A documentary of the mortgage crisis by CNBC: House of Cards. It is a bit slow and simple but still for people that don’t really understand the basics of what happened it is interesting.

Related: Nearly 10% of Mortgages Delinquent or in Foreclosure – Ignorance of Many Mortgage Holders (2007) – How Not to Convert Equity – mortgage terms

Low Mortgage Rates a Mirage as Fees Climb, Eligibility Tightens

…

“A score of 700 was once near perfect,” said Gwen Muse Evans, vice president of credit policy at Fannie Mae, the government-controlled company that helps set lending standards. “Today, a 700 performs more like a 660 did. We have updated our policy to take into account the drift in credit scores.”

Consumer credit scores, called FICOs after creator Fair Isaac Corp., range from 300 to 850. The average FICO score on mortgages bought by Freddie Mac and Fannie Mae rose to 747.5 in the fourth quarter of last year from 722.3 in 2005, according to Inside Mortgage Finance.

Accunet’s Wickert said that a 660 FICO score would have qualified most borrowers for loans with no upfront fees in the past. Now, someone trying to borrow $200,000 with a 660 score would have to pay a 2.8 percent fee, or $5,600, he said. Even someone with a 719 score would have to pay $1,750 in cash.

The low mortgage rates are attractive but a decision to re-finance (or buy) must consider the long term implications. Also if you are re-financing to take advantage of the low rates consider a 20 year or 15 year loan if you are already well into your 30 year loan. A fixed rate loan is the most sensible option at this time.

Related: Low Mortgage Rates Not Available to Everyone – 30 Year Fixed Mortgage Rates and the Fed Funds Rate Chart – Ignorance of Many Mortgage Holders – Fed Plans To Curb Mortgage Excesses – How Not to Convert Home Equity

Jumbo Loan Defaults Rise at Fast Pace as Rich Suffer

2.57% of homeowners with jumbo mortgage are 60 days late, of those that just got loan last year! That is crazy. These kinds of figures are astounding to me. I am still (posted Feb 2007) amazed that 4.4% is the historic low for mortgages over a month late.

…

The top five U.S. jumbo lenders — Chase Home Finance LLC, Bank of America Corp., Washington Mutual Inc., Wells Fargo & Co. and Citigroup Inc. — originated a combined $55.3 billion in jumbos in 2008. They lent just $4.3 billion of that during the last three months of the year, according to Inside Mortgage Finance.

…

The national average for a 30-year fixed-rate jumbo mortgage was 6.57 percent this week compared with 5.34 percent for a conforming loan, according to White Plains, New York-based financial data provider BanxQuote.

Related: The Impact of Credit Scores and Jumbo Size on Mortgage Rates – Low Mortgage Rates Not Available to Everyone – 30 Year Fixed Mortgage Rates and the Fed Funds Rate – posts about mortgages

Apartment Rents Fall, Vacancies at 4-Year High

…

Asking rents fell 0.1 percent from the previous quarter, to $1,052 on average, their first quarter-to-quarter decline in almost six years. They rose 2.4 percent from a year earlier. Effective rents, what tenants actually paid, fell to an average $996 last quarter, down 0.4 percent from the prior quarter and up 2.2 percent from a year earlier.

U.S. rental market set to slow down amid housing glut

Anthony De Silva said he was not happy that he had become a landlord. He bought a two-bedroom condominium 18 months ago on the ocean in Hollywood, Florida, expecting to sell at a $100,000 profit. Instead, he is now looking for tenants at $1,700 a month.

…

“Increasing vacancies does not bode well for rental incomes,” said Nabil El-Hage, a professor at Harvard Business School. “We’ve seen a softening in apartment REITs as a result.”

So for renters nationwide this is one possible silver lining to the current economic crisis. Granted not a large one but in these times any good news is worth appreciating. For real estate investors the news is not as good. The Washington DC market is forecast to go against the trend for reduced rents in 2009.

According to Marus and Millichap, Metrowide vacancy is expected to rise 60 basis points this year to 6.5 percent. Asking rents are projected to advance 3.1 percent to $1,410 per month in 2009, while effective rents increase 2.8 percent to $1,351 per month. Rent growth will lag slightly in Suburban Maryland. Of the 43 rental market they track they project San Francisco to see the largest increases in rent in 2009, followed by San Diego and Washington DC.

