Hans Rosling uses his fascinating data-bubble software to burst myths about the developing world. Look for new analysis on China and the post-bailout world, mixed with classic data shows.

“The worldview students have corresponds to reality the year their teachers were born”

The software he uses, the very cool Gapminder world, developed by his son and bought by Google is available online.

He also correctly congratulates the USA for providing free data it has collected worldwide, for decades, on world health. And correctly criticizes the World Bank for selling the data they compile using taxpayer funds.

Related: Data Visualization Health Care Example – Economic Measurement Issues Arising from Globalization – Millennium Development Goals – Government Debt Compared to GDP 1990-2007

Peter Schiff does a good job of explaining The Truth Behind China’s Currency Peg

…

In fact, for the U.S., de-pegging would cause the economic equivalent of cardiac arrest. Our economy is currently on life support provided by an endless flow of debt financing from China. These purchases are the means by which China maintains the relative value of its currency against the dollar. As the dollar comes under even more downward pressure, China’s purchases must increase to keep the renminbi from rising. By maintaining the peg, China enables our politicians and citizens to continue spending more than they have and avoiding the hard choices necessary to restore our long-term economic health.

…

As demand falls for both dollars and Treasuries, prices and interest rates in the United States will rise. Rising rates will restrict the flow of credit that is currently financing government and consumer spending. This change will finally force a long overdue decline in borrowing.

…

De-pegging will force the hand of U.S. politicians toward pursuing realistic policies. The Chinese will come to their senses eventually because it is in their interest to do so. Meanwhile, the longer the peg is maintained, the more indebted we become, the more out of balance our economy grows, and the more our industrial base shrivels. In short, the longer they wait, the steeper our fall.

I agree the largest impact of the currency peg on the USA is supporting our economy in the short run. If we didn’t go into huge debt it would actually be good for the USA for the long run too. Essentially China subsidies our purchases and borrowing. The problem is that we have taken a good thing too far and become used to living beyond our means. That is not sustainable – even with a subsidy from China.

I disagree that the USA manufacturing base is hollowed out. It is strong in comparison to the rest of the world, except China. China’s manufacturing growth has been phenomenal, compared to that everyone looks weak. Manufacturing jobs are disappearing everywhere, not just in the USA.

Related: Top 10 Manufacturing Countries in 2008 – China and the Sugar Industry Tax Consumers – Why the Dollar is Falling – Who Will Buy All the USA’s Debt? – Peter Schiff Answers Redditers Questions

Over the last few years Elizabeth Warren has become one of my favorite leaders. She is a leader in economic thought, ethical society and the law (she is a law professor at Harvard Law School). Far too many on Wall Street, Washington and in C-suites are leading us down a very bad path. She is a voice we need to heed.

If you can’t explain it, you can’t sell it

…

The 1966 high school debate champion of Oklahoma may get what she wants. The House of Representatives will vote in December on her idea. She suggested a Financial Product Safety Commission in a 2007 article in the magazine Democracy [Unsafe at Any Rate]. President Barack Obama proposed it to Congress in June as the Consumer Financial Protection Agency.

Warren won’t discuss whether she may be a candidate to lead the authority, which would have the power to regulate $13.7 trillion of debt products. A Warren nomination would tell banks that Obama is determined to force reduced checking-account fees and limit lender claims in mortgage advertising, among other measures the industry opposes, said Thomas Cooley, dean of New York University’s Stern School of Business.

…

In her role overseeing the TARP, Warren has been critical of the administration, accusing the Treasury Department of undervaluing the stock warrants that were supposed to compensate taxpayers when banks repay their bailouts. A lack of transparency about how TARP functions “erodes the very confidence” it was to restore, her committee said in a report.

I hope she can take her attempts to reduce political favors being granted huge financial institutions and those institution be forced to follow sensible rules to protect individuals and our economy. With a few more people like there we will have a much better chance of a positive economic future.

Related: Bogle on the Retirement Crisis – Bankruptcies Among Seniors Soaring – Don’t Let the Credit Card Companies Play You for a Fool – http://investing.curiouscatblog.net/2009/04/08/the-best-way-to-rob-a-bank-is-as-an-executive-at-one/

Is it cynical to think that politicians want to provide payments from the treasury to those that paid the politicians? More cynical to think the politicians that created huge Wall Street Welfare payments won’t actually do anything except talk about how they think it is bad that those they paid billions to are buying new mansions and yachts? More cynical to think they will continue to provide huge amounts of nearly free cash for those that paid them to speculate with? More cynical to think if any of those speculators lose money they will give them more welfare? More cynical to think those bought and paid for politicians won’t actually take any steps to tax or curtail speculation? I think maybe I am cynical about Washington doing anything other than talk about how they don’t want to provide huge amounts of cash to Wall Street all the while giving their Wall Street friends huge amounts of cash that will be paid back by our grandchildren.

