The updated data from the United Nations on manufacturing output by country clearly shows the USA remains by far the largest manufacturer in the world. UN Data, in billions of current US dollars:

| Country | 1990 | 1995 | 2000 | 2005 | 2006 | 2007 |

|---|---|---|---|---|---|---|

| USA | 1,041 | 1,289 | 1,543 | 1,663 | 1,700 | 1,831 |

| China | 143 | 299 | 484 | 734 | 891 | 1,106 |

| Japan | 804 | 1,209 | 1.034 | 954 | 934 | 926 |

| Germany | 438 | 517 | 392 | 566 | 595 | 670 |

| Russian Federation | 211 | 104 | 73 | 222 | 281 | 362 |

| Italy | 240 | 226 | 206 | 289 | 299 | 345 |

| United Kingdom | 207 | 219 | 228 | 269 | 303 | 342 |

| France | 224 | 259 | 190 | 249 | 248 | 296 |

| Korea | 65 | 129 | 134 | 200 | 220 | 241 |

| Canada | 92 | 100 | 129 | 177 | 195 | 218 |

| Spain | 101 | 103 | 98 | 164 | 176 | 208 |

| Brazil | 120 | 125 | 96 | 137 | 170 | 206 |

| Additional countries of interest – not the next largest | ||||||

| India | 50 | 59 | 67 | 118 | 135 | 167 |

| Mexico | 50 | 55 | 107 | 122 | 136 | 144 |

| Indonesia | 29 | 60 | 46 | 80 | 102 | 121 |

| Turkey | 33 | 38 | 38 | 75 | 85 | 101 |

The USA’s share of the manufacturing output of the countries that manufactured over $200 billion in 2007 (the 12 countries on the top of the chart above) in 1990 was 28%, 1995 28%, 2000 33%, 2005 30%, 2006 28%, 2007 27%. China’s share has grown from 4% in 1990, 1995 7%, 2000 11%, 2005 13%, 2006 15%, 2007 16%.

Total manufacturing output in the USA was up 76% in 2007 from the 1990 level. Japan, the second largest manufacturer in 1990, and third today, has increased output 15% (the lowest of the top 12, France is next lowest at 32%) while China is up an amazing 673% (Korea is next at an increase of 271%).

Read more

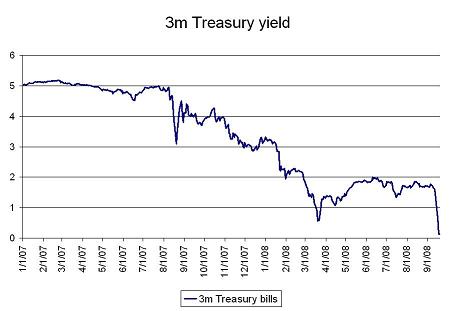

On Wednesday of last week the United States 3 month treasury bill yield reached .03%, yet another remarkable chart from the current crisis.

via: No one wants to hold risk … – “I guess this is what a close to systemic financial crisis in the US looks like”

Daily Treasury Yield Rates show that the rate for Friday the 12th of September 1.49%, Monday the 15th 1.02%, Tuesday .84%, Wednesday .03%, Thursday .23% and Friday .99%.

Related: Corporate and Government Bond Yields – Curious Cat Investing and Economics Search – Credit Crisis Continues (April 2008)

Fed to Loan A.I.G. $85 Billion in Rescue

The decision, only two weeks after the Treasury took over the federally chartered mortgage finance companies Fannie Mae and Freddie Mac, is the most radical intervention in private business in the central bank’s history.

This whole meltdown of the companies that exemplified the mantra that government regulation is bad (when they would like to make money by avoiding regulation) that now come begging for government bailouts because of the risk to the economy of failing to provide bailouts sure is disheartening. You might even think real changes will be made. I am sure changes will be made for awhile and then people will forget and special interests will pay politicians to get special favors and we will find ourselves in a different but similar mess a few decades from now.

Related: Fed Continues Wall Street Welfare – 2nd Largest Bank Failure in USA History – Estate Tax Repeal

Federal Deficit To Double This Year

…

The budget picture is likely to grow even bleaker once government analysts factor in the anticipated costs of the Treasury Department’s decision last weekend to take over struggling mortgage-finance giants Fannie Mae and Freddie Mac.

