I make a point of showing the discount rate changes by the Fed don’t translate to mortgage rate changes. I do so because many people think the discount rate does directly effect mortgage rates. But the Fed announced today, actions that actually do impact mortgage rates.

Federal Reserve to Buy $1.2T in Bonds, Mortgage-Backed Securities

If you are looking at refinancing your mortgage now (or soon) might be a good time, rates were already very low and will be declining. And if you own long term bonds you just got a nice increase in your value (bond prices move up when interest rates move down).

Related: Lowest 30 Year Fixed Mortgage Rates in 37 Years – Low Mortgage Rates Not Available to Everyone – Why do we Have a Federal Reserve Board?

More than half of the nation’s foreclosures last year took place in 35 counties

…

A few of the 35 counties leading the foreclosure boom are in already-distressed areas around Detroit and Cleveland. But most are clustered in places such as Southern California, Las Vegas, Phoenix, South Florida and Washington, where home values shot up dramatically in the first half of the decade, then began to crumble.

…

The worst-hit counties are home to about 20% of U.S. households, but accounted for just over 50% of the nation’s foreclosure actions last year, driving most of the national increase. And even among those places, a few stand out: Eight counties in Arizona, California, Florida and Nevada were the source of about a quarter of the nation’s foreclosures last year.

In more than 650 other counties – about a fifth of the nation – the number of foreclosure actions actually dropped since 2006.

Related: Freezing Mortgage Rates – Nearly 10% of Mortgages Delinquent or in Foreclosure – Jumbo Loan Defaults Rise at Fast Pace – Ignorance of Many Mortgage Holders

Ex-Leaders at Countrywide Start Firm to Buy Bad Loans

Its biggest deal has been with the Federal Deposit Insurance Corporation, which it paid $43.2 million for $560 million worth of mostly delinquent residential loans left over after the failure last year of the First National Bank of Nevada. Many of these loans resemble the kind that Countrywide once offered, with interest rates that can suddenly balloon. PennyMac’s payment was the equivalent of 38 cents on the dollar, according to the full terms of the agreement.

Under the initial terms of the F.D.I.C. deal, PennyMac is entitled to keep 20 cents on every dollar it can collect, with the government receiving the rest. Eventually that will rise to 40 cents.

…

Phone operators for PennyMac — working in shifts — spend 15 hours a day trying to reach borrowers whose loans the company now controls. In dozens of cases, after it has control of loans, it moves to initiate foreclosure proceedings, or to urge the owners to sell the house if they do not respond to calls, are not willing to start paying or cannot afford the house. In many other cases, operators offer drastic cuts in the interest rate or other deals, which PennyMac can afford, given that it paid so little for the loans.

…

But a PennyMac representative instead offered to cut the interest rate on their $590,000 loan to 3 percent, from 7.25 percent, cutting their monthly payments nearly in half, Ms. Laverde said.

This is one way the economy cleans up messes. A foolish organization lends money (or buys mortgages, loans…) to lots of people that couldn’t pay back and they then sell those loans at a big discounts. The new owners of the loans now have this mortgage that the homeowner can’t afford. But the cost of the mortgage to them wasn’t anywhere near the amount the homeowner owes. So the new buyer can make a great deal of money just by getting the homeowner to start paying again (even if it is at a much lower rate). They can also make money by foreclosing and then selling the property but truthfully if they can get the homeowner to pay that is likely a much better quick profit for them (and they can then sell the performing loan to someone else – I would imagine). Who knows if PennyMac will make a ton of money this way, but I fully expect many organizations to do so.

Related: Nearly 10% of Mortgages Delinquent or in Foreclosure – Learning About Mortgages – How Much Further Will Housing Prices Fall? – Jumbo v. Regular Fixed Mortgage Rates: by Credit Score

A documentary of the mortgage crisis by CNBC: House of Cards. It is a bit slow and simple but still for people that don’t really understand the basics of what happened it is interesting.

Related: Nearly 10% of Mortgages Delinquent or in Foreclosure – Ignorance of Many Mortgage Holders (2007) – How Not to Convert Equity – mortgage terms

Low Mortgage Rates a Mirage as Fees Climb, Eligibility Tightens

…

“A score of 700 was once near perfect,” said Gwen Muse Evans, vice president of credit policy at Fannie Mae, the government-controlled company that helps set lending standards. “Today, a 700 performs more like a 660 did. We have updated our policy to take into account the drift in credit scores.”

Consumer credit scores, called FICOs after creator Fair Isaac Corp., range from 300 to 850. The average FICO score on mortgages bought by Freddie Mac and Fannie Mae rose to 747.5 in the fourth quarter of last year from 722.3 in 2005, according to Inside Mortgage Finance.

