suspend a federal law that would make them pump billions of dollars into retirement plans to offset stock-market losses as many struggle to find enough cash just to stay in business.

So lets see, you minimally fund the pension plan for your workers and make optimistic projections about investing returns. The market goes down, and you are now so far underfunding your pension that the law requires you to add funds to the pension. Your solution, go cry to the politicians. How sad. If Pfizer or IBM are having cash flow problems that is amazing. They really should be able to manage their cash better than that. Their most recent quarterly reports do not indicate cash flow problems. Yes I understand we have a credit crisis so if GM were having problems I wouldn’t be surprised (but you know what – they aren’t, in this area).

…

GM was notably absent from the five-page list of companies and organizations asking Congress for relief from the asset thresholds. GM said its pension plans had a $1.8 billion deficit as of Oct. 31, down from a $20 billion surplus 10 months earlier. At that level, GM’s plans would top the pension law’s 2008 asset threshold.

I think companies need to meet their obligations. If they choose to minimally fund their pensions without understanding that financial market are volatile, then they will have to pay up as required by law. When times are good you see all these CEOs taking advantage of pension fund “excesses” to reward themselves. They need to learn that you don’t raid your pension funds (either by taking cash out or not funding current investments – because you claim the assets are already sufficient). Pension funds are long term investments and you cannot manage as though the target value is the minimum amount allowed by law (unless you are willing to pay up cash every time your investments don’t meet your predicted returns). This is very simple stuff.

I believe in the management at Google is doing as good a job as the management at any company. They are not afraid to pursue their convictions even if conventional wisdom says they should not. I believe in Google more than the conventional wisdom. And I have been buying Google stock as it has declined the last 6 months.

I am perfectly happy for Google’s stock price to continue declining: I will continue to buy. I have no intention of selling for decades. Things could change, that would lead me to sell but right now I am firmly a believer in owning a piece of Google for the long term. I am thrilled to have very smart engineers effectively guiding a company (including sustaining a culture where engineers can provide value without the amount of pointy haired boss behavior found elsewhere) to provide value to customers and users of their services while profiting quite nicely. And at these prices the investment opportunity looks great to me. I still believe in following prudent diversification practices (far less than 10% of my investments are in Google stock)

Google CEO defiant in defending energy interests

He was quick to add that Google has a material interest in lower energy costs to help power its crucial data centers. “We’re going to likely consume more [energy], and we’d like the prices to go down,” he said.

…

Schmidt said the bulk of spending on necessary research and development for Google’s ambitious energy plan will have to come from the government. The CEO added that he’s almost certain that an opportunity to tap government largesse is now at hand, as he believes a “stimulus package” will follow the $700 billion Wall Street bailout

I have written about Google’s focus on energy previously: Google Investing Huge Sums in Renewable Energy and is Hiring – Google.org Invests $10 million in Geothermal Energy – Reduce Computer Waste.

With most companies I would be very skeptical delving into area pretty far removed from their core business would likely not prove an effective strategy. But I believe Google can be successful with such efforts. Some will certainly fail but Google will manage that fine and have at least one or two payoff in such a large way that all the investments are paid off quite well.

Related: Google Believes in Engineers – Google’s Underwater Cables – Data Center Energy Needs – 12 Stocks for 10 Years Update – June 2008

When looking at the long term data, USA manufacturing output continues to increase. For decades people have been repeating the claim that the manufacturing base is eroding. It has not been true. I realize the economy is on weak ground today, I am not talking about that, I am looking at the long term trends.

The USA manufactures more than anyone else – by far. The percentage of total global manufacturing is the same today it was two decades ago (and further back as well). For decades people have been saying the USA has lost the manufacturing base – it just is not true. No matter how many times they say it does not make it true. It is true since 2000 the USA increase in manufacturing output (note not a decrease) has not kept pace with global grown in manufacturing output (global output in that period is up 47% and the USA is up 19% – Japan is down 10% for that period).

I would guess 20 years from today the USA will have a lower percentage of worldwide manufacturing. But I don’t see any reason believe the USA will see a decline in total manufacturing output. I just think the rest of the world is likely to grow manufacturing output more rapidly.

Looking at a year or even 2 or 3 years of manufacturing output data leaves a great deal of room to see trends where really just random variation exists. Even for longer periods trends are hard to project into the future.

