Nominal health spending in the United States grew 4.4% in 2008, to $2.3 trillion or $7,681 per person. This was the slowest rate of growth since the Centers for Medicare & Medicaid Services started officially tracking expenditures in 1960, yet once again outpaced nominal GDP growth (2.6% in 2008). This brings health care spending to 16.2% of GDP. In 2003 the total health care spending was 15.3% of GDP.

The huge amount being spent continues to grow to an even larger percentage of GDP every year. The damage to the economy of the dysfunctional health care system in the USA is huge. For comparison the total GDP per person in China is $5,970 (the closest total country per capita GDP, to the health care spending per capita in the USA, is Thailand at $7,703 – World Bank data). The average spending by OECD countries (Europe/USA/Japan…) was $2,966 per person in 2007 (the USA was at $7,290). In 2007 Canada spent $3,895; France $3,601; UK $2,992; Japan $2,581.

- Hospital spending in 2008 grew 4.5% to $718 billion, compared to 5.9% in 2007, the slowest rate of increase since 1998.

- Physician and clinical services’ spending increased 5.0% in 2008 to $496 billion, a deceleration from 5.8% in 2007.

- Retail prescription drug spending growth also decelerated to 3.2% in 2008 as per capita use of prescription medications declined slightly, mainly due to impacts of the recession, a low number of new product introductions, and safety and efficacy concerns. Drug prices increased 2.5% in 2008.

- Spending growth for both nursing home and home health services decelerated in 2008. For nursing homes, spending grew 4.6% in 2008 compared to 5.8% in 2007.

- Total health care spending by public programs, such as Medicare and Medicaid, grew 6.5% in 2008, the same rate as in 2007.

- Health care spending by private sources of funds grew only 2.6% in 2008 compared to 5.6 percent in 2007.

- Private health insurance premiums grew 3.1% in 2008, a deceleration from 4.4% in 2007. Remember many people lost their jobs and did without insurance. Doing so results in reduced spending on health insurance but is far from a good sign.

- Home health care spending growth decelerated from 11.8% in 2007 to 9.0% in 2008. Expenditures reached $64.7 billion in 2008. You can understand why investors (and companies) are looking to invest in home health care.

At the aggregate level, the shares of financing for health services and supplies by businesses (23%), households (31%), other private sponsors (3%), and governments (42%) have remained relatively steady over time. Between 2007 and 2008; however, the federal government share increased significantly (from 23 to 25%), while the state and local government share declined (from 18 to 17%).

Decades ago Dr. Deming included excessive health care costs as one of the seven deadly diseases of western management. We have only seen the problem get worse. Finally it seems that a significant number of people are in agreement that the system is broken.

Read more

Welcome to the Curious Cat Investing and Economics Carnival: we highlight recent personal finance, investing and economics blog posts we found interesting.

- 5 Financial Milestones to Aim for By Age 30 – 1. Contribute to a Roth and a Traditional IRA… 2. Build Six Months Worth of Expenses in your Emergency Fund… 3. Make the Credit Card Companies Hate You…

- USA again the leading manufacturing country, data of the Largest Manufacturing Countries in 2008 by John Hunter – The USA’s share of the manufacturing output, of the countries that manufactured over $185 billion in 2008, 28% in 1990, 28% in 1995, 32% in 2000, 28% in 2005… 24% in 2008. China’s share has grown from 4% in 1990… 10% in 2000… to 18% in 2008.

- Afraid to stay in but scared to get out? Join the club by James Jubak – “If you have to keep $60,000 in cash so that you can sleep at night knowing that you’ve got your financial bases cover, then the loss of a potential gain on that money is, in my book, worth it. I’ve sold into this rally to sock away my kids’ tuition for 2010 and my 2010 tax payment.”

- Invented, Completely New Meaning of the “Invisible Hand” by Gavin Kennedy – “In fact, Stigler explicitly criticises ‘legends’ of the ‘naïve doctrine’ that Smith should be associated with notions that ‘whenever a person seeks to serve his own ends, he invariably serves the ends of society’.”

