Example 30 year mortgage rates (from myfico.com – see site for current rate estimates). We have posted twice on this previously – August 2007 – May 2007. Since then rates have decreased on 30 year fixed mortgages but jumbo rates have increased significantly.

| FICO score | APR May 2007 | APR Feb 2008 – regular | APR Feb 2008 – jumbo | payment/mo May 2007 | payment/mo Feb 2008 – regular | payment/mo Feb 2008 – jumbo |

|---|---|---|---|---|---|---|

| 760-850 | 5.86% | 5.53% | 6.61% | $2,362 | $2,278 | $4,476 |

| 700-759 | 6.08% | 5.75% | 6.83% | $2,419 | $2,525 | $4,579 |

| 660-699 | 6.37% | 6.04% | 7.12% | $2,493 | $2,335 | $4,713 |

| 620-659 | 7.18% | 6.85% | 7.93% | $2,709 | $2,620 | $4,373 |

| 580-619 | 8.82% | 9.22% | 9.40% | $3,167 | $3,282 | $5,834 |

| 500-579 | 9.68% | 10.20% | 10.37% | $3,416 | $3,568 | $6,336 |

Amounts shown for borrowing $400,000 and rates as of Feb 18th (and May 2007). Jumbo payments are based on $700,000. Previously I could see the assumptions on the site which were (but I see no details on the calculated amounts as of Feb 2008): For scores above 620, the APRs above assume a mortgage with 1.0 points and 80% Loan-to-Value Ratio. For scores below 620, these APRs assume a mortgage with 0 points and 60 to 80% Loan-to-Value Ratio.

Read more

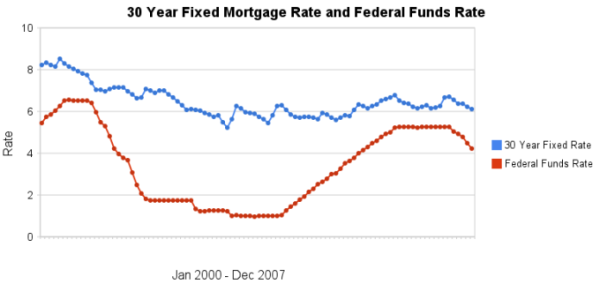

I have update my article showing the historical comparison of 30 year fixed mortgage rates and the federal funds rate. When deciding whether to lock in a rate for a 30 year fixed rate mortgage (when refinancing or buying a new home) some believe moves in the federal reserve discount rate will raise or lower that mortgage rate directly. This is not the case, in general. The effect of federal reserve discount rates on other mortgage rates (such as adjustable rate mortgages is not the same and can be predictably affected by fed fund rate moves).

The chart shows the federal funds rate and the 30 year fixed rate mortgage rate from January 2000 through December 2007 (for more details see the article).

There is not a significant correlation between moves in federal funds rate and 30 year mortgage rates that can be used for those looking to determine short term (over a few days, weeks or months) moves in the 30 year fixed mortgage rates. For example if 30 year rates are at 6% and the federal reserve drops the federal funds rate 50 basis points that tells you little about what the 30 year rate will do. No matter how often those that should know better repeat the belief that there is such a correlation you can look at the actual data in the graph above to see that it is not the case.

Read more

A house is where you live–not an investment

Very good point – as long as you fall into that category of living there until you die. True for some people but far from all. Also, even for those people, it is not a complete view of the financial situation.

A reverse mortgage will allow you to sell the house and get paid for the rest of the time you live there. So you can build up equity over 20,30,40 years and then take a reverse mortgage and get payments every month (based on your investing in your house). Reverse mortgages, like many financial tools, can be applied poorly and is I would guess unethical behavior related to them is fairly high (so be very careful!). If you think of such an option you need to do your research and actually understand what you are doing – you can’t afford to be like the many ignorant mortgagors. The AARP offers information on Reverse Mortgages.

