The costs to employees for health insurance keep increasing, even as employers pay more also. A Premium Sucker Punch:

…

The Corporate Executive Board found in its survey that a quarter of officials from 350 large corporations said they had increased deductibles an average of 9 percent in 2008. But 30 percent of the employers said they expected to raise deductibles an average of 14 percent in 2009. Mercer, a global benefits consulting firm, surveyed nearly 2,000 large corporations in a representative poll and found that 44 percent planned to increase employee-paid portion of premiums in 2009, compared with 40 percent in 2008.

The economic slowdown, according to analysts, is making it more difficult for many employers to subsidize health care costs at previous levels. On average, experts say, benefit packages contain the biggest increases for workers since the recession of 2001. Workers’ health costs are rising much faster than wages.

…

Premiums for employer-sponsored plans over a decade on average have risen to $12,680 a year from $5,791, according to the Henry J. Kaiser Family Foundation. The median deductible for the plans was $1,000 in 2008, compared with $500 from 2001 to 2007, according to a survey of 2,900 employers conducted by Mercer.

The broken health care system in the USA has been a huge drain on the economy and people’s standard of living for decades. The longer we allow the system to decline (increasing costs, declining results) the more damage the economy suffers and the larger the costs to implementing fixes become.

Related: Personal Finance Basics: Long-term Care Insurance – Medical Debt Increases as Economy Declines – International Health Care System Performance – Many Experts Say Health-Care System Inefficient, Wasteful – posts on improving the health care system

Gavin Kennedy is a professor and director of contracts at Edinburgh Business School. He authors the Adam Smith’s Lost Legacy blog discussing the mis-attributions to Adam Smith, which are all too common now. A good example is, Perpetrators of Myths Mislead Generations of Students, Some of Whom Grow Up to (mis)Advise Legislators:

…

Smith’s intellectual arguments, and personal warmth for the growth of commercial society, were driven by the conviction that growth across agriculture, industry and specific, targeted public expenditure, such as defence, justice, and public works and public institutions, would assist the spread of opulence, especially to the labouring poor and their families, albeit slowly and gradually, but steadily too, if legislators and those who influenced them were careful not to approve monopoly schemes to narrow markets and restrict competition, not to indulge in spasms of ‘jealousy of trade’, protectionism, forming loss-making colonies and conducting wars for trivial ends (i.e., not for defensive purposes only).

Introducing, a mystical or miraculous force at work in markets detracts from the real and detailed policy measures that may required from time to time to ensure steady growth, competition, and liberty for all, and not just for the amoral ends of privileged monopolists and their cronies.

Related: Not Understanding Capitalism – Ignorance of Capitalism – Monopolies and Oligopolies do not a Free Market Make – Estate Tax Repeal, Bad Policy

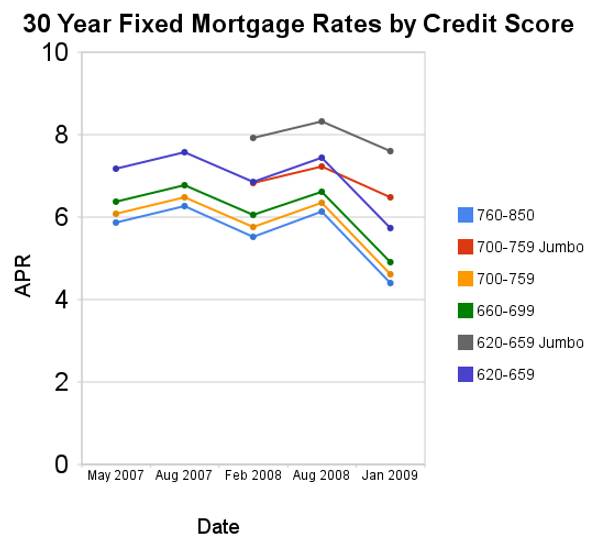

Since August of 2008 conforming mortgage rates are have declined a huge amount. Jumbo rates have fallen a large amount also, but much less (for example for a credit score of 700-759 the jumbo rates declined 73 basis points while the conventional rate declined 172 basis points.

For scores above 620, the APRs above assume a mortgage with 1 point and 80% Loan-to-Value Ratio. For scores below 620, these APRs assume a mortgage with 0 points and 60 to 80% Loan-to-Value Ratio. You can see, with these conditions the rate difference between a credit score of 660 and 800 is not large (remember this is with 20% down-payment) and has not changed much (the difference between the rates if fairly consistent).

