Why you don’t need an extended warranty, Consumer Reports:

– Some repairs are covered by the standard manufacturer warranty that comes with the product

– Products seldom break within the extended-warranty window–after the standard warranty has expired but within the typical two to three years of purchase–our data show.

– When electronics and appliances do break, the repairs, on average, cost about the same as an extended warranty.

Related: Save Money on AV Cables – Shop Around for Drugs – Real Free Credit Report

I would say why Americans are going broke is pretty simple: they buy loads of stuff they can’t afford and don’t need. And the political leaders promote this get another credit card mentality of “budgeting”. This stuff is not that tricky. Don’t borrow what you can’t afford. Save money. Don’t buy frivolous stuff that you can’t afford and don’t really provide you value.

Related: USA Federal Debt Now $516,348 Per Household – Saving for Retirement – Financial Illiteracy Credit Trap – Earn more, spend more, want more

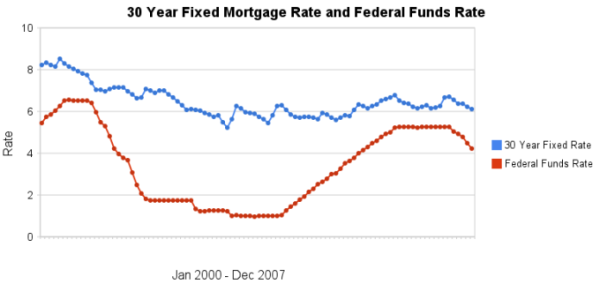

I have update my article showing the historical comparison of 30 year fixed mortgage rates and the federal funds rate. When deciding whether to lock in a rate for a 30 year fixed rate mortgage (when refinancing or buying a new home) some believe moves in the federal reserve discount rate will raise or lower that mortgage rate directly. This is not the case, in general. The effect of federal reserve discount rates on other mortgage rates (such as adjustable rate mortgages is not the same and can be predictably affected by fed fund rate moves).

The chart shows the federal funds rate and the 30 year fixed rate mortgage rate from January 2000 through December 2007 (for more details see the article).

There is not a significant correlation between moves in federal funds rate and 30 year mortgage rates that can be used for those looking to determine short term (over a few days, weeks or months) moves in the 30 year fixed mortgage rates. For example if 30 year rates are at 6% and the federal reserve drops the federal funds rate 50 basis points that tells you little about what the 30 year rate will do. No matter how often those that should know better repeat the belief that there is such a correlation you can look at the actual data in the graph above to see that it is not the case.

Read more

In the USA Municipal bonds are issued by state and local governments and are exempt from federal tax. Therefor if you earn a 5% yield your after tax return is equal to that of a 7.5% yield if you are in the 33% federal tax bracket (7% * .67 = 5%). One way to invest in bonds is using a mutual fund (open or closed end funds). Right now the tax equivalent yields (compared to other bonds) of muni bonds are higher than normal.

Muni Bond Funds Offer High Yields, Tax Perks Dec, 2007:

…

With so many defaults going on in the mortgage arena, investors are worried that the insurers won’t be there to back up any munis that might get into trouble. A fair point, but the bond insurers are bolstering their own capital structures to deal with these concerns, and historically, as I said before, defaults in munis are few and far between.

Why are closed-end muni funds trading at a discount? Typical discounts today are about 10%, which is about as deep as such discounts have ever gotten on a historical basis. The typical discount is half that, or less. Closed-end muni funds sometimes even trade at a premium.

One explanation for the big discount might be the fact that many closed-end muni funds use leverage, in order to increase the tax-exempt returns they can offer investors. In the current credit crisis, leverage is seen as an inherently dangerous thing.

In general I find bonds to be a less desirable investment. Especially in the low yield environment recently (and really going back quite a few years). But for diversification some bonds can make sense for certain portfolios. Given the current tradeoffs (risk v. after tax yield) muni bonds certainly deserve consideration. I would shy away from long term bonds or funds (intermediate or short term) but of course every investor makes their own decisions.

