Predatory Lenders’ Partner in Crime by Eliot Spitzer

In 2003, during the height of the predatory lending crisis, the OCC invoked a clause from the 1863 National Bank Act to issue formal opinions preempting all state predatory lending laws, thereby rendering them inoperative. The OCC also promulgated new rules that prevented states from enforcing any of their own consumer protection laws against national banks. The federal government’s actions were so egregious and so unprecedented that all 50 state attorneys general, and all 50 state banking superintendents, actively fought the new rules.

But the unanimous opposition of the 50 states did not deter, or even slow, the Bush administration in its goal of protecting the banks. In fact, when my office opened an investigation of possible discrimination in mortgage lending by a number of banks, the OCC filed a federal lawsuit to stop the investigation.

It is unfortunate when the federal government chooses to strip states of the ability to protect citizens.

Related: Credit Freeze Stops Identity Theft Cold – Investor Protection Needed

The title of a recent article asks: Are you a sucker to invest in a 401(k)? The answer is an emphatic: No.

But what if instead you had bought that tax-efficient stock fund outside your plan? Wouldn’t your tax bill be lower? Yes, but that’s the wrong way to look at it. If you skip your 401(k) in favor of a taxable account, you must first shell out taxes on that $10,000, which leaves you with just $7,200 to invest (assuming the same 28% bracket).

Plus, over the next 20 years, you’ll have taxes on any dividends and gains the fund pays out. Even though you will get a lower 15% rate on your gains when you sell, you end up with $28,950, or about $4,600 less than with the 401(k). A tinier final tax bill can’t make up for having to pay taxes all along.

This is a very good short simple personal finance article. It explains an issue that might be tricky for some to understand. Those that read it can learn more about personal finance. And it has several points – some of which, I can imagine, might be hard for some to understand. But it does a good job of explaining things simply. And a few points, made well in the article, are often overlooked or under-appreciated:

tax rates will go up – we are passing higher taxes onto the future by not paying our bills now

the tax deferral is a huge benefit – often minimized when people discuss the benefits of IRAs

401(k) employer matches are another huge benefit

As I have said before, learning about personal finance is a long term effort. If you don’t understand everything in an article that is fine, over the years you want to learn more and more. Hopefully this is a useful step on that journey.

Related:

Roth IRAs a Smart bet for Younger Set – Saving for Retirement

Example 30 year mortgage rates (from myfico.com – see site for current rate estimates). We have posted twice on this previously – August 2007 – May 2007. Since then rates have decreased on 30 year fixed mortgages but jumbo rates have increased significantly.

| FICO score | APR May 2007 | APR Feb 2008 – regular | APR Feb 2008 – jumbo | payment/mo May 2007 | payment/mo Feb 2008 – regular | payment/mo Feb 2008 – jumbo |

|---|---|---|---|---|---|---|

| 760-850 | 5.86% | 5.53% | 6.61% | $2,362 | $2,278 | $4,476 |

| 700-759 | 6.08% | 5.75% | 6.83% | $2,419 | $2,525 | $4,579 |

| 660-699 | 6.37% | 6.04% | 7.12% | $2,493 | $2,335 | $4,713 |

| 620-659 | 7.18% | 6.85% | 7.93% | $2,709 | $2,620 | $4,373 |

| 580-619 | 8.82% | 9.22% | 9.40% | $3,167 | $3,282 | $5,834 |

| 500-579 | 9.68% | 10.20% | 10.37% | $3,416 | $3,568 | $6,336 |

Amounts shown for borrowing $400,000 and rates as of Feb 18th (and May 2007). Jumbo payments are based on $700,000. Previously I could see the assumptions on the site which were (but I see no details on the calculated amounts as of Feb 2008): For scores above 620, the APRs above assume a mortgage with 1.0 points and 80% Loan-to-Value Ratio. For scores below 620, these APRs assume a mortgage with 0 points and 60 to 80% Loan-to-Value Ratio.

Read more

The use of sneaky fees by service companies is growing

In early February, United Airlines began to charge customers $25 for an extra bag. Some rental car companies charge an airport concession fee if the lot is conveniently located near the airport. A hotel in Las Vegas now bills customers for any item they take out of the minibar for more than 60 seconds, even if it is not consumed. Some bank gift cards lose part of their value if not used by a certain date.

…

banks collect up to a 3 percent processing fee for third-party credit transactions. Most of that 3 percent is called the “interchange fee.” That fee has outraged merchants in continental Europe, where credit card use is sparse and consumers are accustomed to debit cards. In December the European Commission won a case against Mastercard that requires it to eliminate interchange fees within the next six months.

As I have mentioned before the problems of bad practices by financial companies and the unfortunate truth that they force you to be on guard against them tricking you and taking your money. The Curious Cat credit card tips page provides advice on how not to get tricked by credit card companies into paying big fees along with some other tips.

It a shame financial companies don’t seem to believe in providing an honest service and making a profit as part of provide good value. Instead you have to watch them with the belief they will take you money if they can trick you (through hidden fees, misleading ads…). And it is sad other companies are expanding such anti-customer methods to other markets.

