Apartment Vacancy at 22-Year High in U.S.

…

Asking rents for apartments fell 0.6 percent in the second quarter from the first, Reis said. That matched the rate of change in the first quarter, the biggest drop since Reis began reporting such data in 1999.

…

New York had the lowest vacancy rate in the second quarter, at 2.9 percent, followed by New Haven, home to Yale University; Central New Jersey; New York’s Long Island; and Syracuse, New York, according to Reis.

Related: Housing Rents Falling in the USA – Rent Controls are Unwise – It’s Now a Renter’s Market – articles on investing and real estate

I originally setup the 10 stocks for 10 years portfolio in April of 2005. In order to track performance created a marketocracy portfolio but had to make some minor adjustments (and marketocracy doesn’t allow Tesco to be purchased, though it is easily available as an ADR to anyone in the USA to buy in real life – it is based in England). The current marketocracy calculated annualized rate or return (which excludes Tesco) is 3.5% (the S&P 500 annualized return for the period is -1.7%) – marketocracy subtracts the equivalent of 2% of assets annually to simulate management fees – as though the portfolio were a mutual fund – so without that the return is about 5.5%).

The current stocks, in order of return:

| Stock | Current Return | % of sleep well portfolio now | % of the portfolio if I were buying today | |

|---|---|---|---|---|

| Amazon – AMZN | 136% | 9% | 9% | |

| Google – GOOG | 105% | 15% | 13% | |

| Templeton Dragon Fund – TDF | 80% | 11% | 11% | |

| PetroChina – PTR | 78% | 11% | 10% | |

| Templeton Emerging Market Fund – EMF | 28% | 5% | 6% | |

| Cisco – CSCO | 15% | 6% | 8% | |

| Toyota – TM | 7% | 9% | 11% | |

| Danaher – DHR | -14% | 6% | 9% | |

| Tesco – TSCDY | -14%* | 0%* | 10% | |

| Intel – INTC | -15% | 4% | 6% | |

| Pfizer – PFE | -38% | 5% | 7% | |

| Dell | -60% | 4% | 0% |

The portfolio is beating the S&P 500 by 5.2% annually (which is actually quite good. Also it is a bit confused due to to Tesco not being included. View the current marketocracy Sleep Well portfolio page.

Related: 12 Stocks for 10 Years Update – June 2008 – posts on stocks – investing books

Read more

Mobius Says Derivatives, Stimulus to Spark New Crisis

“Political pressure from investment banks and all the people that make money in derivatives” will prevent adequate regulation, said Mobius, who oversees $25 billion as executive chairman of Templeton in Singapore. “Definitely we’re going to have another crisis coming down,”

…

A “very bad” crisis may emerge within five to seven years as stimulus money adds to financial volatility, Mobius said. Governments have pledged about $2 trillion in stimulus spending.

…

“Banks have lobbied hard against any changes that would make them unable to take the kind of risks they took some time ago,” said Venkatraman Anantha-Nageswaran, global chief investment officer at Bank Julius Baer & Co. in Singapore. “Regulators are not winning the battle yet and I’m not sure if they are making a strong case yet for such changes.”

Mobius also predicted a number of short, “dramatic” corrections in stock markets in the short term, saying that “a 15 to 20 percent correction is nothing when people are nervous.” Emerging-market stocks “aren’t expensive” and will continue to climb

I share this concern for those we bailed out using the money we paid them to pay politicians for more favors. Those paying our politicians like very much paying themselves extremely well and then being bailed out by the taxpayers when their business fails. They are going to try to retain the system they have in place. And they are likely to win – politicians are more likely to provide favors to those giving them large amounts of money than they are to learn about proper management of an economy.

Related: Congress Eases Bank Laws for Big Donors (1999) – Lobbyists Keep Tax Off Billion Dollar Private Equities Deals and On For Our Grandchildren – General Air Travel Taxes Subsidizing Private Plane Airports – CEOs Plundering Corporate Coffers

The Society for Actuaries has published a good resource: Managing post-retirement risks.

