Singapore’s Social Entrepreneur Diana Saw makes things Bloom in Cambodia

The decision was swift as it was simple: move to Cambodia to provide jobs for poor women. I first

visited Phnom Penh in April 2006 and was back the next month to look for a house.

…

I approached the job placement arm of an NGO in Phnom Penh (PP). There are many NGOs who train poor Cambodians, but what this country needs is jobs. You can train people all you like, but if no one employs them, you’ll have frustrated skilled people who are unable to use their

skills.

…

Bloom has a savings plan for staff. Every month staff are encouraged to put away a percentage of their income which goes towards buying a sewing machine. Bloom will then subsidize the cost of the machine. With the machine, workers will be able to become small business owners, supplying bags not only to Bloom, but to other sellers, like small shops in the tourist markets.

Related: Bloom Bags Blog – Using Capitalism to Make the World Better – Make the World a Better Place – Kiva – Provide a Helping Hand – Aim for everybody to gain: workers, customers, suppliers, shareholders… – Obscene CEO Pay

- We believe in the right of all people to a decent life, free of poverty, and with access to education

- We believe you can be rich by helping the poor

The best method to avoid problems with debt collectors is to avoid debt problems (Create Your Cash Reserve – use your credit card responsibly – Buy less stuff). But if you do run into problems and get stuck dealing with debt collectors in addition to the financial trouble you may find yourself very frustrated and stressed. The Fair Debt Collection resource of the Federal Trade Commission provides useful information:

Debt collectors may not harass, oppress, or abuse you or any third parties they contact. For example, debt collectors may not:

- use threats of violence or harm

- publish a list of consumers who refuse to pay their debts (except to a credit bureau)

- use obscene or profane language; or repeatedly use the telephone to annoy someone

Debt collectors may not use any false or misleading statements when collecting a debt. For example, debt collectors may not:

- falsely imply that they are attorneys or government representatives

- falsely imply that you have committed a crime

- falsely represent that they operate or work for a credit bureau

- misrepresent the amount of your debt

- indicate that papers being sent to you are legal forms when they are not

- indicate that papers being sent to you are not legal forms when they are

Why is such a resource needed? Because many debt collectors have behaved unethically and illegally. To file a complaint use that link or call toll-free, 1-877-382-4357.

FTC 2008 Report on Fair Debt Collection Practices Act

Read more

You might think that increased gas prices lead to less driving, but historically that has not been the case. Gas demand is very inelastic (or gas prices are very elastic): which means demand changes very little as prices increase.

How much has consumption actually decreased in the face of huge increases in prices? The US government predicts .3% this year: and there is evidence it might actually be declining more in the last few months. Finally a significant reduction in demand may be upon us. Previously the only significant reaction was increased complaints but little change in behavior.

Gas may finally cost too much:

Related: Bigger Impact: 15 to 18 mpg or 50 to 100 mpg? – Gas Tax – $8,000 Per Gallon (ink not gas) – South Korea Invests $22 Billion in Overseas Energy Projects – The Rebirth of Cities – Traffic Congestion and a Non-Solution – Energy Future – Designing Cities for People, Rather than Cars – Gas Prices Send Surge of Riders to Mass Transit

As the credit card companies continue to prove they are not interested in providing value to the customer and making a fair profit from the value they provide. Instead they attempt to do whatever they can to get money from customers. I would guess because they can get more from careless customers that don’t block each attempt to take their money than the companies have to pay back or pay in fines.

J.P. Morgan Chase — What Every Person With A Credit Card Should Know

Canceling cards from companies that repeatedly treat customers as a source of ill gotten gains is wise. Unfortunately most options seem to be led by the same unethical tactics. Some credit unions seem to actually believe in providing a fair service and treating customers with honesty and integrity (though many just outsource credit card service to a company that has no interest in the mission of the credit union to serve members). During the era of the robber barrons it was accepted that business was amoral. Since then it is understood morality applies in the business world – some people just case less about morality than cash.

Read more

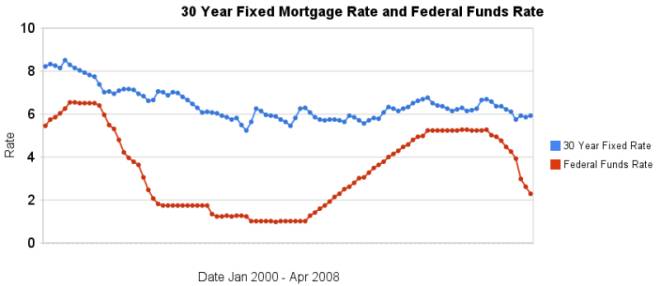

The recent drastic reductions again emphasize (once again) that changes in the federal funds rate are not correlated with changes in the 30 year fixed mortgage rate. In the last 4 months the discount rate has been reduced nearly 200 basis points, while 30 year fixed mortgage rates have fallen 18 basis points.

I have update my article showing the historical comparison of 30 year fixed mortgage rates and the federal funds rate. The chart shows the federal funds rate and the 30 year fixed rate mortgage rate from January 2000 through April 2008 (for more details see the article).

