Dividends Falling Means S&P 500 Is Still Expensive

A total of 288 companies cut or suspended payouts last quarter, the most since Standard & Poor’s records began 54 years ago, when Dwight D. Eisenhower was president. While the S&P 500 is trading at the lowest price relative to earnings since 1985 and all 10 Wall Street strategists tracked by Bloomberg forecast a rally this year, predictions based on dividends show shares are overvalued by as much as 46 percent.

Just last November the S&P 500 dividend yield topped the bond yield for the first time since 1958. Yields often rise as stock prices fall on future prospects and companies announce dividend cuts after stocks have already fallen (due to the deteriorating conditions the company faces). So you always must be careful not to count dividends before they are paid. As an investor you need to look into the future and see how secure the dividends are likely to be.

Related: 10 Stocks for Income Investors – 10 Stocks for 10 Years – Curious Cat Investing Books

I do not like the actions of many in “private equity.” I am a big fan of capitalism. I also object to those that unjustly take from the other stakeholders involved in an enterprise. It is not the specific facts of this case, that I see as important, but the thinking behind these types of actions. Which specific actions are to blame for this bankruptcy is not my point. I detest that financial gimmicks by “private capital” that ruin companies.

Those gimmicks that leave stakeholders that built such companies in ruin should be criticized. It is a core principle that I share with Dr. Deming, Toyota… that companies exist not to be plundered by those in positions of power but to benefit all the stakeholders (employees, owners, customers, suppliers, communities…). I don’t believe you can practice real lean manufacturing and subscribe to this take out cash and leave a venerable company behind kind of thinking.

How Private Equity Strangled Mervyns

When those firms bought Mervyns from Target for $1.2 billion in 2004, they promised to revive the limping West Coast retailer. Then they stripped it of real estate assets, nearly doubled its rent, and saddled it with $800 million in debt while sucking out more than $400 million in cash for themselves, according to the company. The moves left Mervyns so weak it couldn’t survive.

Mervyns’ collapse reveals dangerous flaws in the private equity playbook. It shows how investors with risky business plans, unrealistic financial assumptions, and competing agendas can deliver a death blow to companies that otherwise could have survived. And it offers a glimpse into the human suffering wrought by owners looking to turn a quick profit above all else.

Too much debt is not just a personal finance problem it is a problem for companies too. Continue reading on my original post on the Curious Cat Management Blog.

Related: Leverage, Complex Deals and Mania – Failed Executives Used Too Much Leverage – posts on debt

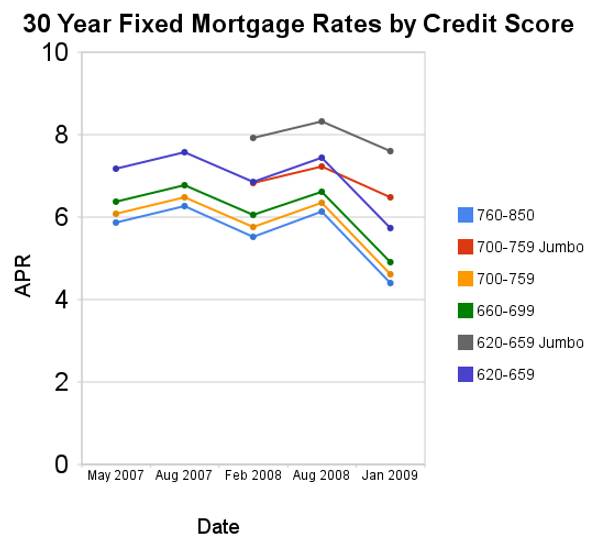

Since August of 2008 conforming mortgage rates are have declined a huge amount. Jumbo rates have fallen a large amount also, but much less (for example for a credit score of 700-759 the jumbo rates declined 73 basis points while the conventional rate declined 172 basis points.

For scores above 620, the APRs above assume a mortgage with 1 point and 80% Loan-to-Value Ratio. For scores below 620, these APRs assume a mortgage with 0 points and 60 to 80% Loan-to-Value Ratio. You can see, with these conditions the rate difference between a credit score of 660 and 800 is not large (remember this is with 20% down-payment) and has not changed much (the difference between the rates if fairly consistent).

Related: Low Mortgage Rates Not Available to Everyone – 30 Year Fixed Rate Mortgage Rate Data – Real Free Credit Report (in USA) – Jumbo Mortgage Shoppers Get Little Relief From Rates – posts on mortgages

Read more

Madoff ‘victims’ do math, realize they profited

The issue came to the forefront this week as about 8,000 former Madoff clients began to receive letters inviting them to apply for up to $500,000 in aid from the Securities Investor Protection Corp. Lawyers for investors have been warning clients to do some tough math before they apply for any funds set aside for the victims, and figure out whether they were a winner or loser in the scheme.

