Fannie Mae (the quasi government mortgage giant) is raising fees for mortgages it buys. Banks and mortgage lenders often sell the mortgage to Fannie Mae shortly after completing the loan. Mortgages get more expensive – again

And Fannie doubled its “adverse market delivery charge” to 0.5%. That is an across-the-board fee assessed against every loan Fannie buys, according to a Fannie spokeswoman. Fannie first instituted the charge this spring.

…

The added fees will be passed on to borrowers and could mean quarter-point increases in interest rates.

…

Fannie will also eliminate buying Alt-A loans by the end of 2008. Alt-A loans, a category between prime and subprime, accounted for about 11% of the company’s loans during the last years of the boom. They have been used mostly by people who couldn’t or wouldn’t document their incomes, their assets or both. These buyers will find it harder to obtain financing once Fannie stops buying the loans.

According to Yun, however, the cutback in Alt-A will hurt people buying second homes to rent out or resell, rather than first time homeowners. “These are people who often rely on their good credit to buy investment properties putting little or no money down,” he said.

Related: Mortgage Rates Rising – Fed Funds Rate Changes Don’t Indicate Mortgage Rate Changes – Jumbo and Regular Mortgage Rates By Credit Score – Homes Entering Foreclosure at Record

Example 30 year mortgage rates (from myfico.com – see site for current rate estimates). Previous posts on this topic: Feb 2008 – August 2007 – May 2007. Since the last post both jumbo and conforming mortgages rates are up (and are up most for high credit scores).

| FICO score | APR Aug 2008 | APR Aug 2008 – jumbo | APR Feb 2008 | APR Feb 2008 – jumbo | APR Aug 2007 | APR May 2007 |

|---|---|---|---|---|---|---|

| 760-850 | 6.12% | 7.00% | 5.53% | 6.61% | 6.27% | 5.86% |

| 700-759 | 6.34% | 7.22% | 5.75% | 6.83% | 6.49% | 6.08% |

| 660-699 | 6.62% | 7.50% | 6.04% | 7.12% | 6.77% | 6.37% |

| 620-659 | 7.43% | 8.31% | 6.85% | 7.93% | 7.58% | 7.18% |

| 580-619 | 9.45% | 9.63% | 9.22% | 9.40% | 9.32% | 8.82% |

| 500-579 | 10.31% | 10.49% | 10.20% | 10.37% | 10.31% | 9.68% |

For scores above 620, the APRs above assume a mortgage with 1.0 points and 80% Loan-to-Value Ratio. For scores below 620, these APRs assume a mortgage with 0 points and 60 to 80% Loan-to-Value Ratio.

Since February the premium for jumbo loans has decreased to 88 basis points (from 108) for all credit scores above 620 (the combination of higher down payment and higher regular interest rates below 620 result in very little premium from Jumbo loans, under 20 basis points.

Related: 30 Year Fixed Rate Mortgage Rate Data – Learning About Mortgages – How Much Worse Can the Mortgage Crisis Get? – Real Free Credit Report (in USA)

I commented on, WaMu Free Checking: The High 3.3% APY May Be Worth A Look, yesterday:

I agree it is worth considering. It has FDIC insurance. But the bank is not very stable. The stock price, for example, was above 40 in the last year. It is below 5 now. But as long as your entire deposit is covered by FDIC you are in safe (though if a bank goes under – not that likely – there can be a delay in getting your money). Normally a bank’s assets would be bought out by another bank.

And today I read of the second largest bank failure in the history of the USA, IndyMac Bank seized by federal regulators:

Regulators said depositors would have no access to banking services online and by telephone this weekend, but could continue to use ATMs, debit cards and checks. Online banking and phone banking services are to resume operations Monday.

Federal authorities said based on a preliminary analysis, the takeover of IndyMac would cost the FDIC between $4 billion and $8 billion.

It is important to make sure your deposits are FDIC insured (in the USA), and to know the limits of the coverage.

FDIC Failed Bank Information Information for IndyMac Bank, F.S.B., Pasadena, CA

IndyMac was a huge mortgage focused bank. Their stock price had fallen from a high of nearly $30 in the last year to below $5 in April, $2 in May and $1 in June. It is a very good thing we have the FDIC.