…

Many investors try to own some assets whose value may grow in times of inflation. However, this sometimes will trade inflation risk for investment risk.

• Common stocks have outperformed inflation in the long run, but are

poor short-term hedges. The historically higher returns from stocks

are not guaranteed and may vary greatly during retirement years.

…

Retirement planning should not rely heavily on income from a bridge job. Many retirees welcome the chance to change careers and move into an area with less pay but more job satisfaction, or with fewer demands on their time and energy.

Terminating employment before age 65 may make it difficult to find a source of affordable health insurance before Medicare is available.

…

Insurance for long-term care covers disabilities so severe that assistance is needed with daily activities such as bathing, dressing and eating. Some policies require a nursing home stay; others do not. The cost of long-term care insurance is much less if purchased at younger ages, well before anticipated need.

The full document is well worth reading.

Related: Many Retirees Face Prospect of Outliving Savings – How to Protect Your Financial Health – Financial Planning Made Easy – personal finance tips

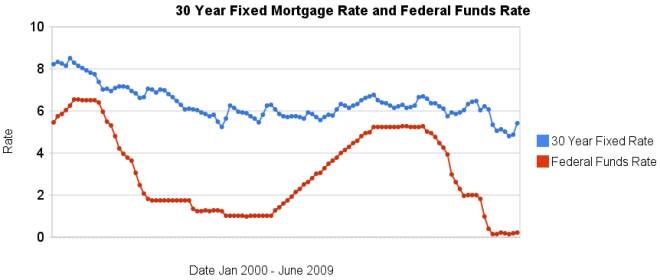

Once again the data shows that the 30 year fixed mortgage rates are not directly related to federal funds rates. In June the fed funds rate increased 3 basis points, 30 year mortgage rates increased 56 basis points. Since January the fed funds rate is up 6 basis points is up while 30 year mortgage rates are up 36 basis points. Home prices have continued to fall even with the very low mortgage rates.

Related: Mortgage Rates: 6 Month and 5 Year Charts – historical comparison of 30 year fixed mortgage rates and the federal funds rate – posts on financial literacy – GM and Citigroup Replaced by Cisco and Travelers in the Dow – Jumbo v. Regular Fixed Mortgage Rates: by Credit Score

For more data, see graphs of the federal funds rate versus mortgage rates for 1980-1999. Source data: federal funds rates – 30 year mortgage rates

Surging U.S. Savings Rate Reduces Dependence on China

…

Nouriel Roubini, an economics professor at New York University and chairman of RGE Monitor, forecasts that the savings rate will ultimately reach 10 percent to 11 percent. What’s critical, he said in a Bloomberg Television interview on June 24, is how quickly it increases.

A rapid rise in the next year because of a collapse in consumption would push the economy, already in its deepest contraction in 50 years, further into recession, he said. If it occurs over a few years, the economy may grow.

…

From 1960 until 1990, households socked away an average of about 9 percent of their after-tax income, government figures show. Americans got out of the habit in the 1990s as they saw their wealth build up in other ways, first through surging stock prices and then soaring home values, Gramley said.

That process has now gone into reverse. U.S. household wealth fell by $1.3 trillion in the first quarter of this year, with net worth for households and nonprofit groups reaching the lowest level since 2004, according to a Fed report. Wealth plunged by a record $4.9 trillion in the last quarter of 2008.

Edmund Phelps, winner of the Nobel Prize in economics in 2006 and a professor at Columbia University in New York, said it may take as long as 15 years for households to rebuild what they lost in the recession.

As I have been saying the living beyond our means must stop. Those that think health of an economy is only the GDP forget that if the GDP is high due to spending tomorrows earnings today that is not healthy. Roubini correctly indicates the speed at which savings increases could easily determine the time we crawl out of the recession. I hope the savings rate does increase to over 10 percent.

