With the recent turmoil in the financial market this is a good time to look at Dollar cost averaging. The strategy is one that helps you actually benefit from market volatility simply.

You actually are better off with wild swings in stock prices, when you dollar cost average, than if they just went up .8% every single month (if both ended with stocks at the same price 20 years later). Really the wilder the better (the limit is essentially the limit at which the economy was harmed by the wild swings and people decided they didn’t want to take risk and make investments.

Here are two examples, if you invest $1,000 in a mutual fund and the price goes up every year (for this example the prices I used over 20 years: 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 22, 24, 26, 28, 30, 33, 36,39) you would end up with $40,800 and you would have invested $20,000. The mutual fund went from $10 a share to $39 over that period (which is a 7% return compounded annually for the share price). If you have the same final value but instead of the price going up every year the price was volatile (for example: 10, 11, 7, 12, 16, 18, 20, 13, 10, 16, 20, 15, 24,29, 36, 27, 24, 34, 39) you end up with more most often (in this example: $45,900).

You could actually end up with less if the price shot up well above the final price very early on and then stayed there and then dropped in the last few years. As you get close to retirement (10 years to start paying close attention) you need to adopt a strategy that is very focused on reducing risk of investment declines for your entire portfolio.

The reason you end up with more money is that when the price is lower you buy more shares. Dollar cost averaging does not guaranty a good return. If the investment does poorly over the entire period you will still suffer. But if the investment does well over the long term the added volatility will add to your return. By buying a consistent amount each year (or month…) you will buy more share when prices are low, you will buy fewer shares when prices are high and the effect will be to add to your total return.

Now if you could time the market and sell all your shares when prices peaked and buy again when prices were low you could have fantastic returns. The problem is essentially no-one has been able to do so over the long term. Trying to time the market fails over and over for huge numbers of investors. Dollar cost averaging is simple and boring but effective as long as you chose a good long term investment vehicle.

Investing to your IRA every year is one great way to take advantage of dollar cost averaging. Adding to your 401(k) retirement plan at work is another (and normally this will automatically dollar cost average for you).

Related: Does a Declining Stock Market Worry You? – Save Some of Each Raise – Starting Retirement Account Allocations for Someone Under 40 – Save an Emergency Fund

Would the Dow Dump General Motors?

…

At this point, it’s not clear if the government will be willing to take on the horribly mismanaged automaker. It’s one thing to save a financial firm that continues to make money and another thing to rescue a business that for decades has been unable to control labor and legacy costs or deliver a product that consumers want. GM could be allowed to declare bankruptcy.

…

But for some reason nostalgic Americans refuse to let the carmakers take a hit and learn from their mistakes. A bailout seems to be preferred. It worked so well for Chrysler.

…

Is it important to the Dow editors to keep an auto presence in the index?

…

And since the Dow is meant to be a barometer of the U.S. market, Toyota and Honda can’t be considered. Then again maybe they should leave a bankrupt company in the Dow. It might be the most accurate barometer of the market yet by tracking all the blue chips that have gone bankrupt.

I discussed dropping GM from the Dow Jones Industrial Average in December of 2005: “I agree removing GM makes sense, though I see no reason to wait.”

Related: Dow Jones Industrial Average Changes – Another Great Quarter for Amazon (July 2007) – Stop Picking Stocks – Curious Cat Investing Web Search

FDIC Details Plan To Alter Mortgages

…

Agency officials estimated the cost to the government at $22.4 billion.

…

The mortgage industry is concerned that any new modification plan will persuade some people to stop making mortgage payments in addition to helping people who already have stopped making payments. The industry argues this will translate into higher interest rates because investors will demand compensation for the increased risk of loan defaults. That, in turn, would limit the number of people who can afford mortgage loans.

…

FDIC estimates that 1.4 million borrowers with such loans are at least two months late on their payments, and another 3 million borrowers will miss at least two payments by the end of next year. The agency estimates that half those borrowers, or about 2.2 million people, would receive a loan modification under the program, and that about 1.5 million will successfully avoid foreclosure.

