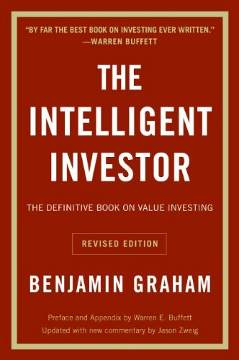

The chart shows the total percent of delinquent loans by commercial banks in the USA.

The first half of 2010 saw residential real estate delinquencies continue to increase and other consumer loan delinquencies decreasing (both trends continue those of the last half of 2009). Residential real estate delinquencies increased 118 basis points to 11.4%. Commercial real estate delinquencies increased just 7 basis points to 8.79%. Agricultural loan delinquencies also increased (25 basis points) though to just 3.35%. Consumer loan delinquencies decreased, with credit card delinquencies down 131 basis points to 5.01% and other consumer loan delinquencies down 15 basis points to 3.34%.

Related: Real Estate and Consumer Loan Delinquency Rates 1998-2009 – Bond Rates Remain Low, Little Change in Late 2009 – Government Debt as Percentage of GDP 1990-2008 – USA, Japan, Germany… -posts with charts showing economic data

Read more

401(k), IRAs and 403(b) retirement accounts are a very smart way to invest in your future. The tax deferral is a huge benefit. And with Roth IRAs and Roth 401(k)s you can even get tax exempt distributions when you retire – which is a huge benefit. Especially if you don’t retire before the bill for all the delayed taxes of the last 20 years starts to be paid. The supposed “tax cuts” that merely shifted taxes from those spending money the last 10 years to those that have to pay for all the stuff the government spent on them has to be paid for. And that will likely happen with higher tax rates courtesy of the last 10 years of not paying the taxes to pay for what the government was spending.

When looking at your 401(k) and 403(b) investment options be sure to pay close attention to expenses for the funds. Some fund families try to get people to investing in high expense funds, that are nearly identical to low expense funds. The investor losses big and the fund companies take big profits. Those people serving on the boards of those funds should be fired. They obviously are not managing with the investors interests at heart (as they are obligated to do – they are suppose to represent the investors in the funds not the friends they have making money off the investors).

Here is an example (that I ran across last week) expense differences for funds that have essentially identical investment objectives and plans in the same retirement plan options: .39% (a respectable rate, though more than it really should be) for [seeks a favorable long-term rate of return from a diversified portfolio selected to track the overall market for common stocks publicly traded in the U.S., as represented by a broad stock market index.], .86% [for "The account seeks a favorable long-term total return, mainly from capital appreciation, by investing primarily in a portfolio of equity securities selected to track the overall U.S. equity markets based on a market index."]. Do not rely on your fund provider to have your interests at heart (and unfortunately many companies don’t seek the best investment options for their employees either).

The .47% added expense isn’t much to miss for 1 year. However, over the life of your retirement account, this is tens of thousands of dollars you will lose just with this one mistake. Personal financial literacy is an easy way to make yourself large amounts of money over the long term. It isn’t very sexy to get .47% extra every year but it is extremely rewarding.

$200,000 at 6% for 25 years grows to $858,000

$200,000 at 6.47% for 25 years grows to $958,000

So in this case, $100,000 for you, instead of just paying the fund company a bit extra every year to let them add to their McMansions. In reality it will be much more than a $100,000 mistake for you if you save enough for retirement. But if you save far too little (as most people do) one advantage is the mistake will be less costly because your low retirement account value reduces the loss you will take.

Related: 401(k)s are a Great Way to Save for Retirement – Retirement Savings Allocation for 2010 – Many Retirees Face Prospect of Outliving Savings

Read more

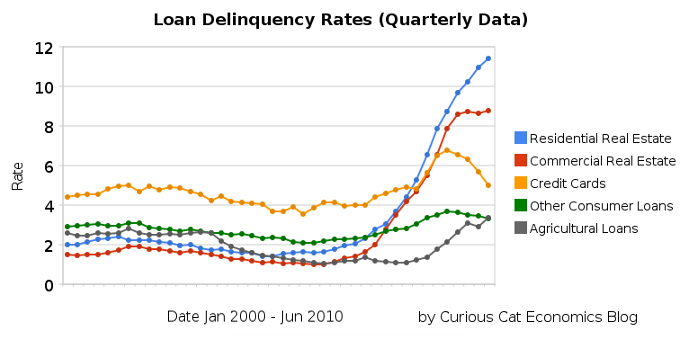

30 year fixed mortgage rates have declined sharply recently to close to 4.5%.

If you are considering refinancing a mortgage now may well be a very good time. If you are not, you maybe should consider it. If so look to shorten the length. If you originally took out a 30 year mortgage and now have, for example, 24 years let, don’t add 6 years to your repayment term by getting a new 30 year mortgage. Instead, look to shorten your pay back period with a 20 year mortgage. The 20 year mortgage will have an even lower rate than the 30 year mortgage.

