Growing Crude Storage in China

…

Bernstein estimates that the amount of crude entering the SPR ports in China—the world’s second biggest oil consumer after the U.S.–has increased by around 400,000 barrels a day since November, based on its assessment using the satellite imaging services of Google, the search engine company.

…

There’s likely more to come. Bernstein says satellite images show a marked increase in oil-storage construction over the past few years and estimates that China’s number of days of forward demand–a gauge of oil storage–amount to just 28 days of imports and 14 days of total demand.

China is targeting storage capacity that will hold demand cover of around 90 days. (The U.S. currently has storage for about 62 days of oil imports.) In other words, there’s a lot more oil still to be packed away in China now and in the coming years as more facilities are built.

This is another smart move by China, in my opinion. With the huge amount of cash they are holding, I would rather hold more of it as crude than dollars. And stockpiling the crude also protects the domestic demand from supply shocks. I would also take other steps they are taking, like investing heavily in adding wind power capacity.

Related: I Wouldn’t Sell Oil at These Prices – Who Will Buy All the USA’s Debt? – Oil Consumption by Country – South Korea To Invest $22 Billion in Overseas Energy Projects

John Bogle was the founder of Vanguard Group and a well respected investment mind. He has written several good books including: The Little Book of Common Sense Investing, Common Sense on Mutual Funds and Bogle on Mutual Funds. This interview from 2006 discusses the state of the retirement system, before the credit crisis.

Frontline: How do they get away with that? Don’t they have to fund them?

John Bogle: No, they don’t, because a lot of it is based on assumptions. Our corporations are now assuming that future returns in their pension plan will be about 8.5 percent per year, and that’s not going to happen. The future returns in the bond market will be about 4.5 percent, and maybe if we’re lucky 7.5 percent on stocks. Call it a 6 percent return — before you deduct the cost of investing all that money, the turnover cost, the management fees. So maybe a 5 percent return is going to be possible, in my judgment, and they are estimating 8.5 percent.

Why? Because when they do it that way, corporation earnings become greatly overstated, and all the executives get nice, big bonuses. They are using pension plan assumptions as a way to manage corporate earnings and meet the expectations of Wall Street.

Frontline: So if a company overstates the value of its pension plan assets, it makes the company look better to Wall Street, so there’s an incentive to kind of exaggerate, if not cheat.

John Bogle: That is precisely correct. And let me clear on the cheating: It’s legal cheating; it’s not illegal cheating. In other words, you can change any reasonable set of numbers — and corporations have done this, have raised the pension assumption from 7 percent to 8.5 percent — and all of a sudden that corporation will report an earnings gain for the year rather than an earnings loss that they would otherwise have. Simple, legal.

The entire PBS series (from 2006) on 401(k)s (including interviews with Elizabeth Warren, David Wray and Alicia Munnell) is worth reading.

In February of 2009 he spoke to the House of Representatives committee exploring retirement security.

Read more

Showing mortgage rates over the last 6 months. Red: 30 year fixed rate. Blue: 15 year fixed rate. Tan: 1 year adjustable rate.

Showing mortgage rates over the last 6 months. Red: 30 year fixed rate. Blue: 15 year fixed rate. Tan: 1 year adjustable rate.

Showing mortgage rates over the last 5 years. Red: 30 year fixed rate. Blue: 15 year fixed rate. Tan: 1 year adjustable rate. From Yahoo Finance, for conventional loans in Virginia.

Showing mortgage rates over the last 5 years. Red: 30 year fixed rate. Blue: 15 year fixed rate. Tan: 1 year adjustable rate. From Yahoo Finance, for conventional loans in Virginia.

The 6 month chart shows that mortgage rates have been declining ever so slightly. Rates on a 1 year adjustable mortgage fell from 5.5 to 4% and have stayed near 4% for all of 2009. 30 and 15 year rates (15 year rates staying about 25 basis points cheaper) have declined from 6.5%, 6 months ago to about 5% at the start of the year and have moved around slightly since. This is while the yield 10 year government treasuries have been rising (normally 30 year fixed rate mortgages track moves in the 10 year government bond). The federal reserve has been buying bonds in order to push down the yield (and stimulate mortgage financing and other borrowing).

