Welcome to the Curious Cat Investing and Economics Carnival: find useful recent personal finance, investing and economics blog posts.

- Global Aging – “Over time, low birth rates lead not only to fewer children, but also to fewer working-age people just as the percentage of dependent elders explodes. This means that as population aging runs its course, it might well go from stimulating the economy to depressing it. Fewer young adults means fewer people needing to purchase new homes, new furniture, and the like, as well as fewer people likely to take entrepreneurial risks. ” (The economic consequences of demographic changes are enormous. Investors often fail to appreciate how important they are – John)

- Google: A Free Cash Flow Analysis by Peter Mycroft Psaras – “I learned this trick by analyzing Warren Buffett’s purchase of International Dairy Queen and noticed that many of the investments he was making then were low capital expenditure/ high free cash flow machines.”

- Oil Consumption by Country 1990-2009 by John Hunter – “The USA consumed 18.7 million barrels a day in 2009. Only China was also over 5 million barrels, they reached 8.2 million in 2009. Japan is next at 4.4 million.”

- 9 lazy portfolios for UK investors – “You don’t need to pay for black box analytics that spit out your fully personalized, mean variance optimised, risk calibrated portfolio. You can just keep things simple and do it yourself.”

- Where corn prices go (and that’s UP), meat prices will follow by Jim Jubak – “But it is good news for farm incomes as higher prices for corn and other commodities push up revenues. That’s good news for the stocks of Mosaic (MOS) and Agrium (AGU) in the fertilizer group, seed companies Monsanto (MON) and Syngenta (SYT), and farm equipment makers Deere (DE) and AGCO (AGCO).”

- Three Small Financial Tweaks You Should Make Before Winter by Mark Riddix – “At a minimum, try to increase your [retirement] contribution 1% every year. Although you shouldn’t miss 1% every time you add it, over time those small increases become 5% and 10%, which means a big long-term boost to your investments.”

- How to Avoid Lifestyle Inflation by Ryan Guina – “Live beneath your means. An increase in income does not change the fact that living beneath your means is the single most important step in financial independence.”

- How to keep yourself from retiring broke – ” According to the Center for Retirement Research, Americans, who are between 32 and 64 years old now, will be short about $90,000 on average to retire comfortably and ‘on time’.”

- Yield Curve by Robert Wasilewski – “You’ll find today’s spread is historically steep… The spread is the compensation that investors get for taking on price risk for buying longer maturities. Bond investors constantly assess whether the additional yield, i.e. spread, compensates for the incremental risk.”

- Asset Allocation In A Rising Interest Rate Environment by Gaétan Ruest – “Typically, a shorter term bond will be less impacted in a rising interest rate environment than a long term bond. But this is only true if the increase in the short term interest rates is the same as at the long term.”

Related: investing books – articles on investing – Curious Cat Investing and Economics Search

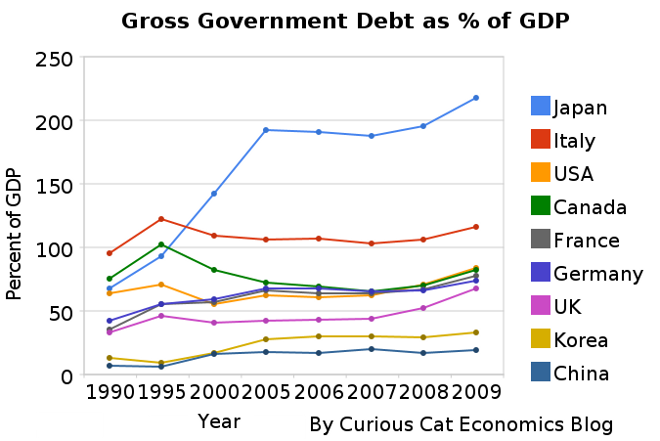

The world today has a much different economic landscape than just 20 years ago. China’s amazing economic growth is likely the biggest story. But the overwhelming success of many other countries is also a huge story. Today it is not the developing world that has governments spending taxes they promise their grandchildren will pay, but instead the richest countries on earth that choose to spend today and pay tomorrow. While “developing” countries have well balanced government budgets overall.