Related: Low Mortgage Rates Not Available to Everyone – 30 Year Fixed Rate Mortgage Rate Data – Real Free Credit Report (in USA) – Jumbo Mortgage Shoppers Get Little Relief From Rates – posts on mortgages

Read more

Here is an interesting article at Bloomberg looks at the Chicago school of economics: Friedman Would Be Roiled as Chicago Disciples Rue Repudiation by John Lippert

By the end of November, the government had committed $8.5 trillion, or more than half the value of everything produced in the country in 2007, to save the financial system.

…

Robert Lucas, a Chicago economist who won a Nobel in 1995 for a theory that argued against governments trying to fine-tune consumer demand, says deregulation may have gone too far. Depression-era laws that separated commercial and investment banks helped depositors decide if they wanted secure accounts or riskier investments. Today, without these distinctions, people can’t be sure if their investments, or those of their customers, are safe.

“I’m changing my views on bank regulation every week,” Lucas, 71, says. “It was an area I saw as under control. Now I don’t believe that.” Lucas says he voted for Obama, the only Democrat besides Bill Clinton he’d supported in 44 years. He concluded the candidate was comfortable talking with professional economists.

…

“The big event of the last 20 years is the success of free markets in India and China,” says McCloskey via telephone from South Africa, where she’s a visiting professor at the University of the Free State in Bloemfontein. “This is more important than any financial crisis and makes it really hard to argue for a return to central planning.”

I believe capitalism is the best system for economic development. Unfortunately, as I have written before, too many decision makers don’t have the slightest clue about economics. They accept simplistic views just like scientifically illiterate people accept simplistic claims that have no merit.

The basics are pretty easy. You want to use the market to guide the economy. You need to regulate in those areas the market alone is know to be weak (negative externalities – including pollution, risks to the public…) anti-market behavior (large players controlling markets for their own benefit, large players paying off politicians for benefits…) and systemic risks (“too big to fail“…). And practical consideration is more important that ideological purity.

One of the most important consistent failures is the continued favoring of large entities that pay politicians large amounts of money. The continued creation of huge organizations that are anti-competitive by their nature and create systemic economic risk have not economic justification. The role of the government should be to enforce competitive markets not allow huge competitors to buyout other huge competitors so that they can further distort the market.

Related: Ignorance of Capitalism – Misuse of Statistics, Mania in Financial Markets – Greenspan Says He Was Wrong On Regulation – Lobbyists Keep Tax Off Billion Dollar Private Equities Deals and On For Our Grandchildren – Treasury Now (1987) Favors Creation of Huge Banks

Why the Germans just hate to spend, spend, spend

…

US, French and British officials puzzle over Germany’s refusal to tackle the recession head-on. German leaders, meanwhile, cannot see why their taxpayers’ money should go into encouraging precisely the kind of behaviour – reckless lending, careless borrowing and overconsumption – that precipitated the financial crisis.

I am with the Germans on this one. The people that want to find some more credit cards to run up don’t understand the problem. Until they come up with strong policies that admit we have been living beyond our means for decades and have to pay for this at some point and fashion a policy based on that understanding we are in danger. Yes another credit card can allow you to continue to live beyond your means, but it also puts you into even worse financial shape than you have already gotten yourself into. It is not a solution, it is an emergency to deal with the complete failure of yourself previously and without a plan to change it is just setting yourself up for a worse situation soon.

Related: How to Use Your Credit Card Responsibly – Have you Saved Your Emergency Fund Yet? – Can I Afford That? – Too Much Stuff

Continuation of: USA Manufacturing is Healthy

The real problem with the USA economy is that a country cannot live beyond its means forever. Those living in USA have consumed far more than they have produced for decades. That is not sustainable. The living beyond our means is mainly due to massively increased consumption, not shrinking output (in manufacturing or service). One, of many examples, of the increased consumption is average square footage of single-family homes in the USA: 1950 – 983; 1970 – 1,500; 1990 – 2,080; 2004 – 2,349.

