The Society for Actuaries has published a good resource: Managing post-retirement risks.

…

Many investors try to own some assets whose value may grow in times of inflation. However, this sometimes will trade inflation risk for investment risk.

• Common stocks have outperformed inflation in the long run, but are

poor short-term hedges. The historically higher returns from stocks

are not guaranteed and may vary greatly during retirement years.

…

Retirement planning should not rely heavily on income from a bridge job. Many retirees welcome the chance to change careers and move into an area with less pay but more job satisfaction, or with fewer demands on their time and energy.

Terminating employment before age 65 may make it difficult to find a source of affordable health insurance before Medicare is available.

…

Insurance for long-term care covers disabilities so severe that assistance is needed with daily activities such as bathing, dressing and eating. Some policies require a nursing home stay; others do not. The cost of long-term care insurance is much less if purchased at younger ages, well before anticipated need.

The full document is well worth reading.

Related: Many Retirees Face Prospect of Outliving Savings – How to Protect Your Financial Health – Financial Planning Made Easy – personal finance tips

Nonfarm payroll employment continued to decline in June (by 467,000), and the unemployment rate increased to changed at 9.5% (with a total of 14.7 million unemployed), the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Job losses were widespread across the major industry sectors, with large declines occurring in manufacturing, professional and business services, and construction.

Since the start of the recession in December 2007, the number of unemployed persons has increased by 7.2 million, and the unemployment rate has risen by 460 basis points (from 4.9% to 9.5%). The number of long-term unemployed (those jobless for 27 weeks or more) increased by 433,000 over the month to 4.4 million. In June, 30% of unemployed persons were jobless for 27 weeks or more.

Employment in manufacturing fell by 136,000 over the month and has declined by 1.9 million during the recession. Health care employment increased by 21,000 in June. Job gains in health care have averaged 21,000 per month thus far in 2009, down from an average of 30,000 per month during 2008.

The number of persons working part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed in June at 9.0 million. Since the start of the recession, the

number of such workers has increased by 4.4 million.

About 2.2 million persons (not seasonally adjusted) were marginally attached to the labor force in June, 618,000 more than a year earlier. These individuals wanted and were available for work and had looked for a job sometime in the past 12 months. They were not counted as unemployed because they had not searched for work in the 4 weeks preceding the survey.

Related: posts on employment – Unemployment Rate Increased to 8.9% – Can unemployment claims predict the end of the American recession? – The Economy is in Serious Trouble – Over 500,000 Jobs Disappeared in November 2008

One factor you must understand when evaluating economic data is that the data is far from straight forward. Even theoretically it is often confusing what something like “savings rate” should represent. And even if that were completely clear the ability to get data that accurately measures what is desired is often difficult if not impossible. Therefore most often there is plenty of question about economic conditions even when examining the best available data. Learning about these realities is important if you wish to be financially literate.

Bigger U.S. Savings Than Official Stats Suggest

A closer look, however, shows that Americans have tightened their belts more sharply than the numbers report. The reason? Official figures for personal spending include a lot of categories, such as Medicare outlays, that are not under the control of households. They also include items, such as education spending, that should be treated as investment in the future rather than current consumption.

After removing these spending categories from the data, let’s call what’s left “pocketbook” spending – the money that consumers actually lay out at retailers and other businesses. By this measure, Americans have cut consumption by $200 billion, or 3.1%, over the past year. This explains why the downturn has hit Main Street hard.

…

Finally, for technical reasons the BEA throws in some “spending” categories where no money actually changes hands. The biggest is “rent on owner-occupied housing,” the money that people supposedly pay themselves for living in their own homes. Despite the housing bust, this number rose by 2.6% over the past year, to $1.1 trillion.

…

A closer look at BEA numbers shows that Americans reduced spending by 3.1% in the past year, indicating that the savings rate has risen to 6.4%

He raises good issues to consider though I am not sure I agree 100% with his reasoning.

Related: The USA Should Reduce Personal and Government Debt – Financial Markets with Robert Shiller – Save Some of Each Raise – Over 500,000 Jobs Disappeared in November (2008)

Debt Negotiators May Give Little Relief to Consumers

Credit-card delinquencies are at record highs, according to Fitch Ratings, and the U.S. unemployment rate of 8.9 percent is the highest since 1983. As more consumers fall behind on bills, settlement companies often end up adding to the debt burden rather than offering a cost-saving solution, said Gail Cunningham, a spokeswoman for the National Foundation for Credit Counseling in Silver Spring, Maryland.