Related: Home Values and Rental Rates – Rent Controls are Unwise – posts on housing – How Walkable is Your Prospective Neighborhood

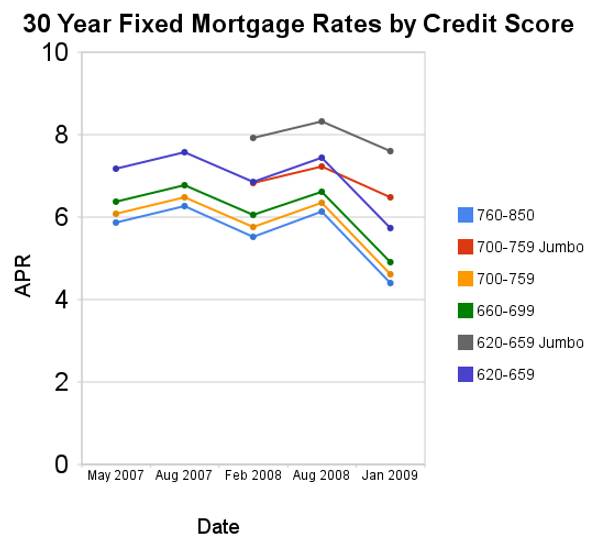

Since August of 2008 conforming mortgage rates are have declined a huge amount. Jumbo rates have fallen a large amount also, but much less (for example for a credit score of 700-759 the jumbo rates declined 73 basis points while the conventional rate declined 172 basis points.

For scores above 620, the APRs above assume a mortgage with 1 point and 80% Loan-to-Value Ratio. For scores below 620, these APRs assume a mortgage with 0 points and 60 to 80% Loan-to-Value Ratio. You can see, with these conditions the rate difference between a credit score of 660 and 800 is not large (remember this is with 20% down-payment) and has not changed much (the difference between the rates if fairly consistent).

Related: Low Mortgage Rates Not Available to Everyone – 30 Year Fixed Rate Mortgage Rate Data – Real Free Credit Report (in USA) – Jumbo Mortgage Shoppers Get Little Relief From Rates – posts on mortgages

Read more

The lowest 30 Year fixed mortgage rates in 37 years is great news for those looking to buy a house or to re-finance. However, that truth (the lowest rate) masks another truth, that it is available to a somewhat limited pool of borrowers. The rates for jumbo 30 year fixed mortgages and for regular 30 year fixed mortgages, for those with lower credit ratings, are not at the lowest rates they have ever reached. And getting mortgage rates that don’t require a 10-20% down payment and fully documented financial position are not as low as they have ever been. 15 year fixed rates are also low, but are not at all time lows. FHA loans still allow very low down payments, but others have moved away from this practice (which is a wise move).

Current rates, national average, from Bankrate: 30 year fixed 5.26%, 30 year fixed jumbo 6.96% (a full 170 basis points higher rate), 15 year fixed 5.07%. Jumbo rates have been less than 40 basis points higher than conventional rates most of time (based on my memory – I am looking for a source to confirm). The site does not present the credit score but my guess is these rates are based on a credit score of 700, or higher. Last week the jumbo rates increased by 11 basis points and regular 30 year rates fell by 3 basis points.

Related: Jumbo v. Regular Fixed Mortgage Rates: by Credit Score – historical mortgage rate chart – Nearly 10% of Mortgages Delinquent or in Foreclosure – misinterpreting data

Changes in the Market For Jumbo Mortgages

…

On Nov 12, 2008 I shopped for an $800,000 30-year fixed-rate mortgage on Mortgage Marvel, an on-line site that I reviewed earlier in 2008 (see A Look at Mortgage Marvel). The mortgage companies on the site quoted rates of 8.125% to 8.375%. The credit unions and banks, in contrast, quoted rates ranging from 5.875% to 7.875%. I have never before seen rate differences on the same transaction this large. They no doubt reflect wide differences in lender access to funding, which is symptomatic of a market in turmoil.

We now have the lowest 30 year fixed mortgage rates since data has been collected (37 years) in the USA. Is this due to the Fed cutting the discount rate? I do not think so. As I have said previously 30 year fixed rates are not correlated with federal reserve rates. But this time the government is actively seeking to reduce mortgage rates.

Mortgage Rate Hits 37-Year Low

…

The 15-year fixed-rate mortgage averaged 4.92%, down from last week when it averaged 5.20%. A year ago the 15-year loan averaged 5.79%. The 15-year mortgage hasn’t been lower since April 1, 2004, when it averaged 4.84%.

