Some companies (Banks, Verizon, Comcast, credit card insurers, United, car dealers…) continually find new ways to be hostile to customers. It really is amazing people put up with their horrible practices. The latest from the fees to check bags, fees to for paying company expenses, waste your time on voice mail hell if you want to talk to us crowd is fees to pay bills using automated systems.

The customer hostility of these companies is part of their DNA. We should recognize the new attempts to fleece customers but there is no reason to be surprised by the new, ever more hostile customer behavior of these companies. There are alternatives for consumers, just find them, and support them. Some industries are dominated by customer hostile companies (which can make avoiding them hard): banks (both consumer and investment banks), credit cards, airlines, cable companies, cell phone service. Even in those industries you can find ethical companies: Southwest Airlines, many credit unions, CarMax…

…

And yet these guys are charging $15. I asked Chase, “How can you charge that much for an automated transaction?” They said, “Well, that’s how much we charge.” And you look at some of the other charges out there. For instance, this week Verizon Communications is introducing a new $3.50 charge if you pay your bill online, automated phone system, or to a service rep without using their recurring, automatic bill paying system.

Time Warner Cable charges $4.99 to pay by phone with a human being, but it too charges nothing to use the automated system.

“People pay for a product or service,” said Doug Heller, executive director of Consumer Watchdog, a Santa Monica advocacy group. “They shouldn’t have to pay again just for the right to pay them.”

Related: Protect Yourself from 11 Car Dealer Tricks – Poor Customer Service: Discover Card – Best Buy Asks Man to Change His Name – Is Poor Service the Industry Standard?

Law enforcement officers, pre-Kindergarten through 12th grade teachers and firefighters/emergency medical technicians can contribute to community revitalization while becoming homeowners through HUD’s Good Neighbor Next Door Sales Program. HUD (United States Department of Housing and Urban Development) offers a substantial incentive in the form of a discount of 50% from the list price of the home. In return you must commit to live in the property for 36 months as your sole residence.

Eligible Single Family homes located in revitalization areas (there are hundreds of revitalization areas across the country. HUD is always working with localities to designate new areas) are listed exclusively for sales through the Good Neighbor Next Door Sales program. Properties are available for purchase through the program for five days.

Check the listings for your state. Follow the instructions to submit your interest in purchasing a specific home. If more than one person submits on a single home a selection will be made by random lottery. You must meet the requirements for a law enforcement officer, teacher, firefighter or emergency medical technician and comply with HUD’s regulations for the program.

HUD requires that you sign a second mortgage and note for the discount amount. No interest or payments are required on this “silent second” provided that you fulfill the three-year occupancy requirement.

Related: Fixed Mortgage Rates Reach New Low – Your Home as an Investment – articles on home ownership

I am looking at mortgage refinance options now (with rates being so low). I am looking at 20 year fixed rate loans with cash out (with over 20% down). The 20 year term will reduce my loan term a bit, and the final monthly cost should actually be not much higher than my current payment (with taking some cash out), I think. Do any readers have opinions on these lenders (or others with competitive offers – low rates and low expenses)?

Total Mortgage – 20 year fixed rate 3.875%, total fees and points not provided ![]() , apr 4.15%

, apr 4.15%

American United Mortgage – 20 year fixed rate 4% [same as 30 year rate ![]() ], fees $2,995 (0 points), apr 4.26%

], fees $2,995 (0 points), apr 4.26%

Aim Loan – 20 year fixed rate 3.875%, fees (about $4,100 I think), apr 4.02%

These are some of the best deals I have been able to find. However, companies can play games with fees and hide excessive costs in requirements they don’t consider fees (appraisal costs…). Rates can bounce around for a specific lender, so I think it make sense to watch several (not just pick out he lowest one on whatever date you first look).

Suggestions on how to tell whether specific lenders good faith estimates are accurate and comparable would be especially appreciated.

Edits:

RoundPoint – looks good, low rates, low fees, good reviews on Zillow.

