I have made some additional loans through Kiva, $250 for 5 loans in: Nicaragua, Ghana, Viet Nam, Togo and Tanzania. I have now made 37 loans for a total of $1,775. 5 loans of $250 have been paid back (and I relent the proceeds). Kiva says 5.64% are delinquent. While they show my delinquency rate they don’t show me which loans are delinquent. Frankly I think that figure may be in error (maybe it is counting one that was delinquent but is not now – see next paragraph). In any event all loans appear to have been paid off in full on time or are being paid in full now on time.

In any event no loans are in default. One loan in Kenya for bike repair shop (that for whatever reason I especially liked) and did connect me more to the troubles in Kenya recently. Kiva mentioned many banks were having trouble keeping in touch with clients as many people fled violence. For two months there was no activity then there was a payment for 3 full months. I was happy when a new payment came in, not for the money being repaid (which shows again that my aim with this money is not a return for me but to provide opportunities to entrepreneurs), but for confirmation he was doing well.

Photo of Cesar Augusto Santamaría Escoto in his welding workshop, Chinandega, Nicaragua.

If you have a Kiva page, let me know and I will add a link to it on the Curious Cat Kivans page.

Related: Provide a Helping Hand – Microfinancing Entrepreneurs – Entrepreneurship posts on the Curious Cat Science and Engineering blog

The USA stock market has not been doing so well recently (the S&P 500 index is down over 9% so far this year). And I own S&P 500 indexes in my retirement account (in addition to other index funds). So I am losing money on those investments but I am not worried. It is possible the market will do very poorly over the next few months, year… if the economy struggles (and with the huge credit card like spending Washington much of the last 30 years and huge increases in gas prices that is certainly possible). But I am not worried.

I don’t plan on using that money for decades. Therefore the short term declines really have no impact on my life. Sure if I was able to move all that money into a money market fund for the decline and then move it back into stock funds for the increase that would be wonderful. But I can’t and no-one has proven to be able to time the market effectively over the long term. It is unlikely you or I will be the ones that do it right. I wouldn’t be surprised if the market was lower at the end of the year, but I wouldn’t be surprised if it was higher either.

Dollar cost averaging is the best long term strategy (not trying to time the market). And using that strategy, if you assume stocks reach whatever level they do say 20 years from now, I am actually better off will prices falling now – so I can buy more shares now that will reach that final price. You actually are better off with wild swings in stock prices, when you dollar cost average, than if they just went up .8% every single month (if both ended with stocks at the same price 20 years later). Really the wilder the better (the limit is essentially the limit at which the economy was harmed by the wild swings (people deciding they didn’t want to take risk, make investments…) to the point that the final value 20 years later is deflated.

Read more

With the drastic increases in food prices recently a home garden an attractive way to save some money. I have planted a garden for several years. Frankly the main reasons I did so had nothing to do with money. I find it cool to plant a seed or small plant and then just water it occasionally and then be able to eat. Plus it is great to just go grab some fresh food and eat it. It tastes great and is healthy.

The increasing price of food it makes it more attractive. I plant a few tomato plants and some pepper and cucumber plants. And then some pea and beans from seed (and I did celery this year – though I didn’t realize I was suppose to start them inside 10 weeks early so we will see what happens). I think my total cost was under $30. I would guess all the water I use will be under $5. From that I will get 10+ weeks many tomatoes and green peppers, sweet peppers, hot peppers. The cucumbers and and peas don’t seem to produce as long (if I remember right from last year). I am trying to plant some peas from seeds every couple of weeks and see if that works to give me peas for a longer period this year.

I also have a bunch of berries. I have wineberries that just grew themselves (which started as 1 plant 3 years ago and now covers maybe 20 square feet) which are the best thing of all from my garden, frankly (I have never been able to buy any berries nearly as good). And I bought a small blackberry plant 2 years ago which has grown to be quite productive. Last year I had birds eating so many berries I hardly got any. The previous 2 years I could get more than I could eat for several weeks and enough to eat for maybe 4 more weeks total. Any advice on how to keep birds away?

Even while there are some financial benefits I really think the good healthy food and fun is more important.

