The decisions over the past 30 years to pass huge huge tax bills to those in the future is unsustainable. Saying you cut taxes when all you actually do is postpone them is dishonest. However, many people go along with such false statements so politicians have learned to buy votes today by raising taxes on the future. Since the public keeps voting for such people when the facts are clear the only explanation is they support raising taxes, not today, but in the future (or, I suppose, they are not able to understand the clear implications of what they vote for). The Long-Term Budget Outlook

…

For decades, spending on Medicare and Medicaid has been growing faster than the economy. CBO projects that if current laws do not change, federal spending on Medicare and Medicaid combined will grow from roughly 5 percent of GDP today to almost 10 percent by 2035. By 2080, the government would be spending almost as much, as a share of the economy, on just its two major health care programs as it has spent on all of its programs and services in recent years.

…

CBO projects that Social Security spending will increase from less than 5 percent of GDP today to about 6 percent in 2035 and then roughly stabilize at that level.

…

Federal interest payments already amount to more than 1 percent of GDP; unless current law changes, that share would rise to 2.5 percent by 2020.

The cost of paying for a dysfunctional medical system has been a huge drain on the USA economy for decades. But that is nothing compared to what the future holds if we don’t adopted sensible strategies that reduce the huge extra costs we pay and the worse performance we receive for that cost.

Social security is not the huge problem many think it is. Still I would support reducing the payout to wealthy individuals and bringing the age limits more in line with the changes in life expectancy. 12.4% of pay for low and middle wage workers (high income earners stop paying social security taxes so in effect marginal tax rates decrease by 12% for any income above $106,800). Medicare taxes add 2.9% bringing the total social security and Medicare taxes to 15.1% (including both the amount paid directly by the employee and the amount paid for the employee by the employer).

Related: True Level of USA Federal Deficit – USA Federal Debt Now $516,348 Per Household – quotations about economics – articles on improving the health care system – USA Spent $2.2 Trillion, 16.2% of GDP, on Health Care in 2007

Two Professors Argue About the Invisible Hand – And Both Get it Wrong too

…

He used the term not in his discussion and analysis of markets (Book I and II of Wealth Of Nations), but in a discussion of the choice of export/importing versus investing in domestic businesses (Book IV of Wealth Of Nations on his critique of mercantile political economy). It had nothing to do with ‘regulating’.

…

It was a metaphor Smith used only three times and he never said “that when this invisible hand exists, when we all pursue our own interest, we end up promoting the public good, and often more effectively than if we had actually and directly intended to do so.” That is a modern construction placed on the metaphor and has next to nothing to do Adam Smith

…

The invisible hand was never in Adam Smith’s world in the form invented in mid-20th century by some economists who created the Chicago version of Adam Smith, while ignoring the Adam Smith born in Kirkcaldy, Scotland in 1723.

Related: There is No Invisible Hand – Myths About Adam Smith Ideas v. His Ideas – Not Understanding Capitalism

Mobius Says Derivatives, Stimulus to Spark New Crisis

“Political pressure from investment banks and all the people that make money in derivatives” will prevent adequate regulation, said Mobius, who oversees $25 billion as executive chairman of Templeton in Singapore. “Definitely we’re going to have another crisis coming down,”

…

A “very bad” crisis may emerge within five to seven years as stimulus money adds to financial volatility, Mobius said. Governments have pledged about $2 trillion in stimulus spending.

…

“Banks have lobbied hard against any changes that would make them unable to take the kind of risks they took some time ago,” said Venkatraman Anantha-Nageswaran, global chief investment officer at Bank Julius Baer & Co. in Singapore. “Regulators are not winning the battle yet and I’m not sure if they are making a strong case yet for such changes.”

Mobius also predicted a number of short, “dramatic” corrections in stock markets in the short term, saying that “a 15 to 20 percent correction is nothing when people are nervous.” Emerging-market stocks “aren’t expensive” and will continue to climb

I share this concern for those we bailed out using the money we paid them to pay politicians for more favors. Those paying our politicians like very much paying themselves extremely well and then being bailed out by the taxpayers when their business fails. They are going to try to retain the system they have in place. And they are likely to win – politicians are more likely to provide favors to those giving them large amounts of money than they are to learn about proper management of an economy.

Related: Congress Eases Bank Laws for Big Donors (1999) – Lobbyists Keep Tax Off Billion Dollar Private Equities Deals and On For Our Grandchildren – General Air Travel Taxes Subsidizing Private Plane Airports – CEOs Plundering Corporate Coffers

Welcome to the Curious Cat Investing and Economics Carnival, we hope you enjoy the following posts we share here.

- Warren Buffet On An Investment News Channel by Robin Bal – “I could see that the mere mention of a time scale like three to five years had derailed the interviewer’s thought process. Coming as she did from a world where three to five hours or at most three to five days is the standard unit of time, the idea of an investor talking in years seemed to have thrown a spanner in her works.”