- The Quiet Danger of Non-Inflation-Adjusted Stock Returns by Stephen Dubner – “the ‘real-real’ value of stocks does make you appreciate how so many people got so jazzed about the spike in housing prices over the last decade: it’’ exciting to see inflation working in your favor day after day…”

- Think You Don’t Need Health Insurance? Think Again – “Very bad medical problems can and do happen to many of us – maybe even you. Those very bad medical problems can be very expensive and potentially ruin one’s financial future if they do not have adequate health insurance.”

- Don’t Be Suckered By Stock Market Rally In 2010 – “For those who do not want to invest, it is best to save up your money and wait for better opportunities since valuations are high right now… I suggest fixed deposits as the best option to preserve your principal.”

- Resolving U.S. Indebtedness: Various Scenarios by Arnold Kling – “Some major technologies, probably either wet or dry nanotech, produce so much economic growth that the ratio of debt to GDP stays under control. I give this a 20 percent chance… Inflate away the debt with moderate inflation… I gives this a 15 percent chance….”

Related: Curious Cat Investing and Economics Custom Search Engine – Curious Cat Investing and Economics Carnival #2

I have discussed the advantage of using credit unions over trying to cope with a bank since so many banks constantly try to trick customers into paying huge fees. Here are some resources to help:

- Find a local credit union – with an overview of services offered

- Find a local credit union from (NCAU) with links to Financial Performance Report data.

- Credit Unions have National Credit Union Share Insurance Fund (NCUSIF) (“backed by the full faith and credit of the U.S. Government”) instead of FDIC. The limits on the share insurance are the same as the limits on FDIC, currently $250,000 per individual account holder. Use the link to make sure your credit union provides NCUSIF coverage.

You can also get credit cards through your credit union. In general credit unions are much more interested in trying to provide the customer value instead of trying to stick them with huge fees. But don’t just trust your credit union, check out the rates and fees they charge and comparison shop for the best credit card.

Related: posts on banking – FDIC Study of Bank Overdraft Fees – Credit Unions Slowly Fill Payday Lenders Void

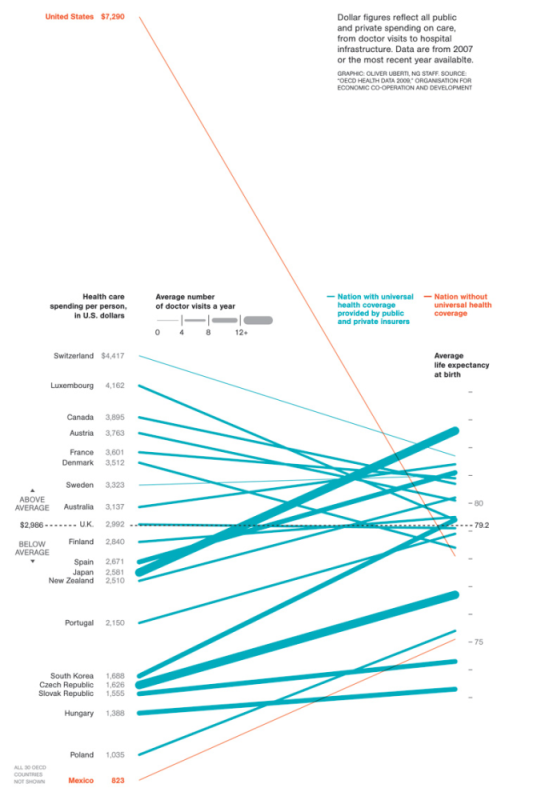

This graphic from the National Geographic shows the amazingly high cost of health care in the USA and the poor performance. Granted just life expectancy is not a good overall measure of success. But this just mirrors the general mediocre at best performance of the USA health care system.

The USA spends $7,290 per person (based on 2007 OECD data) the next highest spending country is Switzerland at $4,417. Canada spends the 4th most: $3,895. Only 5 countries have a lower life expectancy. The most any of those countries spend is $1,626. How people continue to accept arguments by the apologists for the special interests trying to defend the current system is beyond me.

