Who Will Buy All the USA’s Debt? That is a question worth thinking about. The USA is a huge net borrower. The government can’t borrow from consumers because they are hugely in debt themselves. Over the last few decades huge investments from Japan, China and the Middle East in USA government debt have allowed the huge amount of federal debt to continue to grow rapidly. But who is going to buy the increasing amounts of debt; in the next few years, and the next few decades?

China is right to have doubts about who will buy all America’s debt

…

The other area of concern for China is the value of its Treasuries. Given the US borrowing requirement and its lax monetary policy, Treasury bond yields could well rise sharply, causing a corresponding price decline. If China’s holdings match Treasuries’ average 48-month duration, then a 5pc rise in yields, from 1.72pc on the 5-year note to 6.72pc, would lose China 17.5pc of its holdings’ value, or $119bn.

Foreign buyers have absorbed a little over $200bn of Treasuries annually, a useful contribution to financing the $459bn 2008 deficit, but only a modest help towards the $1.35 trillion minimum average deficit forecast for 2009 and 2010.

Unless that changes substantially, there will be $1 trillion annually to be raised by the Treasury from domestic sources, more than double the previous record from domestic and foreign sources together, plus whatever is needed to bail out the banks.

Even if the US savings rate were to rise from zero to its long-term average of 8% of disposable personal income, that would create only an additional $830bn of savings — not enough to fund the domestic share of the deficit. Interest rates would probably have to rise substantially to pull in more foreign investors.

Very true. Anyone buying government debt at these rates has reason to question the wisdom of doing so. Exporters to the USA have macro-economic reasons for buying debt (to keep the value of the dollar from collapsing) but the investing reasons for buying USA debt I find very questionable (I wouldn’t be buying it as an investment, if I were them).

Related: Personal Saving and Personal Debt in the USA – Americans are Drowning in Debt – USA Federal Debt Now $516,348 Per Household – Is the USA Broke?

I am glad to be hosting the 50th edition of the Money Hacks Carnival. There really are a ton of great post on money hacks for your personal finances. I have highlighted some of my favorites from the last week. New visitors to the Curious Cat Economics and Investing Blog may be interested in some of past personal finance posts.

I have included snippets from a some highlighted posts which illustrate the great number of thoughtful individuals writing blogs about how to manage your money more effectively and the economic conditions that impact each of our personal financial lives.

- Patrick, with Military Finance Network, wrote Refund Anticipation Loans are Horrible – “is often near 99% APR or higher. Some Refund Anticipation Loans may cost the consumer up to 30% or more of their total tax return.” [He is exactly right, avoid being hacked out of your money by slick marketing of personal loans - John Hunter, Curious Cat].

- Peter wrote, The Best Decision Doesn’t Always Make The Most Financial Sense: “What I’ve learned through this process is that to succeed financially you have to be willing to make careful decisions about where you’re headed, and realize that success doesn’t always mean making the most logical choice. Sometimes it means taking into account the psychology and human elements of the equation. Only when you do that will you truly be able to make the best decisions for you and your family.”

- An Interview with Larry Winget – “If having a financially secure future is the most important thing to you, then that is where your money will go. Stop saying what is important to you and instead investigate the truth by tracking your spending.”

- Dan, Darwin’s Finance, wrote Generation Debt: Our Children will Hate Us – “We continued to spend like there was no tomorrow. Individual, national and local debt soared to heights that were unsustainable.”

- Mara Rogers, Secrets for Money, presents Another Type of Wealth: Pay It Forward and Random Acts of Kindness – “Your generosity can be shown in a very small and impulsive action such as paying someone a compliment, yet it will still have a very large positive impact on the other person, and typically results in a “ripple effect” of that person then being inspired to help another person.”

- Danelle Ice wrote, College Costs Are Rising: Save Now With an Education Savings Account (ESA) – “According to the College Cost Calculator on AmericanFunds.com, it will cost $168,395 to send our daughter to The University of Texas at Austin starting in 2026 for four years. This calculation is based on a 5% inflation rate.”.

