Gift cards are a bad tool. They are essentially a poor version of money. They are more restrictive than money. They incur fees not incurred when using money. The only redeeming value seems to be they are less socially unacceptable than just giving cash. We should change that attitude. If you are giving cash – just give actually cash not the less useful for of cash that is a gift card.

The Sharper Image Suspends Acceptance Of Gift Cards Due To Bankruptcy

Related: Customer Hostility from Discover Card – Too Much Stuff – Sneaky Fees

The title of a recent article asks: Are you a sucker to invest in a 401(k)? The answer is an emphatic: No.

But what if instead you had bought that tax-efficient stock fund outside your plan? Wouldn’t your tax bill be lower? Yes, but that’s the wrong way to look at it. If you skip your 401(k) in favor of a taxable account, you must first shell out taxes on that $10,000, which leaves you with just $7,200 to invest (assuming the same 28% bracket).

Plus, over the next 20 years, you’ll have taxes on any dividends and gains the fund pays out. Even though you will get a lower 15% rate on your gains when you sell, you end up with $28,950, or about $4,600 less than with the 401(k). A tinier final tax bill can’t make up for having to pay taxes all along.

This is a very good short simple personal finance article. It explains an issue that might be tricky for some to understand. Those that read it can learn more about personal finance. And it has several points – some of which, I can imagine, might be hard for some to understand. But it does a good job of explaining things simply. And a few points, made well in the article, are often overlooked or under-appreciated:

tax rates will go up – we are passing higher taxes onto the future by not paying our bills now

the tax deferral is a huge benefit – often minimized when people discuss the benefits of IRAs

401(k) employer matches are another huge benefit

As I have said before, learning about personal finance is a long term effort. If you don’t understand everything in an article that is fine, over the years you want to learn more and more. Hopefully this is a useful step on that journey.

Related:

Roth IRAs a Smart bet for Younger Set – Saving for Retirement

Example 30 year mortgage rates (from myfico.com – see site for current rate estimates). We have posted twice on this previously – August 2007 – May 2007. Since then rates have decreased on 30 year fixed mortgages but jumbo rates have increased significantly.

| FICO score | APR May 2007 | APR Feb 2008 – regular | APR Feb 2008 – jumbo | payment/mo May 2007 | payment/mo Feb 2008 – regular | payment/mo Feb 2008 – jumbo |

|---|---|---|---|---|---|---|

| 760-850 | 5.86% | 5.53% | 6.61% | $2,362 | $2,278 | $4,476 |

| 700-759 | 6.08% | 5.75% | 6.83% | $2,419 | $2,525 | $4,579 |

| 660-699 | 6.37% | 6.04% | 7.12% | $2,493 | $2,335 | $4,713 |

| 620-659 | 7.18% | 6.85% | 7.93% | $2,709 | $2,620 | $4,373 |

| 580-619 | 8.82% | 9.22% | 9.40% | $3,167 | $3,282 | $5,834 |

| 500-579 | 9.68% | 10.20% | 10.37% | $3,416 | $3,568 | $6,336 |

Amounts shown for borrowing $400,000 and rates as of Feb 18th (and May 2007). Jumbo payments are based on $700,000. Previously I could see the assumptions on the site which were (but I see no details on the calculated amounts as of Feb 2008): For scores above 620, the APRs above assume a mortgage with 1.0 points and 80% Loan-to-Value Ratio. For scores below 620, these APRs assume a mortgage with 0 points and 60 to 80% Loan-to-Value Ratio.

Read more

Options are a tool that investors can use within their portfolio in various ways. They can be used to speculate and they can be used to provide a bit of extra income (with the cost of potentially losing big gains). Mainly they are for more sophisticated investors. Form the Curious Cat Investing Glossary – Stock Options:

For example, if you own 100 shares of Cisco you could sell a covered call option giving someone the right to buy your shares at a specific price by a certain date. So, for example, they pay you $200 for the right to buy you 100 shares at $1 more than it is selling at right now anytime in the next 2 months. They might chose to do so, in order to leverage their investment as it only cost them $200 to benefit from the rise of 100 shares of Cisco. Of course, if it doesn’t go up in 2 months you benefit because you get to keep the cash and your stock.

