Economic data don’t point to boom times just yet

…

By contrast, that ratio of household debt to economic output was 70 percent in 2000. To get back to that level, Americans would need to pay down $3.4 trillion in debt

And it isn’t like the 2000 level was one of great consumer discipline. The economy needs to improve in several ways to be approaching a state that could be called a healthy economy. The 2 biggest, in my mind are 1) decreasing debt (consumer and government) and 2) increasing jobs. My next most important would probably be increasing the number of “good” jobs. Many other data points are important, such as: decreasing income inequality; increasing the age at retirement (because of all the systemic problems caused by extremely long retirements financed not by savings but taxes on existing workers); low inflation (luckily that is continuing to look good); value added economic activity (real GDP); decrease in the cost of the health care system as a % of GDP; decrease in financial leverage; economic strength worldwide (economic weakness of Japan, Europe… can severely hamper economic success in the USA). I do not see a bubble hyped economy as a healthy economy – even if lots of measures look good.

Related: Americans are Drowning in Debt – Dollar Decline Due to Government Debt or Total Debt? – Financial Illiteracy Credit Trap – Consumer Debt Down Over $100 Billion So Far in 2009 (Nov 2009)

The Curious Cat Investing and Economics Carnival highlight recent interesting personal finance, investing and economics blog posts.

- The money made by Microsoft, Apple and Google, 1985 until today – “In terms of profit Apple was ahead of Microsoft in the 1980s, but was then passed and left behind. This chart actually reveals that Apple’s upswing the last few years is the first time the company’s profits have really taken off in a big way. Another interesting observation is how closely the profits of Apple and Google match, even though Apple’s revenues are significantly higher.”

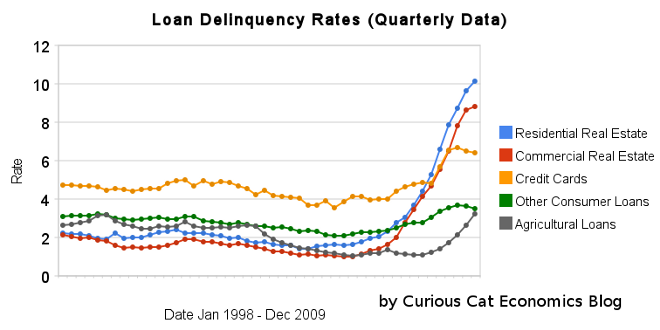

- Real Estate and Consumer Loan Delinquency Rates 1998-2009 by John Hunter – “That last half of 2009 saw residential real estate delinquencies increased 143 basis points to 10.14% and commercial real estate delinquencies increase 98 basis points to 8.81%. Consumer loan delinquencies decreased with credit card delinquencies down 18 basis points to 6.4% and other consumer loan delinquencies down 19 basis points to 3.49%.”

- The Principle That Can Make You Rich or Keep You Broke by David Weliver – “Unfortunately, inertia can also keep us at rest; the same principle that helps us achieve positive goals can make it increasingly difficult to escape bad habits.” (John: Very true, see my post on habits).

- Why do we work so much? – “The countries that consistently rank as having the world’s “happiest people” also tend to work fewer hours than people in the U.S… Most corporate ladders are designed to reward employees with money instead of time. Assuming we only want money to use as a tool for happiness, this makes no sense.”

- How Does Apple Become a $300 Billion Company? by Eric Bleeker – “The more Apple can look like the Microsoft of the mobile world, the more it will be worth. Commanding a market with even half the dominance Microsoft did with operating systems is a once-in-a-generation opportunity, but I’m not so sure the mobile world is built in a way that’ll allow that.”

- Top Fed Official Wants To Break Up Megabanks, Stop The Fed From Guaranteeing Wall Street’s Profits by Shahien Nasiripour – “I don’t think we have any business guaranteeing Wall Street spreads,” Hoenig said. “We need to recognize that and address it by removing these guaranteed extremely low rates. I think it’s extremely important that we do that, and not create the conditions for speculative activity and a new crisis down the road.”

