Half of Commercial Mortgages to Be Underwater

…

We now have 2,988 banks – mostly midsized, that have these dangerous concentrations in commercial real estate lending.” As a result, the economy will face another “very serious problem” that will have to be resolved over the next three years, she said, adding that things are unlikely to return to normalcy in 2010.

…

Warren said it’s time for the government to “pull the plug” on mortgage lenders Fannie Mae and Freddie Mac. “I’m one of those people who never liked public-private partnership to begin with. I think what they did was use public when public was useful and private when private was useful,” she said. “And I think we’ve got to rethink that whole thing.”

“There is no implicit guarantee anymore,” she added. “I don’t care how big you are, if you make serious enough mistakes, then your business can be entirely wiped out.”

Financially literate people should know that the current commercial real estate market is in serious trouble. I still figure it will rebound well. I just want to wait and see how far prices fall and then try to buy when people are so frustrated they will sell at very low prices.

Related: Commercial Real Estate Market Prospects Remain Dim – Mortgage Delinquencies and Foreclosures Data Indicates 2010 Could Show Improvement – Jumbo Loan Defaults Rise at Fast Pace (Feb 2009)

10 Ways the New Healthcare Bill May Affect You by Katie Adams

…

Starting this fall, your health insurance company will no longer be allowed to “drop” you (cancel your policy) if you get sick.

…

Starting this year your child (or children) cannot be denied coverage simply because they have a pre-existing health condition. Health insurance companies will also be barred from denying adults applying for coverage if they have a pre-existing condition, but not until 2014.

…

If you currently have pre-existing conditions that have prevented you from being able to qualify for health insurance for at least six months you will have coverage options before 2014. Starting this fall, you will be able to purchase insurance through a state-run “high-risk pool”, which will cap your personal out-of-pocket expenses for healthcare. You will not be required to pay more than $5,950 of your own money for medical expenses; families will not have to pay any more than $11,900.

…

Under the new law starting in 2014, you will have to purchase health insurance or risk being fined.

…

Starting in 2018, if your combined family income exceeds $250,000 you are going to be taking less money home each pay period. That’s because you will have more money deducted from your paycheck to go toward increased Medicare payroll taxes. In addition to higher payroll taxes you will also have to pay 3.8% tax on any unearned income, which is currently tax-exempt.

Related: How the health care bill could affect you – Answers About Health Care Bill – Why the Health Care Bill May Eventually Curb Medical Costs – post on health care – USA Consumers Paying Down Debt – Personal Finance Basics: Long-term Care Insurance

Many people are ignoring huge costs (to the economy) and benefits (to those financial companies that ruined so many people’s lives and severely damaged the economy. Paying back money the government paid you is not that same as being innocent. While several of the too big to fail banks have paid back the direct cash they were given that is not an indication they are now off the hook for their disastrous behavior.

First we know that much of the money “sent to AIG” just went directly to Goldman Sachs and others. Those big banks had taken risks and the only way those risks paid off was with billions from taxpayers. Without that they would have been bankrupt. And then when they paid the money they received directly they still haven’t paid back the billions they got from taxpayers (via AIG). And this money was paid back at 100 cents on the dollar though those instruments were trading for much less in the market (the government certainly would have found a less costly solution but for ignorance or a desire to reward their former company and friends at Goldman Sachs.

Second, rates have been kept artificially low, to among other things, allow the big banks to make tens of billions (and costing savers tens of billions). Those savers have not been reimbursed for the losses caused by the big banks.

And third if I gamble with money from my company and win my bet on the Super Bowl and then put the money back, I am still not innocent. Just because many of the big banks have paid back the money they were given directly by taxpayers does not mean they didn’t get huge benefits from the government. Pretending they are not bad guys because after ruining the economy, costing millions of people their jobs and savings, getting many benefits from the government, they then pay back the direct cash payments is not accurate.

Response to: The New Bank Tax

Related: Elizabeth Warren Webcast On Failure to Fix the System – The Best Way to Rob a Bank is as An Executive at One – Failure to Regulate Financial Markets Leads to Predictable Consequences – Jim Rogers on the Financial Market Mess – Congress Eases Bank Laws (1999)

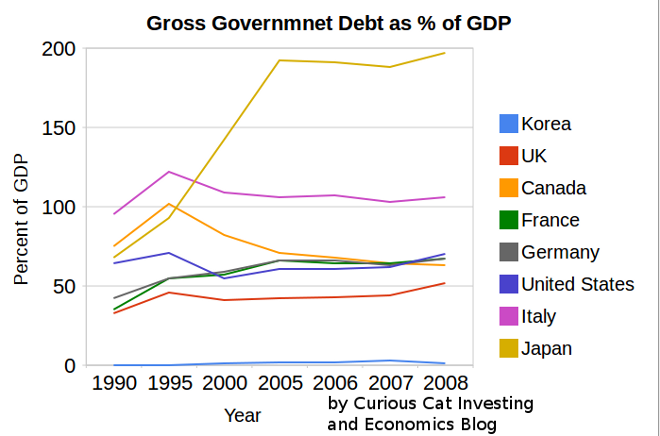

Recently Greece and the huge USA federal deficits have highlighted the problem of excessive government debt. The above chart shows gross government debt by country from the IMF.

Korea has essentially no gross government debt (under 2% of GDP for the entire period). At the other end of the spectrum Japan has seen gross government debt rise to 197% (Japan’s 2008 figure is an IMF estimate). The IMF did not have data for Greece (which would likely look very bad) or China (which I would think would be very low – maybe even negative – the government having more assets than debt).