The Cost of Care by Michelle Andrews

Related: USA Spent $2.2 Trillion, 16.2% of GDP, on Health Care in 2007 – Employees Face Soaring Health Insurance Costs – International Health Care System Performance – USA Heath Care System Needs Reform

Home Prices in 20 U.S. Cities Rose for Fifth Month

…

“The tax credit had the intended impact of drawing buyers in and lowering inventory,” Lawrence Yun, the real-estate agents group’s chief economist, said in a news conference. “An estimated 2 million buyers have taken advantage of the credit.”

…

Foreclosure filings in 2009 will reach a record for the second consecutive year with 3.9 million notices sent to homeowners in default, RealtyTrac Inc., the Irvine, California- based company said Dec. 10. This year’s filings will surpass 2008’s total of 3.2 million.

The housing market seems to have been stabilized with the tax credits, previous declines, continued low mortgage rates and a somewhat better credit environment. The market is still far from healthy. And the credit environment is still very tight. But housing may have hit a bottom nationwide, though this is not certain. I do expect mortgage rates to increase in 2010 which will put pressure on housing prices.

Related: House Prices Seem to be Stabilizing (Oct 2009) – USA Housing Foreclosures Slowly Declining – The Value of Home Ownership – Your Home as an Investment

In December 2008 I decided to substantially increase my investments in the stock market. This turned out to be quite successful. As I said at the time, the economy continues to struggle and the prospects for 2009 did not look good. And I even guessed the stock market (in the USA) would be lower 12 months from now. But, I also said I was far from certain, in that guess and that I had been increasing my stock investment and would continue to do so.

At this time my retirement contributions are going 100% to stock investments (if I were close to retirement I would not do this). I am likely going to reduce the contributions going forward (maybe 75% stocks – 25% money market). Unfortunately my retirement fund does not have great alternatives – it has very good real estate options but I am not ready to start putting new funds there (though I likely will during 2010, at some point).

I did sell reduce my equity exposure in a retirement account that I am not adding to this month. It reduced my overall equity exposure of my portfolio by a couple percentage points, at most. It is still significantly higher than a year ago, due to the incredible gains for 2009 in my stock investments.

Last year I fully fund my Roth IRA, in January and bought Amazon (AMZN), Templeton Emerging Market Fund (EMF) and PetroChina (PTR). I will fully fund the Roth IRA in January again. I am leaning toward some combination of Templeton Emerging Market Fund (EMF), Vanguard Emerging Markets Stock (VWO), Toyota (TM) and maybe Danaher (DHR). I purchased all of those in my non-retirement account in 2009.

Investing well is not easy. Saving money is though, sometime people get these confused. You need to save money for retirement – aim for 10% of your income and invest that conservatively if you do not wish to focus on investing. I have no question fully funding your Roth IRA is a wise move for almost everyone. How to invest once you do that is a bit trickier but funding it is not a difficult question to answer. It was not easy to increase investments into stocks last year, when so many others were selling (and the press is full of stories reinforcing the bad news, bad prospects and risks). You can get great opportunities when others are panicking, but things do not always recovery so nicely.

What the next year holds, again for 2010, if very difficult to see. The economy looks to be in much better shape than a year ago. But it is far from strong. And the recovery in the stock market means the higher prices stocks command today leave more downside risk for stocks, if things do not go well. I am more concentrated in stocks now than I was a year ago, but I am not comfortable with that. I don’t see bonds, even short term bonds, as an acceptable alternative. The risks are not at all justified by the returns in my opinion. I am happy with my real estate investments and may even look to increase that area though I think it may be too early for commercial real estate. I think individual companies may well prosper even if the economy falters – such as Google, Amazon, Danaher, Toyota, Tesco (though Amazon’s price increases may already have more than accounted for this) – all of these are in my 12 stocks for 10 years portfolio.