If we do that over 3 years that would be wonderful. But it is more important we save more. If that means a longer recession to pay off the excessive spending over the last few decades so be it. And it is going to take a lot longer than a few years to pay off those debts. It is just how quickly we really start to make a dent in paying them off that is in question now (or whether we continue to live beyond our means, which I think it still very possible – and unhealthy).

Related: Will Americans Actually Save and Worsen the Recession? – Can I Afford That? – $2,540,000,000,000 in USA Consumer Debt (April 2008) – Paying for Over-spending

…

A recent Pew poll found that 21% of Americans planned to grow their own vegetables, 16% had held a garage sale or sold things online and 10% had either taken in a friend or relative or moved in with one. Pundits are coining phrases such as “austerity chic” and “luxury shame”. Four-fifths of Americans told the BCG they would defer big purchases that can wait.

…

The beneficiaries of the new parsimony are, unsurprisingly, firms that offer low prices. The only two stocks on the Dow Jones Industrial Average that rose in 2008 were Wal-Mart and McDonald’s.

…

The hangover from this party will be long and painful. Households’ total outstanding borrowing fell in the fourth quarter of 2008, for the first time since the second world war. The personal-saving rate rose to 4.2% in the first quarter of 2009, from a nadir of minus 0.7% in 2005. “It is easy to see how consumer deleveraging could result in hundreds of billions of dollars-worth of forgone consumption in coming years,” say Martin Baily, Susan Lund and Charles Atkins of the McKinsey Global Institute.

American consumers are burdened by far too much consumer debt. And spending on non-essentials with debt is un-wise and creates personal risks and a weak (fundamentally) economy. It is true the current economic data will look good when people spend money they don’t have. But it just creates a huge burden for the future economy to cope with.

Related: USA Consumers Paying Down Debt – Too Much Personal Debt – $2,540,000,000,000 in USA Consumer Debt

Debt Negotiators May Give Little Relief to Consumers

Credit-card delinquencies are at record highs, according to Fitch Ratings, and the U.S. unemployment rate of 8.9 percent is the highest since 1983. As more consumers fall behind on bills, settlement companies often end up adding to the debt burden rather than offering a cost-saving solution, said Gail Cunningham, a spokeswoman for the National Foundation for Credit Counseling in Silver Spring, Maryland.

…

New York Attorney General Andrew Cuomo has begun a national investigation of settlement companies, and has sued two for fraud and false advertising. Illinois Attorney General Lisa Madigan has also filed two lawsuits against debt-settlement companies, alleging they “engage in deceptive marketing practices” and “do little or nothing to improve consumers’ financial standings.” Texas Attorney General Greg Abbott sued a debt settlement company in March, saying it engaged in “deceptive and misleading acts,” according to court documents.

It is much better to avoid this problem by taking wise personal finance actions – don’t take on personal debt for minor purchases (for a mortgage then debt is fine, probably fine for a car – though avoid debt if you can). The “secret” is not very secret. Just don’t buy what you can’t pay for. It is very simple, many people just don’t want to follow that simple strategy. Also save money in an emergency fund, so when some emergency comes along you don’t go into debt. You just use your emergency fund.

Once you are stuck in a bad situation with more debt than you can afford to pay back you have bad choices. Obviously many try to take advantage of you. Frankly they realize many that are stuck in bad financial position make bad financial decisions. Therefor it is a good place for those trying to rip people off to find people to take advantage of. The best way to deal with this is not to try and find the best debt negotiators it is to manage you finances well and not get in trouble.

Related: Personal Saving and Personal Debt in the USA – How to Use a Credit Card Successfully – Credit Card Companies Willing to Deal Over Debt – Where to Keep Your Emergency Funds? – Americans are Drowning in Debt

John Bogle was the founder of Vanguard Group and a well respected investment mind. He has written several good books including: The Little Book of Common Sense Investing, Common Sense on Mutual Funds and Bogle on Mutual Funds. This interview from 2006 discusses the state of the retirement system, before the credit crisis.