Amerisave – 20 year fixed rate 3.75%, total fees and points $3,418, apr 3.87% (removed as an option – they don’t respond to customer have tons of negative reviews online about problems, poor service, etc.

Related: Fixed Mortgage Rates Reach New Low – Low Mortgage Rates Not Available to Everyone – 30 Year Fixed Mortgage Rates and the Fed Funds Rate – Mortgage terms

Dividends Beating Bond Yields by Most in 15 Years

Kraft Foods Inc. and DuPont Co. are among 68 companies in the Standard & Poor’s 500 Index with payouts that top the 3.78 percent average rate in credit markets, based on data since 1995 compiled by Bloomberg and Bank of America Corp. While Johnson & Johnson sold 10-year debt at a record low interest rate of 2.95 percent last month, shares of the world’s largest health products maker pay 3.66 percent.

The combination of record-low interest rates, potential profit growth of 36 percent this year and a slowing economy has forced investors into the relative value reversal. For John Carey of Pioneer Investment Management and Federated Investors Inc.’s Linda Duessel, whose firms oversee $566 billion, it means stocks are cheap after companies raised payouts by 6.8 percent in the second quarter

…

S&P 500 companies’ cash probably has grown to a record for a seventh straight quarter, according to S&P. For companies that reported so far, balances increased to $824.8 billion in the period ended June 30 from the first three months of the year, based on data from the New York-based firm.

Cash represents 10.2 percent of total assets at S&P 500 companies, excluding banks and financial firms, according to data compiled by Bloomberg. That’s higher than the 9.5 percent at the end of the second quarter last year, 8.4 percent in 2008 and 7.95 percent in 2007.

“The economy is slowing down, but productivity has been so great in this country and companies have been able to make good profits,”

10-year Treasury note yields were as low as 2.42% last month. The combination of continued extraordinarily low interest rates and good earnings increase this odd situation where dividends increase and interest yields fall. Extremely low yields aimed at by the Fed continue to aid banks and those that caused the credit crisis a huge deal and harm investors.

Money markets and bonds are not attractive places to invest now. Putting money in those places is still necessary for diversification (and as a safety net – especially in cases like 401-k plans where options are often very limited). Seeking out solid companies with strong long term prospects that pay reasonable dividends is a very sensible strategy today.

Related: Where to Invest for Yield Today – S&P 500 Dividend Yield Tops Bond Yield: First Time Since 1958 – 10 Stocks for Income Investors – Bond Yields Show Dramatic Increase in Investor Confidence (Aug 2009)

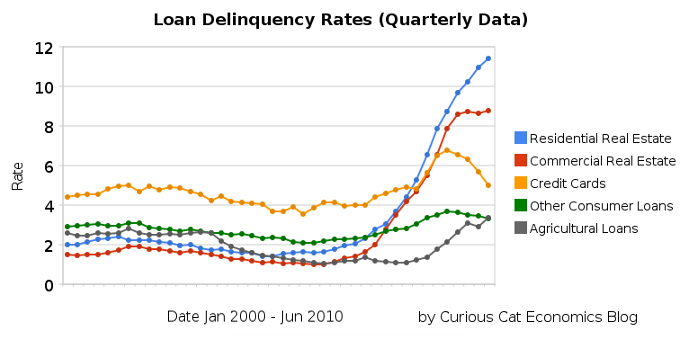

The chart shows the total percent of delinquent loans by commercial banks in the USA.

The first half of 2010 saw residential real estate delinquencies continue to increase and other consumer loan delinquencies decreasing (both trends continue those of the last half of 2009). Residential real estate delinquencies increased 118 basis points to 11.4%. Commercial real estate delinquencies increased just 7 basis points to 8.79%. Agricultural loan delinquencies also increased (25 basis points) though to just 3.35%. Consumer loan delinquencies decreased, with credit card delinquencies down 131 basis points to 5.01% and other consumer loan delinquencies down 15 basis points to 3.34%.