If you plan on staying in the house, a fixed rate mortgage is definitely the better option, in my opinion. If you are going to move (and sell your hose) in a few years, an adjustable rate mortgage may make sense, but I would learn toward a fixed rate mortgage unless you are absolutely sure (because situations can change and you may decide you want to stay).

The poor economy, unemployment rate still at 9.5%, has the Fed continuing massive intervention into the economy. The Fed is keeping the fed funds rate at close to 0%.

If you are looking at a new real estate purchase, financing a 30 year mortgage sure is attractive at rates under to 4.5%.

Related: historical comparison of 30 year fixed mortgage rates and the federal funds rate – 30 Year Fixed Mortgage Rates Remain Low (Dec 2009) – Lowest 30 Year Fixed Mortgage Rates in 37 Years – What are mortgage definitions

For more data, see graphs of the federal funds rate versus mortgage rates for 1980-1999. Source data: federal funds rates – 30 year mortgage rates

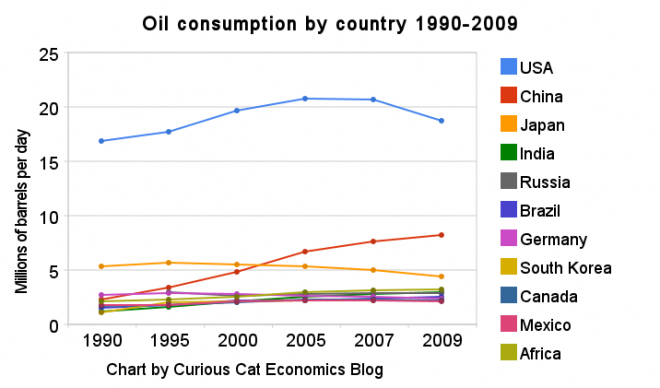

The United States uses far more oil than any other country. The chart shows this very well. The chart shows all countries using over 2 million barrels of oil a day. The USA consumed 18.7 million barrels a day in 2009. Only China was also over 5 million barrels, they reached 8.2 million in 2009. Japan is next at 4.4 million.

The data is from the US Department of Energy for total consumption of petroleum products.

Mexico, Canada, South Korea, Germany, Brazil, Russia and India all use between 2 and 3 million barrels a day. All of Africa is at 3.2 million.

Related: Oil Consumption by Country in 2007 – Manufacturing output by Country 1990-2008 – Increasing USA Foreign Oil Dependence In The Last 40 years – Wind Power Capacity Up 170% Worldwide from 2005-2009

Some fast facts on the Kiva micro-lending site:

- 58 months old

- $153,090,650 raised

- 99% repayment rate

- 395,427 entrepreneurs funded

- 742,717 Kiva lenders

- 201 countries

- Curious Cats Lending Team: – 8 members, 193 loans totaling $7,950

Add to those numbers by joining Kiva today or lending more money today. Let me know and we will add you to the Curious Cat Kivan page.

Related: Provide a Helping Hand Using Kiva – Funding Entrepreneurs in Nicaragua, Ghana, Viet Nam, Togo and Tanzania – Creating a World Without Poverty

We have created a new and improvement Curious Cat Investment book site. Find great resources for your investing and personal finance needs. We have selected the best books by authors including: Benjamin Graham, Warren Buffett, John Bogle, Nicolas Darvas, Peter Lynch and William O’Neil.

Try out our recommended picks.

View the books by category including: investing, economics, retirement, real estate and personal finance.

Related: Curious Cat investing articles – Curious Cat management books – Teaching Children About Money Matters – Bogle on the Retirement Crisis

U.S. Investors Regain Majority Holding of Treasuries

Mutual funds, households and banks have boosted the domestic share of the $8.18 trillion in tradable U.S. debt to 50.2 percent as of May, according to the most recent Treasury Department data.

…

The biggest jump in demand this year among domestic buyers of Treasuries has been commercial lenders. Bank holdings of Treasury and agency securities increased 5 percent to $1.57 trillion last month, according to the latest data available from the Fed.

…

The Fed’s decision to hold its target for the overnight lending rate at a record low has made it possible for banks to borrow at near-zero interest rates to finance purchases of longer-term and higher-yielding Treasuries while lending less.

I must say, unless you are getting special government interest free loans to invest in treasuries (like those that caused the credit crisis are) it seems crazy to me to invest at these low rates. In retirement, it probably does make sense to have some just as a diversification measure but other than that I would certainly reduce my holdings from what they would have been 10 years ago.

If politicians or the fed would just give special favors to me to borrow billions and essentially 0% and then lend it back for more I would take that deal.

But if I am not granted the welfare Chase, Goldman Sachs, Citibank and the rest are (with huge amounts of free money and bailouts if their bets fail) buying extremely low yield government debt is not an investment I want. I don’t think betting on deflation is not a bet I want to take. Inflation seems a bigger risk to me. But people get to make their own decisions, and we will see which investors are right.

