Failing to save is a huge problem in the USA. Spending money you don’t have (taking on personal debt) and not even having emergency savings and retirement savings lead to failed financial futures. Even though those in the USA today are among the richest people ever to live many still seem to have trouble saving. Here is a simple tip to improve that result for yourself.

Anytime you get a raise split the raise between savings, paying off debt (if you have any non-mortgage debt), and increasing the amount you have to spend. I think too many people think financial success is much more complicated than it is. Doing simple things like this (and some of the other things, mentioned in this blog) will help most people do much better than they have been doing.

There are lots of ways to spend money. And many people find ways to spend all or more than all (credit card debt, personal loans…) they have which are sure ways to a failed financial future. So anytime you get a raise (a promotion, new job…) take a portion of that extra money and put it toward your financial future. The proportion can very but I would aim for at least 50% if you have any non-mortgage debt, don’t have a 6 month emergency fund, or are behind in saving for retirement, a house…

Exactly how you calculate if you are behind, I will address in a future post (or you can look around for more information). By taking this fairly simple action you will be setting yourself up for a successful financial future instead of finding yourself falling behind, as so many do. And then when things go badly, as they most likely will sometime during your life, you will have built up a financial position to draw on. Instead of, as so many do now, find that you were living beyond your means when things were going well – which it doesn’t take a genius to see will lead to serious problems when things take a turn for the worse.

So lets say you take a new job and get a raise of $4,000 a year. Instead of spending $4,000 more just put $2,000 away (pay off debt, add to your retirement savings, add to savings for a house, add to your emergency fund…). Then you get a promotion of another $3,000, increase your spending by $1,500 and save the rest. It is such a simple idea and just doing this you can find yourself in the top few percent of those making smart financial decisions. And if you get to the point that you are ahead in all your financial areas then you can take more of each raise you get (but most of the time you will have learned how valuable the extra saving are and figured out the extra toys really are not worth it). But if you want to, once you have created a successful financial life, you can choose to buy more toys.

Related: Retirement Savings Survey Results – Earn more, spend more, want more

There are external risks to your financial health. Many people ruin their financial health even before any external risk can, but lets say you are being responsible then what risks should you seek to protect yourself from?

| Risk | Strategy | Also |

|---|---|---|

| medical costs | health insurance | emergency fund, healthy lifestyle to reduce the likelihood of needing medical care |

| property losses (house damaged, car stolen, property damage…) | homeowners insurance, rental insurance | |

| job loss | emergency fund, unemployment insurance (provided by the government and paid for by the company in most cases – in the USA) | updating skills, maintain a career network, education, learning new skills |

| disability (which both damages your earning potential and often has medical care costs) | disability insurance, health insurance | social security disability insurance – in the USA |

| investment losses | sound investment portfolio and strategy (diversification, appropriate investments, adjusting investment strategy over time) | extra savings |

| having to pay damages caused to others | homeowners insurance often includes personal liability coverage (and car insurance often includes some coverage for damage you cause while driving). check and likely choose to pay for extra liability insurance – costs to add coverage is normally cheap. | |

| unexpected expenses | emergency fund | extra savings |

| loss of income of someone you rely on (spouse) | life insurance | extra savings |

Another protection is to be financially literate. You can risk your financial health by being fooled in spending money you should save, borrowing too much for your house, failing to buy the right insurance, using too much leverage, investing too much in high risk investments…

Related: credit card tips – personal finance tips – personal loan information

The largest oil consuming countries (and EU), in millions of barrels per day:

| Country | consumption | % of oil used | % of population | % of World GDP |

|---|---|---|---|---|

| USA | 20.8 | 25.9 | 4.5 | 21.0 |

| European Union | 14.6 | 18.1 | 7.4 | 21.9 |

| China | 6.9 | 8.6 | 19.9 | 10.7 |

| Japan | 5.4 | 6.7 | 1.9 | 6.5 |

| Russia | 2.9 | 3.6 | 2.1 | 3.2 |

| Germany | 2.6 | 3.3 | 1.2 | 4.3 |

| India | 2.4 | 3.0 | 17.0 | 4.6 |

| Canada | 2.3 | 2.9 | 0.5 | 1.9 |

| Korea | 2.1 | 2.7 | 0.7 | 1.8 |

| Brazil | 2.1 | 2.6 | 2.9 | 2.8 |

| Mexico | 2.1 | 2.6 | 1.6 | 2.1 |

All data is from CIA World Factbook 2008 (downloaded Jun 2008). GDP calculated using purchasing power parity.

Related: Top 10 Manufacturing Countries 2006 – Country H-index Rank for Science Publications – Best Research University Rankings (2007)

Poorer Than You posed the question: Where to Stash Your Rainy Day Fund?

