John Bogle was the founder of Vanguard Group and a well respected investment mind. He has written several good books including: The Little Book of Common Sense Investing, Common Sense on Mutual Funds and Bogle on Mutual Funds. This interview from 2006 discusses the state of the retirement system, before the credit crisis.

Frontline: How do they get away with that? Don’t they have to fund them?

John Bogle: No, they don’t, because a lot of it is based on assumptions. Our corporations are now assuming that future returns in their pension plan will be about 8.5 percent per year, and that’s not going to happen. The future returns in the bond market will be about 4.5 percent, and maybe if we’re lucky 7.5 percent on stocks. Call it a 6 percent return — before you deduct the cost of investing all that money, the turnover cost, the management fees. So maybe a 5 percent return is going to be possible, in my judgment, and they are estimating 8.5 percent.

Why? Because when they do it that way, corporation earnings become greatly overstated, and all the executives get nice, big bonuses. They are using pension plan assumptions as a way to manage corporate earnings and meet the expectations of Wall Street.

Frontline: So if a company overstates the value of its pension plan assets, it makes the company look better to Wall Street, so there’s an incentive to kind of exaggerate, if not cheat.

John Bogle: That is precisely correct. And let me clear on the cheating: It’s legal cheating; it’s not illegal cheating. In other words, you can change any reasonable set of numbers — and corporations have done this, have raised the pension assumption from 7 percent to 8.5 percent — and all of a sudden that corporation will report an earnings gain for the year rather than an earnings loss that they would otherwise have. Simple, legal.

The entire PBS series (from 2006) on 401(k)s (including interviews with Elizabeth Warren, David Wray and Alicia Munnell) is worth reading.

In February of 2009 he spoke to the House of Representatives committee exploring retirement security.

Read more

The Indian stock market surged 17% today on the election results that gave the Congress party an unexpectedly decisive victory. The market was closed early due to the huge spike in prices. The Indian stock market was up 26% this year, before the move today.

Landslide in India Vote Reshapes Landscape

…

Even with a free hand, the Congress-led government will face formidable challenges. India needs to swiftly build roads, highways and power plants; improve public schools and build universities for a swelling young population; and hire nurses and doctors for its feeble public health system. Most of all, it needs to address its abiding poverty. Despite over a decade of high economic growth in India, 300 million people remain below the poverty line.

Driving India’s Economic Reforms

India has great potential and great problems. India has poor physical infrastructure and crippling bureaucracy; India ranked the 122nd easiest country for doing business. The election results are giving investors hope the government will be able to make progress to improve the business climate, which will improve economic performance.

Related: Emerging-market Multinationals – Why Investing is Safer Overseas (Jun 2007) – World’s Wealthiest People – Top 12 Manufacturing Countries in 2007

Can unemployment claims predict the end of the American recession? by Robert J. Gordon

…

To this point I have examined a single indicator to see if it is useful in predicting the end of recessions without any consideration of what is going on in the rest of the economy. Our conclusion is supported by the fact that previous false peaks occurred when new claims were at 80 to 90% of the level at the ultimate true peak. For the peak of 4 April 2009 to be false by this historical precedent, the ultimate future peak would have to be in the range of 730,000 to 800,000. As the weeks go by, such a sharp future increase in new claims looks increasingly implausible.

…

My reasoning leads me to conclude that the ultimate NBER trough of the current business cycle is likely to occur in May or June 2009, substantially earlier than is currently predicted by many professional forecasters.

Interesting points. Time will tell what happens. I am skeptical this measure alone will prove to be perfect but I can believe it will be one useful measure to consider. I tend to be skeptical we are close to a strong recovery. But at what point the economy moves out of a recession is less certain. I still believe we will be lucky if we show job gains by the end of this year.

Related: How Much Worse Can the Mortgage Crisis Get? (March 2008) – Unemployment Rate Increased to 8.9% – Manufacturing Employment Data – 1979 to 2007 – First Quarter 2009 GDP down 6.1% – Poll: 60% say Depression Likely (Oct 2008)

Welcome to the second edition of our investing and economics carnival.