The chart shows gross government debt as percentage GDP from 1990-2009. By Curious Cat Investing and Economics Blog, Creative Commons Attribution. Data source: IMF

The chart shows gross government debt as percentage GDP from 1990-2009. By Curious Cat Investing and Economics Blog, Creative Commons Attribution. Data source: IMF___________________________

There are plenty of reasons to question this data but I think it gives a decent overall picture of where things stand. It may seem like government debt should be an easy figure to know but even just agreeing what would be the most reasonable figure for one country is very difficult, comparing between countries gets even more difficult and the political pressures to reduces how bad the data looks encourages countries to try and make the figures look as good as they can.

The poster child for irresponsible spending is Japan which has gross government debt of 218% of GDP (Japan’s 2009 figure is an IMF estimate). Greece is at 115%. Gross debt is not the only important figure. Government debt held within the country is much less damaging than debt held by those outside the country. Japan holds a large portion of its own debt. If foreigners own your debt then debt payments you make each year are paid outside your country and it is in essence a tax of a portion of your economic production that must be paid. If the debt is internal it mean taxpayers have to support bond holders each year (but at least when those bondholders spend the money it stays within your economy).

Read more

I made several more Kiva loans to entrepreneur in Kenya, Lebanon, Nicaragua, Kenya, Honduras and Armenia (brining my total loans to 251). It really is great to see real people using capitalism to improve their lives. And being able to help by lending some money is wonderful. When looking for loans I give preference to loans that improve productivity and increasing capacity of the entrepreneur. If they use the proceeds of the loan to increase their capacity to produce they can pay off the loan and find themselves much better off.

Douglas Osusu, Kisii, Kenya, in front of his posho mill (used for grinding maize into flour).

Douglas Osusu, Kisii, Kenya, in front of his posho mill (used for grinding maize into flour).A nice example of this is the loan to Douglas Osusu (pictured). He has requested this loan of 80,000 KES to purchase a dairy cow and a posho mill. This loan also has a portfolio yield (Kiva’s equivalent of an annual percentage rate) of 19%. 19% is very loan for loans on Kiva (remember there are significant costs to servicing micro-loans) – I like the rate to be under 30% but sometimes accept rates up to 40% (or even higher occasionally). I also give great preference to low rates, as the lower the rate the better for the entrepreneur. The 3rd factor I consider is the history of the field partner bank (default rate, delinquency rate and currency exchange loss rate). In this case the field partner is new and carries risk because of that. Still in this case I really like the loan and I like that this lender is charging low rates so I want to take the risk and see how they can do. The amount I lend is based on the combination of these factors – I lend more when I have several reasons to really like the loan.

Join other readers by making loans and joining the Curious Cats Lending Team: 8 members, 213 loans totaling $8,775. Comment with the link to your Kiva page and I will add a link on Curious Cat Kivans.

My current default rate is 1.39% and the delinquency rate is 8.49% (see chart of USA general delinquency rates). The delinquency rate is exaggerated due to technical details (some difficulties in reporting in various countries and such things). Agricultural loans often become delinquent on Kiva but still are paid in full (in my experience). While the defaulted loan rate is 1.39% if you look at the percent of dollars lost I have a rate of 1.2% (this is nearly all due to a bank that failed over a year ago to which I had 2 loans where I lost $87.50 of $100 – there are also 2 other losses for under $5). I add to my total loan amount a couple times a year but also I get to keep relending as money is paid back.

Some of my favorite ways to help reduce extreme poverty are Trickle Up, Kiva and using Global Giving to find small organizations.