Pros: Interest rate usually meets or beats inflation, transfers to checking account, separation from checking decreases temptation to spend, no minimum balance requirement

Cons: Slow transfers may hinder urgent emergencies, limited by federal law to 6 transfers out of the account per month

…

Personally, I’m using a credit card/online savings account combination right now. After I graduate from college and grow my emergency fund, I’ll move most of the fund to a money market savings account, and perhaps keep a couple hundred dollars in cash as well.

Here are my thoughts:

A money market fund is where I used to hold emergency funds, but things have changed. Money market funds are paying less than inflation (especially true inflation – which exceeds reported inflation). Right now high yield savings is where I have my emergency funds. You need to not only pick a good choice but pay attention to see if the marketplace shifts and certain options are not as appealing as before.

I would use a credit card for immediate spending needs and then paying the balance in full with funds from high yield savings. But right now high yield savings accounts pay more than money market funds, so just stay with high yield savings. If money market funds pay more in the future then I would put the emergency funds there.

Related: Personal Finance Basics: Health Insurance - personal finance tips

Foreclosure Filings Continue to Rise

…

last week the Mortgage Bankers Association reported that about 2.47 percent of home mortgages were in foreclosure during the first quarter of the year, almost double the 1.28 percent rate of a year earlier, and the highest point since the group began compiling such figures in 1979. A Credit Suisse report this spring predicted that 6.5 million loans will fall into foreclosure over the next five years, reaching more than 8 percent of all U.S. homes.

There numbers really are astounding. How lame were the decisions of banks and mortgagees that nearly 1 in 40 mortgages are in default (and that number likely increasing in the next year to much more?

Related: Homes Entering Foreclosure at Record (Sep 2007) – Homes Entering Foreclosure at Record – Ignorance of Many Mortgage Holders

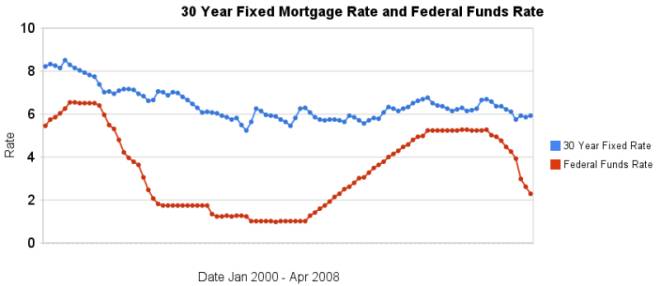

The recent drastic reductions again emphasize (once again) that changes in the federal funds rate are not correlated with changes in the 30 year fixed mortgage rate. In the last 4 months the discount rate has been reduced nearly 200 basis points, while 30 year fixed mortgage rates have fallen 18 basis points.

I have update my article showing the historical comparison of 30 year fixed mortgage rates and the federal funds rate. The chart shows the federal funds rate and the 30 year fixed rate mortgage rate from January 2000 through April 2008 (for more details see the article).

There is not a significant correlation between moves in federal funds rate and 30 year mortgage rates that can be used for those looking to determine short term (over a few days, weeks or months) moves in the 30 year fixed mortgage rates. For example if 30 year rates are at 6% and the federal reserve drops the federal funds rate 50 basis points that tells you little about what the 30 year rate will do. No matter how often those that should know better repeat the belief that there is such a correlation you can look at the actual data in the graph above to see that it is not the case.

Related: real estate articles – Affect of Fed Funds Rates Changes on Mortgage Rates – How Not to Convert Equity – more posts on financial literacy

Read more

Lazy Portfolios update by Paul Farrell provides some examples of how to use index funds to manage your investments:

I think the article is a bit misleading in showing the out-performance of the S&P 500 index (during periods where the S&P 500 index does very well these portfolios will under-perform it). The out-performance shown in the article is largely due to the great performance of international markets recently. Still the strategy is well worth reading about. The strategy is based on using index funds from Vanguard (very well run mutual funds with very low fees). But don’t get tied into Vanguard, if they start to focus on lining their pockets by increasing your fees look for alternatives.

Overall, I give this concept high marks. Dollar cost average appropriate levels of money into such a strategy and you will give yourself a good chance at positive results.

My preference would be to include significant levels of international and developing stocks. For aggressive long term investing I like something like:

40% USA total stock market

15% Real Estate

25% international developed stock market index

20% developing stock market index

When aiming for more security and preserving capital (over growth) I favor something like:

30% USA total stock market

10% Real Estate

25% international developed stock market index

10% developing stock market index

10% short term bond index

15% money market

Of course all sorts of personal financial factors need to be considered for any specific person’s allocations.

Related: Allocating Retirement Account Assets – Why Investing is Safer Overseas – Saving for Retirement – 12 stocks for 10 years – what is a mutual fund?