Wouldn’t it be nice if the politicians actually took actions to fund a partial payback of the hundreds of billions (or maybe trillions) of bailout dollars by taxing financial speculation? I doubt it will happen. But maybe I am too cynical. Maybe politicians will not just do what they have been paid to do. But it seems the best predictor of what congress will do is based on what they are paid to do, based on their past and current behavior. Now what congress will say is very different. those paying Congressmen might not love it if the congressmen call them names but through a few billion more and they are happy to be called names while given the cash to buy new jets and sports teams and parties for their daughters.

Making Wall Street pay by Dean Baker

The logic of a financial transactions tax is simple. It would impose a modest fee on trades of stocks, futures, credit default swaps and other financial instruments. For example, the UK puts a 0.25% tax on the sale or purchase of shares of stock. This has very little impact on people who buy stock with the intent of holding it for a long period of time.

…

We can raise more than $140bn a year taxing financial transactions, an amount equal to 1% of GDP.

…

Since the financial sector is the source of the country’s current economic and budget problems it also makes sense to have this sector bear the brunt of any new taxes that may be needed. The economic collapse caused by Wall Street’s irrational exuberance has led to a huge increase in the country debt burden. It seems only fair that Wall Street bear the brunt of the clean-up costs. A financial transactions tax is the way to make sure that this happens.

One challenge of understanding the state of the economy is we don’t have clear measures. We attempt to gather accurate data but there is quite a bit of inaccuracy in the data (both from preliminary estimates – before all the data is in, which can take months, or longer – and just plain items we have to estimate no matter how long we have).

Related: Manufacturing Data – Accuracy Questions – Why China’s Economic Data is Questionable – What Do Unemployment Statistics Mean? – Manufacturing Jobs Data: USA and China – The Long-Term USA Federal Budget Outlook – Is China’s Recovery for Real?

Economists Seek to Fix a Defect in Data That Overstates the Nation’s Vigor

The problem is particularly acute in manufacturing. Imported components constitute an ever greater share of the computers, autos, appliances and other finished merchandise that roll off assembly lines in the United States – and an ever greater share of all of the nation’s imports.

…

The stated goal, among those at the conference, is to repair the statistics, but that requires several years, lots of money (from Congress) to gather more information about what companies are doing, and whole new procedures for measuring imports. Much of the conference was devoted to an analysis of the gap between existing data and reality, and ways to close that gap.

The Measurement Issues Arising from the Growth of Globalization conference has thankfully provided open access to papers from the conference including:

Offshoring Bias: The Effect of Import Price Mismeasurement on Manufacturing Productivity Read more

It is a shame that it is no surprise when a bank lies to you. I got a “priority notice” from my mortgage company that my 30 year fixed load could be reduced. They show big huge figures showing current interest rate, new interest rate, potential yearly savings of over $5,000… Complete lies. They are claiming savings with a completely different mortgage, a 5/30 year adjustable rate mortgage (which you have to turn over the paper and note they list “mortgage product: 5/1 ARM” and then know what that means).

Then they go on for a page with all sorts of text seemingly designed to confuse fools. Obviously they try to claim the savings are what is important and the different mortgages, risks of rising interest rates etc. are not important [why don't they just make it a 30 year mortgage at the low rate, if they think the interest rate risk they try to stick the client with is such an unimportant detail that isn't even mentioned on the front page with the "comparison" mortgage rates]).

Anyone that trusts any company that so blatantly tries to fool you is crazy. When they are not shy about using such obviously deceitful tactics you can’t trust them to do much much worse in ways that are very difficult to protect yourself from.

As I have said before, don’t trust your bank. More than any other companies I see, financial institution, treat customers as fools to be fleeced not customers to provide value to. It really is amazing people defend banks paying obscene bonuses to those that are able to fool financial illiterates into stupid decisions. The company trying to deceive in this case, did indeed fail (and was saved by the FDIC). Financial institutions have decided that they will just focus on tricking those that are not financially literate out of as much money as they possibly can. If you don’t educate yourself you are at great risk to be taken advantage of by financial institutions focused on finding people they can take advantage of.

