Manufacturing is an powerful driver of economic wealth. For years I have been providing data to counter the contention that the manufacturing base of the USA is gone and the little bit left was shrinking. The latest data again shows the USA is the largest manufacturer, and manufacturing in the USA continues to grow. It is true global manufacturing has begun to grow more rapidly than USA manufacturing in the last few years. I doubt many suspect that the USA’s share of manufacturing stayed stable from 1990 to 1995 then grew to 2000 took until 2006 to return to the 1990-1995 levels and then has declined in 2007 and 2008 a bit below the 1990 level and during that entire time was growing (even in 2007 and 2008).

The USA’s share of the manufacturing output, of the countries that manufactured over $185 billion in 2008, 28% in 1990, 28% in 1995, 32% in 2000, 28% in 2005, 28% in 2006, 26% in 2007 and 24% in 2008. China’s share has grown from 4% in 1990, 6% in 1995, 10% in 2000, 13% in 2005, 14% in 2006, 16% in 2007 to 18% in 2008. Japan’s share has fallen from 22% in 1990 to 14% in 2008 (after increasing to 26% in 1995 then steadily falling). The USA has about 4.5% of the world population, China about 20%.

Based on the latest UN Data, for global manufacturing, in billions of current US dollars:

| Country | 1990 | 1995 | 2000 | 2005 | 2006 | 2007 | 2008 |

|---|---|---|---|---|---|---|---|

| USA | 1,041 | 1,289 | 1,543 | 1,624 | 1,712 | 1,756 | 1,831 |

| China | 145 | 300 | 484 | 734* | 891* | 1,106* | 1,399** |

| Japan | 810 | 1,219 | 1,034 | 979 | 927 | 923 | 1,045 |

| Germany | 438 | 517 | 392 | 571 | 608 | 711 | 767 |

| Italy | 240 | 226 | 206 | 295 | 302 | 345 | 381 |

| United Kingdom | 206 | 218 | 226 | 264 | 295 | 323 | 323 |

| France | 200 | 233 | 190 | 255 | 255 | 287 | 306 |

| Russian Federation | 120 | 64 | 45 | 124 | 157 | 206 | 256 |

| Brazil | 120 | 125 | 96 | 137 | 163 | 201 | 237 |

| Korea | 66 | 131 | 136 | 211 | 234 | 260 | 231 |

| Spain | 112 | 104 | 98 | 160 | 170 | 196 | 222 |

| Mexico | 62 | 67 | 133 | 154 | 175 | 182 | 197 |

| Canada | 92 | 100 | 129 | 168 | 182 | 197 | 195 |

| India | 51 | 61 | 69 | 122 | 141 | 177 | 188 |

* I am using the data from last year that separated the manufacturing data (this year the data does not provide separate manufacturing data for China) instead of that shown in the most recent data (which doesn’t separate manufacturing)

** The China data is not provided for manufacturing alone. The percentage of manufacturing (to manufacturing, mining and utilities) was 78% for 2005-2007 (I used 78% of the manufacturing, mining and utilities figure provided in the 2008 data).

I hope to write a series of posts examining global manufacturing data including looking at manufacturing data specifically (excluding mining and utility data).

Read more

Nouriel Roubini is still worried about the US economy, though he does believe we are coming to the end of the severe recession we have been in.

I believe, that if you were worried about your portfolio being overweighted in stocks late last year, now is a good time to move some money out of the stock market. In December 2008, when many were selling in panic, I invested more in stocks.

The stock market has been on a tear increasing

1 December 2008 the S&P 500 was at 816

1 January 2009 – 903

6 March 2009 – 684 (the lowest point since 1996)

1 May 2009 – 878

1 August 2009 – 987

5 October 2009 – 1040

In 6 months, since the market hit a low on March 6th, it is up 52%. Certainly the decrease in prices seemed overdone. The 50% increase in prices seems overdone also. But trying to predict short term moves in the stock market (say under 1 year) is very difficult and few people can do so successfully (even if you can find lots of people offering their guesses). Predicting the economy, while not easy, is much much easier that predicting the stock market.