Related: Backyard Wildlife: Raptor – Food Price Inflation is Quite High – Backyard Wildlife: Fox – Backyard Wildlife: Turtle

This post is included in the Carnival of Personal Finance #157: Third Anniversary Edition

Foreclosure Filings Continue to Rise

…

last week the Mortgage Bankers Association reported that about 2.47 percent of home mortgages were in foreclosure during the first quarter of the year, almost double the 1.28 percent rate of a year earlier, and the highest point since the group began compiling such figures in 1979. A Credit Suisse report this spring predicted that 6.5 million loans will fall into foreclosure over the next five years, reaching more than 8 percent of all U.S. homes.

There numbers really are astounding. How lame were the decisions of banks and mortgagees that nearly 1 in 40 mortgages are in default (and that number likely increasing in the next year to much more?

Related: Homes Entering Foreclosure at Record (Sep 2007) – Homes Entering Foreclosure at Record – Ignorance of Many Mortgage Holders

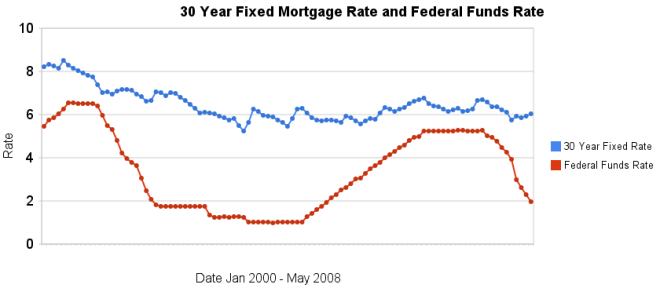

This year, the average discount rate has fallen every month while the average 30 year mortgage rate has climbed all but 1 month (a 5 basis point drop). In January, 2008 the discount rate averaged 3.94% and 30 year conventional fixed rate mortgages averaged 5.76%. In May, 2008 the discount rate had fallen to 1.98% (for a 196 basis point drop) and 30 year conventional fixed rates had risen to 6.04% (for a 28 basis point increase).

The chart shows the federal funds rate and the 30 year conventional fixed rate mortgage rate from January 2000 through May 2008 (for more details see: historical comparison of 30 year fixed mortgage rates and the federal funds rate).

Related: Affect of Fed Funds Rates Changes on Mortgage Rates – real estate articles – Bond Yields 2005-2008 – Jumbo and Regular Mortgage Rates By Credit Score

Read more

Graduates should put off living large after college

The key, experts say, is a simple one: Live like a poor college student for a couple more years. While you’re doing that, you can pay off your debt, start a savings plan and embrace healthy habits that will serve you well for life.

This is exactly what I did. Outside of paying for college, extra living expenses in college were small. Just retaining the spending habit of college gets your personal finances off on a good start.

Patty Procrastinator lives a little better when she first gets out of college and doesn’t start saving in the 401(k) until she’s 32. From that point, she also saves $500 a month, her employer adds $250 a month, and she earns a 9% return — just like Sallie. But at age 65, Patty will have only $1.7 million. That decade of delay will cost Patty $2.4 million.

Incidentally, Sallie contributes from her own money just $60,000 more than Patty does. The rest of the difference comes from employer contributions and investment returns.

By immediately starting to save for retirement and other needs you create a great foundation for your finances. Start saving for a house, a new car, create an emergency fund… Then you can create a situation where the only loans you need to take are for a house and maybe a new car – avoiding credit card debt or other personal loans.

Related: Personal Finance Basics: Health Insurance – Initial Retirement Account Allocations – Why Americans Are Going Broke

Squeezed by credit card companies

Over-the-limit fees aren’t the only tactic in the credit card companies’ bag of tricks. There are a slew of penalties, fees and other billing practices that can cause consumers to find themselves drowning in debt.

…

But even borrowers who pay their bills on time can fall victim to deceptive practices used by the card issuers and get slammed with rising interest and hidden fees, which have become the industry norm in recent years.

…

many banks calculate finance charges using what’s called double-cycle billing, a confusing practice that averages out the balance from your previous two bills. So if you carry a balance and pay a finance charge one month, you’ll get hit with a finance charge on your next bill as well, even if you’ve paid off the balance.