Hundreds and maybe thousands of investors in Madoff’s funds have been withdrawing money from their accounts for many years. In many cases, those investors have withdrawn far more than their principal investment.

…

Jonathan Levitt, a New Jersey attorney who represents several former Madoff clients, said more than half of the victims who called his office looking for help have turned out to be people whose long-term profits exceeded their principal investment.

I discussed this aspect last month, the SPIC covers actual losses, not losses based upon false gains you didn’t have, I don’t think. So if you invested $100,000 and were told (falsely) it was worth $300,000 after years of gains you are not covered for $300,000. And I certainly hope the SPIC fund doesn’t payoff people who already had gains based on false accounting from Madoff.

This whole situation also points out the value of diversification. Diversification is important not just in asset classes (stocks, bonds, cash, real estate…) but in the accounts and companies with which you are dealing (I have always been a bit paranoid in this feeling, compared to others that think this level of diversification is not really needed but this is an example of the risks investments face that diversification can help manage). This is a very difficult situation for investors that had counted on assess they believed they had earned but in fact they had not.

Related: Bail us Out, say Madoff Victims – How to Protect Your Financial Health – Real Free Credit Report – identity theft links

As I suspected those (who are not earning minimum wage you can be sure) that have lost money on the Madoff case would expect others to bail them out: well paid lawyers (I am sure) are making their case for just such a bailout of their wealthy clients.

…

The SIPC has little more than $1.6bn of funds and has promised $500,000 to each Madoff victim who had an account with his firm in the past 12 months.

The debate needs to be about what is the proper role for government. Not about this instance. What type of losses do we want secured? How large of payments do we want to insure? That amount has been $500,000 if we are changing the rules after the fact for a few is that really the best course of action)? How should these payments be funded? Do we really want to raise taxes on our grand children (many of which who will earn less than the equivalent of $50,000 today)? I don’t think so. This SIPC fund should be paid for by fees on investments just like the FDIC is paid for based on fees on covered deposits (as the SIPC is now – but no taxpayer funding should occur).

If we decide we want to pay back people several million each then the fees just need to be raised to fund such a system. Just as with the FDIC if we want the government to backstop the fund by guaranteeing they will loan the fund money if it runs short of cash is fine with me. Then the SIPC fund just pays back the taxpayers with interest.

Read more

Retirement Myths and Realities provides some ideas from former Boeing President, Henry Hebeler:

…

My father used to tell me to save 10 percent of my wages all the time for retirement. And so I did. I never looked at any retirement plan; we didn’t have retirement planning tools in those days.

…

I think the number is closer to 15 (percent) to 20 percent — that’s from the time when you’re a relatively young person, say, 30 years old or something like that.

…

A retiree’s inflation rate is about 0.2 percent higher than the normal Consumer Price Index. When you retire, you have medical expenses that continually increase. You have more need for this service and the unit cost is increasing much faster than inflation.

…

Now, if you’re going to retire at 80 years old, you could actually have a bigger number than 4 percent. If you’re going to retire around 65 or so, 4 percent is not a bad number. Some people are now saying 3.5 percent instead of 4 percent. If you’re going to retire at 55, you’d better spend a lot less than 4 percent because you’ve got another 10 years of life that you’re going to have to support.

He makes some interesting points. I agree it is very important for people to become financially literate and take the time to understand their retirement plans. Just hoping it will work out or trusting that just doing what someone told you are very bad ideas. You need to educate yourself and learn about financing your retirement.

I am not really convinced by his idea that you need to start saving 15-20% for retirement at age 30. But that is a decision each person has to make for themselves. Of course there are many factors including how much risk you are willing to accept, when you plan on retiring, what standard of living you want in retirement…

Related: How Much Retirement Income? – posts on retirement – Saving for Retirement – Our Only Hope: Retiring Later

The economy (in the USA and worldwide) continues to struggle and the prospects for 2009 do not look good. My guess is that the economy in 2009 will be poor. If we are lucky, we will be improving in the fall of 2009, but that may not happen. But what does that mean for how to invest now?

I would guess that the stock market (in the USA) will be lower 12 months from now. But I am far from certain, of that guess. I have been buying some stocks over the last few months. I just increased my contributions to my 401(k) by about 50% (funded by a portion of my raise). I changed the distribution of my future contributions in my 401(k) (I left the existing investments as they were).

My contributions are now going to 100% stock investments (if I were close to retirement I would not do this). I had been investing 25% in real estate. I also moved into a bit more international stocks from just USA stocks. I would be perfectly fine continuing to the 25% in real estate, my reason for switching was more that I wanted to buy more stocks (not that I want to avoid the real estate). The real estate funds have declined less than 3% this year. I wouldn’t be surprised for it to fall more next year but my real reason for shifting contributions to stocks is I really like the long term prospects at the current level of the stock market (both globally and in the USA). The short term I am much less optimistic about – obviously.