What Should You Do With a Check Out of the Blue?

The USA government is sending out checks to taxpayers in an effort to encourage spending which in turn will provide stimulus to the economy in the very short term. First, this is bad policy in my opinion. Second, if you support this policy the precondition is you run surpluses in order to pay for it when you want to carry out such a policy. They have not, instead they have run huge deficits. What they have chosen to do is spend huge amounts and have the taxes paid by the children and grandchildren of those the politicians are spending the money on today. I would support Keynesian government spending in a serious recession or depression – just not for a country already with enormous debts and in a very mild recession.

But ok, so the government chooses to spend your children’s taxes foolishly, what should you do now? This is very easy. Whatever is the wisest move for your personal financial situation for any windfall you receive, regardless of the source of that windfall. If all your savings needs are met there is nothing wrong with buying some toy. But most people need to pay off debt, build an emergency fund, save for retirement or something similar not get another toy. Of course would be nothing wrong with donating it Kiva, Trickle Up, the Concord Coalition or your favorite charity.

The politicians are acting like a 5 year old that wants a new toy. I can too get the new toy now :-O, Mommy you can use your credit card. So what if you already bought me so many toys you couldn’t afford by using your other credit cards and they won’t lend you any more money. Just get another one. Similar to how congress recently yet again increased the allowable federal debt limit to over $9,000,000,000,000.

The stimulus effect of spending is that if you actually purchase a new toy (say a TV), then the store needs to replace that TV so the factory makes another TV… The store, shipper, factory, supplier to the factory all pay staff to carry this out, those staff can buy new books, dishwasher… and the business may buy a new forklift or computer to keep up…

Read more

In response to: What do you think? Should you discuss finances with your children?

…

We both waffle back and forth on these two perspectives and right now we’ve settled somewhere in between. Our children know we have debt, but don’t know the amount. They know I make pretty decent money, but don’t know how much. Our older boys pretty much know the details of our monthly expenses, such as the cable bill, phone bill, utility bills, etc. We’ve shared this with them to help them appreciate things a little more.

I definitely think talking about finances with children is important. I don’t have kids, but I was one ![]() I don’t think you need to get into exactly what the figures are to have valuable conversations. Far too many people become adults with far too poor an understanding of personal finance. Given how important managing money is today I think it is like hunter-gathers not teaching a kid how to hunt.

I don’t think you need to get into exactly what the figures are to have valuable conversations. Far too many people become adults with far too poor an understanding of personal finance. Given how important managing money is today I think it is like hunter-gathers not teaching a kid how to hunt.

Books: Money Sense for Kids – Growing Money: A Complete Investing Guide for Kids – The Motley Fool Investment Guide for Teens – Raising Financially Fit Kids – A Smart Girl’s Guide to Money: How to Make It, Save It, And Spend It

A few blog posts on teaching children about money: Personal Finance for Children and Pre-Teens – 5 Tips for Savvy Parents – Teach your teen the basics of money management

Related: Questions You Should Ask About Your Investments – Why Americans Are Going Broke – How Not to Convert Home Equity

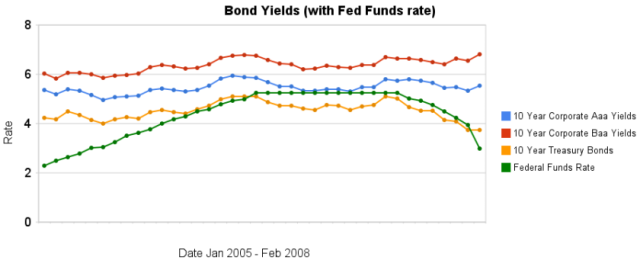

From January 2005 to July 2007 the Federal Funds Rate was steadily increased. The rate was held for a year. Since then the rate has been decreasing (dramatically, recently). As you can see from the chart, 10 year bond yields have been much less variable. The chart also shows 10 year corporate bond yields increasing in February when the federal funds rate fell 100 basis points.

Is the worst over, or just beginning?

…

If rates continue to fall, they could hit not only a new low for the year – the 10-year briefly touched 3.28% in January – but could come close to falling below the 3.07% level they hit in June 2003, which was a 45-year low at the time.

Treasury bond yields are down but a huge part of the reason is a “flight to quality,” where investors are reluctant to hold other bonds (so they buy treasuries when they sell those bonds). Therefore other bond yields (and mortgage rates) are not decreasing (the data in the chart is a bit old – the yields may well decrease some for both 10 year bonds once the March data is posted, though I would expect the spread between treasuries be larger than it was in January).

Data from the federal reserve – corporate Aaa – corporate Baa – ten year treasury – fed funds

Related: 30 Year Fixed Mortgage Rates versus the Fed Funds Rate – After Tax Return on Municipal Bonds