Related: Roth IRA (another good tax smart investing tool) – what are bonds? – Alternative Minimum Tax

So yet again everyone in Washington DC wants to raise taxes on your children and grandchildren to spend money today. We might be going into a recession because the bubble of financing real estate led to people spending money they couldn’t pay back. So now home construction is decreasing, banks are having trouble meeting within capitalization requirement without huge inflows of capital from abroad, excess housing supply…

The government has been spending huge amounts of money it doesn’t have for a long time. So what great ideas do our leaders have: put more burden on the children and grandchildren to pay for our spending today. What a sad state of affairs. And almost no-one seems to question this behavior.

Is the idea that we would go into a recession so remote these leaders never imagined it could happen? No, of course they new it would happen. So what should a country, company, individual do if they know they have some expected event in the future they might want to spend money on? This isn’t really tricky. I would guess many 8 years olds understand the concept. You put the money in the piggy bank for when you will want to spend it.

If you decide to spend not only all the money you have but borrow huge amounts that will tax your future earnings to pay back your current spending that is your choice (as long as you can find someone to lend you money). But as many parents have told their kids you have to live with the decisions you make. You don’t get to spend your money today. Spend tomorrows money today. Spend your kids money today. And then when, tomorrow comes, just spend all that money all over again. How can a country allow leaders to so transparently tax the future of the country?

It is a sad state of affairs. The country chooses not to sent aside funds for obvious future needs. Then instead of accepting the hole they have dug for themselves decides to tax their children even more to continue the spendthrift ways. I think we not only need to have politicians actually read the bills before they vote (they refuse to pass such a law) they need to read about the ant and the grasshopper.

I have no problem with the country choosing to set aside funds to use when they want to try and stave off a recessions (to pay for tax cuts or more spending). I do have a problem with: running enormous deficits every year, raising taxes on our children and grandchildren year after year, and then deciding to raise taxes even more on the future when the obvious happens and perfectly predictable desired expenditures present themselves. The get another credit card school of financial management (that everyone in Washington DC seems to practice) is not workable for a country over the long term. As anyone that has used that strategy personally will tell you – it works for awhile but eventually there are serious consequences.

Read more

A house is where you live–not an investment

Very good point – as long as you fall into that category of living there until you die. True for some people but far from all. Also, even for those people, it is not a complete view of the financial situation.

A reverse mortgage will allow you to sell the house and get paid for the rest of the time you live there. So you can build up equity over 20,30,40 years and then take a reverse mortgage and get payments every month (based on your investing in your house). Reverse mortgages, like many financial tools, can be applied poorly and is I would guess unethical behavior related to them is fairly high (so be very careful!). If you think of such an option you need to do your research and actually understand what you are doing – you can’t afford to be like the many ignorant mortgagors. The AARP offers information on Reverse Mortgages.

Additionally, you lock in a large part of your housing cost (you still have maintenance and taxes but you do not have every increasing rent. Now ever increasing rent is not a certainty but for many it is very likely rent will go up on average over the long term. Ownership of your home removes the risk of being priced out of the area you want to live by increasing rental prices over time. You also lose the potential of benefiting if rent prices fall over time, but I would say the more valuable of those options is avoiding the risk of rising rental prices.

Related: How Not to Convert Equity – Housing Inventory Glut – articles on home ownership and real estate

One way to evaluate the real estate market is to compare rental rates to home values. This can provide a comparison of an approximate cost of buying a house versus the cost to rent. As the ratio of monthly rent to home price increases, at least on this measure or real estate value, the market can be seen as becoming more expensive.

Several points to keep in mind:

- This does not take into account things like tax rates (in higher tax areas the rents will be higher [since the owners will pass on that cost that is not reflected in the home price] – the ratio lower)

- This is only a comparison measure – it can be that rents also experience a bubble. So if rents experience a bubble then the ratio could stay low and fail to indicate an “expensive” market.

- Don’t rely on one measure – this is one useful measure there are plenty of others that matter for real estate prices (income levels, job growth, interest rates, zoning regulations…)

The Rent-Price Ratio for the Aggregate Stock of Owner-Occupied Housing

likely would have to fall considerably.