Read more

Home prices in the United States rose 0.3% on a seasonally-adjusted basis from June to July, according to the Federal Housing Finance Agency’s monthly House Price Index. The previously reported 0.5% increase in June was revised downward to a 0.1% increase. For the 12 months ending in July, U.S. prices fell 4.2%. The U.S. index is 10.5% below its April 2007 peak.

The FHFA monthly index is calculated using purchase prices of houses backing mortgages that have been sold to or guaranteed by Fannie Mae or Freddie Mac. Read the full press release. The Case-Shiller Home Price Indices also have increased (10 and 20 city indices) for June and July.

I am still not convinced we have seen the bottom of the housing price declines nationwide. The economy is still in very fragile territory. But the data does show the declining prices have been stopped in many locations, at least for a while. If job losses continue housing prices may well resume the decline. The commercial real estate market seems to be even weaker than housing.

Related: The Value of Home Ownership – Housing Prices Post Record Declines (April 2008) – posts on economic data – real estate articles

…

BECKY: All right. Let me go at this another way. Let’s pretend you’re on a desert island for a month. There’s only one set of numbers you can get. What would it be?

BUFFETT: Well, I would probably look at– perhaps freight car loadings and– perhaps– and– and truck tonnage moved and– but I’d want to look at a lot of figures.

…

BUFFETT: Well, I think that– unfortunately, I think that the — what– what– we’re really talking about reforming health insurance more than health care. So I– the incentives that produce the 16 or so percent of GDP that’s going to health care, I think unfortunately they’re getting– they’re going to get changed. But– so I think that we really– and I’m talking as much about reforming health care as we’re talking about reforming the insurance. And I think that will be an opportunity missed if we don’t do more about looking at what– what the incentives are in the present system and what they would be in an ideal system.

Related: Buffett’s Fix for the Economy (Oct 2008) – Warren Buffett Webcast on the Credit Crisis – Warren Buffett on Taxes – Many Experts Say Health-Care System Inefficient, Wasteful

I like to buy stocks cheap and then hold them as they rise in price. This is not a unique desire, I know. One thing this lead me to do was find a stock I liked but hold off buying it until I could buy it for less. When that works it is great. However, one thing that happened several times is that I found stocks I really liked and they just went up and went up more and kept going up. And I never owned them.

I learned, after awhile, that is was ok to buy a stock at a higher price once I realized I made a mistake. Instead of just missing out because I made a mistake and didn’t buy it at a lower price than I needed to pay today (which made it feel really lame to buy it now at a higher price) I learned to accept that buying at the higher price available today was the best option.

I have seen two types of situations where this takes place: one I realize I was just way off, it was a great deal at the price I could have bought at – I just made a mistake. And if it was still a good buy, I should buy it. Another is that the stock price goes up but new news more than makes up for the increased stock price (the news makes the value of stock increase more than the price has increased).

I missed out on the Google IPO, even though I really wanted to buy. Then the price went way up and even though I had learned this (don’t avoid buying a stock today just because you made the mistake of not buying it at a lower price earlier) tip I wanted to buy it for less than the current price and so kept not buying it (emotion is a real factor in investing and that is another thing I have realized – you need to accept it and deal with it to be a good investor). Then Google announced spectacular earnings and it was finally enough to get me to buy the stock a few days later at $219 (which was well over twice the price 6 months earlier). But it was a great buy at $219 and losing that just because I should have bought it at $119 is not wise – but something I did many times in the past.

In March of 2009 I bought some ATPG at $3.20. In August I bought more at $11. The news was bit better but really it was just a huge huge bargain at $3.20 and I should have bought a lot more. In the last 5 trading days ATPG was up $5.12 (16.78 – 11.66). A nice gain. Right now, it is up another 68 cents today at $17.43. Now this is a volatile stock and until I sell it may not turn out to be profitable investment, but the odds are good that it will.

It is also hard to know when to sell – in fact for many selling at the wrong time (either selling too late – after it collapses [for good or sell it after a collapse only to see it recover], or too early missing out on huge gains) is the biggest problem they have in becoming a successful investor). One trait of many successful investors is holding the right investments for huge gains. A few stellar performances can lift the entire portfolio to long term investing success. And if you sell those stocks early you miss huge opportunities.

