The race has barely begun – finished plants are years away – but it’s blazing fastest in the Mojave, where the federal government controls immense stretches of some of the world’s best solar real estate right next to the nation’s biggest electricity markets. Just 20 months ago only five applications for solar sites had been filed with the BLM in the California Mojave. Today 104 claims have been received for nearly a million acres of land, representing a theoretical 60 gigawatts of electricity. (The entire state of California currently consumes 33 gigawatts annually.)

Related: Solar Thermal in Desert, to Beat Coal by 2020 – Solar Tower Power Generation – Global Wind Power Installed Capacity – real estate investing articles

Foreclosure Filings Continue to Rise

…

last week the Mortgage Bankers Association reported that about 2.47 percent of home mortgages were in foreclosure during the first quarter of the year, almost double the 1.28 percent rate of a year earlier, and the highest point since the group began compiling such figures in 1979. A Credit Suisse report this spring predicted that 6.5 million loans will fall into foreclosure over the next five years, reaching more than 8 percent of all U.S. homes.

There numbers really are astounding. How lame were the decisions of banks and mortgagees that nearly 1 in 40 mortgages are in default (and that number likely increasing in the next year to much more?

Related: Homes Entering Foreclosure at Record (Sep 2007) – Homes Entering Foreclosure at Record – Ignorance of Many Mortgage Holders

Assessing how much further house prices are likely to fall gets even trickier. One route is to look at market expectations: investors expect a further 20% drop, judging by the prices of futures contracts linked to the Case-Shiller 10 city index. But the futures market is small and illiquid and may overstate the possible declines.

…

Using a model that ties house prices to disposable incomes and long-term interest rates, analysts at Goldman Sachs reckon that the correction in national house prices is only halfway through. They expect an 18-20% correction overall, or another 11-13% decline from today’s levels. But their models suggest that six states – Arizona, Florida, Virginia, Maryland, California and New Jersey, could see further price declines of 25% or more.

Optimists dispute this gloomy assessment, pointing out that some measures of housing affordability have dramatically improved. According to NAR figures, monthly payments on a typical house with a 30-year mortgage and 20% downpayment were 18.5% of the median family’s income in February, down from almost 26% at the peak – and close to the historical average. But this measure of affordability is misleading, not least because credit standards have tightened so much.

…

Given the typical pace of rental growth, Mr Feroli reckons house prices (as measured by the Case-Shiller index) need to fall by 10-15% over the next year and a half for the rent/price yield to return to its historical average.

Actually predicting the where the declines will stop is very difficult. But this articles provides some very good thoughts on what the future holds. While things may not go as those quoted guess their guesses seem pretty reasonable and the explanations make sense.

Related: Home Values and Rental Rates – Housing Prices Post Record Declines – Housing Inventory Glut – mortgage terms

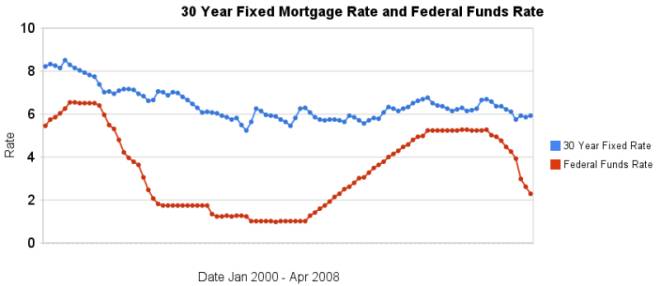

The recent drastic reductions again emphasize (once again) that changes in the federal funds rate are not correlated with changes in the 30 year fixed mortgage rate. In the last 4 months the discount rate has been reduced nearly 200 basis points, while 30 year fixed mortgage rates have fallen 18 basis points.

I have update my article showing the historical comparison of 30 year fixed mortgage rates and the federal funds rate. The chart shows the federal funds rate and the 30 year fixed rate mortgage rate from January 2000 through April 2008 (for more details see the article).

There is not a significant correlation between moves in federal funds rate and 30 year mortgage rates that can be used for those looking to determine short term (over a few days, weeks or months) moves in the 30 year fixed mortgage rates. For example if 30 year rates are at 6% and the federal reserve drops the federal funds rate 50 basis points that tells you little about what the 30 year rate will do. No matter how often those that should know better repeat the belief that there is such a correlation you can look at the actual data in the graph above to see that it is not the case.

Related: real estate articles – Affect of Fed Funds Rates Changes on Mortgage Rates – How Not to Convert Equity – more posts on financial literacy

Read more

Housing prices posted large declines over the last year. One important thing to keep in mind when looking at the recent results is how rare significant declines in housing prices have been. In general housing prices decline very little (less than 10% drops and normally less than 5%). Normally the turnover just decreases dramatically as people refuse to sell at lower prices and just stay in their house until prices recover. Housing Prices Post Record Declines:

Of those 20 metro areas, 17 posted their largest year-over-year declines ever. Ten of the 20 cities posted double-digit dips. The 10-city Case/Shiller index is down 13.6% year-over-year, the biggest drop since its launch in 1987

…

Prices in the Las Vegas metro area have plunged more than any other city, down 22.8% over the 12 months through February. Miami prices plummeted 21.7%. In Phoenix, they’ve fallen 20.8%. Of the 20 cities Case/Shiller tracks, only Charlotte, N.C. showed higher prices, up 1.5% over the 12-month period.