Related: Real Estate and Consumer Loan Delinquency Rates 1998-2009 – Bond Rates Remain Low, Little Change in Late 2009 – Government Debt as Percentage of GDP 1990-2008 – USA, Japan, Germany… -posts with charts showing economic data

Read more

401(k), IRAs and 403(b) retirement accounts are a very smart way to invest in your future. The tax deferral is a huge benefit. And with Roth IRAs and Roth 401(k)s you can even get tax exempt distributions when you retire – which is a huge benefit. Especially if you don’t retire before the bill for all the delayed taxes of the last 20 years starts to be paid. The supposed “tax cuts” that merely shifted taxes from those spending money the last 10 years to those that have to pay for all the stuff the government spent on them has to be paid for. And that will likely happen with higher tax rates courtesy of the last 10 years of not paying the taxes to pay for what the government was spending.

When looking at your 401(k) and 403(b) investment options be sure to pay close attention to expenses for the funds. Some fund families try to get people to investing in high expense funds, that are nearly identical to low expense funds. The investor losses big and the fund companies take big profits. Those people serving on the boards of those funds should be fired. They obviously are not managing with the investors interests at heart (as they are obligated to do – they are suppose to represent the investors in the funds not the friends they have making money off the investors).

Here is an example (that I ran across last week) expense differences for funds that have essentially identical investment objectives and plans in the same retirement plan options: .39% (a respectable rate, though more than it really should be) for [seeks a favorable long-term rate of return from a diversified portfolio selected to track the overall market for common stocks publicly traded in the U.S., as represented by a broad stock market index.], .86% [for "The account seeks a favorable long-term total return, mainly from capital appreciation, by investing primarily in a portfolio of equity securities selected to track the overall U.S. equity markets based on a market index."]. Do not rely on your fund provider to have your interests at heart (and unfortunately many companies don’t seek the best investment options for their employees either).

The .47% added expense isn’t much to miss for 1 year. However, over the life of your retirement account, this is tens of thousands of dollars you will lose just with this one mistake. Personal financial literacy is an easy way to make yourself large amounts of money over the long term. It isn’t very sexy to get .47% extra every year but it is extremely rewarding.

$200,000 at 6% for 25 years grows to $858,000

$200,000 at 6.47% for 25 years grows to $958,000

So in this case, $100,000 for you, instead of just paying the fund company a bit extra every year to let them add to their McMansions. In reality it will be much more than a $100,000 mistake for you if you save enough for retirement. But if you save far too little (as most people do) one advantage is the mistake will be less costly because your low retirement account value reduces the loss you will take.

Related: 401(k)s are a Great Way to Save for Retirement – Retirement Savings Allocation for 2010 – Many Retirees Face Prospect of Outliving Savings

Read more

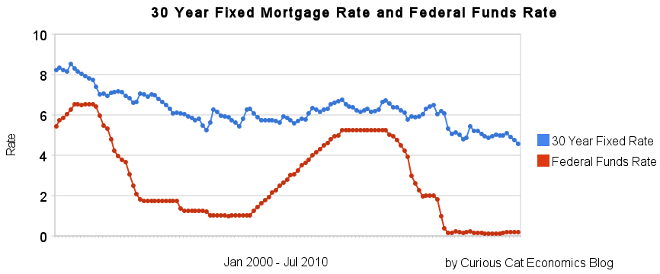

30 year fixed mortgage rates have declined sharply recently to close to 4.5%.

If you are considering refinancing a mortgage now may well be a very good time. If you are not, you maybe should consider it. If so look to shorten the length. If you originally took out a 30 year mortgage and now have, for example, 24 years let, don’t add 6 years to your repayment term by getting a new 30 year mortgage. Instead, look to shorten your pay back period with a 20 year mortgage. The 20 year mortgage will have an even lower rate than the 30 year mortgage.

