FDIC Details Plan To Alter Mortgages

…

Agency officials estimated the cost to the government at $22.4 billion.

…

The mortgage industry is concerned that any new modification plan will persuade some people to stop making mortgage payments in addition to helping people who already have stopped making payments. The industry argues this will translate into higher interest rates because investors will demand compensation for the increased risk of loan defaults. That, in turn, would limit the number of people who can afford mortgage loans.

…

FDIC estimates that 1.4 million borrowers with such loans are at least two months late on their payments, and another 3 million borrowers will miss at least two payments by the end of next year. The agency estimates that half those borrowers, or about 2.2 million people, would receive a loan modification under the program, and that about 1.5 million will successfully avoid foreclosure.

Under the terms of the proposed FDIC program, lenders would reduce monthly payments primarily by cutting the borrower’s interest rate to a minimum rate of 3 percent. If necessary, the company could also extend the repayment period on the loan beyond 30 years, reducing each monthly payment. Finally, in some cases, companies could defer repayment of some principal. The borrower still would be on the hook for the full value of the loan.

Officials said their experience at IndyMac showed that principal reductions were not necessary. So far, FDIC has modified about 20,000 IndyMac loans. In 70 percent of the cases, FDIC was able to create an affordable payment solely by reducing the interest rate. In 21 percent of the cases, the agency also extended the life of the loan. In 9 percent of the cases, it delayed repayment of some principal.

An interesting proposal I would support. Ideally this type of action would not be necessary but since banks were allowed to degrade their standards so far and allowed to grow so large their failures threaten the economy some radical actions are being taken. Compared to many others this is sensible.

Related: How Much Worse Can the Mortgage Crisis Get? – JPMorgan Chase Freezes Mortgage Foreclosures – Fed Plans To Curb Mortgage Excesses (Dec 2007)

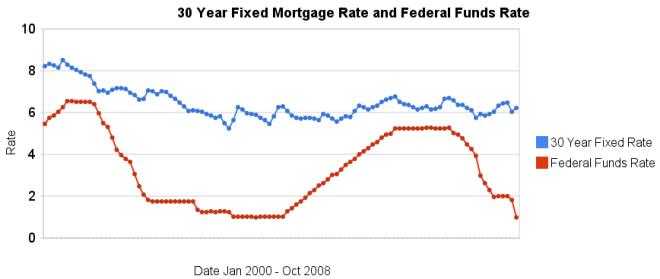

More dramatic evidence that changing in the federal funds rate do not lead to similar changes in 30 year fixed mortgage rates. It is true the last few months are very unusual times for the credit market. However, the current lack of correlation is not the exception, the graph clearly shows there is very little correlation between changes in the two interest rates.

Related: historical comparison of 30 year fixed mortgage rates and the federal funds rate – Affect of Fed Funds Rates Changes on Mortgage Rates – posts on financial literacy – Jumbo v. Regular Fixed Mortgage Rates: by Credit Score

For more data, see graphs of the federal funds rate versus mortgage rates for 1980-1999. Source data: federal funds rates – 30 year mortgage rates

Since the S&P/Case-Shiller 20 city home price index peaked in June 2006 it has fallen 19.5%. In the year ending July 2008 the decline was 16.3%. That is a record drop. In that year Las Vegas declined 29.9%, Phoenix 29.3% and Miami 28.2%. For the largest cities: New York City declined 7.4%, Los Angeles 26.2%, Chicago 10% and Dallas 2.5% (the second lowest decline – Charlotte declined 1.8%); Houston and Philadelphia, the 4th and 5th largest cities are not included in the 20 city index.

Only one city shows a decline in housing values since January, 2000: Detroit is down nearly 7%. Washington is up 95% since January, 2000 (even with a 15.8% decline in the last year), Los Angels and New York are tied for second at 93% increases. The 20 city index is up 66% from January 2000 to July 2008.

The S&P/Case-Shiller Composite of 20 Home Price Index is a value-weighted average of the 20 metro area indices for single family homes.

Source: Record Home Price Declines (pdf)

Related: Housing Prices Post Record Declines – Home Price Declines Exceeding 10% Seen for 20% of Housing Markets – Fourteen Fold Increase in 31 Years – The Ever Expanding House – Coming Collapse in Housing?