- Patrick, Cash Money Life, wrote, How to Save Money on Your Homeowner’s Insurance Rates: 1) shop Around… 2) Increase Your Deductible… 3) Combine your homeowners and auto insurance policies…

- Dorian Wales presents Behavioral Finance in Everyday Life – The Lottery as a Case Study – “Lottery has been deemed a tax on stupidity for a good reason. Every smart and aware consumer knows better than to throw money away on odds smaller than those of getting hit by lightning 3 times in a row.”

Income

Using money and budgeting

- A Simple Budget That Works?.

- Teaching Kids to Spend Their Money Smartly by Dana

- Reduce Spending without Sacrificing Lifestyle #1 – Eliminate Waste

- Given a choice – money provides choices

- Do It Yourself Debt Consolidation by Pinyo

- Double Dipping Your Social Security Benefits by Junior Boomer

- Finding New Mountains to Climb – what to do once you are out of debt

- Can You Find Painless Ways to Cut Your Budget?

Apartment Rents Fall, Vacancies at 4-Year High

…

Asking rents fell 0.1 percent from the previous quarter, to $1,052 on average, their first quarter-to-quarter decline in almost six years. They rose 2.4 percent from a year earlier. Effective rents, what tenants actually paid, fell to an average $996 last quarter, down 0.4 percent from the prior quarter and up 2.2 percent from a year earlier.

U.S. rental market set to slow down amid housing glut

Anthony De Silva said he was not happy that he had become a landlord. He bought a two-bedroom condominium 18 months ago on the ocean in Hollywood, Florida, expecting to sell at a $100,000 profit. Instead, he is now looking for tenants at $1,700 a month.

…

“Increasing vacancies does not bode well for rental incomes,” said Nabil El-Hage, a professor at Harvard Business School. “We’ve seen a softening in apartment REITs as a result.”

So for renters nationwide this is one possible silver lining to the current economic crisis. Granted not a large one but in these times any good news is worth appreciating. For real estate investors the news is not as good. The Washington DC market is forecast to go against the trend for reduced rents in 2009.

According to Marus and Millichap, Metrowide vacancy is expected to rise 60 basis points this year to 6.5 percent. Asking rents are projected to advance 3.1 percent to $1,410 per month in 2009, while effective rents increase 2.8 percent to $1,351 per month. Rent growth will lag slightly in Suburban Maryland. Of the 43 rental market they track they project San Francisco to see the largest increases in rent in 2009, followed by San Diego and Washington DC.

Related: Home Values and Rental Rates – Rent Controls are Unwise – posts on housing – How Walkable is Your Prospective Neighborhood

Times are tough. Economic news is grim. But if you are looking to relax somewhere warm, you are in luck. Deals in Paradise

The bargains in Las Vegas are so gigantic that I couldn’t figure them out myself. I called Howard Lefkowitz, the chief executive of Vegas.com, for a little help. After a little patter promising that “everything is 25 to 30 percent” less than last year, Lefkowitz agreed to a real-time test.

“What would a room at the Bellagio cost me tonight?” I asked. After a few keystrokes — I heard his keyboard clacking over his website — he found a $129 rate for a standard room at the five-star property. “That probably would have cost $225 last year,” he said. “What would $129 have gotten me last year?” I wondered. Lefkowitz didn’t hesitate: “A night at Paris, a nice four-star resort.” What was Paris charging tonight?” I asked. A few more keystrokes and Lefkowitz had an answer: $90.

…

“Call me,” the general manager at a new hotel in Miami advised. “I’ll offer you a price you won’t find on the Web.”

Related: Medieval Peasants had More Vacation Time – Dream More, Work Less – 9 Days in Egypt – Costa Rica Photo Essay – South Carolina Photos

I do not like the actions of many in “private equity.” I am a big fan of capitalism. I also object to those that unjustly take from the other stakeholders involved in an enterprise. It is not the specific facts of this case, that I see as important, but the thinking behind these types of actions. Which specific actions are to blame for this bankruptcy is not my point. I detest that financial gimmicks by “private capital” that ruin companies.

Those gimmicks that leave stakeholders that built such companies in ruin should be criticized. It is a core principle that I share with Dr. Deming, Toyota… that companies exist not to be plundered by those in positions of power but to benefit all the stakeholders (employees, owners, customers, suppliers, communities…). I don’t believe you can practice real lean manufacturing and subscribe to this take out cash and leave a venerable company behind kind of thinking.