Frontline: How do they get away with that? Don’t they have to fund them?

John Bogle: No, they don’t, because a lot of it is based on assumptions. Our corporations are now assuming that future returns in their pension plan will be about 8.5 percent per year, and that’s not going to happen. The future returns in the bond market will be about 4.5 percent, and maybe if we’re lucky 7.5 percent on stocks. Call it a 6 percent return — before you deduct the cost of investing all that money, the turnover cost, the management fees. So maybe a 5 percent return is going to be possible, in my judgment, and they are estimating 8.5 percent.

Why? Because when they do it that way, corporation earnings become greatly overstated, and all the executives get nice, big bonuses. They are using pension plan assumptions as a way to manage corporate earnings and meet the expectations of Wall Street.

Frontline: So if a company overstates the value of its pension plan assets, it makes the company look better to Wall Street, so there’s an incentive to kind of exaggerate, if not cheat.

John Bogle: That is precisely correct. And let me clear on the cheating: It’s legal cheating; it’s not illegal cheating. In other words, you can change any reasonable set of numbers — and corporations have done this, have raised the pension assumption from 7 percent to 8.5 percent — and all of a sudden that corporation will report an earnings gain for the year rather than an earnings loss that they would otherwise have. Simple, legal.

The entire PBS series (from 2006) on 401(k)s (including interviews with Elizabeth Warren, David Wray and Alicia Munnell) is worth reading.

In February of 2009 he spoke to the House of Representatives committee exploring retirement security.

Read more

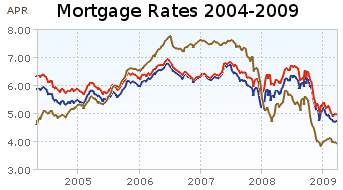

Showing mortgage rates over the last 6 months. Red: 30 year fixed rate. Blue: 15 year fixed rate. Tan: 1 year adjustable rate.

Showing mortgage rates over the last 6 months. Red: 30 year fixed rate. Blue: 15 year fixed rate. Tan: 1 year adjustable rate.

Showing mortgage rates over the last 5 years. Red: 30 year fixed rate. Blue: 15 year fixed rate. Tan: 1 year adjustable rate. From Yahoo Finance, for conventional loans in Virginia.

Showing mortgage rates over the last 5 years. Red: 30 year fixed rate. Blue: 15 year fixed rate. Tan: 1 year adjustable rate. From Yahoo Finance, for conventional loans in Virginia.

The 6 month chart shows that mortgage rates have been declining ever so slightly. Rates on a 1 year adjustable mortgage fell from 5.5 to 4% and have stayed near 4% for all of 2009. 30 and 15 year rates (15 year rates staying about 25 basis points cheaper) have declined from 6.5%, 6 months ago to about 5% at the start of the year and have moved around slightly since. This is while the yield 10 year government treasuries have been rising (normally 30 year fixed rate mortgages track moves in the 10 year government bond). The federal reserve has been buying bonds in order to push down the yield (and stimulate mortgage financing and other borrowing).

Mortgage rates certainly could fall further but the current rates are extremely attractive and I just locked in a mortgage refinance for myself. I am getting a 20 year fixed rate mortgage; I didn’t want to extend the mortgage period by getting another 30 year fixed rate mortgage. For me, the risk of increasing rates outweigh the benefits of picking up a bit lower rate given the current economic conditions. But I can certainly understand the decision to hold out a bit longer in the hopes of getting a better rate. If I had to guess I would say rates will be lower during the next 3 months, but I am not confident enough to hold off, and so I decided to move now.

Related: Mortgage Rates Falling on Fed Housing Focus – posts on mortgages – 30 Year Fixed Mortgage Rates and the Fed Funds Rate – Continued Large Spreads Between Corporate and Government Bond Yields – Lowest 30 Year Fixed Mortgage Rates in 37 Years –