Consumer borrowing falls in March at fastest pace in over 18 years, Americans saving more

In dollar terms, consumer borrowing plunged by $11.1 billion. That’s the largest dollar amount on records dating to 1943, and more than three times the $3.5 billion drop that economists expected. The borrowing category that includes credit cards dropped 6.8 percent in March after a 12.1 percent plunge in February. The category that includes auto loans fell 4.2 percent after rising by 1.2 percent in February.

The Commerce Department last week said that the personal savings rate edged up to 4.2 percent in March, marking the first time in a decade that the savings rate has been above 4 percent for three straight months.

Good. Consumer debt is far to large and should be paid down. This is a start but a small start, but a much larger reduction in outstanding consumer debt is needed before we have reached a healthy level of debt. The continued improvement in that debt level signifies a stronger economy. Far too many financial journalists instead of pointing out the benefits of such improvement note that this reduces current consumption (and thus, effectively, will lower current GDP – compared to what it would be if we continued to spend beyond our means). You cannot spend money your don’t have forever.

Having more stuff in your house (along with an increased outstanding credit card balance) does not make you economically more successful. And the same holds true for the economy. Having more stuff sitting in people’s house and an increasing debt load is not the sign of a stronger economy (even if it is a route to a higher current GDP). Increased saving and reducing debt will strengthen the economy and improve our economic success over the long term.

Related: Will Americans Actually Save and Worsen the Recession? – Proper credit card use – Personal Saving and Personal Debt in the USA – Americans are Drowning in Debt – Buying Stuff to Feel Powerful

U.S. Gas Fields Go From Bust to Boom

…

Huge new fields also have been found in Texas, Arkansas and Pennsylvania. One industry-backed study estimates the U.S. has more than 2,200 trillion cubic feet of gas waiting to be pumped, enough to satisfy nearly 100 years of current U.S. natural-gas demand.

The discoveries have spurred energy experts and policy makers to start looking to natural gas in their pursuit of a wide range of goals: easing the impact of energy-price spikes, reducing dependence on foreign oil, lowering “greenhouse gas” emissions and speeding the transition to renewable fuels.

…

new technologies and a drilling boom have helped production rise 11% in the past two years. Now there’s a glut, which has driven prices down to a six-year low and prompted producers to temporarily cut back drilling and search for new demand.

The natural-gas discoveries come as oil has become harder to find and more expensive to produce. The U.S. is increasingly reliant on supplies imported from the Middle East and other politically unstable regions. In contrast, 98% of the natural gas consumed in the U.S. is produced in North America.

Related: Oil Consumption by Country – posts on energy economics – Forecasting Oil Prices – South Korea To Invest $22 Billion in Overseas Energy Projects – Wind Power Provided Over 1% of Global Electricity in 2007

First Quarter GDP 2009 in the USA was down 6.1%. This is after a revised 6.3% drop in fourth quarter of 2008 (preliminary fourth quarter report showed a 6.2% decline). Real exports of goods and services decreased 30% in the first quarter, compared with a decrease of 23.6% in the fourth. Real imports of goods and services decreased 34.1%, compared with a decrease of 17.5%.

The personal saving rate — saving as a percentage of disposable personal income — was 4.2% in the first quarter, compared with 3.2% in the fourth quarter of 2008.

The news certainly is nothing to be happy about. But the stock markets around the world were buoyed by the Federal Reserves positive words:

Although the economic outlook has improved modestly since the March meeting, partly reflecting some easing of financial market conditions, economic activity is likely to remain weak for a time. Nonetheless, the Committee continues to anticipate that policy actions to stabilize financial markets and institutions, fiscal and monetary stimulus, and market forces will contribute to a gradual resumption of sustainable economic growth in a context of price stability.

True, those words hardly sound like great news but the markets were quite happy.

Related: The Economy is in Serious Trouble (Nov 2008) – Warren Buffett Webcast on the Credit Crisis – Fed Continues Wall Street Welfare (March 2008) – Manufacturing Data – Accuracy Questions

Federal Reserve Beige Book highlights for April 15th. The Beige Book documents comments received from business and other contacts outside the Federal Reserve and is not a commentary on the views of Federal Reserve officials. The book is published eight times a year.

…

Manufacturers’ assessments of future factory activity improved marginally over the survey period as well.

…

Consumer spending remained generally weak. However, several Districts said sales rose slightly or declines moderated compared with the previous survey period.

…

Home prices continued to decline in most Districts, although a few reports noted that prices were unchanged or that the pace of decline had eased. Low mortgage rates were fueling refinancing activity. Outlooks for the housing sector were generally more optimistic than in earlier surveys, with respondents hopeful that increased buyer interest would lead to better sales.

…

Commercial real estate investment activity weakened further.

…

Labor market conditions were weak and reports of layoffs, reductions in work hours, temporary factory shutdowns, branch closures and hiring freezes remained widespread across Districts.

Related: Central Bank Intervention Unprecedented in scale and Scope – Why do we Have a Federal Reserve Board? – Manufacturing Employment Data – 1979 to 2007 – Oil Consumption by Country

It’s Now a Renter’s Market by Prashant Gopal

…

Oklahoma City, where people spent just 12% of their income on rent, was the most affordable. Other cheap markets included Indianapolis, Denver, Fort Worth, and Cleveland. The least affordable market was New York, where people spent 57% of their income on rent.

