Apartment Vacancy at 22-Year High in U.S.

…

Asking rents for apartments fell 0.6 percent in the second quarter from the first, Reis said. That matched the rate of change in the first quarter, the biggest drop since Reis began reporting such data in 1999.

…

New York had the lowest vacancy rate in the second quarter, at 2.9 percent, followed by New Haven, home to Yale University; Central New Jersey; New York’s Long Island; and Syracuse, New York, according to Reis.

Related: Housing Rents Falling in the USA – Rent Controls are Unwise – It’s Now a Renter’s Market – articles on investing and real estate

The decisions over the past 30 years to pass huge huge tax bills to those in the future is unsustainable. Saying you cut taxes when all you actually do is postpone them is dishonest. However, many people go along with such false statements so politicians have learned to buy votes today by raising taxes on the future. Since the public keeps voting for such people when the facts are clear the only explanation is they support raising taxes, not today, but in the future (or, I suppose, they are not able to understand the clear implications of what they vote for). The Long-Term Budget Outlook

…

For decades, spending on Medicare and Medicaid has been growing faster than the economy. CBO projects that if current laws do not change, federal spending on Medicare and Medicaid combined will grow from roughly 5 percent of GDP today to almost 10 percent by 2035. By 2080, the government would be spending almost as much, as a share of the economy, on just its two major health care programs as it has spent on all of its programs and services in recent years.

…

CBO projects that Social Security spending will increase from less than 5 percent of GDP today to about 6 percent in 2035 and then roughly stabilize at that level.

…

Federal interest payments already amount to more than 1 percent of GDP; unless current law changes, that share would rise to 2.5 percent by 2020.

The cost of paying for a dysfunctional medical system has been a huge drain on the USA economy for decades. But that is nothing compared to what the future holds if we don’t adopted sensible strategies that reduce the huge extra costs we pay and the worse performance we receive for that cost.

Social security is not the huge problem many think it is. Still I would support reducing the payout to wealthy individuals and bringing the age limits more in line with the changes in life expectancy. 12.4% of pay for low and middle wage workers (high income earners stop paying social security taxes so in effect marginal tax rates decrease by 12% for any income above $106,800). Medicare taxes add 2.9% bringing the total social security and Medicare taxes to 15.1% (including both the amount paid directly by the employee and the amount paid for the employee by the employer).

Related: True Level of USA Federal Deficit – USA Federal Debt Now $516,348 Per Household – quotations about economics – articles on improving the health care system – USA Spent $2.2 Trillion, 16.2% of GDP, on Health Care in 2007

Two Professors Argue About the Invisible Hand – And Both Get it Wrong too

…

He used the term not in his discussion and analysis of markets (Book I and II of Wealth Of Nations), but in a discussion of the choice of export/importing versus investing in domestic businesses (Book IV of Wealth Of Nations on his critique of mercantile political economy). It had nothing to do with ‘regulating’.

…

It was a metaphor Smith used only three times and he never said “that when this invisible hand exists, when we all pursue our own interest, we end up promoting the public good, and often more effectively than if we had actually and directly intended to do so.” That is a modern construction placed on the metaphor and has next to nothing to do Adam Smith

…

The invisible hand was never in Adam Smith’s world in the form invented in mid-20th century by some economists who created the Chicago version of Adam Smith, while ignoring the Adam Smith born in Kirkcaldy, Scotland in 1723.

Related: There is No Invisible Hand – Myths About Adam Smith Ideas v. His Ideas – Not Understanding Capitalism

Mobius Says Derivatives, Stimulus to Spark New Crisis

“Political pressure from investment banks and all the people that make money in derivatives” will prevent adequate regulation, said Mobius, who oversees $25 billion as executive chairman of Templeton in Singapore. “Definitely we’re going to have another crisis coming down,”

…

A “very bad” crisis may emerge within five to seven years as stimulus money adds to financial volatility, Mobius said. Governments have pledged about $2 trillion in stimulus spending.

…

“Banks have lobbied hard against any changes that would make them unable to take the kind of risks they took some time ago,” said Venkatraman Anantha-Nageswaran, global chief investment officer at Bank Julius Baer & Co. in Singapore. “Regulators are not winning the battle yet and I’m not sure if they are making a strong case yet for such changes.”

Mobius also predicted a number of short, “dramatic” corrections in stock markets in the short term, saying that “a 15 to 20 percent correction is nothing when people are nervous.” Emerging-market stocks “aren’t expensive” and will continue to climb

I share this concern for those we bailed out using the money we paid them to pay politicians for more favors. Those paying our politicians like very much paying themselves extremely well and then being bailed out by the taxpayers when their business fails. They are going to try to retain the system they have in place. And they are likely to win – politicians are more likely to provide favors to those giving them large amounts of money than they are to learn about proper management of an economy.