- How Does the Current Crisis Compare to the Great Depression? by Price Fishback – “How does this compare to the Great Depression? We won’t know the final outcome of this recession for a while, but I can safely say that the current situation is nowhere near as bad as the situation during the 1930’s.”

- US GDP and imports by Matt Nolan – “Now, this doesn’t actually make sense as a measure to look at. Why? Well when we measure GDP we are interested in ‘domestic production’…”

- 100th Entrepreneur Loan by John Hunter – “Participating with Kiva is a great antidote to reading about the unethical ‘leaders’ taking huge sums to run their companies into the ground (or even just taking obscene sums to maintain their company). The opportunity to give real capitalists an chance at a better life is wonderful.”

- The Best 15 Financial iPhone Apps by David Weliver – “More than a dozen great financial apps for the iPhone make tracking and managing your personal finances on the go as easy as texting. Want to enlist your iPhone to help you get richer?”

- Bolster Your Emergency Fund In A Prolonged Crisis – “To prepare for the worst, we should picture an unemployed scenario and get serious about bulking up our emergency fund to meet at least six to eight months of expenses.”

- How to make money without a job and why you should – “There are two more advantages to alternative income besides diversification of income sources. First of all is the expansion of skills… You are learning something new, and making it that much more likely that you’ll be able to add further income streams…

- Five Low-Risk Stocks For Gen Y – “There are much better alternatives for the ultra-conservative Gen Y investors than money market accounts, Treasuries and CDs. A conservative strategy focusing on high quality, low risk dividend stocks should significantly out-perform the above investments, with very little incremental long-term risk.”

- 5 easy ways to save money and the environment – “Bottled water is a huge drain on our resources and are grossly overpriced. Reusable water bottles use fewer resources, save you money… Compact fluorescent light bulbs use 25% of the energy of standard incandescent bulbs and usually last 5 years or more…”

- Text Messaging is the Biggest Scam of the 21st Century – “The cost per GB of cable internet is $0.75… the cost per GB of cell phone data $6.00… the cost per GB of text messaging data is $800…”

I decided to add this investing and economics carnival after running the Curious Cat Management Management Improvement Carnival for several years. If you like these posts you may also be interested in the Invest Reddit where a community of those interested in investing submit and rate articles and blog posts.

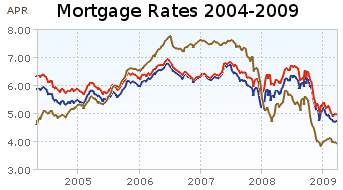

Showing mortgage rates over the last 6 months. Red: 30 year fixed rate. Blue: 15 year fixed rate. Tan: 1 year adjustable rate.

Showing mortgage rates over the last 6 months. Red: 30 year fixed rate. Blue: 15 year fixed rate. Tan: 1 year adjustable rate.

Showing mortgage rates over the last 5 years. Red: 30 year fixed rate. Blue: 15 year fixed rate. Tan: 1 year adjustable rate. From Yahoo Finance, for conventional loans in Virginia.

Showing mortgage rates over the last 5 years. Red: 30 year fixed rate. Blue: 15 year fixed rate. Tan: 1 year adjustable rate. From Yahoo Finance, for conventional loans in Virginia.

The 6 month chart shows that mortgage rates have been declining ever so slightly. Rates on a 1 year adjustable mortgage fell from 5.5 to 4% and have stayed near 4% for all of 2009. 30 and 15 year rates (15 year rates staying about 25 basis points cheaper) have declined from 6.5%, 6 months ago to about 5% at the start of the year and have moved around slightly since. This is while the yield 10 year government treasuries have been rising (normally 30 year fixed rate mortgages track moves in the 10 year government bond). The federal reserve has been buying bonds in order to push down the yield (and stimulate mortgage financing and other borrowing).

