America Must ‘Reassert Stability and Leadership’

Volcker: I remember there were people, beggars and tramps as we called them, who wanted to be fed. So it’s true, today we also have people who are relying on food stamps and other payments but we are a long way from the Great Depression. We are in a serious, great recession. Today we have 10 percent unemployment, but at that time it was more like 20 or 25 percent. That’s a big difference. You had mass unemployment.

…

SPIEGEL: Are you sure? The Wall Street businesses are doing well. The big bonuses are back.

Volcker: It’s amazing how quickly some people want to forget about the trouble and go back to business as usual. We face a real challenge in dealing with that feeling that the crisis is over. The need for reform is obviously not over. It’s hard to deny that we need some forward looking financial reform.

…

SPIEGEL: But the American government seems to have lost some eagerness in setting a tougher regime of rules and regulations to control Wall Street. Everything is being watered down. Why?

Volcker: I will do the best I can to fight any tendency to water it down. What we need is broad international consensus to make things happen.

I am surprised how many people are trying to compare the economic situation today (often using unemployment rates) and say we are in nearly as bad a situation as the great depression. The economy is certainly struggling, great recession, is a good term for it, I think. But taking the high measures of unemployment and underemployment today and comparing it to unemployment in the 1930’s is not comparing like numbers. The employment situation is bad now. It was much worse in the great depression. As intended, support systems like unemployment pay, FDIC, food stamps… have worked to reduce the depth of the recession.

He is right that we need serious reform to the deregulation that allowed the credit crisis to explode the economy.

Related: Volcker: Economic Decline Faster Now Than Any Time He Remembers – The Economy is in Serious Trouble (Nov 2008) – Unemployment Rate Reached 10.2% – Canada’s Sound Regulation Resulted in a Sound Banking System Even During the Credit Crisis

Mortgage defaults hit an all-time high in July according to RealtyTrac (the data in this post is from their survey). Last month default notices nationwide were down 8% from the previous month but still up 22% from November 2008, scheduled foreclosure auctions were down 12% from the previous month but still up 32% from November 2008, and bank repossessions were flat from the previous month and down 2% from November 2008. The housing market is currently not getting worse but it is hardly improving rapidly.

“November was the fourth straight month that U.S. foreclosure activity has declined after hitting an all-time high for our report in July, and November foreclosure activity was at the lowest level we’ve seen since February,” said James J. Saccacio, chief executive officer of RealtyTrac.

Four states account for 52% of national foreclosures for the second month in a row: California, Florida, Illinois and Michigan.

Related: Mortgage Delinquencies Continue to Climb – Over Half of 2008 Foreclosures From Just 35 Counties – Nearly 10% of Mortgages Delinquent or in Foreclosure

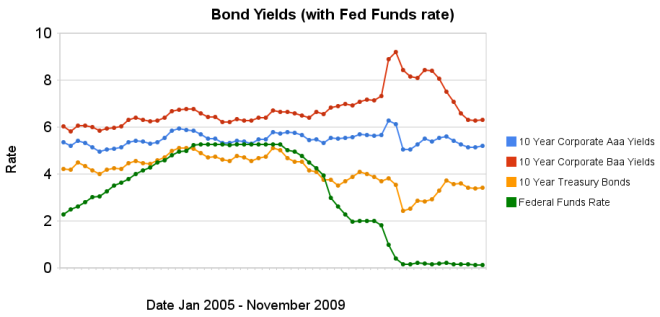

Chart showing corporate and government bond yields from 2005-2009 by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.

Chart showing corporate and government bond yields from 2005-2009 by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.Bond yields have remained low, with little change over the last 4 months. Earlier in the year, yield spreads decreased dramatically, and those reductions have remained over the last 4 months. The federal funds rate remains under .25%.

Data from the federal reserve: corporate Aaa – corporate Baa – ten year treasury – fed funds

Related: Continued Large Spreads Between Corporate and Government Bond Yields (April 2009) – Chart Shows Wild Swings in Bond Yields (Jan 2009) – investing and economic charts

As I have said previously, capitalists support the estate and inheritance taxes. Not those that see themselves as nobility, and call wish to be called capitalists, that want to reward the children of the wealthy (because we all know they need more advantages than they already get). While the Democrats voted in favor of capitalism (letting those who earn wealth prosper) instead of supporting nobility, as has been the recent trend, they did so only for the richest few. So they decided Kings and Queens should not pass all their wealth to the kids (still they can pass more than 50% of it – oh don’t you feel sorry for those poor kids you might have to get just $3.85 million instead of the $7 million they “need”). So the Democrats decided all the children of Lords, Dukes, Earls… should not have to have their trust funds impinged in any way.

