Fed Focusing on Real-Estate Recession as Bernanke Convenes FOMC

…

Commercial property is “certainly going to be a significant drag” on growth, said Dean Maki, a former Fed researcher who is now chief U.S. economist in New York at Barclays Capital Inc., the investment-banking division of London-based Barclays Plc. “The bigger risk from it would be if it causes unexpected losses to financial firms that lead to another financial crisis.”

…

Any sales of mortgage-backed bonds would be the first new issues in the $700 billion U.S. market for commercial-mortgage- backed securities since it was shut down by the credit freeze in 2008. About $3 billion are in the pipeline, and the success of these sales may foster as much as $25 billion in total deals in the next six months

…

Forty-seven percent of loans at the 7,000-plus smaller U.S. lenders are in commercial real estate, compared with 17 percent for the biggest banks…

Related: Data Shows Subprime Mortgages Were Failing Years Before the Crisis Hit – Home Values and Rental Rates – Record Home Price Declines (Sep 2008)

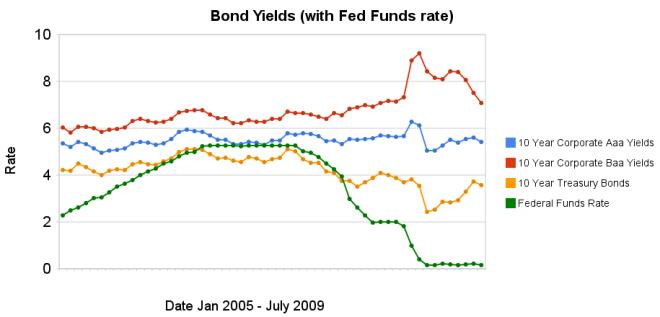

Chart showing corporate and government bond yields by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.

Chart showing corporate and government bond yields by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.The changes in bond yields over the last 3 months months indicate a huge increase in investor confidence. The yield spread between corporate Baa 10 year bonds and 10 year treasury bonds increased 304 basis points from July 2008 to December 2008, indicating a huge swing in investor sentiment away from risk and to security (US government securities). From April 2009 to July 2009 the yield spread decreased by 213 basis points showing investors have moved away from government bonds and into Baa corporate bonds.

From April to July 10 year corporate Aaa yields have stayed essentially unchanged (5.39% to 5.41% in July). Baa yields plunged from 8.39% to 7.09%. And 10 year government bond yields increased from 2.93% to 3.56%. federal funds rate remains under .25%.

Investors are now willing to take risk on corporate defaults for a much lower premium (over government bond yields) than just a few months ago. This is a sign the credit crisis has eased quite dramatically, even though it is not yet over.

Data from the federal reserve: corporate Aaa – corporate Baa – ten year treasury – fed funds

Related: Continued Large Spreads Between Corporate and Government Bond Yields (April 2009) – Chart Shows Wild Swings in Bond Yields (Jan 2009) – investing and economic charts

Here is an excellent article on how to invest in the stock market. I personally tweak this advice a bit but it is much better than most advice you get. Basically keep costs down (don’t pay large fees) and diversify. Lazy Portfolios seven-year winning streak by Paul Farrell

…

In short, even though we know that the average compensation of portfolio managers is often $400,000 to more than a $1 million, the hot-shot managers of these actively managed funds provided no value-added to their funds’ performance. Conclusion: Their investors would be better off investing in index funds.

…

Yes, the market was in negative territory the past few years, but still all eight Lazy Portfolios outperformed each of the six actively-managed funds.

…

Customize your own Lazy Portfolio following these six rules and you’ll win. More important, you’ll have lots of time left to enjoy what really counts, your family, friends, career, sports, hobbies, living.

…

2) Frugality, savings versus financial obesity. Tools like starting early, autopilot saving plans, dollar-cost averaging, frugal living and other tricks are familiar to long-term investors. Trust your frugality instincts — living below your means — it’s a trait common among America’s “millionaires next door.”

Related: Lazy Portfolio Results (April 2008) – Allocations Make A Big Difference – 12 stocks for 10 years – 401(k)s are a Great Way to Save for Retirement

Wells Fargo is offering to donate $1 to Kiva for every person that completes a 7 question survey (no contact information is required) to get what they call a retirement security index. I did and there are 2 benefits to doing so yourself. First, most of us would benefit from more attention to our retirement planning. Second help out Kiva – which I have mentioned many time.

Now I think their questionnaire is far too simplistic but it is hard to get people to spend even 15 minutes looking at a saving plan for retirement. So I know they are trying to keep it very simple so people will complete it. That said, read our posts on retirement planning to lean more about planning for retirement. It is critical that you spend the time in your 20’s, 30’s and 40’s doing this or you are really going to have trouble making decent retirement plans.