The USA debt stood at 64% in 1990, 71% in 1995, 55% in 2000, 61% in 2005 and 70% in 2008. Most countries are expected to see significant increases in 2009. The IMF sees the USA going to 85% in 2009 and 100% in 2012. They see Germany at 79% in 2009 and 90% in 2012. They See the UK at 69% in 2009 and 94% in 2012. They see Japan at 237% in 2012.

The chart shows gross government debt as percentage GDP 1990-2008. By Curious Cat Investing and Economics Blog, Creative Commons Attribution.

The chart shows gross government debt as percentage GDP 1990-2008. By Curious Cat Investing and Economics Blog, Creative Commons Attribution.___________________________

The data here is very similar to the OECD data I provided earlier, Government Debt Compared to GDP 1990 to 2007, though with some notable differences. In the OECD data was still in the best shape, but is seen as having 29% debt to GDP in 2007. The IMF data attempts to avoid issues where some countries have debt of non-federal governments that are hidden when looking just at federal government debt.

Data source: IMF data (for some countries the data is also from that site but at different urls).

Related: The Long-Term USA Federal Budget Outlook – USA, China and Japan Lead Manufacturing Output in 2008 – Oil Consumption by Country in 2007 – Saving Spurts as Spending Slashed

The slow recovery from the massive credit crisis caused recession remains underway. Nonfarm payroll employment declined 36,000 in February, and the unemployment rate held at 9.7%, the U.S. Bureau of Labor Statistics reported today. Employment fell in construction and information, while temporary help services added jobs. Severe winter weather in parts of the country may have affected, negatively, payroll employment and hours.

In February, the number of unemployed persons, at 14.9 million, was essentially unchanged. Among the major worker groups, the unemployment rates for adult men (10.0%), adult women (8.0%), whites (8.8%), African-Americans (15.8%), Hispanics (12.4%), Asians was 8.4%, and teenagers (25.0%) showed little to no change in February.

The number of long-term unemployed (those jobless for 27 weeks and over) was 6.1 million in February and has remained stable since December. About 4 in 10 unemployed persons have been unemployed for 27 weeks or more.

In February, the civilian labor force participation rate (64.8%) and the employment-population ratio (58.5%) were little changed.

The number of persons working part time for economic reasons (sometimes referred to as involuntary part-time workers) increased from 8.3 to 8.8 million in February, partially offsetting a large decrease in the prior month. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.

Since the start of the recession in December 2007, payroll employment has fallen by 8.4 million.

Related: Unemployment Rate Reached 10.2% – Another 450,000 Jobs Lost in June 2009 – Can unemployment claims predict the end of the American recession?

Read more

The delinquency rate for mortgage loans on one-to-four-unit residential properties fell to a seasonally adjusted rate of 9.5% of all loans outstanding as of the end of the fourth quarter of 2009, down 17 basis points from the third quarter of 2009, and up 159 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. The non-seasonally adjusted delinquency rate increased 50 basis points from 9.9% in the third quarter of 2009 to 10.4% this quarter.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the fourth quarter was 4.6%, an increase of 11 basis points from the third quarter of 2009 and 128 basis points from one year ago. The combined percentage of loans in foreclosure or at least one payment past due was 15% on a non-seasonally adjusted basis, the highest ever recorded in the MBA delinquency survey.

The percentage of loans on which foreclosure actions were started during the fourth quarter was 1.2 percent, down 22 basis points from last quarter and up 12 basis points from one year ago.

The percentages of loans 90 days or more past due and loans in foreclosure set new record highs. The percentage of loans 30 days past due is still below the record set in the second quarter of 1985.

The data is far from good but it could well signal the situation is improving. The next few quarters seem poised to start showing better results. Granted given how bad these results are we have a long way to go before the data is actually good. “We are likely seeing the beginning of the end of the unprecedented wave of mortgage delinquencies and foreclosures that started with the subprime defaults in early 2007, continued with the meltdown of the California and Florida housing markets due to overbuilding and the weak loan underwriting that supported that overbuilding, and culminated with a recession that saw 8.5 million people lose their jobs,” said Jay Brinkmann, MBA’s chief economist.

“The continued and sizable drop in the 30-day delinquency rate is a concrete sign that the end may be in sight. We normally see a large spike in short-term mortgage delinquencies at the end of the year due to heating bills, Christmas expenditures and other seasonal factors. Not only did we not see that spike but the 30-day delinquencies actually fell by 16 basis points from 3.79% to 3.63%. Only three times before in the history of the MBA survey has the non-seasonally adjusted 30-day delinquency rate dropped between the third and fourth quarter and never by this magnitude.

“This drop is important because 30-day delinquencies have historically been a leading indicator of serious delinquencies and foreclosures. With fewer new loans going bad, the pool of seriously delinquent loans and foreclosures will eventually begin to shrink once the rate at which these problems are resolved exceeds the rate at which new problems come in. It also gives us growing confidence that the size of the problem now is about as bad as it will get.

“Despite the drop in short-term delinquencies, foreclosure rates could continue to climb, however, based on the ability of borrowers 90 days or more delinquent to solve their problems. A sizable number of the loans in the 90+ day delinquent bucket are in loan modification programs. They are carried as delinquent until borrowers demonstrate they will make the payments agreed to in the plans.

Related posts: Mortgage Delinquencies Continue to Climb (Nov 2009) – USA Housing Foreclosures Slowly Declining (Dec 2009) – Nearly 10% of Mortgages Delinquent or in Foreclosure – How Not to Convert Equity (Jan 2006)

Read more