…

New York Attorney General Andrew Cuomo has begun a national investigation of settlement companies, and has sued two for fraud and false advertising. Illinois Attorney General Lisa Madigan has also filed two lawsuits against debt-settlement companies, alleging they “engage in deceptive marketing practices” and “do little or nothing to improve consumers’ financial standings.” Texas Attorney General Greg Abbott sued a debt settlement company in March, saying it engaged in “deceptive and misleading acts,” according to court documents.

It is much better to avoid this problem by taking wise personal finance actions – don’t take on personal debt for minor purchases (for a mortgage then debt is fine, probably fine for a car – though avoid debt if you can). The “secret” is not very secret. Just don’t buy what you can’t pay for. It is very simple, many people just don’t want to follow that simple strategy. Also save money in an emergency fund, so when some emergency comes along you don’t go into debt. You just use your emergency fund.

Once you are stuck in a bad situation with more debt than you can afford to pay back you have bad choices. Obviously many try to take advantage of you. Frankly they realize many that are stuck in bad financial position make bad financial decisions. Therefor it is a good place for those trying to rip people off to find people to take advantage of. The best way to deal with this is not to try and find the best debt negotiators it is to manage you finances well and not get in trouble.

Related: Personal Saving and Personal Debt in the USA – How to Use a Credit Card Successfully – Credit Card Companies Willing to Deal Over Debt – Where to Keep Your Emergency Funds? – Americans are Drowning in Debt

Why Rising Productivity Is Cause for Worry

…

But there may be another, less benign, reason for rising productivity. In past downturns, educated professionals have escaped mainly unscathed. This time businesses are relentlessly hacking at their professional workforce—a tactic that boosts short-term productivity while hurting long-term growth. Rising productivity may be a sign of weakness, not strength.

Over the past year the number of employed professionals has fallen by 0.7%, a rare decline. Outside of the still-growing education and health-care occupations, the number of employed professionals has dropped by a dramatic 3.6%.

Cutting productive staff for short term rewards is definitely a negative for long term productivity. My guess is the management ranks are not as productive as the non-management ranks are however. My sense is their is more room to eliminate non-value added activity from management positions which will not harm long term productivity growth.

A good way to improve productivity is to reduce excessive pay for senior executives. As the money wasted on exorbitant pay that senior executives lavish on themselves is reduced the capital wasted on them can be better deployed in ways that will improve productivity.

Related: The Real Threat Is Decreased Productivity – Manufacturing Productivity – Manufacturing Contracting Globally

Read more

John Bogle was the founder of Vanguard Group and a well respected investment mind. He has written several good books including: The Little Book of Common Sense Investing, Common Sense on Mutual Funds and Bogle on Mutual Funds. This interview from 2006 discusses the state of the retirement system, before the credit crisis.

Frontline: How do they get away with that? Don’t they have to fund them?

John Bogle: No, they don’t, because a lot of it is based on assumptions. Our corporations are now assuming that future returns in their pension plan will be about 8.5 percent per year, and that’s not going to happen. The future returns in the bond market will be about 4.5 percent, and maybe if we’re lucky 7.5 percent on stocks. Call it a 6 percent return — before you deduct the cost of investing all that money, the turnover cost, the management fees. So maybe a 5 percent return is going to be possible, in my judgment, and they are estimating 8.5 percent.

Why? Because when they do it that way, corporation earnings become greatly overstated, and all the executives get nice, big bonuses. They are using pension plan assumptions as a way to manage corporate earnings and meet the expectations of Wall Street.

Frontline: So if a company overstates the value of its pension plan assets, it makes the company look better to Wall Street, so there’s an incentive to kind of exaggerate, if not cheat.

John Bogle: That is precisely correct. And let me clear on the cheating: It’s legal cheating; it’s not illegal cheating. In other words, you can change any reasonable set of numbers — and corporations have done this, have raised the pension assumption from 7 percent to 8.5 percent — and all of a sudden that corporation will report an earnings gain for the year rather than an earnings loss that they would otherwise have. Simple, legal.

The entire PBS series (from 2006) on 401(k)s (including interviews with Elizabeth Warren, David Wray and Alicia Munnell) is worth reading.

In February of 2009 he spoke to the House of Representatives committee exploring retirement security.