Related: Credit Crisis (August 2007) – Credit Crisis Continues – Homes Entering Foreclosure at Record

Foreclosure Filings Continue to Rise

…

last week the Mortgage Bankers Association reported that about 2.47 percent of home mortgages were in foreclosure during the first quarter of the year, almost double the 1.28 percent rate of a year earlier, and the highest point since the group began compiling such figures in 1979. A Credit Suisse report this spring predicted that 6.5 million loans will fall into foreclosure over the next five years, reaching more than 8 percent of all U.S. homes.

There numbers really are astounding. How lame were the decisions of banks and mortgagees that nearly 1 in 40 mortgages are in default (and that number likely increasing in the next year to much more?

Related: Homes Entering Foreclosure at Record (Sep 2007) – Homes Entering Foreclosure at Record – Ignorance of Many Mortgage Holders

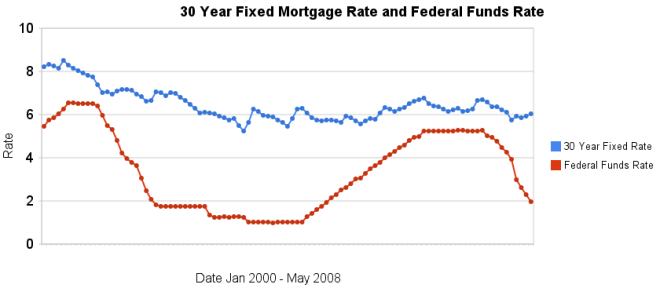

This year, the average discount rate has fallen every month while the average 30 year mortgage rate has climbed all but 1 month (a 5 basis point drop). In January, 2008 the discount rate averaged 3.94% and 30 year conventional fixed rate mortgages averaged 5.76%. In May, 2008 the discount rate had fallen to 1.98% (for a 196 basis point drop) and 30 year conventional fixed rates had risen to 6.04% (for a 28 basis point increase).

The chart shows the federal funds rate and the 30 year conventional fixed rate mortgage rate from January 2000 through May 2008 (for more details see: historical comparison of 30 year fixed mortgage rates and the federal funds rate).

Related: Affect of Fed Funds Rates Changes on Mortgage Rates – real estate articles – Bond Yields 2005-2008 – Jumbo and Regular Mortgage Rates By Credit Score

Read more

The recent drastic reductions again emphasize (once again) that changes in the federal funds rate are not correlated with changes in the 30 year fixed mortgage rate. In the last 4 months the discount rate has been reduced nearly 200 basis points, while 30 year fixed mortgage rates have fallen 18 basis points.

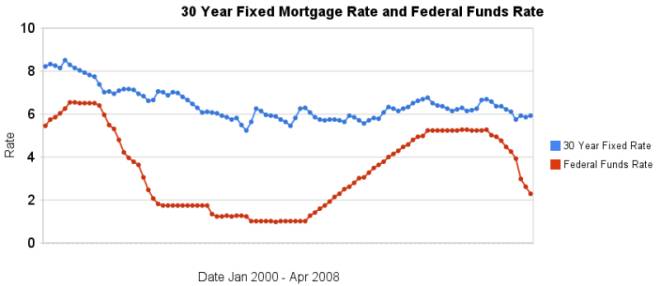

I have update my article showing the historical comparison of 30 year fixed mortgage rates and the federal funds rate. The chart shows the federal funds rate and the 30 year fixed rate mortgage rate from January 2000 through April 2008 (for more details see the article).

There is not a significant correlation between moves in federal funds rate and 30 year mortgage rates that can be used for those looking to determine short term (over a few days, weeks or months) moves in the 30 year fixed mortgage rates. For example if 30 year rates are at 6% and the federal reserve drops the federal funds rate 50 basis points that tells you little about what the 30 year rate will do. No matter how often those that should know better repeat the belief that there is such a correlation you can look at the actual data in the graph above to see that it is not the case.

Related: real estate articles – Affect of Fed Funds Rates Changes on Mortgage Rates – How Not to Convert Equity – more posts on financial literacy

Read more

How bad is the mortgage crisis going to get?