Holding on for the huge gains is a mistake I do not want to make – and so when the opportunity is there for such gains I am willing to risk losing some gains for the potential of a much larger gain. Right now the balance is keeping me from selling any ATPG, though I am likely to sell some if it increases (while continuing to hold some of the position).

Related: Great Google Earnings April 2007 – Nicolas Darvas (investor and speculator) – Not Every Day is Profitable – Does a Declining Stock Market Worry You? – 401(k)s are a Great Way to Save for Retirement – Beating the Market, Suckers Game? – Sleep Well Fund

Mark Mobius is an investment manager with Franklin-Templeton that I have invested with for over a decade (through the Templeton Emerging Markets Trust and Templeton Dragon Fund – they are closed end funds). I believe in Templeton’s emerging market investment team and Mark Mobius and believe his thoughts are worth paying attention to. He recently wrote an overview on Emerging Markets:

…

In Mexico, GDP contracted 10% y-o-y in the second quarter of 2009 as a result of the global economic crisis and swine flu outbreak. In comparison, GDP fell 8% in the first quarter of the year. Declines in the manufacturing, construction and retail sectors had negatively impacted GDP during the period.

…

Since 1995, portfolio inflows into emerging markets have totaled more than US$123 billion. A significant amount, considering it includes the US$49 billion in net outflows in 2008 as a result of the global financial crisis. The recovery in emerging markets and hunt for attractive investment opportunities, however, saw these funds return just as quickly with inflows totaling more than US$44 billion in the first seven months of 2009, nearly 90% of the outflows registered all of last year.

…

Emerging markets account for more than 80% of the world’s population. With economic growth accelerating and population growth decelerating, per capita income is one the rise. In our view, markets such as China, India and Brazil stand at the front of the class.

…

As of end-August 2009, the benchmark MSCI Emerging Markets index had a P/E of 16 times, cheaper than the MSCI World index which was trading at a P/E of 21 times.

Tesco is one of the holdings in my 12 stocks for 10 years portfolio (currently returning 450 basis point above S&P 500 annually). I agree with this well documented post – Tesco: Consistent Earnings Growth at Attractive Price

…

Tesco has leading market share positions in Hungary (#1), Thailand (#1), Ireland (#2), S. Korea (#2), Malaysia (#2), Slovakia (#3), Poland (#4) and Czech Republic (#4).

The company entered China several years ago and plans to open more hypermarkets and shopping centers over the next decade. The Chinese retail market remains very fragmented and the top three players each control less than 1% market share.

…

Tesco generated £5 billion in operating cash flow last year, benefiting from improvement in working capital efficiency and good inventory management. Its capital expenditures were £4.7 billion last year (£2.6 billion in UK and £2.1 billion in international). The company expects its capital expenditures to decline to £3.5 billion this year through spending less on mixed use development land and purchasing fewer existing stores from UK competitors.

…

Tesco ended the year with £9.6 billion in net debt, up £3.4 billion from the prior year… Nevertheless, its interest coverage ratio was 8.9x last year and does not appear too aggressive.

A big part of my reason for buying Tesco is their management teams commitment to lean thinking (Toyota Production System) management methods. I still worry they will not continue to adopt these methods more thoroughly but I believe superior management methods are one reason their performance has been good in the past and should improve even more if they continue to apply those methods more.

Related: Jubak Looks at 5 Technology Stocks – 10 Stocks for Income Investors – Small Business Profit and Cash Flow – GM and Citigroup Replaced by Cisco and Travelers in the Dow

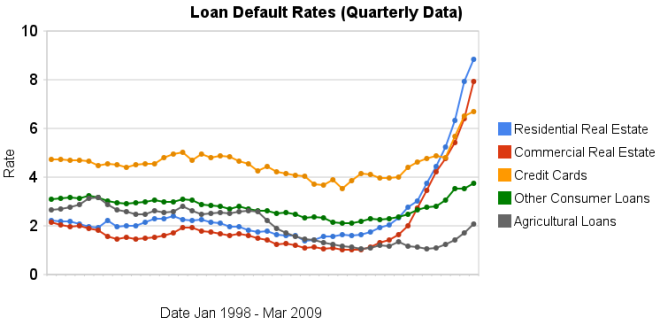

Chart showing loan delinquency rates for real estate, consumer and agricultural loans for 1998 to 2009 by the Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.

