Why This Real Estate Bust Is Different by Mara Der Hovanesian and Dean Foust

…

While the housing crisis seems to be easing, the commercial storm is still gathering strength. Between now and 2012, more than $1.4 trillion worth of commercial real estate loans will come due…

The USA commercial real estate market, by many account, is going to continue to have trouble. I would like to add to my commercial real estate holdings in my retirement account, because I have so little (and other options are not that great), but with the current prospects I am not ready to move. I would not be surprised if the market comes back sooner than people expect: it seems like it is far too fashionable to have bearish feelings about the market. However, it doesn’t seem like the risk reward trade-off is worth it yet.

Related: Commercial Real Estate Market Still Slumping – Victim of Real Estate Bust: Your Pension – Nearly 10% of Mortgages Delinquent or in Foreclosure (Dec 2008) – Urban Planning

What is the aim of prison? To keep criminals locked up so they can’t commit crimes in society is another. Punishment, in order to deter people from committing crime is one reason they exist. And you would hope to mold prisoners so they do not commit crimes when they are freed. But the payment for services does not factor in the results of releasing productive members of society. It seems like doing so could result in improvements.

Better Jails by Andrew Leigh, economics professor, Australian National University

…

To encourage innovation, we should start publicly reporting the outcomes that matter most. Rather than merely telling the public how many people are held in each jail, governments should publish prison-level data on recidivism rates and employment rates.

…

As well as focusing on the important outcomes, Australian states should rethink the contracts they write with private providers. At present, about 16% of inmates are held in a private jail. Unfortunately, the contracts for private jails bear a remarkable similarity to sheep agistment contracts.

Providers are penalised if inmates harm themselves or others, and rewarded if they do the paperwork correctly. Yet the contracts say nothing about life after release. A private prison operator receives the same remuneration regardless of whether released inmates lead healthy and productive lives, or become serial killers.

A smarter way to run private jails would be to contract for the outcomes that matter most. For example, why not pay bonus payments for every prisoner who holds down a job after release, and does not reoffend? Given the right incentives, private prisons might be able to actually teach the public sector a few lessons on how to run a great rehabilitation program.

The idea of paying for outcomes is great. It makes sense for some pay to be based on keeping prisoners housed during their terms. But providing incentives for achievement in returning productive people back to free society is something we should try.

Related: Lean Management in Policing – Urban Planning – Rich Americans Sue to Keep Evidence of Their Tax Evasion From the Justice Department – Randomization in Sports – LA Jail Saves Time Processing Crime – Measuring and Managing Performance in Organizations

Quality Improvement and Government: Ten Hard Lessons From the Madison Experience by David C. Couper, Chief of Police, City of Madison, Wisconsin

Read more

Welcome to the Curious Cat Investing and Economics Carnival: we highlight recent blog posts we found interesting.

- Dividend stocks that beat the market by Jim Jubak – “A hefty dividend isn’t enough to prevent major capital damage when a sector takes that kind of punishment. Another lesson is that a dividend income portfolio needs more frequent care and feeding than I gave this one.”

- Get Real On The Economic Recovery And Stock Market Rally – “Another rapid slump in global economy is far from impossible. Double dip recession could arise from sky-high public debts or another financial crisis sparked by delinquency in prime mortgage loans, risky commercial sector or derivatives.”

- Don’t Miss Out on a Good Investment Today Because You Missed a Better Investment Earlier by John Hunter – Instead of just missing out because I made a mistake and didn’t buy a stock at a lower price earlier, I have learned to accept that buying at the higher price available today can be the best option…

- How much should be in your emergency fund? by Patrick – “Some people recommend at least 3-6 months living expenses, some recommend 6 months to a year, and some recommend a few thousand dollars. In my opinion, this is a very personal decision and should be based on your individual circumstances.”

- Weakon 238: Stock Beta by Philip – ” If the beta comes back 1 or higher then you are relying on the market for your returns and are not protected against a down market. That isn’t a bad thing if you’re tolerant to risk, the beta on my 401(k) is 1.3.”

- Government Debt Around the World as Percentage of GDP 1990-2007 by John Hunter – The overall OECD debt to GDP ratio decreased from 77% in 2005 to 75% in 2007. The USA moved in the opposite direction increasing from 62% to 63%

Amazon’s stock price is up 25% to $117 today, after announcing good earnings and increasing sales projections for the 4th quarter. I own stock in Amazon and have it in my 12 stocks for 10 years portfolio. That portfolio is currently beating the S&P 500 by 500 basis points (for annualized return) with a beta of .96 (meaning with a bit less risk than the S&P 500 historically and an alpha of 4.7).

