…

We’ve come to pay good money–two or three or four times the cost of gasoline–for a product we have always gotten, and can still get, for free, from taps in our homes.

…

In San Francisco, the municipal water comes from inside Yosemite National Park. It’s so good the EPA doesn’t require San Francisco to filter it. If you bought and drank a bottle of Evian, you could refill that bottle once a day for 10 years, 5 months, and 21 days with San Francisco tap water before that water would cost $1.35. Put another way, if the water we use at home cost what even cheap bottled water costs, our monthly water bills would run $9,000.

Taste, of course, is highly personal. New Yorkers excepted, Americans love to belittle the quality of their tap water. But in blind taste tests, with waters at equal temperatures, presented in identical glasses, ordinary people can rarely distinguish between tap water, springwater, and luxury waters.

In addition to throwing your money away the damage done to the environment to package and transport water all over the globe instead of just using your tap to get local water is immense. Stop be so naive and buying products like Evian (not what that is spelled backwards?).

Business Week has an article on Microfinance Draws Mega Players on how investment banks are getting into microfinance. I must admit that while I certainly am happy if the market can get involved in making microfinance aid development I think it might be better suited to non-profit, foundations and charities. I am happy to continue to fund organizations like Trickle Up to help people help themselves.

Kiva is another interesting organization that lets you loan directly to an entrepreneur of your choice. If fact, I have just placed $350 in loans to 5 business entrepreneurs (in Kenya, Mexico, Cameroon and Azerbaijan) – and a $50 donation to Kiva. Kiva provides loans through partners (operating in the countries) to the entrepreneurs. Those partners do charge the entrepreneurs interest (to fund the operations of the lending partner). Kiva pays the principle back to you but does not pay interest. And if the entrepreneur defaults then you do not get your interest paid back (in other words you lose the money you loaned). I plan to just recycle repaid loans to other entrepreneurs.

Add a comment with a link to your Kiva page and I will add a page to this site with links to all Curious Cat blog readers with a link to Kiva pages.

Related: Microfinance article from the New Yorker – Kiva: Microfinance Loans (posted on Christmas day 2006) – helping people succeed economically

Read more

The merger condition required they offer the price point for 2.5 years. Unfortunately it appears it didn’t require that AT&T actually tell anyone about it.

So you can get discount DSL, if you live in the service area, and can figure out how to get the company to allow you to get the price they proposed to the court to bolster their case for merger approval. It sure would be nice if you could deal with companies that didn’t seem to have teams of lawyers kept busy trying to figure out how to say one thing while tricking customers out of as much money as possible. It seems to me we are getting less and less ethical. We just accept that companies are going to try and trick customers into paying as much as possible. My belief that you should just provide an honest service or product at a fair price seems to be some quaint old idea ![]() But since that seems to be the case you have to treat companies as though they are going to trick you in any way they can. Be careful out there.

But since that seems to be the case you have to treat companies as though they are going to trick you in any way they can. Be careful out there.

Related: Incredibly Bad Customer Service from Discover Card – Fake Checks That Make You Pay – Companies Claim to Value Customers

The federal debt is not officially calculated the way that other accounting is done. Future obligations are not included, thus promising ever larger payments for health and retirement programs are not accurately reflected in government official debt totals. There are some legitimate arguments for why using exactly the same standards as others does not make sense for the federal government accounting. However the current methods make it too easy for politicians to claim they are not spending our grandchildren’s money for promises they make today. Rules ‘hiding’ trillions in debt:

Bottom line: Taxpayers are now on the hook for a record $59.1 trillion in liabilities, a 2.3% increase from 2006. That amount is equal to $516,348 for every U.S. household. By comparison, U.S. households owe an average of $112,043 for mortgages, car loans, credit cards and all other debt combined.

Foisting debts on our grandchildren because we elect politicians that refuse to either cut spending (and promised spending) or raise taxes is a sad legacy of the last 30 years for the USA.

Related: Washington Paying Out Money it Doesn’t Have – Is the USA Broke – The Fallacy of Estate Tax Repeal – Social Security Trust Fund

So I had a Discover Card. They charged me for charges I didn’t authorize. They then force me through their maze of policies telling me that it was not possible to be more customer friendly – their policies couldn’t be any different they were the policy (as if that made any sense). So Discover Card had to shut down my account. I told them if they couldn’t provide better service then I didn’t want a new account after they closed my account which was the only way they wouldn’t charge me for charges I didn’t authorize. They owed me $240 from their cashback bonus program. Now they refuse to pay me the money I earned because they say that it is their policy not to pay the cashback bonus if an account is closed.

After going around on that for awhile and them assuring me it was their policy and it was not possible for it to be done any other way by them or anyone else I asked what happened if someone died. Oh then the account is closed and we pay the money we owe on the cashback bonus. So obviously it isn’t that the account being closed makes it impossible for Discover to pay what was owed. It seems pretty obvious it is just a good way to take money Discover owes and just count on people not wanting to waste their time fighting to get what Discover owed them. Maybe one of their marketing people told them doing this to people that just had a parent/spouse… die might be bad publicity so they decided to actual pay what was owed in those instances. Jeez why can’t credit card companies just provide good service and treat customers well instead of only doing the absolute least they can that won’t spark outrage from the public and legislative action to prohibit such practices (I image not paying what was owed to people that died would spark legislative action if it wasn’t already illegal).

Is it really legal to charge someone for charges they didn’t authorize and when they tell you they didn’t authorize them refuse to do anything about it if they don’t close their account and then say we are not going to pay your cashback bonus because your account is closed? it seems to be yet another instance of credit card companies doing everything they can to take money from customers. Of course they claimed it was impossible to do anything else it was their policy to do it this way and no other credit card company is any different.