Related: Paying Back Direct Cash from Taxpayers Does not Excuse Bank Misdeeds – Can Bankers Avoid Taking Responsibility Again? – What the Financial Sector Did to Us

Consumer debt decreased at an annual rate of 3.25% in the second quarter. Revolving credit (credit card debt) decreased at an annual rate of 9.5%, and nonrevolving credit (car loans…) was about unchanged.

Revolving consumer debt now stands at $827 billion down $39 billion this year. That is on top of a $92 decline in 2009. Hopefully we can continue this success.

Through June of 2010 total outstanding consumer debt was $2,419 billion, a decline of $30 billion ($21 billion of the decline was in the 2nd quarter). This still leaves over $8,000 in consumer debt for every person in the USA and $20,000 per family.

Consumer debt grew by about $100 billion each year from 2004 through 2007. In 2009 consumer debt declined over $100 billion so far: from $2,561 billion to $2,449 billion.

The huge amount of outstanding consumer and government debt remains a burden for the economy. At least some progress is being made to decrease consumer debt.

Those living in USA have consumed far more than they have produced for decades. That is not sustainable. You don’t fix this problem by encouraging more spending and borrowing: either by the government or by consumers. The long term problem for the USA economy is that people have consuming more than they have been producing.

Thankfully over the last year at least consumer debt has been declining, but it needs to decline more. I disagree with those that want to see short term improvement in the economy powered by consumer debt. It would be nice to see improvement to the current economy. But we can’t afford to achieve that with more debt. Government debt has been exploding so unfortunately that problem has continued to get worse.

Data from the federal reserve.

Related: Consumer Debt Declined a Record $21.5 Billion in July – The USA Economy Needs to Reduce Personal and Government Debt

40 billionaires pledge to give away half of wealth

This is great news. We need more charity. And we don’t need more trust fund babies. The Giving Pledge was established by Bill Gates and Warren Buffet to encourage this spirit.Charity should be a part of your personal finance plan if you are reading this (if you have access to a computer you are wealthier than most people alive today).

To many of the rich today act like they made their money by creating it by themselves. You can’t be a billionaire without getting it given to you by your parents or making your wealth from society. It is wonderful when people provide great solutions to society and become wealthy. It is ridicules to think those people’s wealth is not the result of the society others created. Using that wealth to make society better is right. Spoiling kids and grandkids with it is acceptable, to a certain level. After a couple million that is insulting, however.

Related: House Votes to Restore Partial Estate Tax Very Richest: Those with Over $7 Million – Rich Americans Sue to Keep Evidence of Their Tax Evasion From the Justice Department – Gates Foundation and Rotary Pledge $200 Million to Fight Polio

Welcome to the Curious Cat Investing and Economics Carnival: we highlight recent personal finance, investing and economics blog posts I found interesting.

- “New Normal” math: How your investing plans must change – “I don’t think the implications of changing stocks’ rate of return from 10% to 5% have sunk in. We acknowledge that stock returns will be poor, and yet all of our retirement advice – save 10% of your income… withdraw 4% in retirement – stays the same.”

- Manufacturing Output as a Percent of GDP by Country by John Hunter – “For the 14 biggest manufacturing countries in 2008, the overall manufacturing GDP percentage was 23.7% of GDP in 1980 and dropped to 17% in 2008… USA economy dropped from 21% in 1980 to 18% in 1990, 16% in 2000 and 13% in 2008.”

- Masters of Earning More – “Ben actually loves his full-time job, but still freelances on the side. Earning more isn’t just for people who hate their job or are in severe credit-card debt. He freelances because he enjoys it.”

- Five plays on the China Middle Class Explosion by Cody Willard – “The middle class in China now stands at nearly 25% of the population (which is 50 million new members a year!).”

- Who Educates The Investors? by Bill Waddell – “Who would want to listen to the insights of someone concerning a manufacturing investment who knows so little about the current state of manufacturing that he thinks Toyota introduced lean to reduce working capital over a five year period?”

- Refinance Now, If You Can by David Weliver – “If you currently owe $200,000 on your mortgage at 5.75%, refinancing could save you more than $100 a month on your payment and reduce the interest you pay over the life of the loan.” (rates are down a bit more since this example was posted – John)

- A Cheap Internet Stock With High Dividend Yield – “stock offers an impressive 6.8% dividend yield and yet the stock only trades at 5x consensus 2011 earnings estimates.”

- Personal Finance Basics: Avoid Debt by John Hunter – “Debt is often toxic to personal financial success. The simple step you can take to avoid the problems many face is to just not buy things until you save up for them. If you want some new shoes or new Droid Incredible or to go see a football game (American or World Cup style) that is fine. Just save up the money and then spend it.”

Related: Curious Cat investing articles – Curious Cat Investing and Economics Custom Search Engine – Curious Cat Investing and Economics Carnival #5