Chart showing loan delinquency rates for real estate, consumer and agricultural loans for 1998 to 2009 by the Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.Delinquency rates on commercial (up another 151 basis points) and residential (93 basis points) real estate continued to increase dramatically in the second quarter. Credit card delinquency rates increased but only by 20 basis points.

Real estate delinquency rates exploded in 2008. In the 4th quarter of 2007 residential delinquency rates were 3.02% by the 4th quarter of 2008 they were 6.34% and in the 2nd quarter of this year they were 8.84% (582 basis points above the 4th quarter of 2007). Commercial real estate delinquency rates were at 2.74% in the 4th quarter of 2007, 5.43% in the fourth quarter of 2008 and 7.91% in the 2nd quarter of 2009 (a 517 basis point increase).

Credit card delinquency rates were much higher than real estate default rates for the last 10 years (the 4-5% range while real estate hovered above or below 2%). Now they are over 200 and 300 basis points bellow residential and commercial delinquency rates respectively. From 4.8% in the 3rd quarter 2008 to 5.66% in the 4th and 6.5% in the 1st quarter of 2009.

The delinquency rate on other consumer loans and agricultural loan delinquency rates are up but nowhere near the amounts of real estate or credit cards.

As I wrote recently bond yields in the last few months show a dramatic increase in investor confidence for corporate bonds.

Related: Loan Delinquency Rates: 1998-2009 – The Impact of Credit Scores and Jumbo Size on Mortgage Rates – 30 Year Mortgage Rate and Federal Funds Rate Chart

China’s recovery: Is it for real?

…

Investors don’t need to answer or even be interested in those philosophical questions. But they do need to consider the possibility that China’s huge acceleration in its growth rate is merely an artifact of the way the country keeps its books.

Economic data is often messy and confusing. The data itself often has measurement error. The actual aim is often not exactly what people think. And the data is often delayed so it provides a view of the situation, not today, but in the past and guesses must be made about what that says about today and the future.

And on top of those factors many countries feel significant internal pressures to report numbers that make the current economy look good. This is just another factor investor must consider when looking to make investments and evaluate economic conditions.

It seems to me the Chinese recovery does look real. How strong the economy will be 6 months from now is less clear but right now things look positive to me.

Related: posts on economic data – What Do Unemployment Stats Mean? – China Manufacturing Expands for the Fourth Straight Month (Jun 2009) – A Bull on China

The Greenback Effect by Warren Buffett

…

Because of this gigantic deficit, our country’s “net debt” (that is, the amount held publicly) is mushrooming. During this fiscal year, it will increase more than one percentage point per month, climbing to about 56 percent of G.D.P. from 41 percent. Admittedly, other countries, like Japan and Italy, have far higher ratios and no one can know the precise level of net debt to G.D.P.

…

Legislators will correctly perceive that either raising taxes or cutting expenditures will threaten their re-election. To avoid this fate, they can opt for high rates of inflation, which never require a recorded vote and cannot be attributed to a specific action that any elected official takes.

…

Our immediate problem is to get our country back on its feet and flourishing — “whatever it takes” still makes sense. Once recovery is gained, however, Congress must end the rise in the debt-to-G.D.P. ratio and keep our growth in obligations in line with our growth in resources.

Unchecked carbon emissions will likely cause icebergs to melt. Unchecked greenback emissions will certainly cause the purchasing power of currency to melt. The dollar’s destiny lies with Congress.

Related: Warren Buffett Webcast on the Credit Crisis – The Long-Term USA Federal Budget Outlook – Berkshire Hathaway Annual Meeting 2008 – Federal Reserve to Buy $1.2 Trillion in Bonds, Mortgage-Backed Securities