Rental markets are driven largely by 2 factors, vacancy rates and jobs. If jobs in a metropolitan area are increasing rents usually increase. If more new apartments are added to the market than jobs (which then increases vacancy rates) this will push down rates. Other factors influence vacancy rates (such as people moving back in with parent, people sharing apartments…). Those factors often are largely influenced by losing jobs in an area.

D.C. apartment market remains strong

…

Rent increases over the past 12 months for all investment grade apartments kept under the long-term average of 4.2 percent per annum, at 0.5 percent since March 2008.

Related: Housing Rents Falling in the USA – Home Values and Rental Rates – Real estate investing articles – Urban Planning – Longer Commutes Translate to Larger Housing Price Declines

Read more

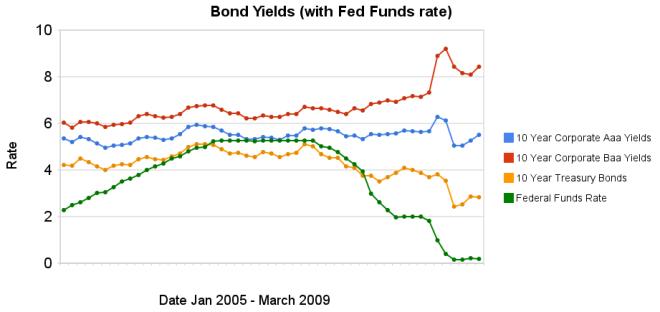

Chart showing corporate and government bond yields by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.

Chart showing corporate and government bond yields by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.The federal funds rate remains under .25%. The large spread between government bonds and corporate bonds remains very large. In the last 3 months the yields on Aaa corporate bonds have increased 45 basis points, Baa corporate bond yields have decreased 1 basis points, while treasury bond yields have increased 40 basis points.

The spread between 10 year Aaa corporate bond yields and 10 year government bond yields is now 268 basis points. In January, 2008 the spread was 159 points. The larger the spread the more people demand in interest, to compensate for the increased risk. The spread between government bonds and Baa corporate bonds decreased to a still very large 566 basis points, the spread was 280 basis point in January 2008, and 362 basis points in September 2008.

Data from the federal reserve: corporate Aaa – corporate Baa – ten year treasury – fed funds

Related: Chart Shows Wild Swings in Bond Yields – Fed to Start Buying Treasury Bonds Today – Corporate and Government Bond Rates Graph (Oct 2008) – investing and economic charts

663,000 jobs were lost in the USA in March and the unemployment rate rose from 8.1 to 8.5 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Since the recession began in December 2007, 5.1 million jobs have been lost, with almost two-thirds (3.3 million) of the decrease occurring in the last 5 months. In March, job losses were large and widespread across the major industry sectors.

In March, the number of unemployed persons increased by 694,000 to 13.2 million, and the unemployment rate rose to 8.5 percent. Why is that different than the numbers above? The numbers are from different sources of data, the first from BLS surveys of businesses and the 694,000 from household surveys. This reminds us that this data is approximate, not exact. Undoubtedly the figures will be revised as more data is analyzed.

Over the past 12 months, the number of unemployed persons has grown by about 5.3 million, and the unemployment rate has risen by 3.4 percentage points. Half of the increase in both the number of unemployed and the unemployment rate occurred in the last 4 months.

The unemployment rates continued to trend upward in March for adult men, 8.8%, adult women 7.0%, whites 7.9% and Hispanics 11.4%. The jobless rates for African Americans, 13.3% and teenagers 21.7% were little changed over the month. The unemployment rate for Asians was 6.4% in March, not seasonally adjusted, up from 3.6% a year earlier.

Related: Over 500,000 Jobs Disappeared in November – Manufacturing Employment Data – 1979 to 2007 – What Do Unemployment Stats Mean?

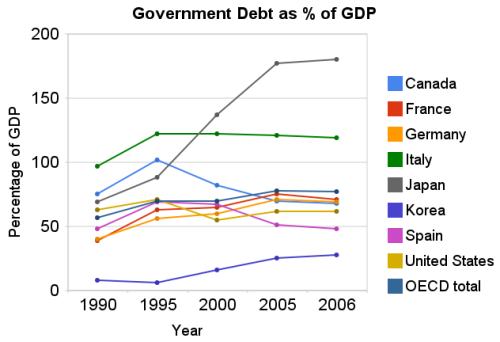

Chart showing government debt as a percentage of GDP by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from OECD, March 2009.

Chart showing government debt as a percentage of GDP by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from OECD, March 2009.The USA federal government debt is far too large, in my opinion. We have been raising taxes on future taxpayers for several decades, to finance our current spending. Within reason deficit spending is fine. What that reasonable level is however, is not easy to know. One big problem with the past few decades is that during very prosperous economic times we spent money that we didn’t have, choosing to raise taxes on the future (instead of either not spending as much or paying for what we were spending by raising taxes to pay for current spending).