Then, there’s a practice known as “trailing interest” – another “gotcha” to watch out for, Arnold said. If you send in a payment according to the full amount on your statement, you may find that you still owe a small balance next month. That’s because you accrued interest between the time you sent the payment and when it was posted to your account.

As previous posts have pointed out you really need to keep your eye on your credit card company as though they will trick you out of your money given any chance to do so.

Related: Don’t Let the Credit Card Companies Play You for a Fool – Managing Your Credit Card Successfully – Sneaky Credit Card Fees – Legislation to Address the Worst Credit Card Fee Abuse, Hopefully

Payday lenders likely doomed in Ohio. Good.

The Senate was unable to find a compromise that both satisfied payday lenders and eliminated the debt trap that bill supporters said forced too many borrowers to take out new loans to pay for old ones. So it did what the House did last month: dropped the hammer.

“I think everybody said there is just no way to redeem this product. It’s fundamentally flawed,” Bill Faith, a leader of the Ohio Coalition for Responsible Lending, said of the twoweek loans. The industry “drew a line in the sand, and the legislature kicked the line aside and said we’re done with this toxic product.”

House Bill 545 would slash the annualized interest rate charged by payday lenders from 391 percent to 28 percent, prohibit loan terms of less than 31 days and limit borrowers to four loans per year. It also would ban online payday lending.

Yes in a small number of cases payday loans are helpful. In the vast majority of cases they harm citizens and the economic well being of society. Legislators should act to fix practices that harm the economy.

Assessing how much further house prices are likely to fall gets even trickier. One route is to look at market expectations: investors expect a further 20% drop, judging by the prices of futures contracts linked to the Case-Shiller 10 city index. But the futures market is small and illiquid and may overstate the possible declines.

…

Using a model that ties house prices to disposable incomes and long-term interest rates, analysts at Goldman Sachs reckon that the correction in national house prices is only halfway through. They expect an 18-20% correction overall, or another 11-13% decline from today’s levels. But their models suggest that six states – Arizona, Florida, Virginia, Maryland, California and New Jersey, could see further price declines of 25% or more.

Optimists dispute this gloomy assessment, pointing out that some measures of housing affordability have dramatically improved. According to NAR figures, monthly payments on a typical house with a 30-year mortgage and 20% downpayment were 18.5% of the median family’s income in February, down from almost 26% at the peak – and close to the historical average. But this measure of affordability is misleading, not least because credit standards have tightened so much.

…

Given the typical pace of rental growth, Mr Feroli reckons house prices (as measured by the Case-Shiller index) need to fall by 10-15% over the next year and a half for the rent/price yield to return to its historical average.

Actually predicting the where the declines will stop is very difficult. But this articles provides some very good thoughts on what the future holds. While things may not go as those quoted guess their guesses seem pretty reasonable and the explanations make sense.

Related: Home Values and Rental Rates – Housing Prices Post Record Declines – Housing Inventory Glut – mortgage terms

Singapore’s Social Entrepreneur Diana Saw makes things Bloom in Cambodia

The decision was swift as it was simple: move to Cambodia to provide jobs for poor women. I first

visited Phnom Penh in April 2006 and was back the next month to look for a house.

…

I approached the job placement arm of an NGO in Phnom Penh (PP). There are many NGOs who train poor Cambodians, but what this country needs is jobs. You can train people all you like, but if no one employs them, you’ll have frustrated skilled people who are unable to use their

skills.

…

Bloom has a savings plan for staff. Every month staff are encouraged to put away a percentage of their income which goes towards buying a sewing machine. Bloom will then subsidize the cost of the machine. With the machine, workers will be able to become small business owners, supplying bags not only to Bloom, but to other sellers, like small shops in the tourist markets.

Related: Bloom Bags Blog – Using Capitalism to Make the World Better – Make the World a Better Place – Kiva – Provide a Helping Hand – Aim for everybody to gain: workers, customers, suppliers, shareholders… – Obscene CEO Pay

- We believe in the right of all people to a decent life, free of poverty, and with access to education

- We believe you can be rich by helping the poor