If you plan on staying in the house, a fixed rate mortgage is definitely the better option, in my opinion. If you are going to move (and sell your hose) in a few years, an adjustable rate mortgage may make sense, but I would learn toward a fixed rate mortgage unless you are absolutely sure (because situations can change and you may decide you want to stay).

The poor economy, unemployment rate still at 9.5%, has the Fed continuing massive intervention into the economy. The Fed is keeping the fed funds rate at close to 0%.

If you are looking at a new real estate purchase, financing a 30 year mortgage sure is attractive at rates under to 4.5%.

Related: historical comparison of 30 year fixed mortgage rates and the federal funds rate – 30 Year Fixed Mortgage Rates Remain Low (Dec 2009) – Lowest 30 Year Fixed Mortgage Rates in 37 Years – What are mortgage definitions

For more data, see graphs of the federal funds rate versus mortgage rates for 1980-1999. Source data: federal funds rates – 30 year mortgage rates

We have created a new and improvement Curious Cat Investment book site. Find great resources for your investing and personal finance needs. We have selected the best books by authors including: Benjamin Graham, Warren Buffett, John Bogle, Nicolas Darvas, Peter Lynch and William O’Neil.

Try out our recommended picks.

View the books by category including: investing, economics, retirement, real estate and personal finance.

Related: Curious Cat investing articles – Curious Cat management books – Teaching Children About Money Matters – Bogle on the Retirement Crisis

U.S. Investors Regain Majority Holding of Treasuries

Mutual funds, households and banks have boosted the domestic share of the $8.18 trillion in tradable U.S. debt to 50.2 percent as of May, according to the most recent Treasury Department data.

…

The biggest jump in demand this year among domestic buyers of Treasuries has been commercial lenders. Bank holdings of Treasury and agency securities increased 5 percent to $1.57 trillion last month, according to the latest data available from the Fed.

…

The Fed’s decision to hold its target for the overnight lending rate at a record low has made it possible for banks to borrow at near-zero interest rates to finance purchases of longer-term and higher-yielding Treasuries while lending less.

I must say, unless you are getting special government interest free loans to invest in treasuries (like those that caused the credit crisis are) it seems crazy to me to invest at these low rates. In retirement, it probably does make sense to have some just as a diversification measure but other than that I would certainly reduce my holdings from what they would have been 10 years ago.

If politicians or the fed would just give special favors to me to borrow billions and essentially 0% and then lend it back for more I would take that deal.

But if I am not granted the welfare Chase, Goldman Sachs, Citibank and the rest are (with huge amounts of free money and bailouts if their bets fail) buying extremely low yield government debt is not an investment I want. I don’t think betting on deflation is not a bet I want to take. Inflation seems a bigger risk to me. But people get to make their own decisions, and we will see which investors are right.

Related: Paying Back Direct Cash from Taxpayers Does not Excuse Bank Misdeeds – Can Bankers Avoid Taking Responsibility Again? – What the Financial Sector Did to Us

40 billionaires pledge to give away half of wealth

This is great news. We need more charity. And we don’t need more trust fund babies. The Giving Pledge was established by Bill Gates and Warren Buffet to encourage this spirit.Charity should be a part of your personal finance plan if you are reading this (if you have access to a computer you are wealthier than most people alive today).

To many of the rich today act like they made their money by creating it by themselves. You can’t be a billionaire without getting it given to you by your parents or making your wealth from society. It is wonderful when people provide great solutions to society and become wealthy. It is ridicules to think those people’s wealth is not the result of the society others created. Using that wealth to make society better is right. Spoiling kids and grandkids with it is acceptable, to a certain level. After a couple million that is insulting, however.

Related: House Votes to Restore Partial Estate Tax Very Richest: Those with Over $7 Million – Rich Americans Sue to Keep Evidence of Their Tax Evasion From the Justice Department – Gates Foundation and Rotary Pledge $200 Million to Fight Polio