The costs to employees for health insurance keep increasing, even as employers pay more also. A Premium Sucker Punch:

…

The Corporate Executive Board found in its survey that a quarter of officials from 350 large corporations said they had increased deductibles an average of 9 percent in 2008. But 30 percent of the employers said they expected to raise deductibles an average of 14 percent in 2009. Mercer, a global benefits consulting firm, surveyed nearly 2,000 large corporations in a representative poll and found that 44 percent planned to increase employee-paid portion of premiums in 2009, compared with 40 percent in 2008.

The economic slowdown, according to analysts, is making it more difficult for many employers to subsidize health care costs at previous levels. On average, experts say, benefit packages contain the biggest increases for workers since the recession of 2001. Workers’ health costs are rising much faster than wages.

…

Premiums for employer-sponsored plans over a decade on average have risen to $12,680 a year from $5,791, according to the Henry J. Kaiser Family Foundation. The median deductible for the plans was $1,000 in 2008, compared with $500 from 2001 to 2007, according to a survey of 2,900 employers conducted by Mercer.

The broken health care system in the USA has been a huge drain on the economy and people’s standard of living for decades. The longer we allow the system to decline (increasing costs, declining results) the more damage the economy suffers and the larger the costs to implementing fixes become.

Related: Personal Finance Basics: Long-term Care Insurance – Medical Debt Increases as Economy Declines – International Health Care System Performance – Many Experts Say Health-Care System Inefficient, Wasteful – posts on improving the health care system

How Should Parents Teach Teens About Credit Cards? by Nancy Trejos

…

there are prepaid cards targeted specifically at teens, such as the Visa Buxx card. With such a card, Bellamkonda would be able to log in and monitor his daughter’s spending online

…

Bill Hardekopf, chief executive of LowCards.com, said parents should pull out their own credit card bills and talk their children through them. Explain the interest rate, minimum payments, grace period and finance charges. If they’ve had late fees or payment problems, they shouldn’t hide them. “Use these as teaching examples,” he said. “Getting a teenager a credit card while she lives in your home is a great teaching opportunity on finances.”

I agree it is wise to explain the use of credit cards to teenagers. I also agree it is wise to have them actually use their own card, assuming they aren’t unreasonably immature and have shown an understanding of personal finance.

Books: Money Sense for Kids – Growing Money: A Complete Investing Guide for Kids – The Motley Fool Investment Guide for Teens – Raising Financially Fit Kids – A Smart Girl’s Guide to Money: How to Make It, Save It, And Spend It

Related: Teaching Children About Money Matters – Student Credit Cards – Majoring in Credit Card Debt

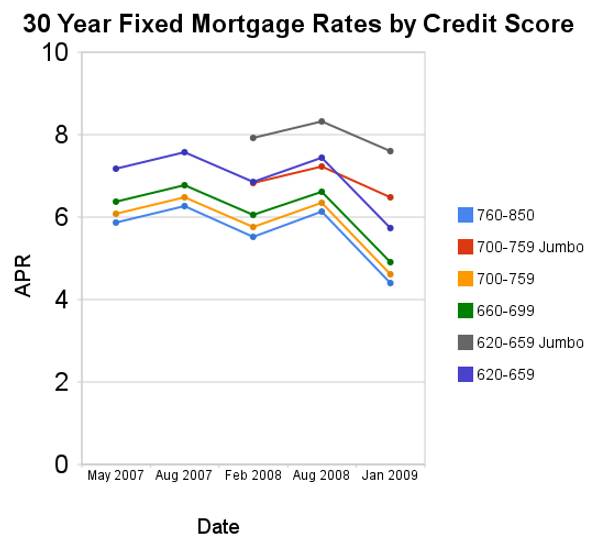

Since August of 2008 conforming mortgage rates are have declined a huge amount. Jumbo rates have fallen a large amount also, but much less (for example for a credit score of 700-759 the jumbo rates declined 73 basis points while the conventional rate declined 172 basis points.

For scores above 620, the APRs above assume a mortgage with 1 point and 80% Loan-to-Value Ratio. For scores below 620, these APRs assume a mortgage with 0 points and 60 to 80% Loan-to-Value Ratio. You can see, with these conditions the rate difference between a credit score of 660 and 800 is not large (remember this is with 20% down-payment) and has not changed much (the difference between the rates if fairly consistent).

Related: Low Mortgage Rates Not Available to Everyone – 30 Year Fixed Rate Mortgage Rate Data – Real Free Credit Report (in USA) – Jumbo Mortgage Shoppers Get Little Relief From Rates – posts on mortgages

Read more

Consumer Credit Falls By Record Amount in November

This is good news. People need to stop spending money they don’t have. I understand perfectly well this means that spending will go down (which will likely lead to reduced economic output – though technically it doesn’t have to, a reduction in imported goods could more than offset the reduced spending and GDP would not decline). Living beyond your means is not a good thing. We should hope that consumer debt continues to decrease. If that means we have some suffering today to pay for living beyond our means for years the “fix” is not to continue to live beyond our means. The “fix” is to accept the consequences of past behavior and build a more sustainable economy now for the future.