How Private Equity Strangled Mervyns

When those firms bought Mervyns from Target for $1.2 billion in 2004, they promised to revive the limping West Coast retailer. Then they stripped it of real estate assets, nearly doubled its rent, and saddled it with $800 million in debt while sucking out more than $400 million in cash for themselves, according to the company. The moves left Mervyns so weak it couldn’t survive.

Mervyns’ collapse reveals dangerous flaws in the private equity playbook. It shows how investors with risky business plans, unrealistic financial assumptions, and competing agendas can deliver a death blow to companies that otherwise could have survived. And it offers a glimpse into the human suffering wrought by owners looking to turn a quick profit above all else.

Too much debt is not just a personal finance problem it is a problem for companies too. Continue reading on my original post on the Curious Cat Management Blog.

Related: Leverage, Complex Deals and Mania – Failed Executives Used Too Much Leverage – posts on debt

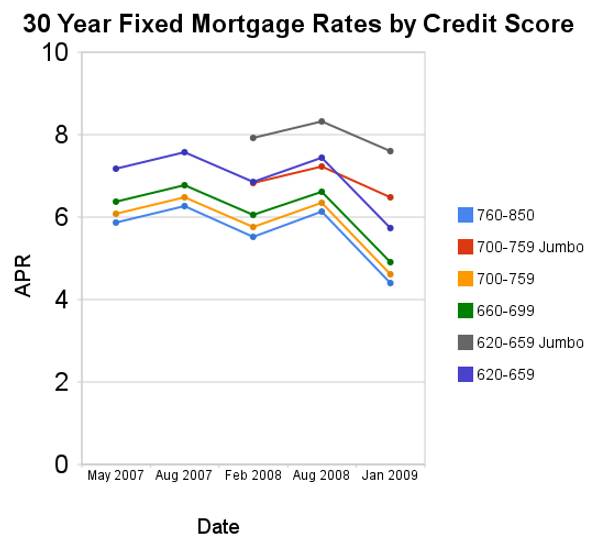

Since August of 2008 conforming mortgage rates are have declined a huge amount. Jumbo rates have fallen a large amount also, but much less (for example for a credit score of 700-759 the jumbo rates declined 73 basis points while the conventional rate declined 172 basis points.

For scores above 620, the APRs above assume a mortgage with 1 point and 80% Loan-to-Value Ratio. For scores below 620, these APRs assume a mortgage with 0 points and 60 to 80% Loan-to-Value Ratio. You can see, with these conditions the rate difference between a credit score of 660 and 800 is not large (remember this is with 20% down-payment) and has not changed much (the difference between the rates if fairly consistent).

Related: Low Mortgage Rates Not Available to Everyone – 30 Year Fixed Rate Mortgage Rate Data – Real Free Credit Report (in USA) – Jumbo Mortgage Shoppers Get Little Relief From Rates – posts on mortgages

Read more

Madoff ‘victims’ do math, realize they profited

The issue came to the forefront this week as about 8,000 former Madoff clients began to receive letters inviting them to apply for up to $500,000 in aid from the Securities Investor Protection Corp. Lawyers for investors have been warning clients to do some tough math before they apply for any funds set aside for the victims, and figure out whether they were a winner or loser in the scheme.

Hundreds and maybe thousands of investors in Madoff’s funds have been withdrawing money from their accounts for many years. In many cases, those investors have withdrawn far more than their principal investment.

…

Jonathan Levitt, a New Jersey attorney who represents several former Madoff clients, said more than half of the victims who called his office looking for help have turned out to be people whose long-term profits exceeded their principal investment.

I discussed this aspect last month, the SPIC covers actual losses, not losses based upon false gains you didn’t have, I don’t think. So if you invested $100,000 and were told (falsely) it was worth $300,000 after years of gains you are not covered for $300,000. And I certainly hope the SPIC fund doesn’t payoff people who already had gains based on false accounting from Madoff.

This whole situation also points out the value of diversification. Diversification is important not just in asset classes (stocks, bonds, cash, real estate…) but in the accounts and companies with which you are dealing (I have always been a bit paranoid in this feeling, compared to others that think this level of diversification is not really needed but this is an example of the risks investments face that diversification can help manage). This is a very difficult situation for investors that had counted on assess they believed they had earned but in fact they had not.