Related: Congress Eases Bank Laws for Big Donors (1999) – Lobbyists Keep Tax Off Billion Dollar Private Equities Deals and On For Our Grandchildren – General Air Travel Taxes Subsidizing Private Plane Airports – CEOs Plundering Corporate Coffers

Welcome to the Curious Cat Investing and Economics Carnival, we hope you enjoy the following posts we share here.

- Warren Buffet On An Investment News Channel by Robin Bal – “I could see that the mere mention of a time scale like three to five years had derailed the interviewer’s thought process. Coming as she did from a world where three to five hours or at most three to five days is the standard unit of time, the idea of an investor talking in years seemed to have thrown a spanner in her works.”

- Loan Default Rates: 1998-2009 by John Hunter – “In the 4th quarter of 2007 residential real estate default rates were 3.02% by the 4th quarter of 2008 they were 6.34% and in the 1st quarter of this year they were 7.91%”

- Key Factors Affecting Long-Term Growth in Federal Spending by Douglas Elmendorf – “Two factors underlie the projected increase in federal spending on Medicare, Medicaid, and Social Security as a share of GDP: rapid growth in health care costs and an aging population.”

- Will the Chinese Keep Saving? by Rachel Ziemba – “Should export-oriented ’surplus’ countries like China keep saving and keep trying to export demand, the reduction in imbalances could actually exacerbate the global economic contraction or contribute to a more sluggish recovery. “

- Use Your Health Insurance! by David Weliver – “So if you’re worried about losing your job (and insurance) or anticipate making a life change that will leave you uninsured, get in to see a doctor while you are still covered.”

- Where is the externality here? by Matt Nolan – “They are paid less because their marginal product is lower, and they are willing to be paid less because the benefit they receive from consuming alcohol is sufficient compensation – this is a completely internalised decision for the drinker isn’t it, so where is the social cost.”

- Quibbles With Quants – “What the models failed to capture was that humans don’t behave in simple, predictable and uncorrelated ways. It’s impossible to overstate the importance of the way these models cope with correlation of peoples’ psychology. To sum it up: they don’t. Let me know if that’s too complex an analysis for the mathematical masters of the universe.”

- Goldman’s Back, and Why We Should Be Worried by Robert Reich – “The decision to bail out AIG resulted in a $13 billion giveaway to Goldman because Goldman was an AIG counterparty. Indeed, Goldman executives and alumni have played crucial roles in guiding the Wall Street bailout from the start. So the fact that Goldman has reverted to its old ways in the market suggests it has every reason to believe it can revert to its old ways in politics, should its market strategies backfire once again — leaving the rest of us once again to pick up the pieces.”

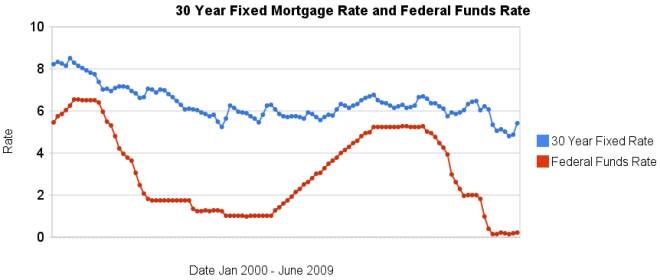

Once again the data shows that the 30 year fixed mortgage rates are not directly related to federal funds rates. In June the fed funds rate increased 3 basis points, 30 year mortgage rates increased 56 basis points. Since January the fed funds rate is up 6 basis points is up while 30 year mortgage rates are up 36 basis points. Home prices have continued to fall even with the very low mortgage rates.

Related: Mortgage Rates: 6 Month and 5 Year Charts – historical comparison of 30 year fixed mortgage rates and the federal funds rate – posts on financial literacy – GM and Citigroup Replaced by Cisco and Travelers in the Dow – Jumbo v. Regular Fixed Mortgage Rates: by Credit Score

For more data, see graphs of the federal funds rate versus mortgage rates for 1980-1999. Source data: federal funds rates – 30 year mortgage rates

Peter Schiff answers economic questions from Reddit users (see part 2). See our Economics and Investing Reddit. He made the point that inflation will be a serious problem. He also recommended several books, including: Economics in One Simple Lesson by Henry Hazlit and The Biggest Con: How the Government is Fleecing You by his father. He is an opinionated economist. I certainly do not agree with everything he says but I think he is worth listening to. As an investor I believe it is important to seek out unconventional opinions and find worthwhile unconventional opinions that can help you beat the market.

Related: Skeptics Think Big Banks Should Not be Bailed Out – Inflation is a Real Threat – Let the Good Times Roll (using Credit) – Dell, Reddit and Customer Focus

Surging U.S. Savings Rate Reduces Dependence on China

…

Nouriel Roubini, an economics professor at New York University and chairman of RGE Monitor, forecasts that the savings rate will ultimately reach 10 percent to 11 percent. What’s critical, he said in a Bloomberg Television interview on June 24, is how quickly it increases.

