2012 Retirement Confidence Survey

The data would be better if some value were placed on defined benefit plans; currently it is a bit confusing how much they may help. But the $25,000 threshold is so low that no matter what being under that value is extremely bad news for anyone over 40. And failing to have saved over just $25,000 toward retirement is bad news for anyone over 30 without a defined benefit plan.

Thirty-four percent of workers report they had to dip into savings to pay for basic expenses in the past 12 months.

…

Thirty-five percent of all workers think they need to accumulate at least $500,000 by the time they retire to live comfortably in retirement. Eighteen percent feel they need between $250,000 and $499,999, while 34 percent think they need to save less than $250,000 for a comfortable retirement.

Workers who have performed a retirement needs calculation are more than twice as likely as those who have not (23 percent vs. 10 percent) to expect they will need to accumulate at least $1 million before retiring.

66% of workers say their family has retirement savings and 58% say they are currently saving for retirement. These results are fairly consistent over the last few decades (the current values are in the lower ranges of results).

Nearly everyone wishes they had more money. One way to act as though you have more than you do is to borrow and spend (which is normally unwise – it can make sense for a house and in limited amounts when you are first going out on your own). Another is to ignore long term needs and just live it up today. That is a very bad personal finance strategy but one many people follow. Saving for retirement is a personal finance requirement. If you can’t save for retirement given your current income and lifestyle you need to reduce your current spending to save or increase your income and then save for retirement.

A year or two of failing to do so is acceptable. Longer stretches add more and more risk to your personal financial situation. It may not be fun to accept the responsibilities of adulthood and plan for the long term. But failing to do so is a big mistake. Determining the perfect amount to save for retirement is complicated. A reasonable retirement saving plan is not.

Saving 10% of your gross income from the time you are 25 until 65 gives you a decent ballpark estimate. Then you can adjust even 5 or 10 years as you can look at your situation. It will likely take over 10% to put you in a lifestyle similar to the one you enjoy while working. But many factors are at play. To be safer saving at 12% could be wise. If you know you want to work less than 40 years saving more could be wise. If you have a defined benefit plan (rare now, but, for example police or fire personnel often still do you can save less but you must work until you gain those benefits or you will be in extremely bad shape.

IRAs, 401(k) and 403(b) plans are a great way to save for retirement (giving you tax deferral and Roth versions of those plans are even better – assuming tax rates rise).

Related: In the USA 43% Have Less Than $10,000 in Retirement Savings – Saving for Retirement

Nonfarm payroll employment rose by 227,000 in February, and the unemployment rate was unchanged at 8.3%, the U.S. Bureau of Labor Statistics reported today. The change in total nonfarm payroll employment for December was revised from +203,000 to +223,000, and the change for January was revised from +243,000 to +284,000. Which brings the total new jobs for this report to 286,000 (227+20+39). This is very good news. There are other serious economic concerns (failure, after years, to take any meaningful action to prevent systemic too big to fail risk, policies harming savers to benefit too big to fail institutions, extremely large and dangerous budget deficits…) and the employment situation still has a long way to go to recover from the credit crisis crash but the recent job news is strongly positive.

The number of unemployed persons, at 12.8 million, was essentially unchanged in February. The unemployment rate held at 8.3%, 80 basis points below the August 2011 rate of 9.1%.

The number of long-term unemployed (those jobless for 27 weeks and over) remains at very damaging levels; it was little changed at 5.4 million in February. These individuals accounted for 42.6% of the unemployed.

Both the labor force and employment rose in February. The civilian labor force participation rate, at 63.9 percent, and the employment-population ratio, at 58.6 percent, edged up over the month.

Private-sector employment grew by 233,000, with job gains in professional and business services, health care and

social assistance, leisure and hospitality, manufacturing, and mining. Government jobs declined by 6,000. In 2011,

government lost an average of 22,000 jobs per month.

Professional and business services added 82,000 jobs in February. Just over half of the increase occurred in temporary help services (+45,000). Job gains also occurred in computer systems design (+10,000) and in management and technical consulting services (+7,000). Employment in professional and business services has grown by 1.4 million since a recent low point in September 2009.