Related: Bail us Out, say Madoff Victims – How to Protect Your Financial Health – Real Free Credit Report – identity theft links

$30.1 trillion in stock market valuation was wiped out last year – Journal of a Plague Year: Faith in Markets Cracks Under Losses:

…

Lehman Brothers Holdings Inc., with assets of $639 billion, filed the largest bankruptcy in U.S. history on Sept. 15. Its creditors may have lost as much $75 billion, the firm’s chief restructuring officer said.

Bear Stearns Cos. was taken over by JPMorgan Chase & Co. in March after a funding crisis triggered by losses from subprime- mortgage investments. Merrill Lynch & Co., facing a crisis of its own, sold itself to Charlotte, North Carolina-based Bank of America Corp. And the last two major investment banks, Goldman Sachs Group Inc. and Morgan Stanley, converted to bank holding companies and got capital injections from the U.S. government.

2008 was quite a memorable year in the markets. What the markets will do this year is hard to know. But the economy is likely to be very weak. Job losses will increase. If we are lucky the economy will be picking up by the end of the year. A huge problem is we have been living well beyond our means for decades. And now we are selling out even more of our children and grandchildren’s future to pay for the extravagance of those last few decades. How costly our credit-card-like financing of government bailouts is going to be is the most important issue I believe.

There is nothing wrong with spending money you saved for a raining day when that day comes. There is a big problem (for your future) taking our more credit cards to spend money you didn’t bother to save. You might have to do so, but the costs you are heaping on your future is very high (and for the economy overall many of those costs will be borne by children not yet born).

Related: The Economy is in Serious Trouble – Crisis May Push USA Federal Deficit to Above $1 Trillion for 2009 – What Should You Do With Your Government “Stimulus” Check? – Over 500,000 Jobs Disappeared in November

As I suspected those (who are not earning minimum wage you can be sure) that have lost money on the Madoff case would expect others to bail them out: well paid lawyers (I am sure) are making their case for just such a bailout of their wealthy clients.

…

The SIPC has little more than $1.6bn of funds and has promised $500,000 to each Madoff victim who had an account with his firm in the past 12 months.

The debate needs to be about what is the proper role for government. Not about this instance. What type of losses do we want secured? How large of payments do we want to insure? That amount has been $500,000 if we are changing the rules after the fact for a few is that really the best course of action)? How should these payments be funded? Do we really want to raise taxes on our grand children (many of which who will earn less than the equivalent of $50,000 today)? I don’t think so. This SIPC fund should be paid for by fees on investments just like the FDIC is paid for based on fees on covered deposits (as the SIPC is now – but no taxpayer funding should occur).

If we decide we want to pay back people several million each then the fees just need to be raised to fund such a system. Just as with the FDIC if we want the government to backstop the fund by guaranteeing they will loan the fund money if it runs short of cash is fine with me. Then the SIPC fund just pays back the taxpayers with interest.

Read more

Compounding is the Most Powerful Force in the Universe

A talking head with some valuable info. I remember my father (a statistics professor) getting me to understand this as a small child (about 6 years old). The concept of growth and mathematical compounding is an important idea to understand as you think and learn about the world. It also is helpful so you understand that statistics don’t lie but ignorant people can draw false conclusions from data.

It is unclear if Einstein really said this but he is often quoted as saying “compounding is the most powerful force in the universe.” Whether he did or not, understanding this simple concept is a critical component of numeracy (literacy with numbers). My guess is that people just find the concept of compounding amazing and then attribute quotes about it to Einstein.

I strongly encourage you to watch at least the first 2 segments (a total of 15 minutes). And then take some time and think about compounding in ways to help you internalize the concepts. You can also read his book: The Essential Exponential For the Future of Our Planet by Albert Bartlett.

Understanding the benefits of compound interest can help you become a much more successful investor. And understanding the principles of compounding can help you see the excess of bubbles cannot continue. You still have to overcome psychology that can be a powerful force leading you to believe never ending growth is possible. But at least you will have the mathematical understanding to help.

Related: Curious Cat Investing and Economics Search – Playing Dice and Children’s Numeracy – Saving for Retirement (compound interest) – Bigger Impact: 15 to 18 mpg or 50 to 100 mpg?