Related: 100th Entrepreneur Loan – More Kiva Entrepreneur Loans: Kenya, El Salvador (June 2010) – Kiva Opens to USA Entrepreneur Loans – MicroFinance Currency Risk – Kiva Fellows Blog: Nepalese Entrepreneur Success

Some companies (Banks, Verizon, Comcast, credit card insurers, United, car dealers…) continually find new ways to be hostile to customers. It really is amazing people put up with their horrible practices. The latest from the fees to check bags, fees to for paying company expenses, waste your time on voice mail hell if you want to talk to us crowd is fees to pay bills using automated systems.

The customer hostility of these companies is part of their DNA. We should recognize the new attempts to fleece customers but there is no reason to be surprised by the new, ever more hostile customer behavior of these companies. There are alternatives for consumers, just find them, and support them. Some industries are dominated by customer hostile companies (which can make avoiding them hard): banks (both consumer and investment banks), credit cards, airlines, cable companies, cell phone service. Even in those industries you can find ethical companies: Southwest Airlines, many credit unions, CarMax…

…

And yet these guys are charging $15. I asked Chase, “How can you charge that much for an automated transaction?” They said, “Well, that’s how much we charge.” And you look at some of the other charges out there. For instance, this week Verizon Communications is introducing a new $3.50 charge if you pay your bill online, automated phone system, or to a service rep without using their recurring, automatic bill paying system.

Time Warner Cable charges $4.99 to pay by phone with a human being, but it too charges nothing to use the automated system.

“People pay for a product or service,” said Doug Heller, executive director of Consumer Watchdog, a Santa Monica advocacy group. “They shouldn’t have to pay again just for the right to pay them.”

Related: Protect Yourself from 11 Car Dealer Tricks – Poor Customer Service: Discover Card – Best Buy Asks Man to Change His Name – Is Poor Service the Industry Standard?

Law enforcement officers, pre-Kindergarten through 12th grade teachers and firefighters/emergency medical technicians can contribute to community revitalization while becoming homeowners through HUD’s Good Neighbor Next Door Sales Program. HUD (United States Department of Housing and Urban Development) offers a substantial incentive in the form of a discount of 50% from the list price of the home. In return you must commit to live in the property for 36 months as your sole residence.

Eligible Single Family homes located in revitalization areas (there are hundreds of revitalization areas across the country. HUD is always working with localities to designate new areas) are listed exclusively for sales through the Good Neighbor Next Door Sales program. Properties are available for purchase through the program for five days.

Check the listings for your state. Follow the instructions to submit your interest in purchasing a specific home. If more than one person submits on a single home a selection will be made by random lottery. You must meet the requirements for a law enforcement officer, teacher, firefighter or emergency medical technician and comply with HUD’s regulations for the program.

HUD requires that you sign a second mortgage and note for the discount amount. No interest or payments are required on this “silent second” provided that you fulfill the three-year occupancy requirement.

Related: Fixed Mortgage Rates Reach New Low – Your Home as an Investment – articles on home ownership

I am looking at mortgage refinance options now (with rates being so low). I am looking at 20 year fixed rate loans with cash out (with over 20% down). The 20 year term will reduce my loan term a bit, and the final monthly cost should actually be not much higher than my current payment (with taking some cash out), I think. Do any readers have opinions on these lenders (or others with competitive offers – low rates and low expenses)?

Total Mortgage – 20 year fixed rate 3.875%, total fees and points not provided ![]() , apr 4.15%

, apr 4.15%

American United Mortgage – 20 year fixed rate 4% [same as 30 year rate ![]() ], fees $2,995 (0 points), apr 4.26%

], fees $2,995 (0 points), apr 4.26%

Aim Loan – 20 year fixed rate 3.875%, fees (about $4,100 I think), apr 4.02%

These are some of the best deals I have been able to find. However, companies can play games with fees and hide excessive costs in requirements they don’t consider fees (appraisal costs…). Rates can bounce around for a specific lender, so I think it make sense to watch several (not just pick out he lowest one on whatever date you first look).