Fannie Mae (the quasi government mortgage giant) is raising fees for mortgages it buys. Banks and mortgage lenders often sell the mortgage to Fannie Mae shortly after completing the loan. Mortgages get more expensive – again

And Fannie doubled its “adverse market delivery charge” to 0.5%. That is an across-the-board fee assessed against every loan Fannie buys, according to a Fannie spokeswoman. Fannie first instituted the charge this spring.

…

The added fees will be passed on to borrowers and could mean quarter-point increases in interest rates.

…

Fannie will also eliminate buying Alt-A loans by the end of 2008. Alt-A loans, a category between prime and subprime, accounted for about 11% of the company’s loans during the last years of the boom. They have been used mostly by people who couldn’t or wouldn’t document their incomes, their assets or both. These buyers will find it harder to obtain financing once Fannie stops buying the loans.

According to Yun, however, the cutback in Alt-A will hurt people buying second homes to rent out or resell, rather than first time homeowners. “These are people who often rely on their good credit to buy investment properties putting little or no money down,” he said.

Related: Mortgage Rates Rising – Fed Funds Rate Changes Don’t Indicate Mortgage Rate Changes – Jumbo and Regular Mortgage Rates By Credit Score – Homes Entering Foreclosure at Record

I commented on, WaMu Free Checking: The High 3.3% APY May Be Worth A Look, yesterday:

I agree it is worth considering. It has FDIC insurance. But the bank is not very stable. The stock price, for example, was above 40 in the last year. It is below 5 now. But as long as your entire deposit is covered by FDIC you are in safe (though if a bank goes under – not that likely – there can be a delay in getting your money). Normally a bank’s assets would be bought out by another bank.

And today I read of the second largest bank failure in the history of the USA, IndyMac Bank seized by federal regulators:

Regulators said depositors would have no access to banking services online and by telephone this weekend, but could continue to use ATMs, debit cards and checks. Online banking and phone banking services are to resume operations Monday.

Federal authorities said based on a preliminary analysis, the takeover of IndyMac would cost the FDIC between $4 billion and $8 billion.

It is important to make sure your deposits are FDIC insured (in the USA), and to know the limits of the coverage.

FDIC Failed Bank Information Information for IndyMac Bank, F.S.B., Pasadena, CA

IndyMac was a huge mortgage focused bank. Their stock price had fallen from a high of nearly $30 in the last year to below $5 in April, $2 in May and $1 in June. It is a very good thing we have the FDIC.

Related: Credit Crisis (August 2007) – Credit Crisis Continues – Homes Entering Foreclosure at Record

Foreclosure Filings Continue to Rise

…

last week the Mortgage Bankers Association reported that about 2.47 percent of home mortgages were in foreclosure during the first quarter of the year, almost double the 1.28 percent rate of a year earlier, and the highest point since the group began compiling such figures in 1979. A Credit Suisse report this spring predicted that 6.5 million loans will fall into foreclosure over the next five years, reaching more than 8 percent of all U.S. homes.

There numbers really are astounding. How lame were the decisions of banks and mortgagees that nearly 1 in 40 mortgages are in default (and that number likely increasing in the next year to much more?

Related: Homes Entering Foreclosure at Record (Sep 2007) – Homes Entering Foreclosure at Record – Ignorance of Many Mortgage Holders

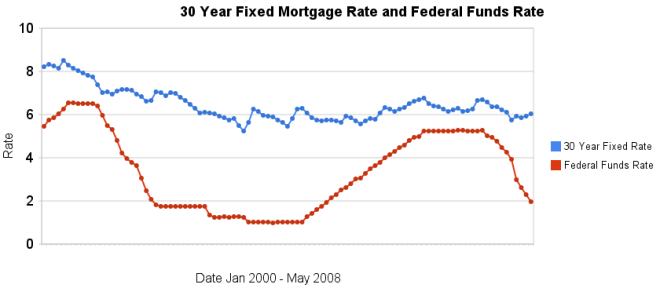

This year, the average discount rate has fallen every month while the average 30 year mortgage rate has climbed all but 1 month (a 5 basis point drop). In January, 2008 the discount rate averaged 3.94% and 30 year conventional fixed rate mortgages averaged 5.76%. In May, 2008 the discount rate had fallen to 1.98% (for a 196 basis point drop) and 30 year conventional fixed rates had risen to 6.04% (for a 28 basis point increase).