- Evaluating Microfinance by Michael Frank – “I decided to use a variation on the “waiting list-control group” method regularly used in medical studies. My evaluation design requires a call for loan applicants in the most similar nearby community that does not have a similar microfinance program already present.”

Welcome to the False Recovery by Eric Janszen

Companies planning for sudden and relatively near-term growth should reshape their strategies to make the best of economic flatness.

He makes a decent point for companies, but the he flips back and forth between the need to save more (because we are buried in debt) and the need to spend more (because we need to grow the economy right now). And while I wouldn’t stake my life on it I wouldn’t be surprised that we have a strong economic rebound (it is also perfectly conceivable we have a next to no growth or even fall into a recession). But it seems to me the return to bubble thinking and spending beyond our means is making a strong comeback.

Another ok, point but we have hardly paying off anything of the previous living beyond our means. It would take decades at this rate.

So the problem is the saving are not actually resulting in increased ability to spend (first point above) – which is bad he says, because it means their won’t be more spending (because people won’t have the ability to spend). Then he says when banks lend the consumers money they will spend and the saving rate will go down (which is bad – though he doesn’t seem to really want more savings (because that means business won’t get increased sales).

The conventional wisdom likes to point out the long term problem of low savings rate but then quickly point out we need more spending or the economy will slow. Yes, when you have an economy that is living beyond its means if you want to address the long term consequences of that it means you have to live within your means. It isn’t tricky. We need to save more. If that means the economy is slower compared to when we lived beyond our means that is what it takes. The alternative is just to live beyond your means for longer and dig yourself deeper into debt.

Read more

Apartment Rents Rise as Sector Stabilizes

…

enters are also staying put longer: the average renter now stays for 19 months, up from an average of 14 months, said Mr. Friedman, and despite low mortgage rates and greater home affordability, fewer renters are leaving to buy homes. “This is the first time in many, many years that it feels like even people who could afford to buy are making the investment decision not to,” Mr. Friedman said.

…

Portland, Ore., posted the largest rent decline, at 0.7%, followed by Las Vegas, San Diego, and Southern California’s Inland Empire. Those three markets have all seen an uptick in home-buying activity, particularly among the low end from first-time buyers and investors.

Colorado Springs had the largest rent increases, 2.5%, followed by Washington DC, 2% and San Antonio 1.5%. There is a very nice new online tool, Padmapper, for renters or landlords. It is a mashup on Google Maps of rental listings by location from Craigslist and other sources. Very good search options. Easy to use. Find more real estate links on the Curious Cat Cool Connections Directory.

Related: It’s Now a Renter’s Market (April 2009) – Housing Rents Falling in the USA (February 2009) – Apartment-vacancy Rate is 7.8%, a 23-year High

The chart shows the total percent of delinquent loans by commercial banks in the USA.

That last half of 2009 saw real estate delinquencies continue to increase. Residential real estate delinquencies increased 143 basis points to 10.14% and commercial real estate delinquencies in 98 basis points to 8.81%. Agricultural loan delinquencies also increased (112 basis points) though to just 3.24%. Consumer loan delinquencies decreased with credit card delinquencies down 18 basis points to 6.4% and other consumer loan delinquencies down 19 basis points to 3.49%.

Related: Loan Delinquency Rates Increased Dramatically in the 2nd Quarter – Bond Rates Remain Low, Little Change in Late 2009 – Government Debt as Percentage of GDP 1990-2008 – USA, Japan, Germany… - posts with charts showing economic data

Read more

Half of Commercial Mortgages to Be Underwater

…

We now have 2,988 banks – mostly midsized, that have these dangerous concentrations in commercial real estate lending.” As a result, the economy will face another “very serious problem” that will have to be resolved over the next three years, she said, adding that things are unlikely to return to normalcy in 2010.

