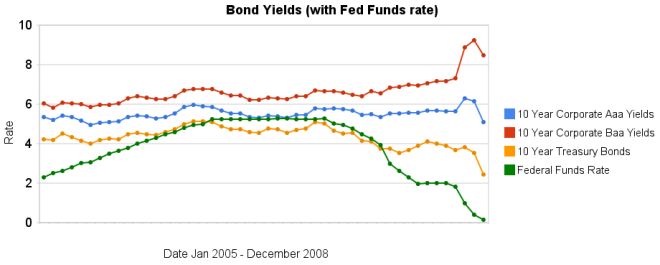

The recent reactions to the credit and financial crisis have been dramatic. The federal funds rate has been reduced to almost 0. The increase in the spread between government bonds and corporate bonds has been dramatic also. In the last 3 months the yields on Baa corporate bonds have increased significantly while treasury bond yields have decreased significantly. Aaa bond yields have decreased but not dramatically (57 basis points), well at least not compared to the other swings.

The spread between 10 year Aaa corporate bond yields and 10 year government bonds increased to 266 basis points. In January, 2008 the spread was 159 points. The larger the spread the more people demand in interest, to compensate for the increased risk. The spread between government bonds and Baa corporate bonds increased to 604 basis points, the spread was 280 basis point in January, and 362 basis points in September.

When looking for why mortgage rates have fallen so far recently look at the 10 year treasury bond rate (which has fallen 127 basis points in the last 3 months). The rate is far more closely correlated to mortgage rates than the federal funds rate is.

Data from the federal reserve – corporate Aaa – corporate Baa – ten year treasury – fed funds

Related: Corporate and Government Bond Rates Graph (Oct 2008) – Corporate and Government Bond Yields 2005-2008 (April 2008) – 30 Year Fixed Mortgage Rates versus the Fed Funds Rate – posts on interest rates – investing and economic charts

Here is an interesting article at Bloomberg looks at the Chicago school of economics: Friedman Would Be Roiled as Chicago Disciples Rue Repudiation by John Lippert

By the end of November, the government had committed $8.5 trillion, or more than half the value of everything produced in the country in 2007, to save the financial system.

…

Robert Lucas, a Chicago economist who won a Nobel in 1995 for a theory that argued against governments trying to fine-tune consumer demand, says deregulation may have gone too far. Depression-era laws that separated commercial and investment banks helped depositors decide if they wanted secure accounts or riskier investments. Today, without these distinctions, people can’t be sure if their investments, or those of their customers, are safe.

“I’m changing my views on bank regulation every week,” Lucas, 71, says. “It was an area I saw as under control. Now I don’t believe that.” Lucas says he voted for Obama, the only Democrat besides Bill Clinton he’d supported in 44 years. He concluded the candidate was comfortable talking with professional economists.

…

“The big event of the last 20 years is the success of free markets in India and China,” says McCloskey via telephone from South Africa, where she’s a visiting professor at the University of the Free State in Bloemfontein. “This is more important than any financial crisis and makes it really hard to argue for a return to central planning.”

I believe capitalism is the best system for economic development. Unfortunately, as I have written before, too many decision makers don’t have the slightest clue about economics. They accept simplistic views just like scientifically illiterate people accept simplistic claims that have no merit.

The basics are pretty easy. You want to use the market to guide the economy. You need to regulate in those areas the market alone is know to be weak (negative externalities – including pollution, risks to the public…) anti-market behavior (large players controlling markets for their own benefit, large players paying off politicians for benefits…) and systemic risks (“too big to fail“…). And practical consideration is more important that ideological purity.

One of the most important consistent failures is the continued favoring of large entities that pay politicians large amounts of money. The continued creation of huge organizations that are anti-competitive by their nature and create systemic economic risk have not economic justification. The role of the government should be to enforce competitive markets not allow huge competitors to buyout other huge competitors so that they can further distort the market.

Related: Ignorance of Capitalism – Misuse of Statistics, Mania in Financial Markets – Greenspan Says He Was Wrong On Regulation – Lobbyists Keep Tax Off Billion Dollar Private Equities Deals and On For Our Grandchildren – Treasury Now (1987) Favors Creation of Huge Banks

Why the Germans just hate to spend, spend, spend

…

US, French and British officials puzzle over Germany’s refusal to tackle the recession head-on. German leaders, meanwhile, cannot see why their taxpayers’ money should go into encouraging precisely the kind of behaviour – reckless lending, careless borrowing and overconsumption – that precipitated the financial crisis.