“We make the estate tax go away for 99.75 percent of the people in the country,” said North Dakota Democrat Earl Pomeroy, the main sponsor. Republicans who voted against the measure said they favored repealing the levy.

Congress in 2001 decided to drop the estate tax in 2010 before reinstating it in 2011 at the previous higher top rate of 55 percent for estates valued at more than $1 million.

Isn’t it amazing how little the children of wealthy are asked to share in the huge inheritances they get. But until the economic literacy of the country improves they are able to pretend noble blood lines passing down huge fortunes are not just those with the gold making the rules.

You might notice the government is in pretty desperate need of money. But some still think asking the kids of the super rich to part with some of their inheritance is too much to ask. I wish they would learn about economics. It is not capitalist to reward being born in the right house with more cash than than many will every earn working 40 plus years (a 50% inheritance tax on the super rich is less than it should be – and it shouldn’t be just the super rich that pay inheritance tax). Maybe exempt $1-2 million and index that. The next million at 50%. Then increase the rate 5% every million. I don’t really see any need to give some kid $100 million because they happen to have been born to a rich parent. Capitalism is about rewarding economic productivity not the birth lottery.

Related: Rich Americans Sue to Keep Evidence of Their Tax Evasion From the Justice Department – Killing Capitalism in Favor of Special Interests – Ignorance of Capitalism – Charge It to My Kids – Buffett on Taxes

N.Y. Raises Pension Requirements to Save $48 Billion

…

For new workers, the bill raises the age for retirement without penalty to 62 from 55, imposes a 38 percent penalty on non-uniformed workers who retire before 62 and increases the minimum years of service to draw a pension to 10 from 5, according to Paterson’s office.

Overtime payments included in calculating pension benefits will be capped at $15,000 a year for civilian workers, and 15 percent of wages for police and firefighters.

Raising the retirement age from 55 to 62 (for new workers) is something that should have been done decades ago. 62 is too young for a full retirement age. If a country has the life expectancies we do they either need to have huge retirement savings (which for NY State would mean huge taxes to support that level of retirement savings) or live off the wealth saved in previous generations (or count on taxes of future generations).

Unfortunately for too long all of the USA we have chosen not to save for retirement when we work and then retire when we still have decades to live (on average). That is not sustainable. You can only add so much to the credit card (buy now let someone pay later strategy). Increasing from 55 to 62 is a good move. But it is too little and too late. More should be done.

Saving for retirement is not complicated. It is just that many people would rather speed money now and now save it. That is easy to understand but it is not helped if we make it sound like saving for retirement is hard. It takes some discipline. But certainly adults should be able to show some discipline. We have to stop acting like not saving for retirement is somehow acceptable. It is no more acceptable than those that had to store food for the winter a few hundred years ago deciding they would rather go swimming all summer and worry about the winter later.

And state governments should not provide out-sized retirement benefits which must be paid for by the taxpayers. 80 years ago maybe setting the retirement age at 55 made sense. It certainly did not for new workers in 1980 (or 1990 or 2000 at least now in 2009 they are making a move in the right direction).

Related: Working Longer and Delaying Retirement – Many Retirees Face Prospect of Outliving Savings – Pushing your financial problems into the future – Gen X Retirement

In the webcast interview above Warren Buffett and Bill Gates discuss business, health care, economics, wall street, the Fed and more. Both agree the health care system is far too expensive and needs to be fixed. And both agree the current reforms are far too small and seem to do little to address the core problems with incentives and entrenched interests maintaining system in need of reform.

Both also agree the future is bright for the USA and the world economically. The innovation possible will may well come from more locations in the next century but those innovations will also come from the USA.

Warren Buffett also defends the independent Federal Reserve board system.

Related: Warren Buffet Webcast to MBAs – Advice from Warren Buffett UT at Austin business school – Bill Gates: Capitalism in the 21st Century

Diabetics in U.S. May Double in 25 Years, Tripling Health Costs

Without new programs to assure that people get health care to manage their condition, 44.1 million people in the U.S. will have diabetes by 2034, from 23.7 million today, the report said. The number of diabetics on Medicare, the government plan for the elderly, will reach 14.1 million from 6.5 million today.