…

Warren said it’s time for the government to “pull the plug” on mortgage lenders Fannie Mae and Freddie Mac. “I’m one of those people who never liked public-private partnership to begin with. I think what they did was use public when public was useful and private when private was useful,” she said. “And I think we’ve got to rethink that whole thing.”

“There is no implicit guarantee anymore,” she added. “I don’t care how big you are, if you make serious enough mistakes, then your business can be entirely wiped out.”

Financially literate people should know that the current commercial real estate market is in serious trouble. I still figure it will rebound well. I just want to wait and see how far prices fall and then try to buy when people are so frustrated they will sell at very low prices.

Related: Commercial Real Estate Market Prospects Remain Dim – Mortgage Delinquencies and Foreclosures Data Indicates 2010 Could Show Improvement – Jumbo Loan Defaults Rise at Fast Pace (Feb 2009)

Bill Gross Warning May Catch Bond Investors Off-Guard

The prospect of a strengthening U.S. economy and rising interest rates makes an “argument to not own as many” bonds, Gross said in the interview.

…

Treasuries have rallied for almost three decades, pushing the yield on the 10-year Treasury note from a high of 15.8 percent in September 1981 to 3.89 percent as of yesterday. The yield reached a record low of 2.03 percent in December 2008 during the height of the credit crunch.

Excess borrowing in nations including the U.S., U.K. and Japan will eventually lead to inflation as governments sell record amounts of debt to finance surging deficits, Gross said.

“People have been making money on fixed income for so long, people assume it’s going to continue when mathematically, it cannot,” said Eigen, whose fund is the third-best selling bond fund this year, according to Morningstar. “When people finally start to lose money in fixed-income, they won’t hesitate to pull money out very soon,” he said.

John Hancock Funds President and Chief Executive Officer Keith Hartstein said retail investors are already late in reversing their rush into bond funds, repeating the perennial mistake of looking to past performance to make current allocation decisions.

I agree bonds don’t look to be an appealing investment. They still may be a smart way to diversify your portfolio. I am investing some of my retirement plan in inflation adjusted bonds and continue to purchase them. My portfolio is already significantly under-weighted in bonds. I would not be buying them if it were not just to provide a small increasing of my bond holdings.

Related: Municipal Bonds, After Tax Return – 10 Stocks for Income Investors – Bond Yields Show Dramatic Increase in Investor Confidence – Investors Sell TIPS as They Foresee Tame Inflation

I created the 10 stocks for 10 years portfolio in April of 2005. In order to track performance created a marketocracy portfolio but had to make some minor adjustments (and marketocracy doesn’t allow Tesco to be purchased, though it is easily available as an ADR to anyone in the USA to buy in real life – it is based in England). The current marketocracy calculated annualized rate or return (which excludes Tesco) is 6.2% (the S&P 500 annualized return for the period is 2.5%) – marketocracy subtracts the equivalent of 2% of assets annually to simulate management fees – as though the portfolio were a mutual fund – so without that the return is about 5.7% above the S&P 500 annually).

The current stocks, in order of return:

| Stock | Current Return | % of sleep well portfolio now | % of the portfolio if I were buying today | |

|---|---|---|---|---|

| Amazon – AMZN | 248% | 11% | 8% | |

| Google – GOOG | 152% | 16% | 15% | |

| PetroChina – PTR | 87% | 9% | 9% | |

| Templeton Dragon Fund – TDF | 80% | 10% | 10% | |

| Templeton Emerging Market Fund – EMF | 40% | 5% | 6% | |

| Cisco – CSCO | 38% | 6% | 8% | |

| Danaher – DHR | 10% | 9% | 10% | |

| Toyota – TM | 10% | 8% | 10% | |

| Intel – INTC | 0% | 4% | 7% | |

| Tesco – TSCDY | -10%* | 0%* | 10% | |

| Pfizer – PFE | -34% | 4% | 8% | |

| Dell | -56% | 3% | 0% |

The current marketocracy results can be seen on the Sleep Well portfolio page.