There is not a significant correlation between moves in federal funds rate and 30 year mortgage rates that can be used for those looking to determine short term (over a few days, weeks or months) moves in the 30 year fixed mortgage rates. For example if 30 year rates are at 6% and the federal reserve drops the federal funds rate 50 basis points that tells you little about what the 30 year rate will do. No matter how often those that should know better repeat the belief that there is such a correlation you can look at the actual data in the graph above to see that it is not the case.

Related: real estate articles – Affect of Fed Funds Rates Changes on Mortgage Rates – How Not to Convert Equity – more posts on financial literacy

Read more

More who need major surgery are leaving U.S.

…

Medical tourism – surgery cost estimates

| Procedure | United States | India | Thailand | Singapore | Costa Rica |

| Coronary bypass | $130,000 | $6,650-$9,300 | $11,000 | $16,500 | $24,000 |

| Spinal fusion | 62,000 | 4,500-8,500 | 7,000 | 10,000 | 25,000 |

| Angioplasty | 57,000 | 5,000-7,500 | 13,000 | 11,200 | 9,000 |

| Hip replacement | 43,000 | 5,800-7,100 | 12,000 | 9,200 | 12,000 |

| Knee replacement | 40,000 | 6,200-8,500 | 10,000 | 11,100 | 11,000 |

Source: Medical Tourism Association (2007).

Related: Traveling for Health Care – International Health Care System Performance – USA Spent $2.1 Trillion on Health Care in 2006 – Broken Health Care System: Self-Employed Insurance – Personal Finance Basics: Health Insurance

The Clifton Gorge State Nature Preserve in Ohio is quite a nice short hike. Photos by John Hunter. If anyone knows what the green beetle is please add a comment.

I visited the preserve last year. Other sites from the trip include: Rocky Gap State Park, Maryland and Coopers Rock State Forest, West Virginia.

More photos: Mount Saint Helens National Volcanic Monument – Capital Crescent Trail (Washington DC) – travel photo directory – Grand Teton National Park

Every year at the Berkshire Hathaway Warren Buffett and Charlie Munger provide great insights on investing and the economy. Here are some thought from today – Buffett to investors: Think small

…

“Overall I think that the U.S. continues to follow policies that will make the dollar weaken against other major currencies

…

Asked what’s in store for the economy, Buffett said he doesn’t have a clue and doesn’t care. “I haven’t the faintest idea,” he said. “We never talk about it, it never comes up in our board meetings or other discussions. We’re not in that business [of economic forecasting], we don’t know how to be in that business. If we knew where the economy was going, we’d do nothing but play the S&P futures market.”

…

In terms of the [chief] investment officer, the board has four names, any one or all of whom would be good at my job. They all are happy where they are now [working outside of Berkshire], but any would be here tomorrow if I died tonight, they all are reasonably young, and compensation would not be a big factor…. There will be no gap after my death in terms of having someone manage the money.

Related: Live From Omaha 2007 – Buffett’s 2008 Letter to Shareholders – 2005 annual meeting with Buffett and Munger – Why Investing is Safer Overseas

Read more

Regulators zero in on credit card reform

The plan would allow consumers more time to pay their monthly bill. It would prevent companies from applying interest-rate increases retroactively to pre-existing balances. And it would ban “double cycle billing,” a practice that computes finance charges based on previous billing cycles.

…

U.S. consumers were saddled with $850 billion in credit card debt as of the end of last year, according to the Consumer Federation of America.

…

“It’s a good first step in addressing a number of abusive practices,” said Travis Plunkett, legislative director at the consumer federation. “However, it will still be necessary for Congress to step in because the proposal only deals with a few of the problems that have been identified.”

At the same time, legislators could have quite a fight on their hands. Previous efforts trying to reform the industry have largely failed, while recent legislative proposals have found little support among GOP lawmakers.

The credit card companies pay politicians a great deal of money. That is the reason sensible regulation has failed. Now those fighting for sensible regulation have to have such an obvious case that even those taking huge amounts of money from the credit card companies can’t stymie sensible rules. Remember to follow our credit card tips to avoid the pitfalls that catch so many – that don’t read our blog ![]()

Related: Legislation to Address the Worst Credit Card Fee Abuse, Maybe – Sneaky Fees – Incredibly Bad Customer Service from Discover Card – Hidden Credit Card Fees

At work people have been talking about the increasing prices of food and the price increases sure are noticeable to me. With the exception of gas, I have not heard discussion of inflation outside of a classroom, maybe ever, I can’t recall hearing it anyway. Egg prices are up 35 percent, with milk and bread not far behind

…

The crunch for American shoppers pales compared with the challenges faced by those in the developing world. Americans spend just 9.9 percent of household income on food, according to the Agriculture Department. Compare that with poor countries such as Ethiopia and Bangladesh, where it’s not uncommon for families to spend 70 percent.

Consumer Price Index Summary – March 2008:

Related: what is inflation risk? – Manufacturing Productivity – What Do Unemployment Stats Mean?