A rapid rise in the next year because of a collapse in consumption would push the economy, already in its deepest contraction in 50 years, further into recession, he said. If it occurs over a few years, the economy may grow.

…

From 1960 until 1990, households socked away an average of about 9 percent of their after-tax income, government figures show. Americans got out of the habit in the 1990s as they saw their wealth build up in other ways, first through surging stock prices and then soaring home values, Gramley said.

That process has now gone into reverse. U.S. household wealth fell by $1.3 trillion in the first quarter of this year, with net worth for households and nonprofit groups reaching the lowest level since 2004, according to a Fed report. Wealth plunged by a record $4.9 trillion in the last quarter of 2008.

Edmund Phelps, winner of the Nobel Prize in economics in 2006 and a professor at Columbia University in New York, said it may take as long as 15 years for households to rebuild what they lost in the recession.

As I have been saying the living beyond our means must stop. Those that think health of an economy is only the GDP forget that if the GDP is high due to spending tomorrows earnings today that is not healthy. Roubini correctly indicates the speed at which savings increases could easily determine the time we crawl out of the recession. I hope the savings rate does increase to over 10 percent.

If we do that over 3 years that would be wonderful. But it is more important we save more. If that means a longer recession to pay off the excessive spending over the last few decades so be it. And it is going to take a lot longer than a few years to pay off those debts. It is just how quickly we really start to make a dent in paying them off that is in question now (or whether we continue to live beyond our means, which I think it still very possible – and unhealthy).

Related: Will Americans Actually Save and Worsen the Recession? – Can I Afford That? – $2,540,000,000,000 in USA Consumer Debt (April 2008) – Paying for Over-spending

The IMF 2009 country report on Canada discusses there current economic condition. As part of that they explore the success Canada had in regulating their banking sector (which stands in stark contract to the catastrophic regulatory failures in the USA and Europe). And also provide ample evidence of that wise regulation did indeed prevent the financial crisis.

- Sound supervision and regulation: The 2008 FSSA Update found that the regulatory and supervisory framework meets best practice in many dimensions, including with regard to

the revised Basel Core Principles for banking supervision. - Stringent capital requirements: Solvency standards apply to banks’ consolidated commercial and securities operations. Tier 1 capital generally significantly exceeds the required 7 percent target (which in turn exceeds the Basel Accord minimum of 4 percent). The leverage ratio is limited to 5 percent of total capital.

- Low risk tolerance and conservative balance sheet structures: Banks have a profitable and stable domestic retail market, and (like their customers) exhibit low risk tolerance. Banks had smaller exposures to “toxic” structured assets and relied less on volatile wholesale funding than many international peers.

- Conservative residential mortgage markets: Only 5 percent of mortgages are non- prime and only 25 percent are securitized (compared with 25 percent and 60 percent, respectively, in the United States). Almost half of residential loans are guaranteed, while the remaining have a loan-to-value ratio (LTV) below 80 percent—mortgages with LTV above this threshold must be insured for the full loan amount (rather than the portion above 80 percent LTV, as in the United States). Also mortgage interest is nondeductible, encouraging borrowers to repay quickly.

- Regulation reviews: To keep pace with financial innovation, federal authorities review financial sector legislation every five years (Ontario has a similar process for securities market legislation).

- Effective coordination between supervisory agencies: Officials meet regularly in the context of the Financial Institutions Supervisory Committee (FISC) and other fora to discuss issues and exchange information on financial stability matters.

- Proactive response to financial strains: The authorities have expanded liquidity facilities, provided liability guarantees, and purchased mortgage-backed securities. In addition, several provinces now provide unlimited deposit insurance for provincially-regulated credit unions. The 2009 Budget further expands support to credit markets, while providing authority for public capital injections and other transactions to support financial stability.

Related: Failure to Regulate Financial Markets Leads to Predictable Consequences – Sound Canadian Banking System – 2nd Largest Bank Failure in USA History – Easiest Countries for Doing Business 2008

Kiva is one of my favorite charities, as I have mentioned several times. They provide a platform that connects those with funds to lend to entrepreneurs. This week they added the ability to lend money to entrepreneurs in the USA. And they also added short webcasts to some of the entrepreneur profiles.

One of my goals for this blog is to increase the number of readers participating in Kiva – see current Curious Cat Kivans. I have also created a curious cat lending team on Kiva. If you lend through Kiva, add a comment with a link to your Kiva page and I will add you to our list of Curious Cat Kivans.

Related: My 100th Entrepreneur Loan Through Kiva – Using Capitalism to Make a Better World