Related: 12 Stocks for 10 Years – July 2009 Update – Investing, My Thoughts at the End of 2009 – posts on stocks – investing books

Read more

Apple currently has the 4th largest market capitalization for USA stocks, behind ExxonMobil (over $300 billion), Microsoft ($250 billion) and Wal-Mart and ahead of Berkshire Hathaway, General Electric, Procter & Gamble and Google ($180 billion). Eric Bleeker has a nice article on fool.com looking at how Apple can grow to a $300 Billion market capitalization.

In many ways, the mobile race is similar to the PC battle of the ‘80s. In one corner we have Apple, packaging its hardware and software in a limited number of systems. In the other corner, there’s Google (replacing Microsoft), licensing out software to any number of hardware vendors.

Apple could actually learn from Microsoft. It needs to be more than just the best smartphone on the market right now. Microsoft never controlled the operating-system market because it was the best — it won because it locked users in, and most people essentially had to use its products. Microsoft has released some real clunkers over the years, but it took few hits from them. Likewise, even though Apple’s unparalleled in its commitment to quality-unlike a certain competitor we just discussed — with a price tag that implies sustainable long-run dominance, Apple needs a margin of safety to ensure that even with a hiccup or two, it will continue to rule the mobile world.

The $300 billion question

So it all boils down to one question: How well can Apple lock users into its ecosystem? As developers continue building apps at rates far in excess of competing platforms and more users synch their digital lives around iTunes, you can see Apple creating a platform that’s sustainable well beyond just the next upgrade. From there, no company possesses a virtuous circle like Apple. Higher iPhone market share begets high-margin sales of apps and media, as well as increased Mac sales. Given the size of the smartphone market, the margins Apple collects from each iPhone, and the boost to other Apple products, you can see a path to $300 billion forming.

I missed out on investing in Apple. I came close to buying in, but didn’t quite do it – that was a big mistake. And I am still not buying now, which could be another mistake. We shall see. I am very comfortable owning Google. But I think Apple could well be good also. My 12 stocks for 10 years portfolio has Cisco, Intel and Amazon which I am happy with and Dell which has been a mistake.

Related: Apple exceeded Google for the first time since Google went public (Aug 2008) – Amazon Soars on Good Earnings and Projected Sales – It is Never to Late to Invest – Great Google Earnings (April 2007)

There are several personal finance basics that everyone must account for. Retirement requires the most planning and accumulating the largest amount of money. Luckily if you plan ahead you have a long time for compounding to work in your favor. Unfortunately most people continue to fail to make even the most minimal efforts to save for retirement: 43% have less than $10k for retirement

The percentage of workers who said they have less than $10,000 in savings grew to 43% in 2010, from 39% in 2009, according to the Employee Benefit Research Institute’s annual Retirement Confidence Survey. That excludes the value of primary homes and defined-benefit pension plans.

Fewer workers report that they and/or their spouse have saved for retirement (69%, down from 75% in 2009 and 72% in 2008. Moreover, fewer workers say that they and/or their spouse are currently saving for retirement (60%, down from 65 percent in 2009).

27% say they have less than $1,000 in savings (up from 20% in 2009).

46% report they and/or their spouse have tried to calculate how much money they will need to have saved for a comfortable retirement by the time they retire.

What is a very rough estimate of what you need? Well obviously factors like a pension, social security payments, age at retirement, home ownership, health insurance, marital status… make a huge difference in the total amount needed. But something in the neighborhood of 15-25 times your desired retirement income is in the ballpark of what most experts recommend. So if you want $50,000 in income you need $750,000 – $1,250,000. Obviously that is difficult to save over a short period of time. The key to saving for retirement is a consistent, long term saving program.

Related: Retirement Savings Survey Results (2007) – How Much Will I Need to Save for Retirement? – Personal Finance Basics: Long-term Care Insurance