Ideally this decrease can be someone gradual, abrupt changes in the economy often cause problems, but far too many economists and policy makers only care about today and the next 6 months. They have been living this way for decades. And it is not sustainable. Consumer debt levels in the USA are far too high. The UK has an even worse personal debt problem. They should come down. Reducing those levels is good for the individuals involved (they gain most of the benefit) and also for the health of the economy (though it does decrease the current economy a bit while making the foundation for future economy much stronger).

Read more

According to the FDIC study of bank overdraft programs during 2007, 75% of banks automatically enrolled customers in automated overdraft programs (which charge high fees). By contrast, 95% of banks treated linked-account programs as opt-in programs, requiring that customers affirmatively request to have accounts link (which are normally do not charge customers high fees).

Fees assessed for linked-account and overdraft LOC programs were typically lower than for automated overdraft programs. Almost half of the banks with linked-account programs (48.9 percent) reported charging no explicit fees for the service. The most common fee associated with linked-account programs was a transfer fee; where charged, the median transfer fee was $5.

There really is no excuse (other than trying to gouge your “customers”) for these fee levels. Charging any money to just move money from a customers saving account to checking account is just making it obvious the bank doesn’t want to serve the bank wants to take money from you. The banks in the sample used by FDIC earned an estimated $1.97 billion in NSF-related fees in 2006, representing 74 percent of the $2.66 billion in service charges on deposit accounts reported by these banks.

A small fee when lending the customer money may be justified but the banks seem to just operate in order to have a big pool of people to catch them with big fees. The model seems to be if we get more “customers” we can catch more of them with one fee or another. It is not an honorable business model to try and catch your customers with huge fees for minor items.

Make sure you have a free linked-account overdraft protection that will tap your saving account if your checking account falls below 0. If they don’t have such a free program, choose a bank or credit union that does. Also an overdraft line of credit might be wise. If the fee is more than $10, go somewhere where they are not so greedy. You also will owe interest on your borrowings (probably a ludicrously high interest rate).

Related: Don’t Let the Credit Card Companies Play You for a Fool – 10 Things Your Bank Won’t Tell You – Hidden Credit Card Fees – FDIC Limit Raised to $250,000

I don’t believe you should carry credit card debt at all. See my tips on using credit cards effectively. And you should have an emergency fund to pay at least 6 months of expenses to tap before using credit card debt. But if you do have debt and you are in such a bad personal financial situation where you will not be able to pay back what you have borrowed this might be useful information: Credit Card Companies Willing to Deal Over Debt

So lenders and their collectors are rushing to round up what money they can before things get worse, even if that means forgiving part of some borrowers’ debts. Increasingly, they are stretching out payments and accepting dimes, if not pennies, on the dollar as payment in full.

…

Lenders are not being charitable. They are simply trying to protect themselves. Banks and card companies are bracing for a wave of defaults on credit card debt in early 2009, and they are vying with each other to get paid first.

…

Card companies will offer loan modifications only to people who meet certain criteria. Most customers must be delinquent for 90 days or longer. Other considerations include the borrower’s income, existing bank relationships and a credit record that suggests missing a payment is an exception rather than the rule.

While a deal may help avoid credit card cancellation or bankruptcy, it will also lead to a sharp drop in the borrower’s credit score for as long as seven years, making it far more difficult and expensive to obtain new loans. The average consumer’s score will fall 70 to 130 points, on a scale where the strongest borrowers register 700 or more.

This is only an option to minimize a big mistake that results in you finding your self in a very bad situation. The credit card companies are not charities or known for giving away money. They are only going to do this when they figure they won’t get the full amount they are owed and figure getting some is the best they can hope for.

Related: Americans are Drowning in Debt – Families Shouldn’t Finance Everyday Purchases on Credit – Don’t Let the Credit Card Companies Play You for a Fool – Hidden Credit Card Fees

Retirement Myths and Realities provides some ideas from former Boeing President, Henry Hebeler:

…

My father used to tell me to save 10 percent of my wages all the time for retirement. And so I did. I never looked at any retirement plan; we didn’t have retirement planning tools in those days.

…

I think the number is closer to 15 (percent) to 20 percent — that’s from the time when you’re a relatively young person, say, 30 years old or something like that.

…

A retiree’s inflation rate is about 0.2 percent higher than the normal Consumer Price Index. When you retire, you have medical expenses that continually increase. You have more need for this service and the unit cost is increasing much faster than inflation.

…

Now, if you’re going to retire at 80 years old, you could actually have a bigger number than 4 percent. If you’re going to retire around 65 or so, 4 percent is not a bad number. Some people are now saying 3.5 percent instead of 4 percent. If you’re going to retire at 55, you’d better spend a lot less than 4 percent because you’ve got another 10 years of life that you’re going to have to support.