Suggestions on how to tell whether specific lenders good faith estimates are accurate and comparable would be especially appreciated.

Edits:

RoundPoint – looks good, low rates, low fees, good reviews on Zillow.

Amerisave – 20 year fixed rate 3.75%, total fees and points $3,418, apr 3.87% (removed as an option – they don’t respond to customer have tons of negative reviews online about problems, poor service, etc.

Related: Fixed Mortgage Rates Reach New Low – Low Mortgage Rates Not Available to Everyone – 30 Year Fixed Mortgage Rates and the Fed Funds Rate – Mortgage terms

U.S. Home Prices Face Three-Year Drop as Supply Gains

…

Sales of new and existing homes fell to the lowest levels on record in July as a federal tax credit for buyers expired and U.S. unemployment remained near a 26-year high.

…

There were 4 million homes listed with brokers for sale as of July. It would take a record 12.5 months for those properties to be sold at that month’s sales pace, according to the Chicago- based Realtors group.

…

In addition to the as many as 8 million properties vacant or in foreclosure, owners of another 3.8 million homes — 5 percent of U.S. households — said they are “very likely” to put their properties on the market within six months if there is improvement, according to a survey by Seattle-based Zillow.

…

Owners of about 11 million homes, or 23 percent of households with a mortgage, owed more than their property was worth as of June 30, according to CoreLogic. Another 2.4 million borrowers had less than 5 percent equity in their houses and probably would lose money on a sale after paying broker fees and closing costs, CoreLogic said Aug 25.

The shadow inventory, poor job market and low net home equity positions continue to put a huge amount of pressure on the housing market. Very low interest rates help support the market but not much else does. In some locations the rental market is starting to help. But the tightening of credit standards is reducing the pool of potential buyers. While it is a good thing (because credit standards were far too loose) it still will extend the duration of a bear housing market.

I would be looking to buy now, if I didn’t own a house already (and was planning on staying long term).

Related: Real Estate and Consumer Loan Delinquency Rates 2000-2010 – 10 million More Renters In the Next 5 Years – The Value of Home Ownership – Nearly 10% of Mortgages Delinquent or in Foreclosure (Dec 2008)

Buffett Rules Out Double-Dip Recession Amid Growth

…

“I’ve seen sentiment turn sour in the last three months or so, generally in the media,” Buffett said. “I don’t see that in our businesses. I see we’re employing more people than a month ago, two months ago.”

…

[GE CEO] Immelt said. “We need people to be able to feel like they’re going to get loans, the process is going to work and that they understand the rules,” Immelt said. Signs across the world show growth improving as evidenced by a rise in GE’s orders

Related: Warren Buffet Webcast to MBAs – Global Economy Prospects Look Good But Also at Risk (June 2010) – Auto Manufacturing in 2009: USA 5.7 million, Japan 7.9 million, China 13.8 million

Dividends Beating Bond Yields by Most in 15 Years

Kraft Foods Inc. and DuPont Co. are among 68 companies in the Standard & Poor’s 500 Index with payouts that top the 3.78 percent average rate in credit markets, based on data since 1995 compiled by Bloomberg and Bank of America Corp. While Johnson & Johnson sold 10-year debt at a record low interest rate of 2.95 percent last month, shares of the world’s largest health products maker pay 3.66 percent.

The combination of record-low interest rates, potential profit growth of 36 percent this year and a slowing economy has forced investors into the relative value reversal. For John Carey of Pioneer Investment Management and Federated Investors Inc.’s Linda Duessel, whose firms oversee $566 billion, it means stocks are cheap after companies raised payouts by 6.8 percent in the second quarter

…

S&P 500 companies’ cash probably has grown to a record for a seventh straight quarter, according to S&P. For companies that reported so far, balances increased to $824.8 billion in the period ended June 30 from the first three months of the year, based on data from the New York-based firm.