Related: Add to Your 401(k) and IRA – Spending Guidelines in Retirement – Retirement Savings Survey Results – Personal Finance: Saving for Retirement

Short selling stock is a tool that can help keep markets more stable. However, short selling can be used to manipulate the market and in the last decade naked short selling has contributed to such manipulation. The SEC has made permanent a temporary rule that was approved in 2008 in response to continuing concerns regarding “fails to deliver” and potentially abusive “naked” short selling. In particular, temporary Rule 204T made it a violation of Regulation SHO and imposes penalties if a clearing firm:

* does not purchase or borrow shares to close-out a “fail to deliver”

* resulting from a short sale in any equity security

* by no later than the beginning of trading on the day after the fail first occurs (Trade + 4 days).

Cutting Down Failures to Deliver: An analysis conducted by the SEC’s Office of Economic Analysis, which followed the adoption of the close-out requirement of Rule 204T and the elimination of the “options market maker” exception, showed the number of “fails” declined significantly.

For example, since the fall of 2008, fails to deliver in all equity securities has decreased by approximately 57 percent and the average daily number of threshold list securities has declined from a high of approximately 582 securities in July 2008 to 63 in March 2009. Which still is not acceptable, in my opinion. In general this is a good move by the SEC, but still not sufficient.

Transparency is increased some by the SEC with the new rules:

* Daily Publication of Short Sale Volume Information. It is expected in the next few weeks that the SROs will begin publishing on their Web sites the aggregate short selling volume in each individual equity security for that day.

* Disclosure of Short Sale Transaction Information. It is expected in the next few weeks that the SROs will begin publishing on their Web sites on a one-month delayed basis information regarding individual short sale transactions in all exchange-listed equity securities.

* Twice Monthly Disclosure of Fails Data. It is expected in the next few weeks that the Commission will enhance the publication on its Web site of fails to deliver data so that fails to deliver information is provided twice per month and for all equity securities, regardless of the fails level.

Full SEC press release: SEC Takes Steps to Curtail Abusive Short Sales and Increase Market Transparency

Related: SEC Temporarily Bans Short-selling Financial Stocks – Shorting Using Inverse Funds – Too Much Leverage Killed Mervyns

I originally setup the 10 stocks for 10 years portfolio in April of 2005. In order to track performance created a marketocracy portfolio but had to make some minor adjustments (and marketocracy doesn’t allow Tesco to be purchased, though it is easily available as an ADR to anyone in the USA to buy in real life – it is based in England). The current marketocracy calculated annualized rate or return (which excludes Tesco) is 3.5% (the S&P 500 annualized return for the period is -1.7%) – marketocracy subtracts the equivalent of 2% of assets annually to simulate management fees – as though the portfolio were a mutual fund – so without that the return is about 5.5%).

The current stocks, in order of return:

| Stock | Current Return | % of sleep well portfolio now | % of the portfolio if I were buying today | |

|---|---|---|---|---|

| Amazon – AMZN | 136% | 9% | 9% | |

| Google – GOOG | 105% | 15% | 13% | |

| Templeton Dragon Fund – TDF | 80% | 11% | 11% | |

| PetroChina – PTR | 78% | 11% | 10% | |

| Templeton Emerging Market Fund – EMF | 28% | 5% | 6% | |

| Cisco – CSCO | 15% | 6% | 8% | |

| Toyota – TM | 7% | 9% | 11% | |

| Danaher – DHR | -14% | 6% | 9% | |

| Tesco – TSCDY | -14%* | 0%* | 10% | |

| Intel – INTC | -15% | 4% | 6% | |

| Pfizer – PFE | -38% | 5% | 7% | |

| Dell | -60% | 4% | 0% |

The portfolio is beating the S&P 500 by 5.2% annually (which is actually quite good. Also it is a bit confused due to to Tesco not being included. View the current marketocracy Sleep Well portfolio page.

Related: 12 Stocks for 10 Years Update – June 2008 – posts on stocks – investing books

Read more

Mobius Says Derivatives, Stimulus to Spark New Crisis

“Political pressure from investment banks and all the people that make money in derivatives” will prevent adequate regulation, said Mobius, who oversees $25 billion as executive chairman of Templeton in Singapore. “Definitely we’re going to have another crisis coming down,”

…

A “very bad” crisis may emerge within five to seven years as stimulus money adds to financial volatility, Mobius said. Governments have pledged about $2 trillion in stimulus spending.

…

“Banks have lobbied hard against any changes that would make them unable to take the kind of risks they took some time ago,” said Venkatraman Anantha-Nageswaran, global chief investment officer at Bank Julius Baer & Co. in Singapore. “Regulators are not winning the battle yet and I’m not sure if they are making a strong case yet for such changes.”

Mobius also predicted a number of short, “dramatic” corrections in stock markets in the short term, saying that “a 15 to 20 percent correction is nothing when people are nervous.” Emerging-market stocks “aren’t expensive” and will continue to climb

I share this concern for those we bailed out using the money we paid them to pay politicians for more favors. Those paying our politicians like very much paying themselves extremely well and then being bailed out by the taxpayers when their business fails. They are going to try to retain the system they have in place. And they are likely to win – politicians are more likely to provide favors to those giving them large amounts of money than they are to learn about proper management of an economy.