He makes some interesting points. I agree it is very important for people to become financially literate and take the time to understand their retirement plans. Just hoping it will work out or trusting that just doing what someone told you are very bad ideas. You need to educate yourself and learn about financing your retirement.

I am not really convinced by his idea that you need to start saving 15-20% for retirement at age 30. But that is a decision each person has to make for themselves. Of course there are many factors including how much risk you are willing to accept, when you plan on retiring, what standard of living you want in retirement…

Related: How Much Retirement Income? – posts on retirement – Saving for Retirement – Our Only Hope: Retiring Later

More Insurers Raise Fees on Variable Annuities

As SmartMoney has reported, this is one way that annuities are failing to live up to their big promises. The guarantees attached to the products – minimum returns of 6% per year or better, market upside, no chance of loss and a lifetime income stream – were designed to attract people in retirement or close to it.

And it worked, attracting $650 billion in assets in the last five years. But the guarantees are only as good as the insurance company’s ability to hedge them, and even when the markets were rising, some insurance company executives admitted their strategies hadn’t been tested by real-life crisis conditions. Now some estimates suggest that hedging costs have doubled in the last year, and insurers are passing those costs along to their customers.

…

For example, an investor might purchase a $100,000 annuity that pays a guaranteed 6% annual return for 10 years, or market returns — whichever is better. The fees for a product like that might look something like this:

- 1.3% annually on the current balance to cover the underlying investment

- 1% annually on the current balance for the insurance wrapper (called the mortality and expense charge)

- 1% of the original purchase price to cover the guarantee

The fees now rising are all in that last category — charges that cover guarantees. At the Hartford, the fees of three different kinds of guarantees are rising, from the current charge of 0.35% to 0.75%.

In general I am not inclined to insurance investment products. They are frequently overloaded with fees. Annuities can provide some balance in retirement, so annuitizing a portion of assets at retirement may be reasonable. But I would not use insurance investment products for a significant portion of my retirement assets.

Related: Personal Finance: Long-term Care Insurance – Many Retirees Face Prospect of Outliving Savings – Investor Protection Needed – Retirement Tips from TIAA CREF

We now have the lowest 30 year fixed mortgage rates since data has been collected (37 years) in the USA. Is this due to the Fed cutting the discount rate? I do not think so. As I have said previously 30 year fixed rates are not correlated with federal reserve rates. But this time the government is actively seeking to reduce mortgage rates.

Mortgage Rate Hits 37-Year Low

…

The 15-year fixed-rate mortgage averaged 4.92%, down from last week when it averaged 5.20%. A year ago the 15-year loan averaged 5.79%. The 15-year mortgage hasn’t been lower since April 1, 2004, when it averaged 4.84%.

Homeowners refinance, put savings under mattress

These rates sure are fantastic if you are in the market. I was not in the market, but I am considering re-financing now. You need to be careful and not just withdraw money because you can. If you can refinance and reduce your payments it may well be a wise move though. One problem can be extending the date you will finally be free of mortgage debt. If you re-finance a current 30 year loan, that you got 5 years ago, you will now be paying 5 more years. One option is to see if you can get a 25 or 20 year loan. Or if you can make a 15 year loan work, do that (15 and 30 year fixed rate mortgages are common).

Read more

The economy (in the USA and worldwide) continues to struggle and the prospects for 2009 do not look good. My guess is that the economy in 2009 will be poor. If we are lucky, we will be improving in the fall of 2009, but that may not happen. But what does that mean for how to invest now?

I would guess that the stock market (in the USA) will be lower 12 months from now. But I am far from certain, of that guess. I have been buying some stocks over the last few months. I just increased my contributions to my 401(k) by about 50% (funded by a portion of my raise). I changed the distribution of my future contributions in my 401(k) (I left the existing investments as they were).

My contributions are now going to 100% stock investments (if I were close to retirement I would not do this). I had been investing 25% in real estate. I also moved into a bit more international stocks from just USA stocks. I would be perfectly fine continuing to the 25% in real estate, my reason for switching was more that I wanted to buy more stocks (not that I want to avoid the real estate). The real estate funds have declined less than 3% this year. I wouldn’t be surprised for it to fall more next year but my real reason for shifting contributions to stocks is I really like the long term prospects at the current level of the stock market (both globally and in the USA). The short term I am much less optimistic about – obviously.

I will also fully fund my Roth IRA for 2009, in January. I plan to buy a bit more Amazon (AMZN) and Templeton Emerging Market Fund (EMF). And will likely buy a bit of Danaher (DHR) or PetroChina (PTR) with the remaining cash.

Related: 401(k)s are a Great Way to Save for Retirement – Lazy Portfolio Results – Starting Retirement Account Allocations for Someone Under 40