Related: Credit Card Currency Conversion Costs – Bad Practice: .05% Interest – Customer Hostility from Discover Card – Challenge Those Credit Fees

My friend, Sean Stickle and his wife, Jill Foster, were featured in a Washington Post article today on finances of couples: I Do, but You Don’t:

…

In January 2006, they had an epiphany. Despite having declared saving for retirement as their priority, they spent $11,000 on restaurant meals the previous year. “We were living a contradiction,” Foster said. Foster became even more of a strict financial manager. She started using Quicken to keep track of all their expenditures. She made sure 12 percent of their income went toward retirement. She cut their restaurant budget to $1,500 a year.

Related: I Want My Coffee – Backyard Wildlife-Raptor – Retirement Savings Survey Results – Get Your Own Science Art – Malcolm Gladwell and Synchronicity

One of the most important financial moves you can make is to start investing for your retirement early. This post is directed at those in the USA (but you can adjust the ideas for your particular situation). Retirement accounts with tax free growth, tax deferred growth and/or even tax deductible contributions can add to the benefits of such an investment. And matching by your company can give you an immediate return or 100% or 50% or some other amount. With 100% matching if you invest $2,000 your company adds $2,000 to your retirement account. For 50% they would add $1,000 in the event you added $2,000.

In other posts I will cover some of the other details involved but some people can be confused just by what investment options to chose. Normally you will have a limited choice of mutual funds. Hopefully you will have a good family of funds to choose from such as Vanguard, TIAA-CREF, American, Franklin-Templeton, T.Rowe Price etc.). If so, the most important thing is really just to get started adding money. The details of how you allocate the investment is secondary to that.

So once you have made the decision to save for your retirement what allocation makes sense? Well diversification is a valuable strategy. Some options you will likely have include S&P 500 index fund, Russel 5000 (total market index – or some such), small cap growth, international stocks, money market fund, bond fund and perhaps international bonds, short term bonds, specialty funds (health care, natural resources) long term bonds, real estate trusts…

Just to get a simple idea of what might make sense when you are starting out and under 40 and don’t have other substantial assets in any of these areas (large mutual fund holdings, your own house, investment real estate…) this is an allocation I think is reasonable (but don’t take my word for it go read what other say and then make your own decisions):

25% Total stock market index (~Wilshire 5000)

25% international stocks

20% small cap stocks

10% real estate

10% high quality short term bonds in a Euros, Yen…

10% short term bonds (or money market)

Read more

Why you don’t need an extended warranty, Consumer Reports:

– Some repairs are covered by the standard manufacturer warranty that comes with the product

– Products seldom break within the extended-warranty window–after the standard warranty has expired but within the typical two to three years of purchase–our data show.

– When electronics and appliances do break, the repairs, on average, cost about the same as an extended warranty.

Related: Save Money on AV Cables – Shop Around for Drugs – Real Free Credit Report

I would say why Americans are going broke is pretty simple: they buy loads of stuff they can’t afford and don’t need. And the political leaders promote this get another credit card mentality of “budgeting”. This stuff is not that tricky. Don’t borrow what you can’t afford. Save money. Don’t buy frivolous stuff that you can’t afford and don’t really provide you value.

Related: USA Federal Debt Now $516,348 Per Household – Saving for Retirement – Financial Illiteracy Credit Trap – Earn more, spend more, want more

Carnival of Personal Finance #137 includes our post: Your Home as an Investment. Some great links in the carnival:

how much should you save for retirement? – “Assuming 8% growth annually, I’ll need to contribute about 20% of my current salary every year.” (a bit high I think…)

How to “only” yourself to death – “Some quick Excel work tells me that by cutting out and cutting back we dropped our ‘only-ies’ from $316 per month to $191 per month (and a lot of that is cell phone). That’s a 39% monthly savings or $1,500 a year back in our pocket.”

10 Tips for First time Apartment Renters – “you should be paying 1/3 of your gross income, so if you make $5,000 per month before taxes, your rent should not be more than $1,666″

Related: saving for retirement

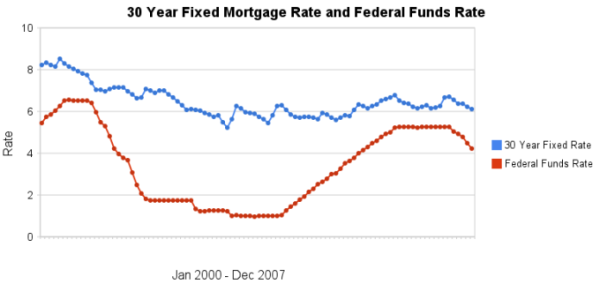

I have update my article showing the historical comparison of 30 year fixed mortgage rates and the federal funds rate. When deciding whether to lock in a rate for a 30 year fixed rate mortgage (when refinancing or buying a new home) some believe moves in the federal reserve discount rate will raise or lower that mortgage rate directly. This is not the case, in general. The effect of federal reserve discount rates on other mortgage rates (such as adjustable rate mortgages is not the same and can be predictably affected by fed fund rate moves).

The chart shows the federal funds rate and the 30 year fixed rate mortgage rate from January 2000 through December 2007 (for more details see the article).

There is not a significant correlation between moves in federal funds rate and 30 year mortgage rates that can be used for those looking to determine short term (over a few days, weeks or months) moves in the 30 year fixed mortgage rates. For example if 30 year rates are at 6% and the federal reserve drops the federal funds rate 50 basis points that tells you little about what the 30 year rate will do. No matter how often those that should know better repeat the belief that there is such a correlation you can look at the actual data in the graph above to see that it is not the case.

Read more