Accunet’s Wickert said that a 660 FICO score would have qualified most borrowers for loans with no upfront fees in the past. Now, someone trying to borrow $200,000 with a 660 score would have to pay a 2.8 percent fee, or $5,600, he said. Even someone with a 719 score would have to pay $1,750 in cash.

The low mortgage rates are attractive but a decision to re-finance (or buy) must consider the long term implications. Also if you are re-financing to take advantage of the low rates consider a 20 year or 15 year loan if you are already well into your 30 year loan. A fixed rate loan is the most sensible option at this time.

Related: Low Mortgage Rates Not Available to Everyone – 30 Year Fixed Mortgage Rates and the Fed Funds Rate Chart – Ignorance of Many Mortgage Holders – Fed Plans To Curb Mortgage Excesses – How Not to Convert Home Equity

Jumbo Loan Defaults Rise at Fast Pace as Rich Suffer

2.57% of homeowners with jumbo mortgage are 60 days late, of those that just got loan last year! That is crazy. These kinds of figures are astounding to me. I am still (posted Feb 2007) amazed that 4.4% is the historic low for mortgages over a month late.

…

The top five U.S. jumbo lenders — Chase Home Finance LLC, Bank of America Corp., Washington Mutual Inc., Wells Fargo & Co. and Citigroup Inc. — originated a combined $55.3 billion in jumbos in 2008. They lent just $4.3 billion of that during the last three months of the year, according to Inside Mortgage Finance.

…

The national average for a 30-year fixed-rate jumbo mortgage was 6.57 percent this week compared with 5.34 percent for a conforming loan, according to White Plains, New York-based financial data provider BanxQuote.

Related: The Impact of Credit Scores and Jumbo Size on Mortgage Rates – Low Mortgage Rates Not Available to Everyone – 30 Year Fixed Mortgage Rates and the Fed Funds Rate – posts about mortgages

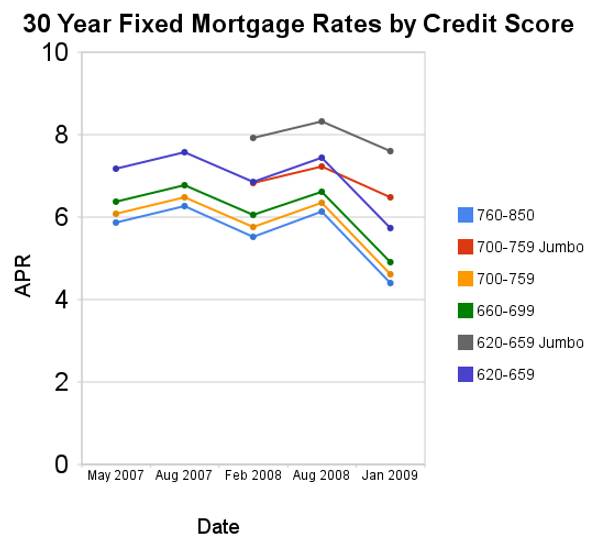

Since August of 2008 conforming mortgage rates are have declined a huge amount. Jumbo rates have fallen a large amount also, but much less (for example for a credit score of 700-759 the jumbo rates declined 73 basis points while the conventional rate declined 172 basis points.

For scores above 620, the APRs above assume a mortgage with 1 point and 80% Loan-to-Value Ratio. For scores below 620, these APRs assume a mortgage with 0 points and 60 to 80% Loan-to-Value Ratio. You can see, with these conditions the rate difference between a credit score of 660 and 800 is not large (remember this is with 20% down-payment) and has not changed much (the difference between the rates if fairly consistent).

Related: Low Mortgage Rates Not Available to Everyone – 30 Year Fixed Rate Mortgage Rate Data – Real Free Credit Report (in USA) – Jumbo Mortgage Shoppers Get Little Relief From Rates – posts on mortgages

Read more

The lowest 30 Year fixed mortgage rates in 37 years is great news for those looking to buy a house or to re-finance. However, that truth (the lowest rate) masks another truth, that it is available to a somewhat limited pool of borrowers. The rates for jumbo 30 year fixed mortgages and for regular 30 year fixed mortgages, for those with lower credit ratings, are not at the lowest rates they have ever reached. And getting mortgage rates that don’t require a 10-20% down payment and fully documented financial position are not as low as they have ever been. 15 year fixed rates are also low, but are not at all time lows. FHA loans still allow very low down payments, but others have moved away from this practice (which is a wise move).