Related: FDIC Study of Bank Overdraft Fees – Ignorance of Many Mortgage Holders – Don’t Let the Credit Card Companies Play You for a Fool – Customer Hostility from Discover Card – Legislation to Address the Worst Credit Card Fee Abuse – Maybe

This hardly constitutes an outright collapse, nor is it necessarily cause for concern. American exporters, whose goods have become more competitive abroad, are happy with their weaker currency. Similarly domestic producers may be cheered that rival, imported goods are more expensive. And European tourists, who can buy more for their euros during weekend shopping excursions to America, may cheer too. However, the continued decline of the dollar does come against a backdrop of ominous murmurs from the likes of China and Russia, who hold much of their reserves in dollars, about the need to shift their reserves out of the greenback. Brazil’s imposition of a 2% levy on portfolio inflows is also a sign that other countries are getting nervous about seeing their currencies rise against the dollar.

…

But it is hard, also, to think of a parallel in history. A country heavily in debt to foreigners, with a government deficit it is making little headway at controlling, is creating vast amounts of additional currency. Yet it is allowed to get away with very low interest rates. Eventually such an arrangement must surely break down, bringing a new currency system into being, just as Bretton Woods emerged in the 1940s.

The absence of a credible alternative to the dollar means that, despite its declining value, its status as the world’s reserve currency is not seriously under threat. But the system could change in other ways. A world where currencies traded within bands, or where foreign creditors insist on America issuing some debt in other currencies, are all real possibilities as the world adjusts to a declining dollar.

The issuance of USA government debt of any significant size in other currencies would be an amazing event, to me. However, that does not mean it won’t happen. In my opinion it is hard to justify the non-collapse of the dollar, and has been for quite some time.

The huge future tax liability imposed over the last few decades along with the failure to save by those in the country creates a hollow economy. Granted the USA had a huge surplus of wealth built up since the end of World War II. The USA has to a great extent sold off that wealth to finance living beyond the productive capacity of the country the last 20-30 years. But that can only go on so long.

The only thing saving the dollar is that other countries do not want the dollar to decline because they don’t want the competition of American goods (either being sold to their country or for the goods they hope to export). So they intervene to stop the fall of the dollar (and buy USA government debt). That can serve to artificially inflate the dollar for some time. However, eventually I think that will collapse. And when it does it will likely be very quick. The idea of the USA issuing debt in other currencies seems crazy now. It could then go from possibility to necessity within months.

You cannot print money forever to live beyond your means and have people accept it as valuable. The government can runs deficits if the citizen’s finance that debt with savings: and still maintain a sound currency. But the recent period, given the macro-economic conditions, don’t justify the value of the dollar. It should have fallen much further a long time ago. The other saving grace for the dollar is few large economies have untarnished economies. The Euro has strengths but is hardly perfect. The Chinese Renminbi is possibly the strongest contender but the economy is still very controlled, financial data is untrustworthy, political freedom is not sufficient… The Japanese Yen does have some strengths but really their long term macro-economic conditions is far from sound.

Related: The USA Economy Needs to Reduce Personal and Government Debt – Let the Good Times Roll (using Credit) – Federal Reserve to Buy $1.2T in Bonds, Mortgage-Backed Securities – Who Will Buy All the USA’s Debt?

Minnesota’s attorney general suing 3 debt-relief companies

The company failed to deliver on its promises, she said, forcing Anderson-Howze, of St. Paul, to become one of hundreds of Minnesota consumers to seek help from Minnesota Attorney General Lori Swanson.

Swanson sued Moneyworks LLC and two other debt assistance companies on Tuesday, alleging that the companies made unsolicited phone calls promising lowered interest rates, guaranteed savings and money-back guarantees. Swanson alleges that Washington-based Priority Direct Marketing, Clear Financial Solutions of Florida and Moneyworks LLC, based in Georgia, “charged financially strapped people a lot of money to lower the interest rates on their credit cards, only they failed to do so, leaving people even further behind on their bills.”

…

Swanson also sent a letter to the Federal Trade Commission asking it to adopt federal regulations to prohibit companies from charging consumers until services are delivered satisfactorily.

Many organizations overing to help with debt relief are fraudulent. They are constantly being shut down for illegal activity. You must be very careful when you consider dealing with any of these organizations. Do not pay out money up front. Make sure the organization has a strong reputation and history of ethical behavior. Be financially literate: don’t get taken advantage of.