Under the terms of the proposed FDIC program, lenders would reduce monthly payments primarily by cutting the borrower’s interest rate to a minimum rate of 3 percent. If necessary, the company could also extend the repayment period on the loan beyond 30 years, reducing each monthly payment. Finally, in some cases, companies could defer repayment of some principal. The borrower still would be on the hook for the full value of the loan.

Officials said their experience at IndyMac showed that principal reductions were not necessary. So far, FDIC has modified about 20,000 IndyMac loans. In 70 percent of the cases, FDIC was able to create an affordable payment solely by reducing the interest rate. In 21 percent of the cases, the agency also extended the life of the loan. In 9 percent of the cases, it delayed repayment of some principal.

An interesting proposal I would support. Ideally this type of action would not be necessary but since banks were allowed to degrade their standards so far and allowed to grow so large their failures threaten the economy some radical actions are being taken. Compared to many others this is sensible.

Related: How Much Worse Can the Mortgage Crisis Get? – JPMorgan Chase Freezes Mortgage Foreclosures – Fed Plans To Curb Mortgage Excesses (Dec 2007)

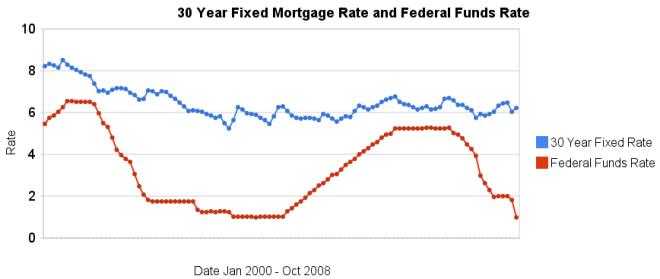

More dramatic evidence that changing in the federal funds rate do not lead to similar changes in 30 year fixed mortgage rates. It is true the last few months are very unusual times for the credit market. However, the current lack of correlation is not the exception, the graph clearly shows there is very little correlation between changes in the two interest rates.

Related: historical comparison of 30 year fixed mortgage rates and the federal funds rate – Affect of Fed Funds Rates Changes on Mortgage Rates – posts on financial literacy – Jumbo v. Regular Fixed Mortgage Rates: by Credit Score

For more data, see graphs of the federal funds rate versus mortgage rates for 1980-1999. Source data: federal funds rates – 30 year mortgage rates

JPMorgan Chase Freezes Foreclosures

…

According to the most recent data compiled by the Hope Now Alliance of lenders, counselers, and other industry players, lenders started the foreclosure process on 565,000 homeowners in this year’s third quarter. Some 265,000 homes were actually foreclosed on, nearly twice the number from the third quarter of 2007. Moreover, more than 2.2 million homeowners are more than 60 days delinquent in their mortgage payments, also a near doubling from last year.

FDIC Chairman, Sheila Bair, has been encouraging banks to take such action and instituted such action on the mortgages the FDIC acquired when they took over Indymac – Loan Modification Program for Distressed Indymac Mortgage Loans

Related: Ignorance of Many Mortgage Holders (July 2007) – Foreclosure Filings Continue to Rise – Historical 30 Year Fixed Mortgage Rates – Homes Entering Foreclosure at Record (Sep 2007) – 2nd Largest Bank Failure in USA History

In his blog Scott Adams, author of Dilbert, provides often quite intelligent and interesting thoughts. In a recent post he wrote on investing and Diversification:

I didn’t own much in the way of stocks for the past several years, thanks to not using professional advisors. A big chunk of my money has been in California Municipal bonds of various types, and all are insured.

…

In order to diversify more, I started migrating money over to the stock market during this recent plunge. The market could go a lot lower still, but this is either the beginning of the end of the United States as we know it, in which case it doesn’t matter how I invested, or it is a once-in-a-lifetime stock buying opportunity. It was an easy decision.