In case it isn’t totally obvious to you. You don’t fix this problem by encouraging more spending and borrowing: either by the government or by consumers. The long term problem for the USA economy is that people have consuming more than they have been producing. Personally, as this continues you reach a point where getting another credit card does not work. The same holds true for the collective health of a country. A country cannot solve the problem of having bills come due from decades of living beyond its means by charging more so that they can continue to live beyond their means.

Where the USA is in the continuum, is hard for me to judge. For the sack of illustration, lets say a consumer can get to 10 cards before they finally fail. If the consumer reaches the limit on 2 credit cards they have the choice to continue to the party by getting another credit card. Or they have the choice of addressing the situation they have gotten themselves into. If they decide to become responsible they have a challenge but one they can endure with some hardships.

If they press on to 5 credit cards and then max them out they come to the same decision. Dig themselves deeper in debt to avoid the problem today or live up their past behavior and become responsible. The work they have ahead of themselves is much more challenging than if they had started working on the problem when they only had 2 cards.

If they press on to 9 cards and now have the decision again. The effort to find a solution may be almost impossible. Borrow more to pay for past mistakes while maintaining some expenditures may be possible (but they will have to live on less than they earn). By the time you are this far down the failed path you have so much going to pay for your past bills you can’t spend even close to what you currently earn on current expenses. Letting yourself get to this point is very bad. And most likely as a person you will go bankrupt.

Read more

The challenges are difficult. I am not confident the current leadership (if their is leadership globally) is capable of making the difficult decisions. There are not easy answers though their are some pretty basic principles people should agree on (excessive leverage is dangerous, massive positions that endanger entire economies are dangerous…). But how to deal with those issues is not easy.

Related: Leverage, Complex Deals and Mania – Treasury Now (1987) Favors Creation of Huge Banks – Monopolies and Oligopolies do not a Free Market Make – Negligent Watchmen

Financial Markets with Professor Robert Shiller (spring 2008) is a fantastic resource from Open Yale courses: 26 webcast (also available as mp3) lectures on topics including: The Universal Principle of Risk Management, Stocks, Real Estate Finance and Its Vulnerability to Crisis, Stock Index, Oil and Other Futures Markets and Learning from and Responding to Financial Crisis (Guest Lecture by Lawrence Summers).

Robert Shiller created the repeat-sales home price index with Karl Case that is known as the Case-Shiller home price index.

Related: Berkeley and MIT courses online – Open Access Education Materials – Curious Cat Science and Engineering Blog open access posts – Paul Krugman Speaks at Google

The New Paradigm for Financial Markets is George Soros‘ newest book. Here is an interview with him in May of this year, on PBS, Financial World Shifts Gears Amid Economic Tumult, about the ideas in the book and the current crisis.

GEORGE SOROS: I think this is the most serious crisis of our lifetime. It’s not just a housing crisis, but a crisis of the financial system.

…

GEORGE SOROS: The regulators have failed to regulate, and they really have to — they left it to the market. That was this market fundamentalist philosophy, that markets will take care of themselves.

…

And I contend that there’s been what I call a super bubble that has been growing over the last 25 years at least, which basically consisted of an extension in credit, increasing use of leverage. That was the trend in reality.

And the misconception that credit is that markets can be left to their own devices. Now, in fact, they are given to excesses, and occasionally they create crises, but each time the authorities intervene and bail out the failing institutions, provide fiscal stimulus, monetary stimulus.

So it seems like the market corrects itself, but it’s actually the intervention of the authorities that saves the market.

Related: Soros on the Financial Market Collapse – Jim Rogers on the Financial Market Mess – Leverage, Complex Deals and Mania

Consumer debt gets bailout attention

…

“Approximately 40 percent of U.S. consumer credit is provided through securitization of credit card receivables, auto loans and student loans and similar products. This market, which is vital for lending and growth, has for all practical purposes ground to a halt.”

The Next Meltdown: Credit-Card Debt

…

Innovest estimates that credit-card issuers will take a $41 billion hit from rotten debt this year and a $96 billion blow in 2009.

…

Risky borrowers with low credit scores account for roughly 30% of outstanding credit-card debt, compared with 11% of mortgage debt. More than 45% of Washington Mutual’s credit-card portfolio is subprime, according to Innovest.

Related: Americans are Drowning in Debt – How to Use Your Credit Card – Credit Crisis (Aug 2007) – Curious Cat Economics Search Engine