Read more

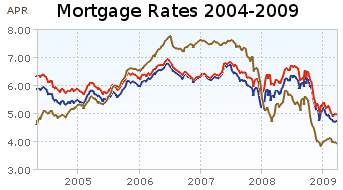

Showing mortgage rates over the last 6 months. Red: 30 year fixed rate. Blue: 15 year fixed rate. Tan: 1 year adjustable rate.

Showing mortgage rates over the last 6 months. Red: 30 year fixed rate. Blue: 15 year fixed rate. Tan: 1 year adjustable rate.

Showing mortgage rates over the last 5 years. Red: 30 year fixed rate. Blue: 15 year fixed rate. Tan: 1 year adjustable rate. From Yahoo Finance, for conventional loans in Virginia.

Showing mortgage rates over the last 5 years. Red: 30 year fixed rate. Blue: 15 year fixed rate. Tan: 1 year adjustable rate. From Yahoo Finance, for conventional loans in Virginia.

The 6 month chart shows that mortgage rates have been declining ever so slightly. Rates on a 1 year adjustable mortgage fell from 5.5 to 4% and have stayed near 4% for all of 2009. 30 and 15 year rates (15 year rates staying about 25 basis points cheaper) have declined from 6.5%, 6 months ago to about 5% at the start of the year and have moved around slightly since. This is while the yield 10 year government treasuries have been rising (normally 30 year fixed rate mortgages track moves in the 10 year government bond). The federal reserve has been buying bonds in order to push down the yield (and stimulate mortgage financing and other borrowing).

Mortgage rates certainly could fall further but the current rates are extremely attractive and I just locked in a mortgage refinance for myself. I am getting a 20 year fixed rate mortgage; I didn’t want to extend the mortgage period by getting another 30 year fixed rate mortgage. For me, the risk of increasing rates outweigh the benefits of picking up a bit lower rate given the current economic conditions. But I can certainly understand the decision to hold out a bit longer in the hopes of getting a better rate. If I had to guess I would say rates will be lower during the next 3 months, but I am not confident enough to hold off, and so I decided to move now.

Related: Mortgage Rates Falling on Fed Housing Focus – posts on mortgages – 30 Year Fixed Mortgage Rates and the Fed Funds Rate – Continued Large Spreads Between Corporate and Government Bond Yields – Lowest 30 Year Fixed Mortgage Rates in 37 Years –

Nonfarm payroll employment continued to decline in April, and the unemployment rate rose from 8.5 to 8.9 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Since the recession began in December 2007, 5.7 million jobs have been lost. In April, job losses were large and widespread across nearly all major private-sector industries. Overall, private-sector employment fell by 611,000.

The number of unemployed persons increased by 563,000 to 13.7 million. Unemployment rates for April for adult men reached 9.4% and for adult women 7.1%. The number of long-term unemployed (those jobless for 27 weeks or more) increased by 498,000 to 3.7 million over the month and has risen by 2.4 million since the start of the recession in December 2007.

The civilian labor force participation rate rose in April to 65.8 percent, and the employment-population ratio was unchanged at 59.9 percent. The employment-population ratios for adult men and women showed little or no change over the month. However, since December 2007, the men’s ratio was down by 440 basis points, while the women’s ratio was down by 130 basis points. Since those that stop looking for work (retire or just stop actively looking) are not counted as unemployed the participation rate is a useful statistic to examine in conjunction with the unemployment rate.

Much of the commentary on the April job losses have been that the decrease in the number of job losses from previous months shows the economy is stabilizing. While it is true losing 611,000 jobs is better than losing 700,000 jobs, losing 611,000 is still very bad. The unemployment rate increased to 8.9% and long term unemployment is increasing drastically. This is hardly good economic news. It is true that there is hope that the economy is turning around, but the employment data we have so far is hardly positive (employment data is a lagging economic indicator so it is not surprising employment data does not recover before other signs point to improvement).

Related: Another 663,000 Jobs Lost in March in the USA – USA Unemployment Rate Rises to 8.1%, Highest Level Since 1983 – Over 500,000 Jobs Disappeared in November – What Do Unemployment Stats Mean?

Your Life Insurance Policy May Not Be Protected by Ben Levisohn, Business Week

…

Insurance customers need to be more vigilant. Stop focusing only on cost and service and start worrying about solvency. Check such agencies as Standard & Poor’s (MHP), Fitch Ratings, Moody’s, and A.M. Best to find the highest-rated companies, and be alert for downgrades. Then dig deeper. Find out about an insurer’s exposure to real estate and mortgages and make sure its debt holdings are investment-grade. “Everyone’s under the false assumption that it doesn’t matter what company you buy from,” says Thomas Archer, chairman of financial-services firm Archer Financial Group in New York. “It does.”