Mortgage rates certainly could fall further but the current rates are extremely attractive and I just locked in a mortgage refinance for myself. I am getting a 20 year fixed rate mortgage; I didn’t want to extend the mortgage period by getting another 30 year fixed rate mortgage. For me, the risk of increasing rates outweigh the benefits of picking up a bit lower rate given the current economic conditions. But I can certainly understand the decision to hold out a bit longer in the hopes of getting a better rate. If I had to guess I would say rates will be lower during the next 3 months, but I am not confident enough to hold off, and so I decided to move now.

Related: Mortgage Rates Falling on Fed Housing Focus – posts on mortgages – 30 Year Fixed Mortgage Rates and the Fed Funds Rate – Continued Large Spreads Between Corporate and Government Bond Yields – Lowest 30 Year Fixed Mortgage Rates in 37 Years –

Nonfarm payroll employment continued to decline in April, and the unemployment rate rose from 8.5 to 8.9 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Since the recession began in December 2007, 5.7 million jobs have been lost. In April, job losses were large and widespread across nearly all major private-sector industries. Overall, private-sector employment fell by 611,000.

The number of unemployed persons increased by 563,000 to 13.7 million. Unemployment rates for April for adult men reached 9.4% and for adult women 7.1%. The number of long-term unemployed (those jobless for 27 weeks or more) increased by 498,000 to 3.7 million over the month and has risen by 2.4 million since the start of the recession in December 2007.

The civilian labor force participation rate rose in April to 65.8 percent, and the employment-population ratio was unchanged at 59.9 percent. The employment-population ratios for adult men and women showed little or no change over the month. However, since December 2007, the men’s ratio was down by 440 basis points, while the women’s ratio was down by 130 basis points. Since those that stop looking for work (retire or just stop actively looking) are not counted as unemployed the participation rate is a useful statistic to examine in conjunction with the unemployment rate.

Much of the commentary on the April job losses have been that the decrease in the number of job losses from previous months shows the economy is stabilizing. While it is true losing 611,000 jobs is better than losing 700,000 jobs, losing 611,000 is still very bad. The unemployment rate increased to 8.9% and long term unemployment is increasing drastically. This is hardly good economic news. It is true that there is hope that the economy is turning around, but the employment data we have so far is hardly positive (employment data is a lagging economic indicator so it is not surprising employment data does not recover before other signs point to improvement).

Related: Another 663,000 Jobs Lost in March in the USA – USA Unemployment Rate Rises to 8.1%, Highest Level Since 1983 – Over 500,000 Jobs Disappeared in November – What Do Unemployment Stats Mean?

The 2000–2002 bear market had three, with average gains of 21 per cent in the Dow Jones Industrials over 45 days.

The granddaddy of all bear markets, 1929 –1932, had six false alarms with an average gain of 47 per cent. And Japan’s ongoing bear saw the Nikkei rise by at least a third four times in its first four years with 10 more false dawns since then.

Bear markets typically end with a whimper rather than a bang, casting doubt on the latest recovery according to Hussman Econometrics, which analysed numerous US market bottoms and bear market rallies. With the exception of the 1987 crash, the month before the lowest point of a downturn saw a gradual descent.

I don’t put much money on the line trying to time the stock market. I thought the decline was overdone and I have found some things to buy. I am not convinced the current assent of the USA market especially means the bear market is over. If I had to sell stocks, I would be much happier to do it now than 3 months ago. That said, I am not selling anything or reducing my planned buying (401k buying).

Related: Financial Markets Continue Panicky Behavior (Oct 2008) – Trying to Beat the Market – Add to Your 401(k) and IRA – see my investing portfolio results

Consumer borrowing falls in March at fastest pace in over 18 years, Americans saving more

In dollar terms, consumer borrowing plunged by $11.1 billion. That’s the largest dollar amount on records dating to 1943, and more than three times the $3.5 billion drop that economists expected. The borrowing category that includes credit cards dropped 6.8 percent in March after a 12.1 percent plunge in February. The category that includes auto loans fell 4.2 percent after rising by 1.2 percent in February.

The Commerce Department last week said that the personal savings rate edged up to 4.2 percent in March, marking the first time in a decade that the savings rate has been above 4 percent for three straight months.