Additionally, you lock in a large part of your housing cost (you still have maintenance and taxes but you do not have every increasing rent. Now ever increasing rent is not a certainty but for many it is very likely rent will go up on average over the long term. Ownership of your home removes the risk of being priced out of the area you want to live by increasing rental prices over time. You also lose the potential of benefiting if rent prices fall over time, but I would say the more valuable of those options is avoiding the risk of rising rental prices.

Related: How Not to Convert Equity – Housing Inventory Glut – articles on home ownership and real estate

Behind the Ever-Expanding American Dream House

Consider: Back in the 1950s and ’60s, people thought it was normal for a family to have one bathroom, or for two or three growing boys to share a bedroom. Well-off people summered in tiny beach cottages on Cape Cod or off the coast of California. Now, many of those cottages have been replaced with bigger houses. Six-room apartments in cities like New York or Chicago have been combined, because upper-middle-class people now think a six-room apartment is too small. Is it wealth? Is it greed? Or are there more subtle things going on?

This is extreme wealth. It is also part of the reason housing prices take an ever increasing multiple of median income. Basically people are buying two houses (not just one). Average square footage of single-family homes in the USA: 1950 – 983; 1970 – 1,500; 1990 – 2,080; 2004 – 2,349.

Related: mortgage terms defined – Trying to Keep up with the Jones – Too Much Stuff – Investing Search Engine

One way to evaluate the real estate market is to compare rental rates to home values. This can provide a comparison of an approximate cost of buying a house versus the cost to rent. As the ratio of monthly rent to home price increases, at least on this measure or real estate value, the market can be seen as becoming more expensive.

Several points to keep in mind:

- This does not take into account things like tax rates (in higher tax areas the rents will be higher [since the owners will pass on that cost that is not reflected in the home price] – the ratio lower)

- This is only a comparison measure – it can be that rents also experience a bubble. So if rents experience a bubble then the ratio could stay low and fail to indicate an “expensive” market.

- Don’t rely on one measure – this is one useful measure there are plenty of others that matter for real estate prices (income levels, job growth, interest rates, zoning regulations…)

The Rent-Price Ratio for the Aggregate Stock of Owner-Occupied Housing

likely would have to fall considerably.

This paper is well worth reading. I would like to point out another factor here though. When those investing in real estate were focused largely on capital gains (say a few years ago) there could well have been an increased demand for rental property (which increased prices). That effect also moved extra supply into the rental market (that previously would have been sold to owners that would live there instead of investors). Those investors were more concerned with capital gains and it seems to me could well have been willing to accept lower rents just to have some cash coming in to help pay the expenses.

As those investors no longer believe they will receive large capital gains in the short term it is possible they will be more focused on cash flow – and seek increased rents. I will not be surprised that rent prices increase as investors focus more on cash flow and stop assuming such large capital gains will be where their profits are made. Thus the ratio will close both by real estate value declines and rental price increases.

Related: Explaining Rent-Home Price Ratios – True Rent-to-Price Ratio for Housing – articles on the real estate market – Real Estate Median Prices Down 1.5% in the Last Year – Rent Controls are Unwise

Response to: The desirability of rent controls

I do not believe rent controls are wise, in general. There are some options I wouldn’t mind – some sort of affordable housing that has breaks from the government (tax…) in exchange for a commitment to keep rental rates down. But wholesale rent controls are very unwise I believe.

A related issue I find amusing. You will hear don’t regulate at all state that it is regulation preventing housing being constructed (zoning regulations) that create rising prices which they imply is unfair. It seems to me the data shows the opposite of what those people claim. People are willing to pay more for the regulated housing markets. That means the market forces value the regulation and in order to increase the economic utility (which is represented by what people will pay) more regulation should be used not less.