Related: Congress Eases Bank Laws for Big Donors (1999) – Lobbyists Keep Tax Off Billion Dollar Private Equities Deals and On For Our Grandchildren – General Air Travel Taxes Subsidizing Private Plane Airports – CEOs Plundering Corporate Coffers

Welcome to the Curious Cat Investing and Economics Carnival, we hope you enjoy the following posts we share here.

- Warren Buffet On An Investment News Channel by Robin Bal – “I could see that the mere mention of a time scale like three to five years had derailed the interviewer’s thought process. Coming as she did from a world where three to five hours or at most three to five days is the standard unit of time, the idea of an investor talking in years seemed to have thrown a spanner in her works.”

- Loan Default Rates: 1998-2009 by John Hunter – “In the 4th quarter of 2007 residential real estate default rates were 3.02% by the 4th quarter of 2008 they were 6.34% and in the 1st quarter of this year they were 7.91%”

- Key Factors Affecting Long-Term Growth in Federal Spending by Douglas Elmendorf – “Two factors underlie the projected increase in federal spending on Medicare, Medicaid, and Social Security as a share of GDP: rapid growth in health care costs and an aging population.”

- Will the Chinese Keep Saving? by Rachel Ziemba – “Should export-oriented ’surplus’ countries like China keep saving and keep trying to export demand, the reduction in imbalances could actually exacerbate the global economic contraction or contribute to a more sluggish recovery. “

- Use Your Health Insurance! by David Weliver – “So if you’re worried about losing your job (and insurance) or anticipate making a life change that will leave you uninsured, get in to see a doctor while you are still covered.”

- Where is the externality here? by Matt Nolan – “They are paid less because their marginal product is lower, and they are willing to be paid less because the benefit they receive from consuming alcohol is sufficient compensation – this is a completely internalised decision for the drinker isn’t it, so where is the social cost.”

- Quibbles With Quants – “What the models failed to capture was that humans don’t behave in simple, predictable and uncorrelated ways. It’s impossible to overstate the importance of the way these models cope with correlation of peoples’ psychology. To sum it up: they don’t. Let me know if that’s too complex an analysis for the mathematical masters of the universe.”

- Goldman’s Back, and Why We Should Be Worried by Robert Reich – “The decision to bail out AIG resulted in a $13 billion giveaway to Goldman because Goldman was an AIG counterparty. Indeed, Goldman executives and alumni have played crucial roles in guiding the Wall Street bailout from the start. So the fact that Goldman has reverted to its old ways in the market suggests it has every reason to believe it can revert to its old ways in politics, should its market strategies backfire once again — leaving the rest of us once again to pick up the pieces.”

The Formula That Killed Wall Street

His method was adopted by everybody from bond investors and Wall Street banks to ratings agencies and regulators. And it became so deeply entrenched—and was making people so much money—that warnings about its limitations were largely ignored.

Then the model fell apart. Cracks started appearing early on, when financial markets began behaving in ways that users of Li’s formula hadn’t expected. The cracks became full-fledged canyons in 2008—when ruptures in the financial system’s foundation swallowed up trillions of dollars and put the survival of the global banking system in serious peril.

Very nice article on the dangers of financial markets to those that believe that math can provide all the answers. Math can help find opportunities. However markets have physical, psychological and regulatory limitations. And markets frequently experience huge panics or manias. People continue to fail to model that properly.

Related: All Models Are Wrong But Some Are Useful – Leverage, Complex Deals and Mania – Financial Markets with Robert Shiller – Financial Market Meltdown – Failure to Regulate Financial Markets Leads to Predictable Consequences

The Society for Actuaries has published a good resource: Managing post-retirement risks.

…

Many investors try to own some assets whose value may grow in times of inflation. However, this sometimes will trade inflation risk for investment risk.

• Common stocks have outperformed inflation in the long run, but are

poor short-term hedges. The historically higher returns from stocks

are not guaranteed and may vary greatly during retirement years.

…

Retirement planning should not rely heavily on income from a bridge job. Many retirees welcome the chance to change careers and move into an area with less pay but more job satisfaction, or with fewer demands on their time and energy.

Terminating employment before age 65 may make it difficult to find a source of affordable health insurance before Medicare is available.

…

Insurance for long-term care covers disabilities so severe that assistance is needed with daily activities such as bathing, dressing and eating. Some policies require a nursing home stay; others do not. The cost of long-term care insurance is much less if purchased at younger ages, well before anticipated need.

The full document is well worth reading.

Related: Many Retirees Face Prospect of Outliving Savings – How to Protect Your Financial Health – Financial Planning Made Easy – personal finance tips