Cash represents 10.2 percent of total assets at S&P 500 companies, excluding banks and financial firms, according to data compiled by Bloomberg. That’s higher than the 9.5 percent at the end of the second quarter last year, 8.4 percent in 2008 and 7.95 percent in 2007.

“The economy is slowing down, but productivity has been so great in this country and companies have been able to make good profits,”

10-year Treasury note yields were as low as 2.42% last month. The combination of continued extraordinarily low interest rates and good earnings increase this odd situation where dividends increase and interest yields fall. Extremely low yields aimed at by the Fed continue to aid banks and those that caused the credit crisis a huge deal and harm investors.

Money markets and bonds are not attractive places to invest now. Putting money in those places is still necessary for diversification (and as a safety net – especially in cases like 401-k plans where options are often very limited). Seeking out solid companies with strong long term prospects that pay reasonable dividends is a very sensible strategy today.

Related: Where to Invest for Yield Today – S&P 500 Dividend Yield Tops Bond Yield: First Time Since 1958 – 10 Stocks for Income Investors – Bond Yields Show Dramatic Increase in Investor Confidence (Aug 2009)

Nonfarm payroll employment decreased by 54,000 job in August, and the unemployment rate increased to 9.6%, the U.S. Bureau of Labor Statistics reported today. Government employment fell, as 114,000 temporary workers hired for the census completed their work. Private-sector payroll employment continued to trend up modestly (+67,000).

The estimates were for worse news so that loss of 54,000 jobs was seen as good news. That is still pretty bad news. There was some slightly good news though in that 123,000 fewer jobs were lost in the June and July than previously thought. So the total jobs report shows a gain of 69,000 from the previously reported data. The change in total nonfarm payroll employment for June was revised from -221,000 to -175,000, and the change for July was revised from -131,000 to -54,000.

The number of unemployed persons now stands at 14.9 million. Among the major worker groups, the unemployment rate for adult men (9.8%), adult women (8.0%), teenagers (26.3%). The number of long-term unemployed (those jobless for 27 weeks and over) declined by 323,000 over the month to 6.2 million. In August, 42% of unemployed persons had been jobless for 27 weeks or more.

In August, the civilian labor force participation rate stood at 64.7% and the employment-population ratio was 58.5%. Since its most recent low in December 2009, private-sector employment has risen by 763,000.

Employment in health care increased by 28,000 in August. Thus far in 2010, the health care industry has added an average of 20,000 jobs per month, about in line with the average monthly job growth in 2009. Manufacturing employment declined by 27,000 over the month. A decline in motor vehicles and parts (-22,000) offset a gain of similar magnitude in July as the industry departed somewhat from its usual layoff and recall pattern for annual retooling.

The average workweek for all employees on private nonfarm payrolls was unchanged over the month at 34.2 hours. The manufacturing workweek for all employees increased by 0.1 hour to 40.2 hours, and factory overtime was up by 0.1 hour. The average workweek for production and nonsupervisory employees on private nonfarm payrolls increased by 0.1 hour to 33.5 hours.

Average hourly earnings of all employees on private nonfarm payrolls increased by 6 cents, or 0.3 percent, to $22.66 in August. Over the past 12 months, average hourly earnings have increased by 1.7 percent. In August, average hourly earnings of private-sector production and nonsupervisory employees increased by 3 cents, or 0.2 percent, to $19.08.

The data points to a stagnant economy. The free fall created by the credit crisis has been stopped thankfully and there is hope for better news going forward but nothing definite. Job growth is a key right now and growth of over 200,000 jobs a month is needed to really provide hope for a stronger economy, which would start to reduce the risks of sliding back into another recession (and to allow improvement on reducing the amount of the government deficit).

Related: USA Economy Lost 125,000 Jobs and Unemployment Rate Decreased to 9.5% (July 2010) – Unemployment Rate Reached 10.2% (Nov 2009) – Another 450,000 Jobs Lost in June 2009