Selling covered call options allows the investor to earn a bit of extra money but they will lose out if the stock shoots up as then the investor that bought the option can buy your shares at the agreed to price even if it now is $5 a share more. Read more on options including naked puts, naked calls…

Employees may receive options to buy company stock at a Company’s stock at a set price for several years in the future. In general, those options cannot be traded on the market (the employee must keep them or exercise them – pay the strike price to purchase the stock). Why are options such a nice perk if you must pay the strike price? Because they are often good for years and the strike price is set at today’s price (though this doesn’t have to be the case). On the whole stocks go up over time so most of the time the stock will increase in value over the years and the options to buy it at the price several years ago is very valuable. For startup companies, there is often a high likelihood of going out of business in which case the options are worthless, but if the company is successful the options can be worth a great deal.

Related: Hedging an investment – Books on Speculation with Investment – Google to Let Workers Sell Options Online

The Dow Jones Industrial Average is a widely followed stock market measure of 30 stocks. I think the S&P 500 is a better measure to pay attention to, but the DJIA continues to be used and it has some historical interest. Today 2 stocks (Altria and Honeywell) were removed and two new stocks we added (Bank of America and Chevron). They were the two largest cap USA based companies (other than Berkshire Hathaway, Warren Buffett’s company) not in the DJIA. Bank of America has a market capitalization of $186 billion and Chevron’s is $165 billion. Google’s market cap is $160 billion.

I mentioned before I would replace GM with Toyota (though that might violate one of their traditions). I also would have added Google, with this update, rather than Bank of America (Citigroup, JPMorgan Chase, American Express and AIG are all financial industry companies and GE has huge financing components also).

The current DJIA stocks:

| Stock | Market Capitalization | Year Added |

|---|---|---|

| Exxon (XOM) | $438 Billion | 1928 |

| GE | 337 | 1896 |

| Microsoft | 260 | 1999 |

| AT&T (T) | 217 | 1999 |

| Proctor & Gamble (PG) | 200 | 1932 |

| Walmart (WMT) | 195 | 1997 |

| Bank of America (BAC) | 186 | 2007 |

| Johnson & Johnson (JNJ) | 178 | 1997 |

| Chevron (CVX) | 165 | 2007 |

| Pfizer (PFE) | 150 | 2004 |

| JPMorgan Chase (JPM) | 145 | 1991 |

| IBM | 145 | 1979 |

One of the most important financial moves you can make is to start investing for your retirement early. This post is directed at those in the USA (but you can adjust the ideas for your particular situation). Retirement accounts with tax free growth, tax deferred growth and/or even tax deductible contributions can add to the benefits of such an investment. And matching by your company can give you an immediate return or 100% or 50% or some other amount. With 100% matching if you invest $2,000 your company adds $2,000 to your retirement account. For 50% they would add $1,000 in the event you added $2,000.

In other posts I will cover some of the other details involved but some people can be confused just by what investment options to chose. Normally you will have a limited choice of mutual funds. Hopefully you will have a good family of funds to choose from such as Vanguard, TIAA-CREF, American, Franklin-Templeton, T.Rowe Price etc.). If so, the most important thing is really just to get started adding money. The details of how you allocate the investment is secondary to that.

So once you have made the decision to save for your retirement what allocation makes sense? Well diversification is a valuable strategy. Some options you will likely have include S&P 500 index fund, Russel 5000 (total market index – or some such), small cap growth, international stocks, money market fund, bond fund and perhaps international bonds, short term bonds, specialty funds (health care, natural resources) long term bonds, real estate trusts…

Just to get a simple idea of what might make sense when you are starting out and under 40 and don’t have other substantial assets in any of these areas (large mutual fund holdings, your own house, investment real estate…) this is an allocation I think is reasonable (but don’t take my word for it go read what other say and then make your own decisions):

25% Total stock market index (~Wilshire 5000)

25% international stocks

20% small cap stocks

10% real estate

10% high quality short term bonds in a Euros, Yen…

10% short term bonds (or money market)

Read more

Jimmy Rodgers is one of the most successful investors ever. He and George Soros were partners during the amazing run with Quantum Fund (up over 4000% in 10 years) and he has been successful since. This interview provides his current thoughts – ‘It’s going to be much worse’

Rogers looks at the Fed’s willingness to add liquidity to an already inflationary environment and sees the history of the 1970s repeating itself. Does that mean stagflation? “It is a real danger and, in fact, a probability.”