Mortgage rates certainly could fall further but the current rates are extremely attractive and I just locked in a mortgage refinance for myself. I am getting a 20 year fixed rate mortgage; I didn’t want to extend the mortgage period by getting another 30 year fixed rate mortgage. For me, the risk of increasing rates outweigh the benefits of picking up a bit lower rate given the current economic conditions. But I can certainly understand the decision to hold out a bit longer in the hopes of getting a better rate. If I had to guess I would say rates will be lower during the next 3 months, but I am not confident enough to hold off, and so I decided to move now.

Related: Mortgage Rates Falling on Fed Housing Focus – posts on mortgages – 30 Year Fixed Mortgage Rates and the Fed Funds Rate – Continued Large Spreads Between Corporate and Government Bond Yields – Lowest 30 Year Fixed Mortgage Rates in 37 Years –

Consumer borrowing falls in March at fastest pace in over 18 years, Americans saving more

In dollar terms, consumer borrowing plunged by $11.1 billion. That’s the largest dollar amount on records dating to 1943, and more than three times the $3.5 billion drop that economists expected. The borrowing category that includes credit cards dropped 6.8 percent in March after a 12.1 percent plunge in February. The category that includes auto loans fell 4.2 percent after rising by 1.2 percent in February.

The Commerce Department last week said that the personal savings rate edged up to 4.2 percent in March, marking the first time in a decade that the savings rate has been above 4 percent for three straight months.

Good. Consumer debt is far to large and should be paid down. This is a start but a small start, but a much larger reduction in outstanding consumer debt is needed before we have reached a healthy level of debt. The continued improvement in that debt level signifies a stronger economy. Far too many financial journalists instead of pointing out the benefits of such improvement note that this reduces current consumption (and thus, effectively, will lower current GDP – compared to what it would be if we continued to spend beyond our means). You cannot spend money your don’t have forever.

Having more stuff in your house (along with an increased outstanding credit card balance) does not make you economically more successful. And the same holds true for the economy. Having more stuff sitting in people’s house and an increasing debt load is not the sign of a stronger economy (even if it is a route to a higher current GDP). Increased saving and reducing debt will strengthen the economy and improve our economic success over the long term.

Related: Will Americans Actually Save and Worsen the Recession? – Proper credit card use – Personal Saving and Personal Debt in the USA – Americans are Drowning in Debt – Buying Stuff to Feel Powerful

Peet’s Coffee: In Africa, Brewing Good Works by Steve Hamm

…

Because of bad roads and delays at border crossings, it took 12 days for a truck with a container full of green coffee beans to travel 1,000 miles to the Kenyan port of Mombasa. The sea journey from Mombasa took nearly two months. Worse, when the shipment arrived in Oakland, Calif., in late February, a portion of the coffee was slightly damaged.

Moayyad traveled to Rwanda to cement relationships with farmer groups and gather stories about the farmers for use in marketing. With a videographer tagging along, she navigated molar-crunching roads in a four-wheel-drive pickup to remote villages and farms perched on hillsides high above Rwanda’s Lake Kivu. On the roadsides, children greeted the passing truck with an excited cry of “Abazungu [white people]!” Moayyad plans to post a journal of her travels on Peet’s Web site, aimed at the company’s most loyal customers, called Peetniks.

A good effort. Real world issues confront you when you take steps to build the capacity for capitalism to help people live better lives. We need more such efforts to help capitalists make better lives for themselves around the world.

Related: Bill Gates: Capitalism in the 21st Century – International Development Fair, The Human Factor – Helping Capitalism Create a Better World – Frontline Explores Kiva in Uganda

photo of Cesar Augusto Santamaría Escoto in his welding workshop, Chinandega, Nicaragua.

photo of Cesar Augusto Santamaría Escoto in his welding workshop, Chinandega, Nicaragua.I made my 100th contribution to a micro-loan through Kiva last week. Participating with Kiva is a great antidote to reading about the unethical “leaders” taking huge sums to run their companies into the ground (or even just taking obscene sums to maintain their company). The opportunity to give real capitalists an chance at a better life is wonderful.

Kiva allows you to lend money to entrepreneur (in increments of $25). The most you get back is the amount you loaned, and if the entrepreneur, does not pay back the loan then you take a loss. This is something you do if you believe if giving people an opportunity to make a better life for themselves through hard work and intelligent economic choices.