Homeowners refinance, put savings under mattress

These rates sure are fantastic if you are in the market. I was not in the market, but I am considering re-financing now. You need to be careful and not just withdraw money because you can. If you can refinance and reduce your payments it may well be a wise move though. One problem can be extending the date you will finally be free of mortgage debt. If you re-finance a current 30 year loan, that you got 5 years ago, you will now be paying 5 more years. One option is to see if you can get a 25 or 20 year loan. Or if you can make a 15 year loan work, do that (15 and 30 year fixed rate mortgages are common).

Read more

The percentage of loans in the foreclosure process at the end of the third quarter was 2.97 percent, an increase of 22 basis points from the second quarter of 2008 and 128 basis points from one year ago. The percentage of loans in the process of foreclosure set a new record this quarter, to 1.35 million.

Mortgages are counted as delinquent or in foreclosure (once they are in foreclosure they are not counted as delinquent). So the total percentage of mortgages not being paid by the homeowner is 2.97% (in foreclosure) + 6.99% (delinquent) = 9.96%. That is amazingly bad. In February of 2007 I wrote about this and the delinquency rate was 4.7% which sounded pretty bad to me. Amazingly 4.4% is a historic low for this figure. Can you believe 1/25 mortgages is delinquent and that is as good as we ever get? That is pretty shocking to me.

The seasonally adjusted total delinquency rate is now the highest recorded in the Mortgage Bankers Association survey. The seasonally adjusted delinquency rate increased 41 basis points to 4.34 percent for prime loans, increased 136 basis points to 20.03 percent for subprime loans, increased 29 basis points to 12.92 percent for FHA loans, and increased 46 basis points to 7.28 percent for VA loans.

The percent of loans in the foreclosure process increased 16 basis points to 1.58 percent for prime loans, and increased 74 basis points for subprime loans to 12.55 percent. FHA loans saw an eight basis point increase in the foreclosure inventory rate to 2.32 percent, while the foreclosure inventory rate for VA loans increased 13 basis points to 1.46 percent.

Since loans that would have gone into foreclosure in the past are being kept out of foreclosure due to some programs ( ) the rate or seriously delinquent is a useful measure of serious problems. Seriously delinquent mortgages are 90 days past due. The rate increased 52 basis points for prime loans to 2.87 percent, increased 171 basis points for subprime loans to 19.56 percent, increased 62 basis points for FHA loans to 6.05 percent, and increased 45 basis points for VA loans percent to 3.45 percent.

Compared to a year ago: the seriously delinquent rate was 156 basis points higher for prime loans and 818 basis points higher for subprime loans. The rate also increased 51 basis points for FHA loans and 89 basis points for VA loans.

Related: Homes Entering Foreclosure at Record (Sep 2007) – Foreclosure Filings Continue to Rise – How Much Worse Can the Mortgage Crisis Get? – How Not to Convert Equity

Diversification overrated? Not a chance by Jason Zweig

For anyone with a sustainable ability to identify the hottest investment of the moment, diversification is a mistake. But if you really believe you’ve got that ability, you’re not just mistaken. You need to be hauled off in a straitjacket to the Institute for the Treatment of Investment Insanity.

Exactly right. As we posted previously Warren Buffett’s diversification thoughts are similar

You have to remember when Warren Buffett says “professional and have confidence” he doesn’t really mean just what those words say. He mean if you are Charlie Munger, George Soros, Jimmy Rodgers and maybe 10 other people alive today (maybe I am too restrictive, maybe he would include 50 more people alive today, but I doubt it).

Related: Dilbert on Investing – investment risks – Curious Cat Investing and Economics Search Engine

Financial Markets with Professor Robert Shiller (spring 2008) is a fantastic resource from Open Yale courses: 26 webcast (also available as mp3) lectures on topics including: The Universal Principle of Risk Management, Stocks, Real Estate Finance and Its Vulnerability to Crisis, Stock Index, Oil and Other Futures Markets and Learning from and Responding to Financial Crisis (Guest Lecture by Lawrence Summers).

Robert Shiller created the repeat-sales home price index with Karl Case that is known as the Case-Shiller home price index.

Related: Berkeley and MIT courses online – Open Access Education Materials – Curious Cat Science and Engineering Blog open access posts – Paul Krugman Speaks at Google