Good. Consumer debt is far to large and should be paid down. This is a start but a small start, but a much larger reduction in outstanding consumer debt is needed before we have reached a healthy level of debt. The continued improvement in that debt level signifies a stronger economy. Far too many financial journalists instead of pointing out the benefits of such improvement note that this reduces current consumption (and thus, effectively, will lower current GDP – compared to what it would be if we continued to spend beyond our means). You cannot spend money your don’t have forever.

Having more stuff in your house (along with an increased outstanding credit card balance) does not make you economically more successful. And the same holds true for the economy. Having more stuff sitting in people’s house and an increasing debt load is not the sign of a stronger economy (even if it is a route to a higher current GDP). Increased saving and reducing debt will strengthen the economy and improve our economic success over the long term.

Related: Will Americans Actually Save and Worsen the Recession? – Proper credit card use – Personal Saving and Personal Debt in the USA – Americans are Drowning in Debt – Buying Stuff to Feel Powerful

Your Life Insurance Policy May Not Be Protected by Ben Levisohn, Business Week

…

Insurance customers need to be more vigilant. Stop focusing only on cost and service and start worrying about solvency. Check such agencies as Standard & Poor’s (MHP), Fitch Ratings, Moody’s, and A.M. Best to find the highest-rated companies, and be alert for downgrades. Then dig deeper. Find out about an insurer’s exposure to real estate and mortgages and make sure its debt holdings are investment-grade. “Everyone’s under the false assumption that it doesn’t matter what company you buy from,” says Thomas Archer, chairman of financial-services firm Archer Financial Group in New York. “It does.”

• $300,000 in life insurance death benefits

• $100,000 in cash surrender or withdrawal value for life insurance

• $100,000 in withdrawal and cash values for annuities

• $100,000 in health insurance policy benefits

• $300,000 in homeowners benefits

• $300,000 in auto insurance benefits

One option is to diversify your insurance coverage, just like you diversifying investments. Historically insurance company failures have been rare, and even it is even rarer that state funds don’t cover the insurance. But if you have large amounts of insurance you can be a bit safer by having your life insurance needs covered by multiple insurers.

Related: Personal Finance Basics: Long-term Care Insurance – Insurers Raise Fees on Variable Annuities – Personal Finance Basics: Health Insurance – How to Protect Your Financial Health

Read more

Each year Warren Buffett and Charlie Munger answer questions in front of crowds of tens of thousands of Berkshire Hathaway shareholders in Omaha, Nebraska. The question and answer sessions provide great wisdom on economics, investing and management. Here are some of the highlights I have found from the meeting yesterday.

Buffett, Munger praise Google’s ‘moat’

Berkshire’s Buffett Calls Wells Fargo ‘Fabulous’ Bank

The stock closed at $19.61 yesterday after falling below $9 in March. Buffett said he was speaking to a class the day the shares dropped that low and told students that, at that price, “If I had to put all of my net worth into stock, that would be the stock.”

Buffett, who has said he values lenders partly on their ability to acquire funds from depositors, told shareholders today that he’d “love” to buy the entire bank and is unable to do so because Berkshire wouldn’t get permission from regulators.

But he warned that efforts such as the Treasury’s $700 billion Troubled Asset Relief Program and the $787 billion fiscal stimulus plan passed this year by Congress will have to be paid for, one way or another. And with political leaders showing little inclination to raise taxes, one sure way to pay for excess spending is to inflate the value of the currency, Buffett said. The biggest losers in a surge of inflation, he added, would include holders of bonds and other fixed-income assets.

…

“Government does need to step in,” Buffett said, referring to the 6% contraction of the U.S. economy in the fourth quarter of 2008 and the first quarter of 2009.

That’s not to say he is pleased with the earmarks Congress has attached to some of the rescue legislation. Inevitably, Buffett said, when big organizations turn massive resources on a problem, “there’s a fair amount of slop.”

Related: Berkshire Hathaway Annual Meeting 2008 – Warren Buffett’s Letter to Shareholders 2009 – Great Advice from Warren Buffett – Warren Buffett’s 2004 Annual Report

Read more