It is no surprise those that spend what they don’t have personally elect those that do the same thing for the nation. But as those that spend money they don’t have eventually realize you have to become responsible at some point.

Related: More Government Waste – True Level of USA Federal Deficit – Lobbyists Keep Tax Off Billion Dollar Private Equities Deals and On For Our Grandchildren

Chatting with Obama by Bill O’Reilly

I really wish people understood capitalism. Capitalism requires regulation. It was known to all the economist in Adam Smith’s time that the government must regulate or powerful forces that would not allow the free market to function as it should – which destroys the potential of capitalism. This is not some minor point, it is absolutely essential to the theory of how capitalism provides value to society.

The ignorance that equates allowing manipulation of the market by powerful forces undermining capitalism (which is supported by those that claim to support capitalism – “regulation distorting free markets”) with disrupting the free market annoys me. I know I should accept that ignorance is just rampant but sometimes I can’t get over it. I truly support capitalism and seeing it abused by so many ignorant pundits and politicians is distressing.

And when those with influence constantly reinforce ideas based on ignorance then many, that can’t think for themselves, accept idiotic ideas like “free markets” should allow oligopolies to consolidate reducing the benefits of capitalism, that polluters should be allowed to push negative externalities onto the public, that allowing trust fund babies to receive massive inheritances is good (capitalism is meant to reward those that contribute, not reward those who were related to someone useful) and that the inheritance tax is bad (it is the BEST tax that exists, arguably along with taxes on negative externalities) and on and on.

The idiotic idea that government regulation of markets is interference is equivalent to saying police interfere with freedom by enforcing laws against violent crime. Yes the watchmen must be watched. You can have bad policing and bad regulation; but the idea that policing the free market, in itself is wrong, is so ignorant we have to stop accepting such claims as if they were anything but ravings of radicals or ignorant people (or people that are both).

By the way I am using ignorant with the sense of “lacking knowledge or comprehension of the thing specified.” Sometimes the word is used to claim the other person’s opinion is wrong, which is not an accurate way to use the word. It is my opinion that those espousing crazy ideas like, free markets are those without regulation, don’t understand capitalism is based upon the idea of perfect competition. If they do, but have decided that fundamental aspect (along with negative externalities, rewards based on who your parents are instead of what you produce…) of capitalism is wrong, but they have a new theory that somehow updates capitalism I am waiting to hear about it. I am basing my guess of their ignorance on their statement seeming to be completely disconnected with capitalist theory.

Read more

The growth in the number of jobs in the USA continues to be bad. The growth in jobs has been very poor thus far this century. The good news has been unemployment has been fairly low, it now sits at a 4 year high of 5.7% (which is not great but not horrible by historic standards).

Update: today the labor department announced the unemployment rate increased to 6.1%.

This year the news has been worse, with actually declining numbers of jobs and some economics see No job turnaround on horizon:

…

“I’m not expecting increases in employment until next year because in the second half of this year we’ll see very lethargic economic growth,” said Joel Prakken, chairman of Macroeconomic Advisers. The Conference Board has created a new reading called the Employment Trends Index, which combines a number of different economic readings to predict when employment will turn higher or lower. The index, which typically signals three to six months before job losses will turn to job gains, has yet to show signs of a recovery.

“We think the unemployment rate will keep growing, probably reach between 6 to 6.5% by mid 2009 and only start declining in the second half of next year,” said Gad Levanon, senior economist at The Conference Board.

Related: What Do Unemployment Stats Mean? – Economic Fault: Income Inequality

Americans working past retirement

…

Twenty-nine percent of people in their late 60s were working in 2006, up from 18 percent in 1985, according to the Bureau of Labor Statistics. Nearly 6 million workers last year were 65 or over. Over the next decade, the number of 55-and-up workers is expected to rise at more than five times the rate of the overall work force, the BLS reported.

…

Working another three years — from 62 to 65, for example — and continuing to save 15 percent of salary could raise annual income from investments by 22 percent. Make it five years and boost savings contributions still higher — even better.

Putting off retirement also may enable people to delay when they start taking Social Security benefits, which can significantly increase payments.

“The longer the delay, the better” financially, said Fahlund. “To me the ideal would be 70, because you get the biggest Social Security benefit possible and all those additional years of employment. And it keeps you going mentally and physically too.”