Conventional wisdom is correct about China growing manufacturing output tremendously. China has grown from 4% of the output of the largest manufacturing companies in 1990 to manufacturing 16% of the total output in China today. That 12% had to come from other’s shares. And given all you hear from the general press, financial press, politicians, commentators… you would think the USA must have much less than China today, so may 10% and maybe they had 20% in 1990. When actually in 1990 the USA had 28% and in 2007 they had 27%.

Manufacturing jobs are not moving oversees. Manufacturing jobs are decreasing everywhere.

Read more

Diversification overrated? Not a chance by Jason Zweig

For anyone with a sustainable ability to identify the hottest investment of the moment, diversification is a mistake. But if you really believe you’ve got that ability, you’re not just mistaken. You need to be hauled off in a straitjacket to the Institute for the Treatment of Investment Insanity.

Exactly right. As we posted previously Warren Buffett’s diversification thoughts are similar

You have to remember when Warren Buffett says “professional and have confidence” he doesn’t really mean just what those words say. He mean if you are Charlie Munger, George Soros, Jimmy Rodgers and maybe 10 other people alive today (maybe I am too restrictive, maybe he would include 50 more people alive today, but I doubt it).

Related: Dilbert on Investing – investment risks – Curious Cat Investing and Economics Search Engine

Feds Rethink Rules on Retirement Savings

Among the possible changes: allowing taxpayers to delay taking required withdrawals from their individual retirement accounts, 401(k) plans and other similar accounts this year — or at least reducing the amount that must be withdrawn. Also under consideration are various ways to provide tax relief for people who already have made their required withdrawals for this year.

This is silly. Everyone in the situation of having to make a withdrawal has know about the requirement for years. My guess is this has been the law for over 20 years. Yes, the stock market is down. Yes, being forced to sell now would be bad. And how does providing “tax relief” to those who already made required withdrawals make any sense? Why not just have the treasury send checks to every American, who had a loss on an investment this year, equal to the amount of their loss? (By the way this is sarcasm – they should not really do that). These people have lost any sense of what investing, planning, responsibly… are.

First, knowing you have required withdrawals from your IRA, you should not hold those assets in stock (I suppose you could have significant cash assets outside your IRA and chose to just use the next option). Second, you can buy the stock outside your IRA at the same minute you sell them in the IRA. What is the big deal: the cost should be about $20 in stock commission for each stock – you save that much each time you fill up your gas tank lately (compared to prices this summer). All that not having to withdraw funds does is let those wealthy enough not to need a small amount of their IRA or 401(k) savings by the time they are 70 1/2 to keep deferring taxes on their investment gains.

Therein lies one of the major problems. This year’s distributions are based on Dec. 31, 2007, levels — a time when market prices generally were far above today’s deeply depressed values. As a result, “millions of Americans are forced to withdraw larger-than-anticipated amounts from already-depleted retirement funds,” says David Certner, legislative policy director at AARP, an advocacy group that represents nearly 40 million older Americans.

What kind of 1984 newspeak is this? I mean this is absolutely ridicules. You have to withdraw the exact amount you knew on January 1st 2008. Nothing about that has changed in almost a year. How can the Wall Street Journal report this without pointing out the completely false claim.

Read more

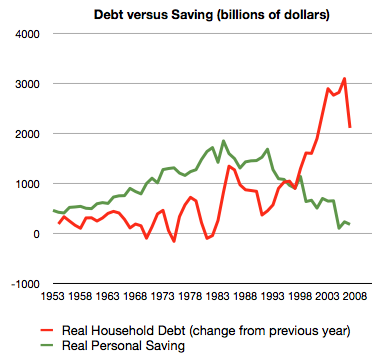

The whole sorry mess in one picture (including chart) by Philip Brewer

…

Starting back in about 2005, the American consumer reached the point that they could no longer service ever-increasing amounts of debt. That led to the housing bubble popping. The result is what you can see in the last datapoint on the graph–less new borrowing in 2007.