Related: Stock Market Decline – Warren Buffett on Diversification – Investment Allocations Make A Big Difference

On Tuesday the United States Treasury department purchased $125 billion of bank stocks becoming one of the largest stockholders in the world instantly.

$25 billion was invested in Citigroup, JPMorgan Chase and Wells Fargo.

$15 billion was invested in Bank of America and $10 billion in Merrill Lynch (which is being acquired by Bank of America).

$10 billion was invested in Goldman Sachs and Morgan Stanley. And the treasury department invested $3 billion in Bank of New York Mellon $2 billion in State Street.

Related: Goldman Sachs Rakes In Profit in Credit Crisis (Nov 2007) – Warren Buffett Webcast on the Credit Crisis – Rodgers on the US and Chinese Economies (Feb 2008) – Credit Crisis

Long term care insurance is an important part of a personal financial portfolio. It provides insurance for for expenses beyond medical and nursing care for chronic illnesses (assisted living expenses). So while looking at your personal finance insurance needs (health insurance, disability insurance, automobile insurance, homeowners [or rental] insurance [with personal liability insurance - or separate personal liability insurance] and life insurance don’t forget to consider long term care insurance.

Can You Afford Long-Term-Care Insurance?

…

AARP estimates that a 65-year-old in good health can expect to pay between $2,000 and $3,000 a year for a policy that covers nursing-home and home care.

“About 70 percent of individuals over age 65 will require at least some type of long-term care services during their lifetime. Over 40 percent will need care in a nursing home for some period of time.” – National Clearinghouse for Long-Term Care Information

Advice on buying long term care insurance from AARP, the Department of Health and Human Services and Consumer Reports.

Read more

Americans need to save much more money. This is true for people’s personal financial health. And it is true for the long term health of the economy. Of course the credit card immediate gratification culture doesn’t put much weight on those factors. And if Americans actually do reduce their consumption to save more that will harm the economy in the short term. But since those reading this are people (the economy can’t read) the smart thing for most readers is to save more to create a stronger financial future for themselves.

Turmoil May Make Americans Savers, Worsening ‘Nasty’ Recession

…

From 1960 until 1990, households socked away an average of about 9 percent of their after-tax income, Commerce Department figures show. But Americans got out of the saving habit starting in the 1990s

…

“Consumers are starting to realize that they’ve been living in a fantasy world,” says Lyle Gramley, a former Fed governor who is now senior economic adviser at Stanford Group Co. in Washington. “They will have to begin salting away money for retirement, their children’s education and other reasons.”

Americans have a way to go to catch up with their counterparts in other countries. The 0.4 percent of disposable income that U.S. households saved last year compares with 10.9 percent for Germany and 3.1 percent for Japan

Related: Americans are Drowning in Debt – Too Much Stuff – Financial Illiteracy Credit Trap

‘Armageddon’ Prices Fail to Lure Buyers Amid Selling

…

The selling is being compounded by hedge funds and mutual funds dumping holdings to meet redemptions, which may push prices even lower, according to analysts at UBS AG.

…

Corporate debt has been pressured by “incessant selling by hedge funds and leveraged institutions as they unwind,” Bill Gross, manager of the world’s biggest bond fund at Newport Beach, California-based Pacific Investment Management Co.

…

Corporate bond prices plunged to 79.9 cents on the dollar on average from 94 cents at the end of August and 99 cents at the end of 2007, according to index data compiled by New York-based Merrill Lynch & Co.

…

“The de-leveraging that we’re witnessing will probably continue,” said Paul Scanlon, team leader for U.S. high yield and bank loans at Boston-based Putnam Investments LLC, which manages $55 billion in fixed income. “My sense is that’s not turning around in the very near term.”

I am not very familiar with the bond market but it does seem like the panic is in full swing but calling the bottom is always hard. I would guess the de-leveraging (and investors pulling money out of bond funds) could well lead things lower over the short term.

Related: Corporate and Government Bond Rates Graph – Municipal Bonds After Tax Return