The economic reality is retiring at 62 is not realistic for most people today. Retirement age has barely budged at life expectancy has increased by 20 years. I have long felt the best practice for the economy is to provide part time work to transition into retirement. This allows people to slow down their work lives, but not completely leave it behind. And the financial benefits are very helpful to all those that did not save enough early in their lives.

Related: Retirement Delayed, Working Longer – Our Only Hope: Retiring Later – Many Retirees Face Prospect of Outliving Savings – Retirement Savings Survey Results – Saving for Retirement – Spending Guidelines in Retirement – Tips To Allow Retiring Sooner

I respect the management of Google. They are not tied to conventional ways of thinking. When they bought huge amounts of dark fiber (fiber optic cable that had been laid down in the internet bubble period, but was sitting unused). I figured they had made good investments while the cable was very cheap (pennies on the dollar). I watch with interest as they continue to build their own (with partners) fiber network. I am guessing this may be partially because they are smart enough to know the business oligopolies providing internet infrastructure will try to exploit their positions and government cannot be counted out to play their proper regulatory role, which is required in a capitalist system. And partially due to their huge bandwidth needs and projections for future growth.

And since those oligopolies are not very effective companies (that rely largely on paying politicians, in order to undermine the proper role of government in a capitalist system, to gain government granted monopolist profits). That increases the benefit of Google buying into their own distribution network since excess capacity can likely be sold at a large profit: the competing companies are so used to charging monopoly prices leaving lots of room for profit. The second point can be debated but I don’t think if the economy functioned properly, with intelligently regulated natural monopolies providing internet bandwidth, I doubt Google would invest in this, but, of course, I could be wrong.

About the Unity bandwidth consortium

Google stretching underwater comms cable?

…

Meanwhile, ITWeb reports that Google is looking to run a third underwater cable to South Africa.

Related: Monopolies and Oligopolies do not a Free Market Make – Challenges in Laying Internet Fiber Under Oceans – Plugging America’s Broadband Gap – Not Understanding Capitalism

Kiva has added a fellows blog – which is a great idea. The fellows are funded by Kiva (fellows are unpaid) to go to spend time in the countries Kiva facilitates loans for working with the local partners. This post is about Rita Bashnet (in photo) an entrepreneur from Nepal:

…

Five years ago, Ms. Rita took her first loan of NRs. 10,000 (USD $150) and purchased some extra seed and fertilizer in the hopes of expanding her small vegetable patch. With the profits from this initial investment and a second loan from Patan Business and Professional Women (they offer a graduated loan program), she then purchased her first dairy cow.

…

After hearing about a program that subsidized the installation of methane gas storage tanks, Ms. Rita took another loan and applied for the program. With this new system, she is now able to capture the valuable gas released from her cow’s waste in a simple controlled-release storage tank. Today she no longer purchases gas from the city and can even sell some during times of shortage.

…

Ms. Rita exemplifies the potential of microfinance. A combination of access to capital and strategic investment has allowed her and her family to drastically improve their economic situation in a short five years.

Great story, and exactly my hope for using capitalism to improve the standard of living for people around the globe. I notice today, for the first time, some of those seeking loans are about to have their listings expire unfunded. Kiva gives listings 30 days to be funded. I have no problem if some loans are not funded (I want to help entrepreneurs by providing funding to build a business – some loans are for things like adding a room onto their house, which is fine but not what I want to support with interest free loans from me). But, this is a big change from when I couldn’t find anyone to loan to (they had so many people looking to lend that they didn’t have enough loans to fund). If you haven’t loaned money through Kiva (or you haven’t added to your loan portfolio recently), please consider it now. If you do, send me your Kiva lender link and I will add it to Curious Cat Kivans. My biggest wish for this blog is to get more readers listed on that page.

Related: Using Capitalism to Make a Better World – Funding Entrepreneurs in Nicaragua, Ghana, Viet Nam, Togo and Tanzania – 2006 Nobel Peace Prize to Economist – Frontline Explores Kiva in Uganda – Trickle Up

The Entrepreneurship Lottery by Scott Shane

Generating significant financial value is something done by a very small percentage of start-ups, but a handful that do generate a lot of value.

Scott Shane is a Professor of Entrepreneurial Studies at Case Western Reserve University

Related: Easiest Countries from Which to Operate Businesses – Capitalism in China – Frontline Explores Kiva in Uganda