Related: Manage Your Borrowing and Avoid Debt Negotiators – USA Consumers Paying Down Debt – Continued Credit Card Company Customer Dis-Service

There are several issues with economic data, as I have mentioned before. These issues have to be considered when analyzing economic data and being financially literate requires an understanding of the problems with economic data. The political pressures for manipulating the data to appear good exist is every country. The practical difference is the other forces that push for data that is more accurate (businesses, investors, economists… need accurate data to succeed) and practices that have been adopted to provide accurate data.

Foreign Policy magazine takes a look at problems in How China Cooks Its Books

But local and provincial governmental officials are the ones who actually fiddle with the numbers. They retain considerable autonomy and power, and have a self-interested reason to manipulate economic statistics. When they reach or exceed the central government’s economic goals, they get rewarded with better jobs or more money. “The higher [their] GDP [figures], the higher the chance will be for local officials to get promoted,” explained Liu.

…

Last October, Vice Premier Li Keqiang said in a speech after inspecting China’s Statistics Bureau, “China’s foundation for statistics is still very weak, and the quality of statistics is to be further improved” — a brutally harsh assessment coming from a top state official.

…

China’s economy grew at an annualized 6.1 percent rate in the first quarter, and 7.9 percent in the second. Yet electricity usage, a key indicator in industrial growth and a harder metric to manipulate, declined 2.2 percent in the first six months of the year. How could an economy largely dependent on manufacturing grow while its industrial sector shrank? It couldn’t; the numbers don’t add up

My guess is China’s data is highly questionable and still China’s economy is fairly strong. But because the data is so questionable it does make the risks of being wrong on that guess fairly high. Even the US government data is flawed: it is no surprise China’s data is less reliable.

Related: Is China’s Recovery for Real? – Misuse of Statistics – Mania in Financial Markets – Manufacturing Employment Data – 1979 to 2007 – The Long-Term USA Federal Budget Outlook –

Data Shows Subprime Mortgages Were Failing Years Before the Crisis Hit

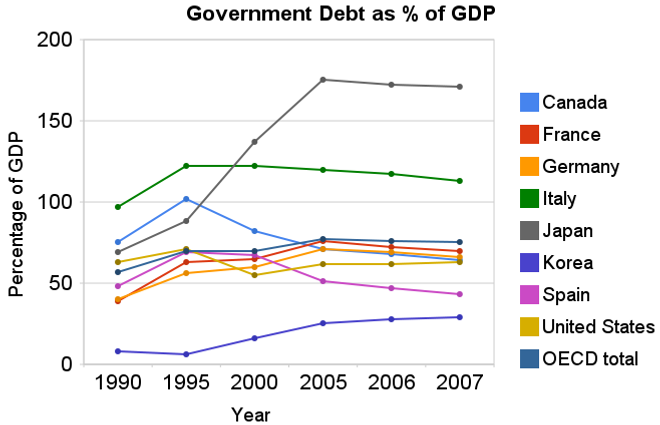

Chart showing government debt as a percentage of GDP by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from OECD, Sept 2009.

Chart showing government debt as a percentage of GDP by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from OECD, Sept 2009.For 2007 most countries slightly decreased their government debt to GDP ratio – as economic growth exceeded debt growth. The OECD is made up of countries in Europe and the USA, Japan, Korea, Australia, New Zealand and Canada. The overall OECD debt to GDP ratio decreased from 77% in 2005 to 75% in 2007. The USA moved in the opposite direction increasing from 62% to 63%: still remaining far below the OECD total. Most likely 2008, 2009 and 2010 will see both the USA and other OECD national dramatically increase the debt burden.

Compared to the OECD countries the USA is actually better than average. The chart shows the percentage of GDP that government debt represents for various countries. The USA ended 2007 at 63% while the overall OECD total is 75%. In 1990 the USA was at 63% and the OECD was at 57%. Japan is the line way at the top with a 2007 total of 171% (that is a big problem for them). Korea is in the best shape at just a 29% total in 2007 but that is an increase from just 8% in 1990.

Related: Government Debt as a Percentage of GDP Through 2006 – Oil Consumption by Country in 2007 – Federal Deficit To Double This Year – Politicians Again Raising Taxes On Your Children – True Level of USA Federal Deficit – Top 12 Manufacturing Countries in 2007

Read more