Operating cash flow for Amazon was $2.25 billion for the trailing twelve months, compared with $1.27 billion for prior year. Free cash flow increased 98% to $1.92 billion from $0.97 billion for the trailing twelve months.

Net sales increased 28% to $5.45 billion in the third quarter, compared with $4.26 billion in third quarter 2008. Operating income increased 62% to $251 million in the third quarter, compared with $154 million in third quarter 2008.

Net income increased 68% to $199 million in the third quarter, or $0.45 per diluted share, compared with net income of $118 million, or $0.27 per diluted share, in third quarter 2008.

“Kindle has become the #1 bestselling item by both unit sales and dollars – not just in our electronics store but across all product categories on Amazon.com. It’s also the most wished for and the most gifted. We are grateful for and energized by this customer response,” said Jeff Bezos, founder and CEO of Amazon.com. “Earlier this week we began shipping the latest generation Kindle. Its 3G wireless works in the U.S. and 100 countries, and we’ve just lowered its price to $259.”

North America segment sales, representing the Company’s U.S. and Canadian sites, were $2.84 billion, up 23% from third quarter 2008. International segment sales, representing the Company’s U.K., German, Japanese, French and Chinese sites, were $2.61 billion, up 33% from third quarter 2008. Worldwide Electronics & Other General Merchandise sales grew 44% to $2.36 billion.

For the quarter that ends in December, Amazon forecast sales of $8.1 billion to $9.1 billion (compared with $8.19 billion in previous analyst estimates).

Amazon continues to build a strong company for the long term. I must admit I think the current stock price might be a bit too high. But I believe in the long term success of the company. They continue to make intelligent, customer focused decisions.

Related: 12 Stocks for 10 Years – July 2009 Update – Another Great Quarter for Amazon (July 2007) – Very Good Amazon Earnings (April 2007) – Amazon Innovation – Jeff Bezos and Root Cause Analysis – Jeff Bezos management quotes

This hardly constitutes an outright collapse, nor is it necessarily cause for concern. American exporters, whose goods have become more competitive abroad, are happy with their weaker currency. Similarly domestic producers may be cheered that rival, imported goods are more expensive. And European tourists, who can buy more for their euros during weekend shopping excursions to America, may cheer too. However, the continued decline of the dollar does come against a backdrop of ominous murmurs from the likes of China and Russia, who hold much of their reserves in dollars, about the need to shift their reserves out of the greenback. Brazil’s imposition of a 2% levy on portfolio inflows is also a sign that other countries are getting nervous about seeing their currencies rise against the dollar.

…

But it is hard, also, to think of a parallel in history. A country heavily in debt to foreigners, with a government deficit it is making little headway at controlling, is creating vast amounts of additional currency. Yet it is allowed to get away with very low interest rates. Eventually such an arrangement must surely break down, bringing a new currency system into being, just as Bretton Woods emerged in the 1940s.

The absence of a credible alternative to the dollar means that, despite its declining value, its status as the world’s reserve currency is not seriously under threat. But the system could change in other ways. A world where currencies traded within bands, or where foreign creditors insist on America issuing some debt in other currencies, are all real possibilities as the world adjusts to a declining dollar.

The issuance of USA government debt of any significant size in other currencies would be an amazing event, to me. However, that does not mean it won’t happen. In my opinion it is hard to justify the non-collapse of the dollar, and has been for quite some time.

The huge future tax liability imposed over the last few decades along with the failure to save by those in the country creates a hollow economy. Granted the USA had a huge surplus of wealth built up since the end of World War II. The USA has to a great extent sold off that wealth to finance living beyond the productive capacity of the country the last 20-30 years. But that can only go on so long.

The only thing saving the dollar is that other countries do not want the dollar to decline because they don’t want the competition of American goods (either being sold to their country or for the goods they hope to export). So they intervene to stop the fall of the dollar (and buy USA government debt). That can serve to artificially inflate the dollar for some time. However, eventually I think that will collapse. And when it does it will likely be very quick. The idea of the USA issuing debt in other currencies seems crazy now. It could then go from possibility to necessity within months.

You cannot print money forever to live beyond your means and have people accept it as valuable. The government can runs deficits if the citizen’s finance that debt with savings: and still maintain a sound currency. But the recent period, given the macro-economic conditions, don’t justify the value of the dollar. It should have fallen much further a long time ago. The other saving grace for the dollar is few large economies have untarnished economies. The Euro has strengths but is hardly perfect. The Chinese Renminbi is possibly the strongest contender but the economy is still very controlled, financial data is untrustworthy, political freedom is not sufficient… The Japanese Yen does have some strengths but really their long term macro-economic conditions is far from sound.