Related: Save Some of Each Raise – It is Never to Late to Invest – Does a Declining Stock Market Worry You? – Uncertain Economic Times

China has been growing incredibly quickly for years. The credit crisis slowed things down. But unlike so many other governments that spent all their resources and more in good times, China has plenty of cash and spent a great deal on large projects. That spending has boosted their economy. And with that encouragement their economy has continued to grow, including consumer spending. As I posted earlier, China May Take Car Sales Lead from USA in 2009.

China Raises GDP Growth Estimates, Narrowing Gap With Japan

…

China’s expansion in 2008 compares with U.S. growth of less than 1 percent. Japan’s gross domestic product shrank 1.2 percent. The Indian economy expanded 6.7 percent in the fiscal year ended March 2009.

Economic data always has some errors within, and from China the data is even less reliable. But the overall strength seem very real and significant.

Related: Government Debt Compared to GDP 1990-2007 – Japanese Economy Grew at 3.7% Annual Rate (Aug 2009)

I made several more loans using Kiva today to entrepreneurs in: Mongolia, Costa Rica, Kenya, Togo and Peru. One nice improvement they have made to the layout of the site is to show the “portfolio yield” (which is their form of APR – to provide an idea of the fees an entrepreneurs must pay).

Since I am making loans on Kiva to help others out one of the big factors for me is the cost to the entrepreneur. I just would much rather provide funding for loans where the entrepreneurs gets a reasonably low rate. I understand there are costs the lenders have to cover. I have no problem with that, but if my choice is helping an entrepreneurs get a loan at 20% or 40% I am going to take 40%. I figure the odds that the entrepreneurs benefits will be much greater with lower costs. I also prefer loans where I see how the loan will let them be more productive, for example by purchasing a machine to help improve productivity.

I wish Kiva would let me selected lenders I like and then have the results shown only for those lenders (as one option).

I encourage you to join me: let me know if you contribute to Kiva and I will add your Kiva page to our list of Curious Cat Kivans. Also join the Curious Cats Kiva Lending Team.

Related: 100th Entrepreneur Loan – Creating a World Without Poverty – Financial Thanksgiving – MicroFinance Currency Risk

Why This Real Estate Bust Is Different by Mara Der Hovanesian and Dean Foust

…

While the housing crisis seems to be easing, the commercial storm is still gathering strength. Between now and 2012, more than $1.4 trillion worth of commercial real estate loans will come due…

The USA commercial real estate market, by many account, is going to continue to have trouble. I would like to add to my commercial real estate holdings in my retirement account, because I have so little (and other options are not that great), but with the current prospects I am not ready to move. I would not be surprised if the market comes back sooner than people expect: it seems like it is far too fashionable to have bearish feelings about the market. However, it doesn’t seem like the risk reward trade-off is worth it yet.

Related: Commercial Real Estate Market Still Slumping – Victim of Real Estate Bust: Your Pension – Nearly 10% of Mortgages Delinquent or in Foreclosure (Dec 2008) – Urban Planning

Elizabeth Warren is the single person I most trust with understanding the problems of our current credit crisis and those who perpetuate the climate that created the crisis. Unfortunately those paying politicians are winning in their attempts to retain the current broken model. We can only hope we start implementing policies Elizabeth Warren supports – all of which seem sensible to me (except I am skeptical on her executive pay idea until I hear the specifics).

She is completely right that the congress giving hundreds of billions of dollars to those that give Congressmen big donations is wrong. Something needs to be done. Unfortunately it looks like the taxpayers are again looking to re-elect politicians writing rules to help those that pay the congressmen well (one of the problems is there is little alternative – often both the Democrat and Republican candidates will both provide favors to those giving them the largest bribes/donations – but you get the government you deserve and we don’t seem to deserve a very good one). We suffer now from the result of them doing so the last 20 years. Wall Street has a winning model and betting against their ability to turn Washington into a way for them to mint money and be favored by Washington rule making is probably a losing bet. If Wall Street wins the cost will again be in the Trillions for the damage caused to the economy.

Related: If you Can’t Explain it, You Can’t Sell It – Jim Rogers on the Financial Market Mess – Misuse of Statistics – Mania in Financial Markets – Skeptics Think Big Banks Should Not be Bailed Out