One smart investor, no matter how smart, will have many wrong guesses about the future. Still he is someone worth listening to.

Related: Investment Biker – Charge It to My Kids – Buffett’s 2007 Letter to Shareholders

I originally setup the 10 stocks for 10 years portfolio in April of 2005. With Microsoft’s move to buy Yahoo I have sold Yahoo and replaced it with Danaher, a stock I have been considering for this portfolio from the start. I have also sold some Templeton Dragon Fund since the last update, as I indicated I would. Unfortunately, Petro China just missed reaching the price I had set to sell a portion of the position before falling dramatically (the gain at the last update was 298% now it is “only” 132%).

The performance since the last update has not been good but that isn’t much of a concern to me. The long term prospects remain very good for this portfolio, I believe. At this time the stocks in the sleep well portfolio in order of returns -

| Stock | Current Return | % of sleep well portfolio now | % of the portfolio if I were buying today | |

|---|---|---|---|---|

| Google – GOOG | 137% | 16% | 14% | |

| PetroChina – PTR | 132% | 8% | 8% | |

| Amazon – AMZN | 106% | 7% | 6% | |

| Templeton Dragon Fund – TDF | 85% | 10% | 10% | |

| Toyota – TM | 44% | 10% | 10% | |

| Templeton Emerging Market Fund – EMF | 39% | 3.5% | 4% | |

| Cisco – CSCO | 32% | 6.5% | 8% | |

| Tesco – TSCDY | 9% | 0% | 10% | |

| Danaher – DHR | -4% | 4.5% | 8% | |

| Intel – INTC | -4% | 4% | 6% | |

| Pfizer – PFE | -11% | 6% | 8% | |

| Dell | -40% | 6% | 6% |

The Yahoo position was closed at an 11% loss. It was the second of the original 10 stocks to be effectively removed due to changes in ownership. At this point I am most positive on Google, Petro China, Toyota, Templeton Dragon Fund and Tesco. I am wary of Dell – they seem to be moving in the wrong direction, but I am willing to give them longer to improve.

Read more

I would say why Americans are going broke is pretty simple: they buy loads of stuff they can’t afford and don’t need. And the political leaders promote this get another credit card mentality of “budgeting”. This stuff is not that tricky. Don’t borrow what you can’t afford. Save money. Don’t buy frivolous stuff that you can’t afford and don’t really provide you value.

Related: USA Federal Debt Now $516,348 Per Household – Saving for Retirement – Financial Illiteracy Credit Trap – Earn more, spend more, want more

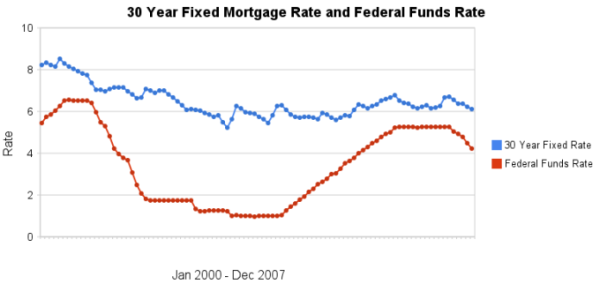

I have update my article showing the historical comparison of 30 year fixed mortgage rates and the federal funds rate. When deciding whether to lock in a rate for a 30 year fixed rate mortgage (when refinancing or buying a new home) some believe moves in the federal reserve discount rate will raise or lower that mortgage rate directly. This is not the case, in general. The effect of federal reserve discount rates on other mortgage rates (such as adjustable rate mortgages is not the same and can be predictably affected by fed fund rate moves).

The chart shows the federal funds rate and the 30 year fixed rate mortgage rate from January 2000 through December 2007 (for more details see the article).

There is not a significant correlation between moves in federal funds rate and 30 year mortgage rates that can be used for those looking to determine short term (over a few days, weeks or months) moves in the 30 year fixed mortgage rates. For example if 30 year rates are at 6% and the federal reserve drops the federal funds rate 50 basis points that tells you little about what the 30 year rate will do. No matter how often those that should know better repeat the belief that there is such a correlation you can look at the actual data in the graph above to see that it is not the case.

Read more