Related: $2,540,000,000,000 in USA Consumer Debt – Americans are Drowning in Debt – save an emergency fund – Financial Illiteracy Credit Trap – posts on saving money

How to thrive when this bear dies by Jim Jubak

…

In the case of the 2000-02 bear, the initial rush after the end of the bear delivered a huge share of the 101% gain for the bull market that ran from October 2002 through October 2007. In the 16 months from the Oct. 9, 2002, low through Feb. 9, 2004, the S&P 500 gained 47%. The gains from the remaining years of the “great” bull market of the “Oughts” were rather anemic: just 9% in 2004, 3% in 2005 and 14% in 2006.

…

If I’m right about the arrival of a secular bear, emerging economies and their stock markets will deliver higher returns, despite relatively slow growth, than the even more slowly growing developed economies. If I’m wrong about the secular bear, emerging economies will still deliver stronger growth than the world’s developed economies. Under either scenario, investors want to increase their exposure to the world’s emerging economies, which deliver more performance bang for less risk than most investors think.

Jim Jubak is one of my favorite investing writers. He can of course be wrong but he provides worthwhile insight, backed with research, and specific suggestions. I am also positive on the outlook for stocks (though what the next year or so hold I am less certain) and on emerging markets.

Related: Why Investing is Safer Overseas – Rodgers on the US and Chinese Economies – Beating the Market – The Growing Size of non-USA Economies – Warren Buffett’s 2004Annual Report

S&P 500 Payout Tops Bond Yield, a First Since 1958 (site broke the link, so I removed it):

…

Treasuries routinely had higher yields than stocks before 1958, according to Bernstein. When this relationship came to an end, yields were near their current levels. The S&P 500 dividend yield fell 0.58 percentage point, to 3.24 percent, in the third quarter of 1958. The 10-year yield rose about the same amount, 0.6 point, to 3.80 percent.

Two explanations later emerged for the reversal, he wrote. One held that the economy’s recovery from the 1957-58 recession showed “investors could finally put to rest the widely held expectation of an imminent return to the Great Depression.” The second was the increasing popularity of investing in growth stocks, or shares of companies whose sales and earnings rose at a relatively fast pace. Because of their expansion, the companies often paid below-average dividends.

Reversal of Fortunes Between Stocks and Bonds

Arnott takes it a step further. “In a world of deleveraging, both for the financial services arena and for the economy at large, growth is less certain,” he says. “And with the economy eroding sharply, so is inflation. If stocks don’t deliver nominal growth in dividends and earnings, then their yield ‘must’ exceed the Treasury yield, in order to give us any sort of risk premium.”

Related: Corporate and Government Bond Rates Graph – Highest Possible Returns – posts on interest rates – investing strategy

Financial Markets with Professor Robert Shiller (spring 2008) is a fantastic resource from Open Yale courses: 26 webcast (also available as mp3) lectures on topics including: The Universal Principle of Risk Management, Stocks, Real Estate Finance and Its Vulnerability to Crisis, Stock Index, Oil and Other Futures Markets and Learning from and Responding to Financial Crisis (Guest Lecture by Lawrence Summers).

Robert Shiller created the repeat-sales home price index with Karl Case that is known as the Case-Shiller home price index.

Related: Berkeley and MIT courses online – Open Access Education Materials – Curious Cat Science and Engineering Blog open access posts – Paul Krugman Speaks at Google

The New Paradigm for Financial Markets is George Soros‘ newest book. Here is an interview with him in May of this year, on PBS, Financial World Shifts Gears Amid Economic Tumult, about the ideas in the book and the current crisis.

GEORGE SOROS: I think this is the most serious crisis of our lifetime. It’s not just a housing crisis, but a crisis of the financial system.

…

GEORGE SOROS: The regulators have failed to regulate, and they really have to — they left it to the market. That was this market fundamentalist philosophy, that markets will take care of themselves.

…

And I contend that there’s been what I call a super bubble that has been growing over the last 25 years at least, which basically consisted of an extension in credit, increasing use of leverage. That was the trend in reality.

And the misconception that credit is that markets can be left to their own devices. Now, in fact, they are given to excesses, and occasionally they create crises, but each time the authorities intervene and bail out the failing institutions, provide fiscal stimulus, monetary stimulus.

So it seems like the market corrects itself, but it’s actually the intervention of the authorities that saves the market.

Related: Soros on the Financial Market Collapse – Jim Rogers on the Financial Market Mess – Leverage, Complex Deals and Mania