This paper is well worth reading. I would like to point out another factor here though. When those investing in real estate were focused largely on capital gains (say a few years ago) there could well have been an increased demand for rental property (which increased prices). That effect also moved extra supply into the rental market (that previously would have been sold to owners that would live there instead of investors). Those investors were more concerned with capital gains and it seems to me could well have been willing to accept lower rents just to have some cash coming in to help pay the expenses.

As those investors no longer believe they will receive large capital gains in the short term it is possible they will be more focused on cash flow – and seek increased rents. I will not be surprised that rent prices increase as investors focus more on cash flow and stop assuming such large capital gains will be where their profits are made. Thus the ratio will close both by real estate value declines and rental price increases.

Related: Explaining Rent-Home Price Ratios – True Rent-to-Price Ratio for Housing – articles on the real estate market – Real Estate Median Prices Down 1.5% in the Last Year – Rent Controls are Unwise

Response to: The desirability of rent controls

I do not believe rent controls are wise, in general. There are some options I wouldn’t mind – some sort of affordable housing that has breaks from the government (tax…) in exchange for a commitment to keep rental rates down. But wholesale rent controls are very unwise I believe.

A related issue I find amusing. You will hear don’t regulate at all state that it is regulation preventing housing being constructed (zoning regulations) that create rising prices which they imply is unfair. It seems to me the data shows the opposite of what those people claim. People are willing to pay more for the regulated housing markets. That means the market forces value the regulation and in order to increase the economic utility (which is represented by what people will pay) more regulation should be used not less.

Related: articles on real estate investing – regulatory risk (for rent control that would be the risk that investment property rights were limited due to rent control)

Unfortunately it is not uncommon to find companies that choose to line their pockets at the expense of customers. I wish we could find companies that want to provide good value and make some profit by doing so. My stock broker used to allow clients idle cash to be invested and earn a reasonably decent rate (not Vanguard money market fund but you know for a company that doesn’t want to provide the best customer value a least something remotely approaching fair). This year (or last year) they stopped doing so and switched to the following rate structure:

Dollar Range Interest Rate Annual Percentage Yield

$0.01-$4,999 0.04999% 0.05%

$5,000-$24,999 0.04999% 0.05%

$25,000-$99,999 0.29959% 0.30%

You might think they make an error and mean 5% and just put the decimal in the wrong place but you would be wrong. It used to be leaving your money in money market accounts with the broker wasn’t great but the 50+ basis point hit was worth the convenience. Now HSBC pays 4.25% for online savings. So at 100 times what the broker pays they would be slightly higher than HSBC. Sorry paying 1/85 of what HSBC pays is not just talking a bit of your clients money for yourself. That is obscene. You can no longer trust that your stock broker will only talk 50+ basis points of you money market earnings. Take a look at your account and setup an account with HSBC, Vanguard (current yield 4.64%) or something similar that pays a reasonable rate for any short term savings.

If your broker pays less than 2% on a money market account of $5,000 that is a scary sign. What else they might be doing that isn’t so obviously unfair is difficult to know. Getting above 4% for a cash saving account now is pretty good, in my opinion.

Related: Customer Hostility from Discover Card – Frugality Versus Better Returns – Learning About Personal Loans

$8,000-per-gallon printer ink leads to antitrust lawsuit

The printer makers have been waging an all-out war against third-party vendors that sell replacement cartridges at a fraction of the price. The tactics employed by the printer makers to maintain monopoly control over ink distribution for their printing products have become increasingly aggressive. In the past, we have seen HP, Epson, Lenovo and other companies attempt to use patents and even the Digital Millennium Copyright Act in their efforts to crush third-party ink distributors.

The companies have also turned to using the ink equivalent of DRM, the use of microchips embedded in ink cartridges that work with a corresponding technical mechanism in the printer that blocks the use of unauthorized third-party ink.

Tip – by a printer from a company that doesn’t rip you off as much for ink: The Kodak 5300 All-in-One Printer, which uses ultra low-priced ink to help you save up to 50 percent. Kodak has made the strategic decision to compete with the entrenched printing companies by not ripping off customers as much.

Related: Kodak Debuts Printers With Inexpensive Cartridges – Price Discrimination in the Internet Age – Zero Ink Printing – Open Source 3-D Printing