I will also fully fund my Roth IRA for 2009, in January. I plan to buy a bit more Amazon (AMZN) and Templeton Emerging Market Fund (EMF). And will likely buy a bit of Danaher (DHR) or PetroChina (PTR) with the remaining cash.

Related: 401(k)s are a Great Way to Save for Retirement – Lazy Portfolio Results – Starting Retirement Account Allocations for Someone Under 40

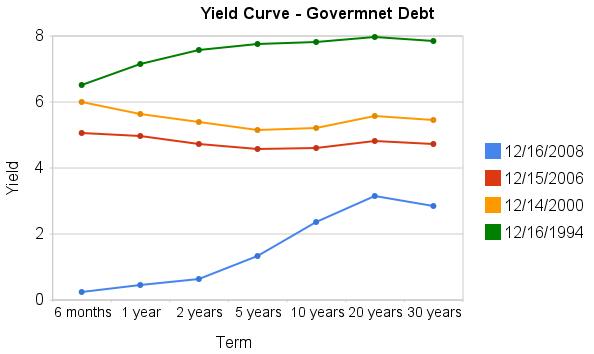

Treasury bills have been providing remarkably low yields recently. And the Fed today cut their target federal funds rate to 0-.25% (what is the fed funds rate?). With such low rates already in the market the impact of a lowered fed funds rate is really negligible. The importance is not in the rate but in the continuing message from the Fed that they will take extraordinary measures to soften the recession.

There are significant risks to this aggressive strategy (and there would be risks for acting cautiously too). But I cannot understand investing in the dollar under these conditions or in investing in long term bonds (though lower grade bonds might make some sense as a risky investment for a small portion of a portfolio as the prices have declined so much).

The current yields, truly are amazing as this graph shows. The chart shows the yield curve in Dec 2008, 2006, 2000 and 1994 based on data from the US Treasury

Related: Corporate and Government Bond Rates Graph – Discounted Corporate Bonds Failing to Find Buying Support – Municipal Bonds After Tax Return – Total Return

I don’t actually agree with the contention in this post, but the post is worth reading. I will admit I am more certain of I like the prospect of investing in certain stocks (Google, Toyota, Danaher, Petro China, Templeton Dragon Fund, Amazon [I don't think Amazon looks as cheap as the others, so their is a bit more risk I think but I still like it]) for the next 5 years than I am in the overall market. But I am also happy to buy into the S&P 500 now in my 401(k).

Stocks Still Overpriced even after $6 Trillion in Market Cap gone from the Index

…

Even if we assumed a healthy economy, the price is no bargain. Throw in the fact that we are in recession and you can understand why the S & P 500 is still overvalued. We haven’t even come close to the historical P/E of 15.79 which includes good times as well.

Just to be clear current PE ratios have nothing to do with next year. It would be accurate to say someone making the argument that the S&P 500 is cheap now because of the current PE ratio, is leaving out an important factor which is what will earning be like next year. It does seem likely earnings will fall. But I also am not very concerned about earning next year, but rather earning over the long term. I see no reason to be fearful the long term earning potential of say Google is harmed today.

Related: S&P 500 Dividend Yield Tops Bond Yield for the First Time Since 1958 – 10 Stocks for 10 Years – Starting Retirement Account Allocations for Someone Under 40 – Books on Investing

Recent market collapses have made it even more obvious how import proper retirement planning is. There are many aspects to this (this is a huge topic, see more posts on retirement planning). One good strategy is to put a portion of your portfolio in income producing stocks (there are all sorts of factors to consider when thinking about what percentage of your portfolio but 10-20% may be good once you are in retirement). They can provide income and can providing growing income over time (or the income may not grow over time – it depends on the companies success).

…

Strategy #3: Buy common stocks with solid dividends and a history of raising dividends for the long haul. That way you let time and compounding work for you. While you may be buying $1 per share in dividends today with stocks like these, you’re also buying, say, 8% annual increases in dividends. In 10 years, that turns a $1-a-share dividend into $2.16 a share in dividends.

3 of this picks are: Enbridge Energy Partners (EEP), dividend yield of 15.5%, dividend history; Energy Transfer Partners (ETP), 11.2%, dividend history; Rayonier (RYN), yielding 6.7%, dividend history.

Of course those dividends may not continue, these investments do have risk.

Related: S&P 500 Dividend Yield Tops Bond Yield: First Time Since 1958 –

Discounted Corporate Bonds Failing to Find Buying Support – Allocations Make A Big Difference