By not even paying for what we are spending when times were prosperous we put ourselves in a bad situation when we have poor economic conditions – like today. If we were responsible during good economic times (and at least paid for what we spent) we could have reduced our debt as a percentage of GDP. Even if we did not pay down debt, just by not increasing the outstanding debt while the economy grew the ratio of debt to GDP would decline. Then when times were bad, we could afford to run deficits and perhaps bring the debt level up to some reasonable level (maybe 40% of GDP – though it is hard to know what the target should be, 40% seems within the realm of reason to me, for now).

There is at least one more point to remember, the figures in the chart are based on reported debt. The USA has huge liabilities that are not accounted for. So you must remember that the actually debt is much higher than reported in the official debt calculation.

Now on to the good news. As bad as the USA has been at spending tomorrows increases in taxes today, compared to the OECD countries we are actually better than average. The OECD is made up of countries in Europe, the USA, Japan, Korea, Australia, New Zealand and Canada. The chart shows the percentage of GDP that government debt represents for various countries. The USA ended 2006 at 62% while the overall OECD total is 77%. In 1990 the USA was at 63% and the OECD was at 57%. Japan is the line way at the top with a 2006 total of 180% (that is a big problem for them). Korea is in the best shape at just a 28% total in 2006 but that is an increase from just 8% in 1990.

Related: Federal Deficit To Double This Year – Politicians Again Raising Taxes On Your Children – True Level of USA Federal Deficit – Who Will Buy All the USA’s Debt? – Top 12 Manufacturing Countries in 2007 – Oil Consumption by Country

Read more

Here is a very interesting paper showing real analysis of the data to illustrate that the deteriorating condition of loans should have been caught by those financing such loans years before the mortgage crisis erupted. Understanding the Subprime Mortgage Crisis by Yuliya Demyanyk, Federal Reserve Bank of Cleveland and Otto Van Hemert, New York University.

…

In many respects, the subprime market experienced a classic lending boom-bust scenario with rapid market growth, loosening underwriting standards, deteriorating loan performance, and decreasing risk premiums.30 Argentina in 1980, Chile in 1982, Sweden, Norway, and Finland in 1992, Mexico in 1994, Thailand, Indonesia, and Korea in 1997 all experienced the culmination of a boom-bust scenario, albeit in different economic settings.

Were problems in the subprime mortgage market apparent before the actual crisis erupted in 2007? Our answer is yes, at least by the end of 2005. Using the data available only at the end of 2005, we show that the monotonic degradation of the subprime market was already apparent. Loan quality had been worsening for five years in a row at that point. Rapid appreciation in housing prices masked the deterioration in the subprime mortgage market and thus the true riskiness of subprime mortgage loans. When housing prices stopped climbing, the risk in the market became apparent.

Related: Nearly 10% of Mortgages Delinquent or in Foreclosure – How Much Worse Can the Mortgage Crisis Get? – Homes Entering Foreclosure at Record – Articles on Real Estate

Health spending in the United States grew 6.1 percent in 2007, to $2.2 trillion or $7,421 per person.

For comparison the total GDP per person in China is $6,100. This continues the trend of health care spending taking an every increasing portion of the economic output (the economy grew by 4.8 percent in 2007). This brings health care spending to 16.2% of GDP (which is yet another, in a string of record high percentages of GDP spent on health care). In 2003 the total health care spending was 15.3 of GDP.

With the exception of prescription drugs (which grew at 1.4% in 2007, compared to the 3.5% in 2006), spending for most other health care services grew at about the same rate or faster than in 2006. Hospital spending, which accounts for about 30 percent of total health care spending, grew 7.3 percent in 2007, compared to 6.9 percent in 2006.

Spending growth for both nursing home and home health services accelerated in 2007 (4.8% v. 4.0%). Spending growth for freestanding home health care services increased to 11.3 percent. Total health care spending by public programs, such as Medicare and Medicaid, grew 6.4% in 2007 v. 8.2% in 2006. In comparison, health care spending by private sources grew 5.8% compared to 5.4%.

Private health insurance premiums grew 6.0 percent in 2007, the same rate as in 2006. Out-of-pocket spending grew 5.3 percent in 2007, an acceleration from 3.3 percent growth in 2006. Out-of-pocket spending accounted for 12.0 percent of national health spending in 2007. This share has been steadily declining both recently and over the long-run; in 1998, it accounted for 14.7 percent of health spending and, in 1968, out-of-pocket spending accounted for 34.8 percent of all health spending.

The costs for health services and supplies for 2007 were distributed among businesses (25%), households (31%), other private sponsors (4%), and governments (40%).

Decades ago Dr. Deming included excessive health care costs as one of the seven deadly diseases of western management. We have only seen the problem get worse. Finally it seems that a significant number of people are in agreement that the system is broken. Still, admitting the system is broken is not the same as agreeing on how to fix it. The way forward to workable solutions still seems very difficult.

Full press release from the United States Department of Health and Human Services.

Related: International Health Care System Performance – Personal Finance Basics: Health Insurance – Many Experts Say Health-Care System Inefficient, Wasteful – How to Improve the Health Care System