Current rates, national average, from Bankrate: 30 year fixed 5.26%, 30 year fixed jumbo 6.96% (a full 170 basis points higher rate), 15 year fixed 5.07%. Jumbo rates have been less than 40 basis points higher than conventional rates most of time (based on my memory – I am looking for a source to confirm). The site does not present the credit score but my guess is these rates are based on a credit score of 700, or higher. Last week the jumbo rates increased by 11 basis points and regular 30 year rates fell by 3 basis points.

Related: Jumbo v. Regular Fixed Mortgage Rates: by Credit Score – historical mortgage rate chart – Nearly 10% of Mortgages Delinquent or in Foreclosure – misinterpreting data

Changes in the Market For Jumbo Mortgages

…

On Nov 12, 2008 I shopped for an $800,000 30-year fixed-rate mortgage on Mortgage Marvel, an on-line site that I reviewed earlier in 2008 (see A Look at Mortgage Marvel). The mortgage companies on the site quoted rates of 8.125% to 8.375%. The credit unions and banks, in contrast, quoted rates ranging from 5.875% to 7.875%. I have never before seen rate differences on the same transaction this large. They no doubt reflect wide differences in lender access to funding, which is symptomatic of a market in turmoil.

We now have the lowest 30 year fixed mortgage rates since data has been collected (37 years) in the USA. Is this due to the Fed cutting the discount rate? I do not think so. As I have said previously 30 year fixed rates are not correlated with federal reserve rates. But this time the government is actively seeking to reduce mortgage rates.

Mortgage Rate Hits 37-Year Low

…

The 15-year fixed-rate mortgage averaged 4.92%, down from last week when it averaged 5.20%. A year ago the 15-year loan averaged 5.79%. The 15-year mortgage hasn’t been lower since April 1, 2004, when it averaged 4.84%.

Homeowners refinance, put savings under mattress

These rates sure are fantastic if you are in the market. I was not in the market, but I am considering re-financing now. You need to be careful and not just withdraw money because you can. If you can refinance and reduce your payments it may well be a wise move though. One problem can be extending the date you will finally be free of mortgage debt. If you re-finance a current 30 year loan, that you got 5 years ago, you will now be paying 5 more years. One option is to see if you can get a 25 or 20 year loan. Or if you can make a 15 year loan work, do that (15 and 30 year fixed rate mortgages are common).

Read more

The percentage of loans in the foreclosure process at the end of the third quarter was 2.97 percent, an increase of 22 basis points from the second quarter of 2008 and 128 basis points from one year ago. The percentage of loans in the process of foreclosure set a new record this quarter, to 1.35 million.

Mortgages are counted as delinquent or in foreclosure (once they are in foreclosure they are not counted as delinquent). So the total percentage of mortgages not being paid by the homeowner is 2.97% (in foreclosure) + 6.99% (delinquent) = 9.96%. That is amazingly bad. In February of 2007 I wrote about this and the delinquency rate was 4.7% which sounded pretty bad to me. Amazingly 4.4% is a historic low for this figure. Can you believe 1/25 mortgages is delinquent and that is as good as we ever get? That is pretty shocking to me.

The seasonally adjusted total delinquency rate is now the highest recorded in the Mortgage Bankers Association survey. The seasonally adjusted delinquency rate increased 41 basis points to 4.34 percent for prime loans, increased 136 basis points to 20.03 percent for subprime loans, increased 29 basis points to 12.92 percent for FHA loans, and increased 46 basis points to 7.28 percent for VA loans.

The percent of loans in the foreclosure process increased 16 basis points to 1.58 percent for prime loans, and increased 74 basis points for subprime loans to 12.55 percent. FHA loans saw an eight basis point increase in the foreclosure inventory rate to 2.32 percent, while the foreclosure inventory rate for VA loans increased 13 basis points to 1.46 percent.

Since loans that would have gone into foreclosure in the past are being kept out of foreclosure due to some programs ( ) the rate or seriously delinquent is a useful measure of serious problems. Seriously delinquent mortgages are 90 days past due. The rate increased 52 basis points for prime loans to 2.87 percent, increased 171 basis points for subprime loans to 19.56 percent, increased 62 basis points for FHA loans to 6.05 percent, and increased 45 basis points for VA loans percent to 3.45 percent.

Compared to a year ago: the seriously delinquent rate was 156 basis points higher for prime loans and 818 basis points higher for subprime loans. The rate also increased 51 basis points for FHA loans and 89 basis points for VA loans.

Related: Homes Entering Foreclosure at Record (Sep 2007) – Foreclosure Filings Continue to Rise – How Much Worse Can the Mortgage Crisis Get? – How Not to Convert Equity