I encourage you to join me: let me know if you contribute to Kiva and I will add your Kiva page to our list of Curious Cat Kivans. Also join the Curious Cats Kiva Lending Team.

My loans have been made to in 32 countries including: Ghana, Cambodia, Uganda, Viet Nam, Peru, Ukraine, Mongolia, Ecuador and Tajikistan. Kiva provides sector (but I think this data is a not that accurate – it depends on the Kiva partners that are not that accurate on identifying the sectors (it seems to me). A large number of the loans are in retail, clothing and food. I like making loans that will improve productivity (manufacturing, providing productivity enhancing services…) but can’t find as many of those as I would like (8% of my loans are in manufacturing, 11% agriculture, retail 18%, 23% food, 25% services (very questionable – these are normally really retail or food, it seems to me).

Some examples of the entrepreneurs I have lent to: welding workshop (Nicaragua), expanding generator services business with computer services (Cambodia), food production (Ghana), manufacturing nylon (Nigeria), internet cafe (Lebanon), electronics repair (Benin), new engine for mill (Togo), weaving (Indonesia) and a food market (Mexico).

Related: Financial Thanksgiving – MicroFinance Currency Risk – Creating a World Without Poverty – Provide a Helping Hand

21 of my loans have been paid back in full. 3 have defaulted. Those figure give a distorted picture though (I believe). There was a problem with a Kiva partner (they partner with micro-finance banks around the world) MIFEX, in Ecuador. Kiva discovered that MIFEX (i) improperly inflated the loan amounts it posted for entrepreneurs on the Kiva website and (ii) kept the excess amount of the posted loan to fund its own operational expenses. Kiva does not expect any further payments on these loans. I had 2, so I think those 2 give a fair impression. The 3rd default is from Kenya. That loan was to a business selling bicycle parts. In 2008, in Kenya, the prevailing political crisis deteriorated and businesses have either been destroyed or closed in fear of looters. Technically the loan did default, however, I was paid $71.50 out of $75 loan (so the defaulted amount was very small.

Read more

Home Ownership Shelter, or Burden?

The other area of concentrated distress is subprime mortgages, which increased their share of the American mortgage market from 7% in 2001 to over 20% in 2006. According to the Mortgage Bankers Association, the delinquency rate was 22% in the fourth quarter of 2008, compared with only 5% for prime loans.

…

“Perhaps the most compelling argument for housing as a means of wealth accumulation”, argues Richard Green of the University of Southern California, “is that it gives households a default mechanism for savings.” Because people have to pay off a mortgage, they increase their home equity and save more than they otherwise would. This is indeed a strong argument: social-science research finds that people save more if they do so automatically rather than having to choose to set something aside every month.

Yet there are other ways to create “default savings”, such as companies offering automatic deductions to retirement plans. In any case, some of the financial snake oil peddled at the height of the housing bubble was bad for saving.

The debate over whether home ownership is a wise investment or not, is contentious (more so in the last year than it was several years ago). I believe in most cases it probably is wise, but there are certainly cases where it is not. If you put yourself in too much debt that is often a big problem. I also think you should save a down payment first. If you are going to move (or have good odds you may want to) then renting is often the better option.

The “default saving” feature is one of the large benefits of home ownership. That benefit is destroyed when you take out loans against the rising value of the house. And in fact this can not just remove the benefit but turn into a negative. If you spend money you should have (increasing your debt) that can not only remove you default saving benefit but actual make your debt situation worse than if you never bought.

Related: Your Home as an Investment – Nearly 10% of Mortgages Delinquent or in Foreclosure – Housing Rents Falling in the USA – Ignorance of Many Mortgage Holders

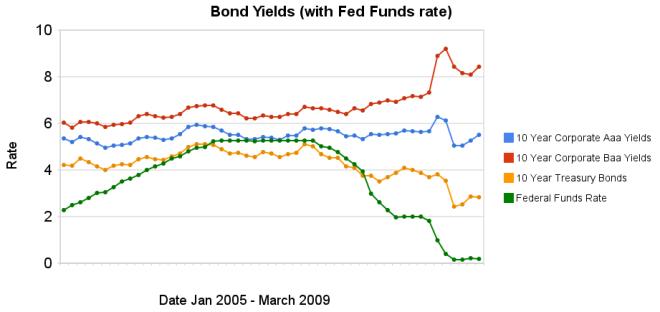

Chart showing corporate and government bond yields by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.