I am with the Germans on this one. The people that want to find some more credit cards to run up don’t understand the problem. Until they come up with strong policies that admit we have been living beyond our means for decades and have to pay for this at some point and fashion a policy based on that understanding we are in danger. Yes another credit card can allow you to continue to live beyond your means, but it also puts you into even worse financial shape than you have already gotten yourself into. It is not a solution, it is an emergency to deal with the complete failure of yourself previously and without a plan to change it is just setting yourself up for a worse situation soon.

Related: How to Use Your Credit Card Responsibly – Have you Saved Your Emergency Fund Yet? – Can I Afford That? – Too Much Stuff

Citigroup Saw No Red Flags Even as It Made Bolder Bets

…

Citigroup’s stock has plummeted to its lowest price in more than a decade, closing Friday at $3.77. At that price the company is worth just $20.5 billion, down from $244 billion two years ago. Waves of layoffs have accompanied that slide, with about 75,000 jobs already gone or set to disappear from a work force that numbered about 375,000 a year ago.

…

“They pushed to get earnings, but in doing so, they took on more risk than they probably should have if they are going to be, in the end, a bank subject to regulatory controls,” said Roy Smith, a professor at the Stern School of Business at New York University. “Safe and soundness has to be no less important than growth and profits but that was subordinated by these guys.”

It is sad to see the same story repeated over and over. Give people the change for obscene bonuses. They make up claims that they are making lots of money to get bonuses but actually set the company to go bankrupt. They take huge bonuses because of course they are so smart and successful. The company fails and they say the market is to blame (it isn’t that they are really not that smart and of course they deserve the obscene bonuses they took before the collapse – or even after the collapse). They feel no shame for the horrible mess they leave in their wake that they would paid more than a king’s ransom to manage. They will be on to similar schemes in a few years.

If you are a bank you make money by borrowing for less than you lend. If you are a speculator then you try to out bet the other speculators. Nothing wrong with either choice to me. When you want to say you are a bank but you want to make most of your money from speculating their is a problem. Investment banks used to also make huge amounts from fees they would charge (they still do but not enough to offset the huge speculative losses).

Read more

The New Paradigm for Financial Markets is George Soros‘ newest book. Here is an interview with him in May of this year, on PBS, Financial World Shifts Gears Amid Economic Tumult, about the ideas in the book and the current crisis.

GEORGE SOROS: I think this is the most serious crisis of our lifetime. It’s not just a housing crisis, but a crisis of the financial system.

…

GEORGE SOROS: The regulators have failed to regulate, and they really have to — they left it to the market. That was this market fundamentalist philosophy, that markets will take care of themselves.

…

And I contend that there’s been what I call a super bubble that has been growing over the last 25 years at least, which basically consisted of an extension in credit, increasing use of leverage. That was the trend in reality.

And the misconception that credit is that markets can be left to their own devices. Now, in fact, they are given to excesses, and occasionally they create crises, but each time the authorities intervene and bail out the failing institutions, provide fiscal stimulus, monetary stimulus.

So it seems like the market corrects itself, but it’s actually the intervention of the authorities that saves the market.

Related: Soros on the Financial Market Collapse – Jim Rogers on the Financial Market Mess – Leverage, Complex Deals and Mania

FDIC Details Plan To Alter Mortgages

…

Agency officials estimated the cost to the government at $22.4 billion.

…

The mortgage industry is concerned that any new modification plan will persuade some people to stop making mortgage payments in addition to helping people who already have stopped making payments. The industry argues this will translate into higher interest rates because investors will demand compensation for the increased risk of loan defaults. That, in turn, would limit the number of people who can afford mortgage loans.

…

FDIC estimates that 1.4 million borrowers with such loans are at least two months late on their payments, and another 3 million borrowers will miss at least two payments by the end of next year. The agency estimates that half those borrowers, or about 2.2 million people, would receive a loan modification under the program, and that about 1.5 million will successfully avoid foreclosure.

Under the terms of the proposed FDIC program, lenders would reduce monthly payments primarily by cutting the borrower’s interest rate to a minimum rate of 3 percent. If necessary, the company could also extend the repayment period on the loan beyond 30 years, reducing each monthly payment. Finally, in some cases, companies could defer repayment of some principal. The borrower still would be on the hook for the full value of the loan.

Officials said their experience at IndyMac showed that principal reductions were not necessary. So far, FDIC has modified about 20,000 IndyMac loans. In 70 percent of the cases, FDIC was able to create an affordable payment solely by reducing the interest rate. In 21 percent of the cases, the agency also extended the life of the loan. In 9 percent of the cases, it delayed repayment of some principal.