• $300,000 in life insurance death benefits

• $100,000 in cash surrender or withdrawal value for life insurance

• $100,000 in withdrawal and cash values for annuities

• $100,000 in health insurance policy benefits

• $300,000 in homeowners benefits

• $300,000 in auto insurance benefits

One option is to diversify your insurance coverage, just like you diversifying investments. Historically insurance company failures have been rare, and even it is even rarer that state funds don’t cover the insurance. But if you have large amounts of insurance you can be a bit safer by having your life insurance needs covered by multiple insurers.

Related: Personal Finance Basics: Long-term Care Insurance – Insurers Raise Fees on Variable Annuities – Personal Finance Basics: Health Insurance – How to Protect Your Financial Health

Read more

It seems to me the situation that lead to the current economic problems are due to the overthrown of the Glass-Steagal and other long time sensible regulation put in place to restrict economy wide destruction caused by a few large financial firms (well, that plus incredibly poor management by people that paid themselves many times more than anyone else and other factors – huge consumer debt…). But the most significant systemic problem was failure to regulate even close to sensibly. I have several posts on this topic on previously: Congress Eases Bank Laws, 1999 – Treasury Now (1987) Favors Creation of Huge Banks – Canadian Banks Avoid Failures Common Elsewhere and Greenspan Says He Was Wrong On Regulation.

Capitalism requires sensible regulation. Regulation is not a friction on capitalism it is a necessary component. Poor regulation is a friction that is waste that should be excised. Unfortunately that is a very challenging task and when you allow those with the most gold to set the rules it is no surprise you have them saying they should not be regulated but should be protected. The failure of financial regulations do show the very obvious problem we have currently of those that donate huge amounts to politicians are granted favors that are paid for by the economy overall.

The widespread failure to regulate financial markets recently is almost certain to lead to this exact type of situation every time. Companies will over-leverage, take huge risks, take huge pay while times are good and just go bankrupt when times are bad. Think about how a bank makes money. They charge fees for things like: writing a loan, overdraft charges on your account, arranging financing (loan or stock sale)… They charge more for in interest than they pay. Some money there but really they are doing nothing special so they should not be able to charge too much. Even the ridicules fees companies pay (often those in the companies have arrangements to get personal special deals – allocations of IPO’s, jobs later…) for arranging stock sales do not have a systemic risk. Those risks should be very easy to manage sensible.

They speculate in currency markets, commodities markets, futures, derivatives… If you want a stable economy if you allow huge speculative investments to be assumed to such an extent they risk the economy you are in trouble. If you refused those risks to limited liability companies perhaps your limited regulation model might work. Where those profiting on products with negative economic externalities would personally go bankrupt prior to the losses becoming economically crippling. But I doubt even that would work. And we don’t have that now. We allow people to setup limited liability corporations, drain them of capital on speculation of potential value and then walk about with hundreds of millions of dollars if the company fails. And the negative externalities (due to huge leverage) are huge.

Regulation seems the obvious solution. And it works when applied. It wasn’t until the USA decided to abandon the financial system regulation and enforcement that the problems became systemic. And see the current Canadian banking system for what happens, even while the world economy is collapsing if you required banks to remain banks instead of massively leveraged speculators paying huge bonus to the executives based on their claims of profitability.

I agree trying to control risk is dangerous. There are however, very sensible measures to take. Do not allow huge financial companies to exist (we have laws on anti-trust, anti-competitive behavior…). Do not allow banks to speculate (more than a careful controlled regulated amount). Do not allow massive leverage of massive amounts of money. Do require audited financial records. Do require companies that want to speculate to be much smaller than regulated bank, and bank-like companies. Do elect politicians that will appose allowing companies to undertake systemic risks to the economy for short term financial gains.

We continue to elect politicians that provide large favors to those giving them money at the expense and risk to the rest of us. Therefore we are bringing this upon ourselves. When we chose to stop supporting politicians that behave in that way then we will get different behavior. Until that point it will continue. We don’t seems to be in any mood to change what we have been doing.

Comments on Note to Regulators: Beware the Montana Paradox

Related: More on Failed Banking Executives – more posts on regulation in capitalist economies – Credit Crisis the Result of Planned Looting of the World Economy – Bad Behavior