…

The analysis by O’Grady and his colleagues included the impact of aging and obesity rates

The broken health care system needs to be fixed. We continue to spend huge amounts of money and yet fail to take sensible steps to improve outcomes (see our recent post for another example of failing to focus on outcome measures).

Related: USA Heath Care System Needs Reform – Deficit Threat from Health Care Costs – articles on improving the medical care system – USA Spent $2.2 Trillion, 16.2% of GDP, on Health Care in 2007 – Study Finds Obesity as Teen as Deadly as Smoking

With the dollar declining sharply, many are focused on the issue now. And the most common culprit for blame seems to be the federal debt. While I agree the dollar is likely to fall, the deficit doesn’t seem like the main reason, to me. The federal debt is large and growing quickly, which is a problem. But still the USA federal debt to GDP is lower than the OECD average. Even with a few more years of crazy federal debt growth the USA will still be below that average.

Japan has by far the highest level of government debt in the OECD. The Yen is not collapsing. The debt is a factor but the lack of saving (USA consuming more than it produces) seems the biggest problem to me. China not only does not have large government debt it has large amounts of personal savings. People have been living far within their means in Japan and China (only by government intervention, due to desires to not have the currency appreciate has that appreciation been slowed).

Thankfully we have been increasing savings a bit recently but it is a drop in the bucket so far (Consumer Debt Down Over $100 Billion So Far in 2009). It will have to increase in size and continue for years to begin to address the problems in a significant way.

Related: The USA Economy Needs to Reduce Personal and Government Debt (March 2009) – The Truth Behind China’s Currency Peg – Who Will Buy All the USA’s Debt?

What is the aim of prison? To keep criminals locked up so they can’t commit crimes in society is another. Punishment, in order to deter people from committing crime is one reason they exist. And you would hope to mold prisoners so they do not commit crimes when they are freed. But the payment for services does not factor in the results of releasing productive members of society. It seems like doing so could result in improvements.

Better Jails by Andrew Leigh, economics professor, Australian National University

…

To encourage innovation, we should start publicly reporting the outcomes that matter most. Rather than merely telling the public how many people are held in each jail, governments should publish prison-level data on recidivism rates and employment rates.

…

As well as focusing on the important outcomes, Australian states should rethink the contracts they write with private providers. At present, about 16% of inmates are held in a private jail. Unfortunately, the contracts for private jails bear a remarkable similarity to sheep agistment contracts.

Providers are penalised if inmates harm themselves or others, and rewarded if they do the paperwork correctly. Yet the contracts say nothing about life after release. A private prison operator receives the same remuneration regardless of whether released inmates lead healthy and productive lives, or become serial killers.

A smarter way to run private jails would be to contract for the outcomes that matter most. For example, why not pay bonus payments for every prisoner who holds down a job after release, and does not reoffend? Given the right incentives, private prisons might be able to actually teach the public sector a few lessons on how to run a great rehabilitation program.

The idea of paying for outcomes is great. It makes sense for some pay to be based on keeping prisoners housed during their terms. But providing incentives for achievement in returning productive people back to free society is something we should try.

Related: Lean Management in Policing – Urban Planning – Rich Americans Sue to Keep Evidence of Their Tax Evasion From the Justice Department – Randomization in Sports – LA Jail Saves Time Processing Crime – Measuring and Managing Performance in Organizations

Quality Improvement and Government: Ten Hard Lessons From the Madison Experience by David C. Couper, Chief of Police, City of Madison, Wisconsin

Read more

Hans Rosling uses his fascinating data-bubble software to burst myths about the developing world. Look for new analysis on China and the post-bailout world, mixed with classic data shows.

“The worldview students have corresponds to reality the year their teachers were born”

The software he uses, the very cool Gapminder world, developed by his son and bought by Google is available online.

He also correctly congratulates the USA for providing free data it has collected worldwide, for decades, on world health. And correctly criticizes the World Bank for selling the data they compile using taxpayer funds.

Related: Data Visualization Health Care Example – Economic Measurement Issues Arising from Globalization – Millennium Development Goals – Government Debt Compared to GDP 1990-2007