An interesting proposal I would support. Ideally this type of action would not be necessary but since banks were allowed to degrade their standards so far and allowed to grow so large their failures threaten the economy some radical actions are being taken. Compared to many others this is sensible.

Related: How Much Worse Can the Mortgage Crisis Get? – JPMorgan Chase Freezes Mortgage Foreclosures – Fed Plans To Curb Mortgage Excesses (Dec 2007)

It doesn’t take much effort to notice the economic news is increasingly dire. And this is not just a few alarmist reports, the economy is in serious trouble. The decades of spending beyond their means (for consumers and those the consumers elected to run government) are creating a very difficult situation. And the credit crisis precipitating the current slide has brought to light many failures to properly regulate the economy. U.S. Slump May Be Longest in Decades as Growth Fell Off ‘Cliff’

The implosion of credit markets last month will cause the economy to shrink at a 3 percent annual rate in the fourth quarter and decline at a 1.5 percent pace in the first three months of 2009, according to the median estimate of 59 economists surveyed Nov. 3 to Nov. 11. Following last quarter’s 0.3 percent drop, the slump would be the longest since 1974-75.

…

Falling demand will cause an even bigger increase in unemployment than projected last month. Economists surveyed forecast the jobless rate will rise to 7 percent in the first quarter of 2009, up from last month’s forecast of 6.6 percent. The rate will climb to 7.7 percent by the end of 2009, the highest level since 1992, the survey showed.

The jobless rate rose to 6.5 percent in October, the highest since 1994

There is little doubt the economy is in for serious trouble. What investment moves are wise now is less obvious. I have been buying during the decline and continue to do so. I bought some Google yesterday at the same price I first bought Google for several years ago. I think in 10 years that will pay off quite well, but time will tell. My purchases of Google earlier this year would obviously have been better if I had made them yesterday than when I did.

I discussed the Economic Crisis on my Curious Cat Management Blog last month:

One of the challenges with personal financial matters is they are by nature long term issues. What you did over the last 5 years cannot be fixed in a few weeks, most likely it takes years.

Related: Stock Market Decline – Bad News on Jobs

Consumer debt gets bailout attention

…

“Approximately 40 percent of U.S. consumer credit is provided through securitization of credit card receivables, auto loans and student loans and similar products. This market, which is vital for lending and growth, has for all practical purposes ground to a halt.”

The Next Meltdown: Credit-Card Debt

…

Innovest estimates that credit-card issuers will take a $41 billion hit from rotten debt this year and a $96 billion blow in 2009.

…

Risky borrowers with low credit scores account for roughly 30% of outstanding credit-card debt, compared with 11% of mortgage debt. More than 45% of Washington Mutual’s credit-card portfolio is subprime, according to Innovest.

Related: Americans are Drowning in Debt – How to Use Your Credit Card – Credit Crisis (Aug 2007) – Curious Cat Economics Search Engine

JPMorgan Chase Freezes Foreclosures

…

According to the most recent data compiled by the Hope Now Alliance of lenders, counselers, and other industry players, lenders started the foreclosure process on 565,000 homeowners in this year’s third quarter. Some 265,000 homes were actually foreclosed on, nearly twice the number from the third quarter of 2007. Moreover, more than 2.2 million homeowners are more than 60 days delinquent in their mortgage payments, also a near doubling from last year.

FDIC Chairman, Sheila Bair, has been encouraging banks to take such action and instituted such action on the mortgages the FDIC acquired when they took over Indymac – Loan Modification Program for Distressed Indymac Mortgage Loans

Related: Ignorance of Many Mortgage Holders (July 2007) – Foreclosure Filings Continue to Rise – Historical 30 Year Fixed Mortgage Rates – Homes Entering Foreclosure at Record (Sep 2007) – 2nd Largest Bank Failure in USA History

On Tuesday the United States Treasury department purchased $125 billion of bank stocks becoming one of the largest stockholders in the world instantly.

$25 billion was invested in Citigroup, JPMorgan Chase and Wells Fargo.

$15 billion was invested in Bank of America and $10 billion in Merrill Lynch (which is being acquired by Bank of America).

$10 billion was invested in Goldman Sachs and Morgan Stanley. And the treasury department invested $3 billion in Bank of New York Mellon $2 billion in State Street.

Related: Goldman Sachs Rakes In Profit in Credit Crisis (Nov 2007) – Warren Buffett Webcast on the Credit Crisis – Rodgers on the US and Chinese Economies (Feb 2008) – Credit Crisis