Chart showing corporate and government bond yields by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.The federal funds rate remains under .25%. The large spread between government bonds and corporate bonds remains very large. In the last 3 months the yields on Aaa corporate bonds have increased 45 basis points, Baa corporate bond yields have decreased 1 basis points, while treasury bond yields have increased 40 basis points.

The spread between 10 year Aaa corporate bond yields and 10 year government bond yields is now 268 basis points. In January, 2008 the spread was 159 points. The larger the spread the more people demand in interest, to compensate for the increased risk. The spread between government bonds and Baa corporate bonds decreased to a still very large 566 basis points, the spread was 280 basis point in January 2008, and 362 basis points in September 2008.

Data from the federal reserve: corporate Aaa – corporate Baa – ten year treasury – fed funds

Related: Chart Shows Wild Swings in Bond Yields – Fed to Start Buying Treasury Bonds Today – Corporate and Government Bond Rates Graph (Oct 2008) – investing and economic charts

One problem with investing in mutual funds is potential tax bills. If the fund has invested well and say bought Google at $150 and then Google was at $700 (a few years ago) there is the potential tax liability of the $550 gain per share. So if funds have been successful (which is one reason you may want to invest in them) they often have had a large potential tax liability.

With an open end mutual fund the price is calculated each day based on the net asset value, which is fair but really the true value if there is a large potential tax liability is less than if there was none. So in reality you had to believe the management would outperform enough to make up for the extra taxes that would be owed.

Well, the drastic stock market decline over the last few years has turned this upside down and many mutual funds actual have tax losses that they have realized (which can be used to offset future capital gains). Say the fund had realized capital losses of $30,000,000 last year. Then if they have capital gains of $20,000,000 next year they can use the losses from last year and will not report any taxable capital gains. And the next year the first $10,000,000 in capital gains would be not table either. Business Week, had an article on this recently – Big Losers Can Be Big Tax Shelters

…

Yet it is Miller’s newer charge, Legg Mason Opportunity, which holds stocks of all sizes and can take short positions, that will prove to be the real tax haven. Morningstar pegs its losses at 285% of its $1.2 billion in assets.

…

There are other funds with returns so ugly and losses so large that it may not matter what their trading style is for many years: Fidelity Select Electronics (FSELX), -539%; MFS Core Equity A, -369%; Janus Worldwide (JAWWX), -304%; Vanguard U.S. Growth (VWUSX), -227%.

How does a fund have over 100% tax losses? The way I can think of is if they have a great deal of redemptions. If the fund shrinks in size from a $3 billion fund to a $300 million fund they could have a 50% realized capital loss (down to $750 million) but then another $450 million in redemptions). Now the $300 million has a $750 million capital loss or 250%.

Related: Shorting Using Inverse Funds – Lazy Portfolio Results – Does a Declining Stock Market Worry You? – Asset Allocations Make A Big Difference

663,000 jobs were lost in the USA in March and the unemployment rate rose from 8.1 to 8.5 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Since the recession began in December 2007, 5.1 million jobs have been lost, with almost two-thirds (3.3 million) of the decrease occurring in the last 5 months. In March, job losses were large and widespread across the major industry sectors.

In March, the number of unemployed persons increased by 694,000 to 13.2 million, and the unemployment rate rose to 8.5 percent. Why is that different than the numbers above? The numbers are from different sources of data, the first from BLS surveys of businesses and the 694,000 from household surveys. This reminds us that this data is approximate, not exact. Undoubtedly the figures will be revised as more data is analyzed.

Over the past 12 months, the number of unemployed persons has grown by about 5.3 million, and the unemployment rate has risen by 3.4 percentage points. Half of the increase in both the number of unemployed and the unemployment rate occurred in the last 4 months.

The unemployment rates continued to trend upward in March for adult men, 8.8%, adult women 7.0%, whites 7.9% and Hispanics 11.4%. The jobless rates for African Americans, 13.3% and teenagers 21.7% were little changed over the month. The unemployment rate for Asians was 6.4% in March, not seasonally adjusted, up from 3.6% a year earlier.

Related: Over 500,000 Jobs Disappeared in November – Manufacturing Employment Data – 1979 to 2007 – What Do Unemployment Stats Mean?