Related: articles on real estate investing – regulatory risk (for rent control that would be the risk that investment property rights were limited due to rent control)

London Leads the Biggest U.K. House-Price Drop for Five Years

…

Prices in the London region fell an average of 28,099 pounds on the month and all 32 areas of the capital in the survey had declines, led by the districts of Hackney, Tower Hamlets and Islington, Rightmove said. Home costs in Kensington and Chelsea, where Russian billionaire Roman Abramovich lives, fell 4.9 percent to 1.65 million pounds.

Related: Fourteen Fold Increase in 31 Years

Fed Plans To Curb Mortgage Excesses, way late but at least they may do something.

Yes the Fed should have taken more aggressive action. But the legislators should not throw stones at others – what have they done? A recent example – they want to lower the down payment required for FHA loans to 1.5%. I can’t take anyone’s opinion, of how others should have behaved seriously, when they vote for such legislation in the midst of a subprime mortgage loan crisis. What are these people thinking. Ok, everyone now says loan standards were to lax, people stopped putting 20% or even 10% down on home purchase. Ok, lets blame the Fed and then lower the down payment required for federal backed mortgages to 1.5% (from the already very low 3%). Did this crazy legislation just barely squeak by? Nope, passed the senate 93-1! Lets have the politicians explain what they have done right before they just criticize others. Their game of blaming others while doing next to nothing positive themselves is sad.

Another real voice of reason. The Mortgage Bankers Association (MBA) really expects anyone to pay any attention to their opinions. They have someone managed to create a threat to the economy so large that $90 a barrel oil is not the threat to the economy people are worried about. I think anyone that reads these opinions from the MBA and doesn’t see them as self serving statements and nothing else should be ashamed of themselves. Shouldn’t the Washington Post at least include some follow up question on why the public should listen to that organization. What was there senior vice president saying 5 years ago to ensure the economy wasn’t threatened by the reckless action of their members? We seem to have forgotten that individuals and organization should be held accountable for their actions. Quote some people that are not only concerned with their benefits without regard for what it does to everyone else. If that is not what they are doing, lets see 5 policy recommendations they have made in the last 5 years that are good for America and bad for you and your members. I don’t think the rest of us believe what is good for the MBA is good for America.

Related: Why do we Have a Federal Reserve Board? – Ignorance of Many Mortgage Holders – How Not to Convert Equity – Washington Paying Out Money it Doesn’t Have – Legislation to Address the Worst Credit Card Fee Abuse (Maybe) – Lobbyists Keep Tax Off Billion Dollar Private Equities Deals and On For Our Grandchildren

Double-digit home price drops coming

The survey attempted to identify the high and low points of housing prices in each of the markets, some of which started declining from their peak in the third quarter of 2005. All are median prices for single-family houses. Nationally, Moody’s is projecting an average price decline of 7.7 percent. That’s a jump from the 6.6 percent total price drop that the company was forecasting in June and more than twice that of last October’s forecast of a 3.6 percent price decrease.

This forecast appears to me to be from the absolute top to the bottom over the course of several years. That decline is now estimated to be over 10% for nearly 23% of the markets. The remaining 67% will decline less than 10% from the peaks or increase. There average price decline prediction (again from the top of the market to the bottom) nationwide is now 7.7% up from an estimate of 3.6% last year.

Some pretty amazing statistics are in this article – Homes entering foreclosure at record:

Serious delinquencies, those 90 days or more late, jumped to 1.11 percent of all loans, from 0.98 percent in the first quarter. The loans actually entering foreclosure proceedings stood at 0.65 percent, a rise from 0.58 percent in the first three months – and the highest rate in the MBA’s 55-year history.

This quote however is a bit misguided I think:

Stagnant home prices have not taken a toll on housing affordability. Yes people that put nothing down and took out mortgage where they could not pay the monthly payments and planned to just borrow even more from the house if the house price went up can’t afford it – but they couldn’t afford it in the first place.

Related: Learning About Mortgages – Mortgage Defaults: Latest Woe for Housing – Ignorance of Many Mortgage Holders – Median Housing Prices Down 1.5% in the Last Year – How Not to Convert Equity