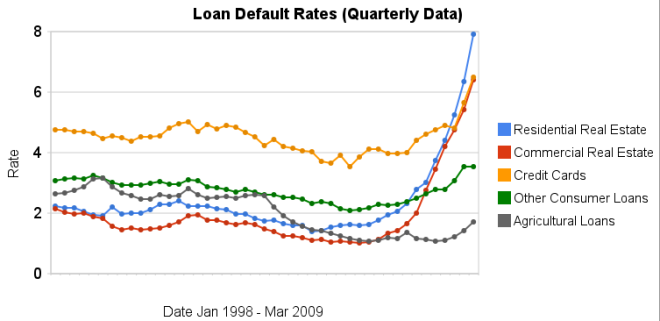

- Loan Default Rates: 1998-2009 by John Hunter – “In the 4th quarter of 2007 residential real estate default rates were 3.02% by the 4th quarter of 2008 they were 6.34% and in the 1st quarter of this year they were 7.91%”

- Key Factors Affecting Long-Term Growth in Federal Spending by Douglas Elmendorf – “Two factors underlie the projected increase in federal spending on Medicare, Medicaid, and Social Security as a share of GDP: rapid growth in health care costs and an aging population.”

- Will the Chinese Keep Saving? by Rachel Ziemba – “Should export-oriented ’surplus’ countries like China keep saving and keep trying to export demand, the reduction in imbalances could actually exacerbate the global economic contraction or contribute to a more sluggish recovery. “

- Use Your Health Insurance! by David Weliver – “So if you’re worried about losing your job (and insurance) or anticipate making a life change that will leave you uninsured, get in to see a doctor while you are still covered.”

- Where is the externality here? by Matt Nolan – “They are paid less because their marginal product is lower, and they are willing to be paid less because the benefit they receive from consuming alcohol is sufficient compensation – this is a completely internalised decision for the drinker isn’t it, so where is the social cost.”

- Quibbles With Quants – “What the models failed to capture was that humans don’t behave in simple, predictable and uncorrelated ways. It’s impossible to overstate the importance of the way these models cope with correlation of peoples’ psychology. To sum it up: they don’t. Let me know if that’s too complex an analysis for the mathematical masters of the universe.”

- Goldman’s Back, and Why We Should Be Worried by Robert Reich – “The decision to bail out AIG resulted in a $13 billion giveaway to Goldman because Goldman was an AIG counterparty. Indeed, Goldman executives and alumni have played crucial roles in guiding the Wall Street bailout from the start. So the fact that Goldman has reverted to its old ways in the market suggests it has every reason to believe it can revert to its old ways in politics, should its market strategies backfire once again — leaving the rest of us once again to pick up the pieces.”

Here is a good blog post showing one great feature of the blogosphere (that term seems to have fallen out of use hasn’t it): interaction. It also shows that you have to think critically. You can’t just accept what you read (you never can, but that is even more true with blogs than it is with newspapers that at least have some standards normally). I tend to agree with this posts look at the data, though I have not examined the issue closely.

Bad Math, Bad Statistics: Trying to get a blogger to admit a mistake

1981: 229465714 * 8476.0 = 1.944 trillion

1992: 255029699 * 14847.0 = 3.786 trillion (94% gain)

2005: 292892127 * 25036.0 = 7.332 trillion (93.6% gain)

Er, doesn’t look like a lag to me. In fact, it looks like it’s doubling every 12-13 years just as much as GDP is. I also looked up total income statistics for the US, and found the following figures (source). (Note these figures are different. More on that later.)

1981: $2,580,600,000 (2.58 / 3.1 = 83% of GDP)

1992: $5,349,384,000 (more than double!) (5.34 / 6.2 = 86% of GDP)

2005: $10,252,973,000 (another double!) (10.25 / 12.4 = 82% of GDP)

Anyway it is a much more interesting argument than I would hear when I listened to TV “pundits” years ago spout meaningless talking points at each other. Granted they argument is not going to be studied as a wonderful example of how we should debate. Still it is much above what passes for debate from our politicians (yes this is more a sad commentary on how failed our politicians are than a statement of how marvelous the argument on the GDP issue is between the two bloggers).

Here is a math question for you, what has a bigger impact moving from 15 to 18 mpg or 50 to 100 mpg?

Related: Government Debt as a Percentage of GDP – USA Consumers Paying Down Debt – Is Productivity Growth Bad? – Americans are Drowning in Debt

Chart showing loan default rates for real estate, consumer and agricultural loans for 1998 to 2009 by the Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.

Chart showing loan default rates for real estate, consumer and agricultural loans for 1998 to 2009 by the Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.As you can see real estate default rates exploded in 2008. In the 4th quarter of 2007 residential default rates were 3.02% by the 4th quarter of 2008 they were 6.34% and in the 1st quarter of this year they were 7.91% (471 basis points above the 4th quarter of 2007). Commercial real estate default rates were at 2.74 in the 4th quarter of 2007, 5.43% in the fourth quarter of 2008 and 6.5% in the 1st quarter of 2009 (a 366 basis point increase).

Credit card default rates were much higher for the last 10 years (the 4-5% range while real estate hovered above or below 2%). In the last 2 quarters it has increased sharply. From 4.8% in the 3rd quarter 2008 to 5.66% in the 4th and 6.5% in the 1st quarter of 2009. The default rate on other consumer loans are up but nowhere near the amounts of real estate or credit cards.