Related: The USA Economy Needs to Reduce Personal and Government Debt – Let the Good Times Roll (using Credit) – Federal Reserve to Buy $1.2T in Bonds, Mortgage-Backed Securities – Who Will Buy All the USA’s Debt?

Nouriel Roubini is still worried about the US economy, though he does believe we are coming to the end of the severe recession we have been in.

I believe, that if you were worried about your portfolio being overweighted in stocks late last year, now is a good time to move some money out of the stock market. In December 2008, when many were selling in panic, I invested more in stocks.

The stock market has been on a tear increasing

1 December 2008 the S&P 500 was at 816

1 January 2009 – 903

6 March 2009 – 684 (the lowest point since 1996)

1 May 2009 – 878

1 August 2009 – 987

5 October 2009 – 1040

In 6 months, since the market hit a low on March 6th, it is up 52%. Certainly the decrease in prices seemed overdone. The 50% increase in prices seems overdone also. But trying to predict short term moves in the stock market (say under 1 year) is very difficult and few people can do so successfully (even if you can find lots of people offering their guesses). Predicting the economy, while not easy, is much much easier that predicting the stock market.

Read more

I like to buy stocks cheap and then hold them as they rise in price. This is not a unique desire, I know. One thing this lead me to do was find a stock I liked but hold off buying it until I could buy it for less. When that works it is great. However, one thing that happened several times is that I found stocks I really liked and they just went up and went up more and kept going up. And I never owned them.

I learned, after awhile, that is was ok to buy a stock at a higher price once I realized I made a mistake. Instead of just missing out because I made a mistake and didn’t buy it at a lower price than I needed to pay today (which made it feel really lame to buy it now at a higher price) I learned to accept that buying at the higher price available today was the best option.

I have seen two types of situations where this takes place: one I realize I was just way off, it was a great deal at the price I could have bought at – I just made a mistake. And if it was still a good buy, I should buy it. Another is that the stock price goes up but new news more than makes up for the increased stock price (the news makes the value of stock increase more than the price has increased).

I missed out on the Google IPO, even though I really wanted to buy. Then the price went way up and even though I had learned this (don’t avoid buying a stock today just because you made the mistake of not buying it at a lower price earlier) tip I wanted to buy it for less than the current price and so kept not buying it (emotion is a real factor in investing and that is another thing I have realized – you need to accept it and deal with it to be a good investor). Then Google announced spectacular earnings and it was finally enough to get me to buy the stock a few days later at $219 (which was well over twice the price 6 months earlier). But it was a great buy at $219 and losing that just because I should have bought it at $119 is not wise – but something I did many times in the past.

In March of 2009 I bought some ATPG at $3.20. In August I bought more at $11. The news was bit better but really it was just a huge huge bargain at $3.20 and I should have bought a lot more. In the last 5 trading days ATPG was up $5.12 (16.78 – 11.66). A nice gain. Right now, it is up another 68 cents today at $17.43. Now this is a volatile stock and until I sell it may not turn out to be profitable investment, but the odds are good that it will.

It is also hard to know when to sell – in fact for many selling at the wrong time (either selling too late – after it collapses [for good or sell it after a collapse only to see it recover], or too early missing out on huge gains) is the biggest problem they have in becoming a successful investor). One trait of many successful investors is holding the right investments for huge gains. A few stellar performances can lift the entire portfolio to long term investing success. And if you sell those stocks early you miss huge opportunities.

Holding on for the huge gains is a mistake I do not want to make – and so when the opportunity is there for such gains I am willing to risk losing some gains for the potential of a much larger gain. Right now the balance is keeping me from selling any ATPG, though I am likely to sell some if it increases (while continuing to hold some of the position).

Related: Great Google Earnings April 2007 – Nicolas Darvas (investor and speculator) – Not Every Day is Profitable – Does a Declining Stock Market Worry You? – 401(k)s are a Great Way to Save for Retirement – Beating the Market, Suckers Game? – Sleep Well Fund

Mark Mobius is an investment manager with Franklin-Templeton that I have invested with for over a decade (through the Templeton Emerging Markets Trust and Templeton Dragon Fund – they are closed end funds). I believe in Templeton’s emerging market investment team and Mark Mobius and believe his thoughts are worth paying attention to. He recently wrote an overview on Emerging Markets:

…

In Mexico, GDP contracted 10% y-o-y in the second quarter of 2009 as a result of the global economic crisis and swine flu outbreak. In comparison, GDP fell 8% in the first quarter of the year. Declines in the manufacturing, construction and retail sectors had negatively impacted GDP during the period.