This interview of Paul Krugman is worth reading. And it does seem to me the magnitude of the mortgage crisis is very large and likely will result in national declines in home prices of over 15% from the peak. Which is a very large decline. And in local markets declines of 35% seem likely.

Related: Home Price Declines Exceeding 10% Seen for 20% of Housing Markets (Sep 2007) – Home Values and Rental Rates – Real Estate Median Prices Down 1.5% in the Last Year (Aug 2007) – Real Estate articles

The next shoe to drop in housing

…

Fannie and Freddie are demanding higher credit scores and charging higher rates for those who don’t have them. Until recently, a borrower with a 620 score might pay the same as one with a 680 score, said Victoria Bingham, chief executive with Pacific Rim Mortgage in Tigard, Ore.

But now that person might have to pay a half percentage point more. With today’s rates, that translates into 6.75% for a 30-year fixed-rate mortgage instead of 6.25%, or $74 more a month on a $225,000 loan, typical for her client base.

Borrowers must also put more money down, especially if they don’t have stellar credit. For instance, those with down payments of less than 5% need a credit score of at least 680, said Steven Plaisance, executive vice president of Arvest Mortgage Co. in Tulsa, Ok. Previously, he could make loans to people without big down payments if they had other strong points, such as stable employment.

Related: Federal Funds Rate and 30 Year Fixed Mortgage Rate – Mortgage Payments by Credit Score (Aug 2007) – learn about mortgage terms – Beginning of the End of Housing Bubble? – How Not to Convert Equity

Central bank intervention … unprecedented in scale and scope by Brad Setser

…

As around $900b, the fed’s balance sheet is something like 6-7% of US GDP. With $1600b in foreign assets, the PBoC’s external balance sheet alone is more like 50% of China’s GDP.

…

But with Martin Wolf now arguing that scenarios with more than a trillion in credit market losses cannot be ruled out – even more unprecedented central bank — and government — action cannot be entirely ruled out. The scale of the “great unwind” has been stunning. The pace of change in the policy debate only slightly less so.

Related: Fed takes leap towards the unthinkable – Goldman Sachs Rakes In Profit in Credit Crisis – Misuse of Statistics: Mania in Financial Markets – Why do we Have a Federal Reserve Board?

Fed Plans To Curb Mortgage Excesses, way late but at least they may do something.

Yes the Fed should have taken more aggressive action. But the legislators should not throw stones at others – what have they done? A recent example – they want to lower the down payment required for FHA loans to 1.5%. I can’t take anyone’s opinion, of how others should have behaved seriously, when they vote for such legislation in the midst of a subprime mortgage loan crisis. What are these people thinking. Ok, everyone now says loan standards were to lax, people stopped putting 20% or even 10% down on home purchase. Ok, lets blame the Fed and then lower the down payment required for federal backed mortgages to 1.5% (from the already very low 3%). Did this crazy legislation just barely squeak by? Nope, passed the senate 93-1! Lets have the politicians explain what they have done right before they just criticize others. Their game of blaming others while doing next to nothing positive themselves is sad.

Another real voice of reason. The Mortgage Bankers Association (MBA) really expects anyone to pay any attention to their opinions. They have someone managed to create a threat to the economy so large that $90 a barrel oil is not the threat to the economy people are worried about. I think anyone that reads these opinions from the MBA and doesn’t see them as self serving statements and nothing else should be ashamed of themselves. Shouldn’t the Washington Post at least include some follow up question on why the public should listen to that organization. What was there senior vice president saying 5 years ago to ensure the economy wasn’t threatened by the reckless action of their members? We seem to have forgotten that individuals and organization should be held accountable for their actions. Quote some people that are not only concerned with their benefits without regard for what it does to everyone else. If that is not what they are doing, lets see 5 policy recommendations they have made in the last 5 years that are good for America and bad for you and your members. I don’t think the rest of us believe what is good for the MBA is good for America.

Related: Why do we Have a Federal Reserve Board? – Ignorance of Many Mortgage Holders – How Not to Convert Equity – Washington Paying Out Money it Doesn’t Have – Legislation to Address the Worst Credit Card Fee Abuse (Maybe) – Lobbyists Keep Tax Off Billion Dollar Private Equities Deals and On For Our Grandchildren