Agricultural loan default rates are actually about as low now as they have every been 1.71%. That is up a bit from the 1.06% low the default rate hit in the 1st quarter of 2009 but actually lower than it was for half of the last decade (the last 5 years it has been lower but prior to that it was higher – in fact with higher default rates than either real estate loan category).

Related: Mortgage Rates: 6 Month and 5 Year Charts – Jumbo Loan Defaults Rise at Fast Pace – Continued Large Spreads Between Corporate and Government Bond Yields – Nearly 10% of Mortgages Delinquent or in Foreclosure

The Formula That Killed Wall Street

His method was adopted by everybody from bond investors and Wall Street banks to ratings agencies and regulators. And it became so deeply entrenched—and was making people so much money—that warnings about its limitations were largely ignored.

Then the model fell apart. Cracks started appearing early on, when financial markets began behaving in ways that users of Li’s formula hadn’t expected. The cracks became full-fledged canyons in 2008—when ruptures in the financial system’s foundation swallowed up trillions of dollars and put the survival of the global banking system in serious peril.

Very nice article on the dangers of financial markets to those that believe that math can provide all the answers. Math can help find opportunities. However markets have physical, psychological and regulatory limitations. And markets frequently experience huge panics or manias. People continue to fail to model that properly.

Related: All Models Are Wrong But Some Are Useful – Leverage, Complex Deals and Mania – Financial Markets with Robert Shiller – Financial Market Meltdown – Failure to Regulate Financial Markets Leads to Predictable Consequences

Economists are raising projections for the USA economy in the second half of 2009. The predictions are still for an anemic economy growing at just 1.5% and with unemployment reaching 10.1%. Still I think if we achieve that we should feel lucky. Economists Raise U.S. Outlook as Recession Fades

…

The economy probably shrank at a 1.8 percent rate from April to June, the latest survey showed, less than economists forecast last month. The U.S. will return to growth in the current quarter and expand 2.1 percent next year.

…

A separate report from the Commerce Department today showed the trade deficit unexpectedly narrowed in May as exports jumped while imports of crude oil and auto parts slid. The gap between imports and exports decreased 9.8 percent to $26 billion, the smallest since November 1999, from $28.8 billion in April.

Unemployment will rise to 10.1 percent in the first quarter of 2010 from 9.5 percent last month, already the highest since August 1983, the survey of economists showed.

The trade deficit is still far to large. And the to move the economy in the right direction we need to continue reducing personal debt (and start reducing government debt).

Related: First Quarter GDP 2009 down 6.1% – When Will the Recession Be Over? – Warren Buffett Webcast on the Credit Crisis

The Society for Actuaries has published a good resource: Managing post-retirement risks.

…

Many investors try to own some assets whose value may grow in times of inflation. However, this sometimes will trade inflation risk for investment risk.

• Common stocks have outperformed inflation in the long run, but are

poor short-term hedges. The historically higher returns from stocks

are not guaranteed and may vary greatly during retirement years.

…

Retirement planning should not rely heavily on income from a bridge job. Many retirees welcome the chance to change careers and move into an area with less pay but more job satisfaction, or with fewer demands on their time and energy.

Terminating employment before age 65 may make it difficult to find a source of affordable health insurance before Medicare is available.

…

Insurance for long-term care covers disabilities so severe that assistance is needed with daily activities such as bathing, dressing and eating. Some policies require a nursing home stay; others do not. The cost of long-term care insurance is much less if purchased at younger ages, well before anticipated need.

The full document is well worth reading.

Related: Many Retirees Face Prospect of Outliving Savings – How to Protect Your Financial Health – Financial Planning Made Easy – personal finance tips

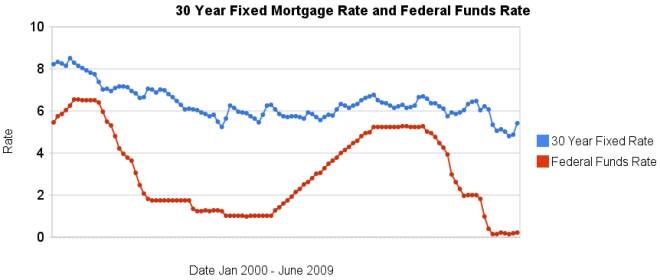

Once again the data shows that the 30 year fixed mortgage rates are not directly related to federal funds rates. In June the fed funds rate increased 3 basis points, 30 year mortgage rates increased 56 basis points. Since January the fed funds rate is up 6 basis points is up while 30 year mortgage rates are up 36 basis points. Home prices have continued to fall even with the very low mortgage rates.

Related: Mortgage Rates: 6 Month and 5 Year Charts – historical comparison of 30 year fixed mortgage rates and the federal funds rate – posts on financial literacy – GM and Citigroup Replaced by Cisco and Travelers in the Dow – Jumbo v. Regular Fixed Mortgage Rates: by Credit Score

For more data, see graphs of the federal funds rate versus mortgage rates for 1980-1999. Source data: federal funds rates – 30 year mortgage rates