Read more

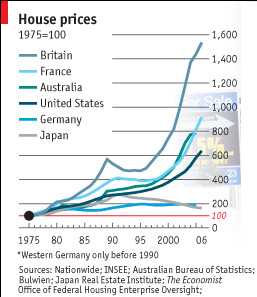

From 1975 to 2006 house prices in the UK increased 14 times. At 14 times that works out to about a 9% annual rate of return which is doesn’t sound nearly as impressive as a 14 fold increase to most people (I believe). The article does not mention if the chart is adjusted for inflation (a 9% return after inflation is incredibly good, a 9% return before factoring in inflation – which would reduce the rate of return – is good but reasonable) – my guess is that the chart is adjusted for inflation (meaning Britain’s owning real estate have been fortunate). Online calculator for annual rates of return over time.

Real estate rate of returns (when calculated on the total price) also underestimate the “real return” most investors experience because investors often only put down a portion of the investment. So the real rate of return is increased dramatically to the investor as a result of the the multiplier effect of buying on margin. Of course, real estate also has expense related to upkeep and the advantage of providing a place to live…

The graph (from the economist – see: Through the roof) shows other countries, USA: about 6 times, France 9 times… Remember these rates are averages for entire countries some areas in each country will have far exceeded these rates.

The graph could be a bit better if they didn’t make several of the colors almost the same.

Related: More Non Bubble Bursting in Housing – Europe and USA Housing Price Boom – How Not to Convert Equity – 30 year fixed Mortgage Rates

Realtors take a large percentage of a home’s sale price for their services. It has never made much sense to me. It does not seem like the services are proportional to the sales price. I don’t see how it costs 5 times more to sell a $1,000,000 house than a $200,000 house. The Freakonomics authors have commented on the problems caused by the way realtors charge for services.

Study Offers Provocative Comparison of Selling a Home:

“Our results are good news for buyers,” he said. “The price buyers pay appears to be driven entirely by the characteristics of the property and of the seller. Whether the property is sold through FSBOMadison.com or a realtor appears to make little difference in terms of purchase price.” “Realtors undoubtedly can provide value to sellers,” Nevo concluded. “But our research shows that for-sale-by-owner Web sites increasingly are making selling your own home more appealing and offering a viable alternative to realtors.”

Study: The Relative Performance of Real Estate Marketing Platforms: MLS versus FSBOMadison.com (pdf)

Very nice illustration in Personal Finance Success Comes More From Smart Budgeting Than Smart Investing:

Now, Kevin’s a smart investing cookie and is able to crank out a 16% return each year. I just take my money, dump it in a Vanguard 500, and move on with life, which means over the long haul I earn a 12% return. Who earns more in the long run?

After five years of this same investing, Kevin has $34,385.68 in his investment account, while I have $63,528.47 in mine, a difference of $29,142.79 in the frugal guy’s favor. Even at the twenty five year mark, if the investments have continued for that long, Kevin has $1,246,070.12 in his account, while I have $1,333,338.70 in mine, a difference of $87,268.58.

I would use lower returns (to better match what I think is reasonable to use in projections about the future) but by using higher returns it actually makes a stronger point (the compounding at 16% is extraordinary – I was actually surprised that at the 25 year mark that the results were the way they were). The lesson is powerful. Your personal finance situation is a factor of several things, but very close to the most important is just actually saving money, as the post illustrates.

Related: Trying to Keep up with the Jones – Earn more, spend more, want more – Living on Less – Saving for Retirement – How much have people saved?

I got my bill from Discover Card and Discover acts as though it is my problem that they have charged me for things I did not authorize. They then say the only way to be safe is to close this account and open a new one (a waste of my time). I would think it would be easy to not charge customers from fraudulent places but Discover seems to think this is beyond them. Once I was transferred to the fraud person (the 3rd person I had to speak to) they said they frequently saw fraud reports for this company and so it would most likely be fixed without a problem. They then said ok, we can setup a new account. I told them that I told the previous person if Discover didn’t fix this without closing the existing account I would take my business elsewhere so no new account was needed.

What do I want from a credit card? I want to be able to use it to buy what I want. I want them to not charge me for things I don’t authorize. If I tell them I have been charged for something I didn’t order I want them to think that is a problem and fix it. I want good customer service which basically boils down to being able to reach them on the phone without wasting a bunch of my time and having the person that answers treat me like a valued customer they want to serve instead of acting as though I was bothering them. Their failure (charging me for things that I did not authorize) was wasting my time. Those are the important factors. Now if I can get a cash rebate too, great. Anyone have suggestions? Since I don’t carry a balance I don’t care what the interest rate is.

It is fairly amazing how horrible the customer service is for credit cards given the huge profits the companies make. The main thing I want is one that treats my time as valuable and does everything it can to avoid wasting my time.

Update (from the Washington Post today): Americans Can’t Do Without Their Credit Cards, But the Card Companies Are Another Matter

At the bottom of the education scale, the picture is reversed. Among high-school dropouts, the divorce rate rose from 38% for those who first married in 1975-79 to 46% for those who first married in 1990-94. Among those with a high school diploma but no college, it rose from 35% to 38%. And these figures are only part of the story. Many mothers avoid divorce by never marrying in the first place. The out-of-wedlock birth rate among women who drop out of high school is 15%. Among African-Americans, it is a staggering 67%.

Does this matter? Kay Hymowitz of the Manhattan Institute, a conservative think-tank, says it does. In her book “Marriage and Caste in America”, she argues that the “marriage gap” is the chief source of the country’s notorious and widening inequality. Middle-class kids growing up with two biological parents are “socialised for success”. They do better in school, get better jobs and go on to create intact families of their own. Children of single parents or broken families do worse in school, get worse jobs and go on to have children out of wedlock.