…

Since 1995, portfolio inflows into emerging markets have totaled more than US$123 billion. A significant amount, considering it includes the US$49 billion in net outflows in 2008 as a result of the global financial crisis. The recovery in emerging markets and hunt for attractive investment opportunities, however, saw these funds return just as quickly with inflows totaling more than US$44 billion in the first seven months of 2009, nearly 90% of the outflows registered all of last year.

…

Emerging markets account for more than 80% of the world’s population. With economic growth accelerating and population growth decelerating, per capita income is one the rise. In our view, markets such as China, India and Brazil stand at the front of the class.

…

As of end-August 2009, the benchmark MSCI Emerging Markets index had a P/E of 16 times, cheaper than the MSCI World index which was trading at a P/E of 21 times.

Tesco is one of the holdings in my 12 stocks for 10 years portfolio (currently returning 450 basis point above S&P 500 annually). I agree with this well documented post – Tesco: Consistent Earnings Growth at Attractive Price

…

Tesco has leading market share positions in Hungary (#1), Thailand (#1), Ireland (#2), S. Korea (#2), Malaysia (#2), Slovakia (#3), Poland (#4) and Czech Republic (#4).

The company entered China several years ago and plans to open more hypermarkets and shopping centers over the next decade. The Chinese retail market remains very fragmented and the top three players each control less than 1% market share.

…

Tesco generated £5 billion in operating cash flow last year, benefiting from improvement in working capital efficiency and good inventory management. Its capital expenditures were £4.7 billion last year (£2.6 billion in UK and £2.1 billion in international). The company expects its capital expenditures to decline to £3.5 billion this year through spending less on mixed use development land and purchasing fewer existing stores from UK competitors.

…

Tesco ended the year with £9.6 billion in net debt, up £3.4 billion from the prior year… Nevertheless, its interest coverage ratio was 8.9x last year and does not appear too aggressive.

A big part of my reason for buying Tesco is their management teams commitment to lean thinking (Toyota Production System) management methods. I still worry they will not continue to adopt these methods more thoroughly but I believe superior management methods are one reason their performance has been good in the past and should improve even more if they continue to apply those methods more.

Related: Jubak Looks at 5 Technology Stocks – 10 Stocks for Income Investors – Small Business Profit and Cash Flow – GM and Citigroup Replaced by Cisco and Travelers in the Dow

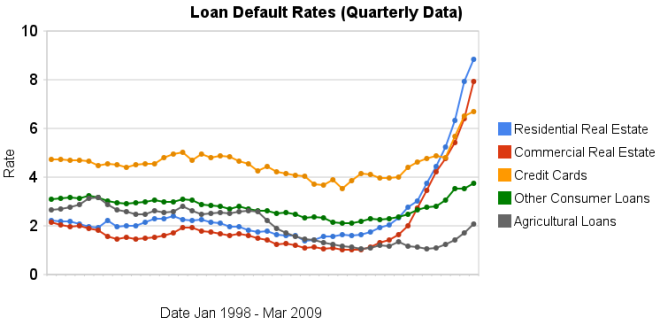

Chart showing loan delinquency rates for real estate, consumer and agricultural loans for 1998 to 2009 by the Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.

Chart showing loan delinquency rates for real estate, consumer and agricultural loans for 1998 to 2009 by the Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.Delinquency rates on commercial (up another 151 basis points) and residential (93 basis points) real estate continued to increase dramatically in the second quarter. Credit card delinquency rates increased but only by 20 basis points.

Real estate delinquency rates exploded in 2008. In the 4th quarter of 2007 residential delinquency rates were 3.02% by the 4th quarter of 2008 they were 6.34% and in the 2nd quarter of this year they were 8.84% (582 basis points above the 4th quarter of 2007). Commercial real estate delinquency rates were at 2.74% in the 4th quarter of 2007, 5.43% in the fourth quarter of 2008 and 7.91% in the 2nd quarter of 2009 (a 517 basis point increase).

Credit card delinquency rates were much higher than real estate default rates for the last 10 years (the 4-5% range while real estate hovered above or below 2%). Now they are over 200 and 300 basis points bellow residential and commercial delinquency rates respectively. From 4.8% in the 3rd quarter 2008 to 5.66% in the 4th and 6.5% in the 1st quarter of 2009.

The delinquency rate on other consumer loans and agricultural loan delinquency rates are up but nowhere near the amounts of real estate or credit cards.

As I wrote recently bond yields in the last few months show a dramatic increase in investor confidence for corporate bonds.

Related: Loan Delinquency Rates: 1998-2009 – The Impact of Credit Scores and Jumbo Size on Mortgage Rates – 30 Year Mortgage Rate and Federal Funds Rate Chart