Other metro areas recorded only modest price declines, including Portland, Ore., down 2.0%, Seattle, off 2.7% and Dallas, 4.1%. In the nation’s largest city, New York, metro area prices dropped a modest 6.6%.

Related: Home Price Declines Exceeding 10% Seen for 20% of Housing Markets (Sep 2007) – How Not to Convert Equity – Housing Inventory Glut (Aug 2007) – Mortgage Defaults: Latest Woe for Housing (Feb 2007)

Home Prices Drop Most in Areas with Long Commute by Kathleen Schalch

The Washington, D.C., metropolitan area has been hit hard. Prices tumbled an average of 11 percent in the past year. That’s the big picture. But a look at Ashburn, Va., about 40 miles from the center of town, finds a steeper fall.

…

Jonathan Hill, vice president of Metropolitan Regional Information Systems, which tracks home sales, sat in his office recently, clicking through page after page of price data sorted by ZIP code. There were a lot of negative numbers, but not in places that are close in or near public transit.

…

David Stiff, chief economist for the company that produces the Case-Shiller Home Price Index, saw the trend in other cities, as well – including Los Angeles, San Francisco, New York, San Diego, Miami and Boston. Stiff recently matched home resale values against commute times and found that in most of these major metropolitan areas, the trend is the same. The longer the commute, the steeper the drop in prices.

Related: Urban Planning – How Walkable is Your Prospective Neighborhood – Exurbs Hardest Hit in Recent Housing Slump (Feb 2007)

It has long been the case that home owners refuse to accept falling prices and choose to demand higher prices than the market demands in a falling market. Therefore when prices should fall (to find buyers) instead the sales decrease as buyers don’t decrease prices to a level buyers are willing to pay. Be It Ever So Illogical: Homeowners Who Won’t Cut the Price

Three years ago, when the real estate bubble was still inflating, this sort of standoff was the exception. It’s the norm today. Overall home sales have fallen a remarkable 33 percent since the summer of 2005. Home prices, on the other hand, continued to rise until 2006 and are now only 5 to 10 percent below where they were in mid-2005, according to various measures.

How bad is the mortgage crisis going to get?

This interview of Paul Krugman is worth reading. And it does seem to me the magnitude of the mortgage crisis is very large and likely will result in national declines in home prices of over 15% from the peak. Which is a very large decline. And in local markets declines of 35% seem likely.

Related: Home Price Declines Exceeding 10% Seen for 20% of Housing Markets (Sep 2007) – Home Values and Rental Rates – Real Estate Median Prices Down 1.5% in the Last Year (Aug 2007) – Real Estate articles

The next shoe to drop in housing

…

Fannie and Freddie are demanding higher credit scores and charging higher rates for those who don’t have them. Until recently, a borrower with a 620 score might pay the same as one with a 680 score, said Victoria Bingham, chief executive with Pacific Rim Mortgage in Tigard, Ore.

But now that person might have to pay a half percentage point more. With today’s rates, that translates into 6.75% for a 30-year fixed-rate mortgage instead of 6.25%, or $74 more a month on a $225,000 loan, typical for her client base.

Borrowers must also put more money down, especially if they don’t have stellar credit. For instance, those with down payments of less than 5% need a credit score of at least 680, said Steven Plaisance, executive vice president of Arvest Mortgage Co. in Tulsa, Ok. Previously, he could make loans to people without big down payments if they had other strong points, such as stable employment.

Related: Federal Funds Rate and 30 Year Fixed Mortgage Rate – Mortgage Payments by Credit Score (Aug 2007) – learn about mortgage terms – Beginning of the End of Housing Bubble? – How Not to Convert Equity

Vacant Homes in U.S. Climb to Most Since 1970s With Ghost Towns

…

About 370,000 new homes are for sale because people who initially contracted to buy them backed out, according to estimates in a Feb. 15 report from analysts at New York-based CreditSights Inc. An additional 216,000 homes are under construction, according to Commerce Department data.

In January 1973, the number of finished new homes for sale was 97,000, when the U.S. population was about 212 million, according to the U.S. Census Bureau. In December 2007, 197,000 completed homes were on the market and in January 2008 there were 195,000. The current population is 303.5 million.

Home prices may fall at least 8 percent nationwide and by as much as 26 percent from the third quarter of 2007 before hitting bottom, according to a Feb. 13 report from New York- based Deutsche Bank AG analyst Karen Weaver, the firm’s global head of securitization research.

…

“The builders are looking for ways to accelerate sales and get inventory moving,”

The news certainly continues to be quite bad on the home front.

Related: Housing Inventory Glut (August 2007) – Home Price Declines Exceeding 10% Seen for 20% of Housing Markets – Ever Larger Houses – Exurbs Hardest Hit in Recent Housing Slump