The chart shows the federal funds rate and the 30 year conventional fixed rate mortgage rate from January 2000 through May 2008 (for more details see: historical comparison of 30 year fixed mortgage rates and the federal funds rate).

Related: Affect of Fed Funds Rates Changes on Mortgage Rates – real estate articles – Bond Yields 2005-2008 – Jumbo and Regular Mortgage Rates By Credit Score

Read more

The recent drastic reductions again emphasize (once again) that changes in the federal funds rate are not correlated with changes in the 30 year fixed mortgage rate. In the last 4 months the discount rate has been reduced nearly 200 basis points, while 30 year fixed mortgage rates have fallen 18 basis points.

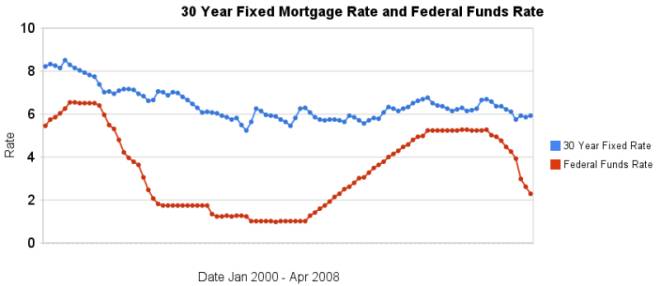

I have update my article showing the historical comparison of 30 year fixed mortgage rates and the federal funds rate. The chart shows the federal funds rate and the 30 year fixed rate mortgage rate from January 2000 through April 2008 (for more details see the article).

There is not a significant correlation between moves in federal funds rate and 30 year mortgage rates that can be used for those looking to determine short term (over a few days, weeks or months) moves in the 30 year fixed mortgage rates. For example if 30 year rates are at 6% and the federal reserve drops the federal funds rate 50 basis points that tells you little about what the 30 year rate will do. No matter how often those that should know better repeat the belief that there is such a correlation you can look at the actual data in the graph above to see that it is not the case.

Related: real estate articles – Affect of Fed Funds Rates Changes on Mortgage Rates – How Not to Convert Equity – more posts on financial literacy

Read more

Housing prices posted large declines over the last year. One important thing to keep in mind when looking at the recent results is how rare significant declines in housing prices have been. In general housing prices decline very little (less than 10% drops and normally less than 5%). Normally the turnover just decreases dramatically as people refuse to sell at lower prices and just stay in their house until prices recover. Housing Prices Post Record Declines:

Of those 20 metro areas, 17 posted their largest year-over-year declines ever. Ten of the 20 cities posted double-digit dips. The 10-city Case/Shiller index is down 13.6% year-over-year, the biggest drop since its launch in 1987

…

Prices in the Las Vegas metro area have plunged more than any other city, down 22.8% over the 12 months through February. Miami prices plummeted 21.7%. In Phoenix, they’ve fallen 20.8%. Of the 20 cities Case/Shiller tracks, only Charlotte, N.C. showed higher prices, up 1.5% over the 12-month period.

Other metro areas recorded only modest price declines, including Portland, Ore., down 2.0%, Seattle, off 2.7% and Dallas, 4.1%. In the nation’s largest city, New York, metro area prices dropped a modest 6.6%.

Related: Home Price Declines Exceeding 10% Seen for 20% of Housing Markets (Sep 2007) – How Not to Convert Equity – Housing Inventory Glut (Aug 2007) – Mortgage Defaults: Latest Woe for Housing (Feb 2007)

It has long been the case that home owners refuse to accept falling prices and choose to demand higher prices than the market demands in a falling market. Therefore when prices should fall (to find buyers) instead the sales decrease as buyers don’t decrease prices to a level buyers are willing to pay. Be It Ever So Illogical: Homeowners Who Won’t Cut the Price

Three years ago, when the real estate bubble was still inflating, this sort of standoff was the exception. It’s the norm today. Overall home sales have fallen a remarkable 33 percent since the summer of 2005. Home prices, on the other hand, continued to rise until 2006 and are now only 5 to 10 percent below where they were in mid-2005, according to various measures.