Health care and social assistance employment rose by 61,000 over the month. Within health care, ambulatory care services added 28,000 jobs, and hospital employment increased by 15,000. Over the past 12 months, health care employment has risen by 360,000.

In February, employment in leisure and hospitality increased by 44,000, with nearly all of the increase in food services and drinking places (+41,000). Since a recent low in February 2010, food services has added 531,000 jobs.

Manufacturing employment rose by 31,000 in February. All of the increase occurred in durable goods manufacturing, with job gains in fabricated metal products (+11,000), transportation equipment (+8,000), machinery (+5,000), and furniture and related products (+3,000). Durable goods manufacturing has added 444,000 jobs since a recent trough in January 2010. Of all the good news the continued manufacturing gains may well be the best news.

Related: Nov 2010 USA Unemployment Rate Rises to 9.8% – USA Unemployment Rate Remains at 9.7% (Feb 2010) – Another 663,000 Jobs Lost in March 2009, in the USA

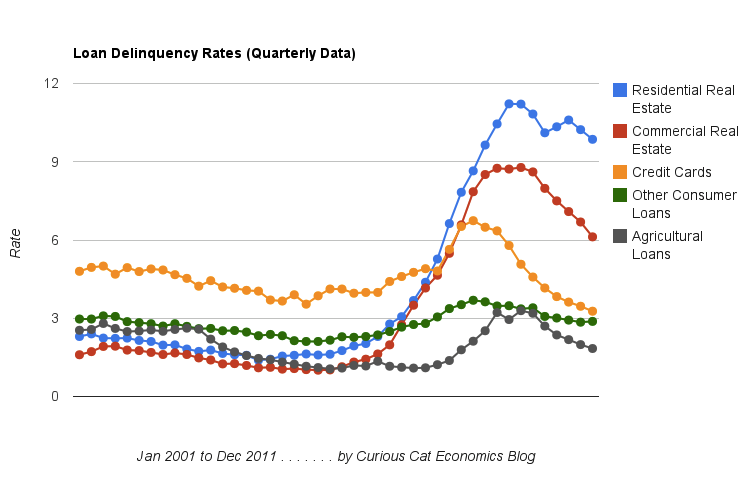

Chart showing loan delinquency rates from 2001-2011. It shows seasonally adjusted data for all banks for consumer and real estate loans. The chart is available for use with attribution. Data from the Federal Reserve.

2011 saw delinquency rates for loans fall across the board in the USA. Residential real estate delinquency rates fell just 25 basis points (to a still extremely large 9.86%). Commercial real estate delinquency rates fell an impressive 186 basis points (to a still high 6.12%). Credit card delinquency rates fell 86 basis points to a 17 year low, 3.27%.

The job market continues to struggle, though it is doing fairly well the last few months. The serious long term problems created by governments spending beyond their means (for decades) and allowing too big to fail institutions to destroy economic wealth and create great risk to the economy are not easy to solve: and we made no progress in doing so in 2011. The reduction in delinquency rates is a good sign for the economy. The residential real estate delinquency rates are still far too high as is government debt. And the failure to address the too big to fail (big donors to the politicians) is continuing to cause great damage to the economy.

We need to reduce consumer and government debt. Many corporations are actually flush with cash, so at least we don’t have a huge corporate debt problem. Reducing debt load will decrease risks to the economy and provide wealth for consumers to tap as they move into retirement. The too-big-to-fail big political donors like to keep policies in place that encourage too much debt and favor complex financial instruments that they take huge fees from and then let the government deal with the aftermath. The politicians continued favors to too-big-to-fail institutions is very damaging to out economic well being.

Across the board, the wealthy economies are facing a rapidly aging population (the USA is actually acing this at a much slower rate than most other rich countries – which is helpful).

Related: Consumer and Real Estate Loan Delinquency Rates 2000-2011 – Real Estate and Consumer Loan Delinquency Rates 1998-2009 – Government Debt as Percent of GDP 1998-2010 for OECD

3 Economic Misconceptions That Need to Die

…

Just 6.4% of nondurable goods — things like food, clothing and toys — purchased in the U.S. are made in China; 76.2% are made in America. For durable goods — things like cars and furniture — 12% are made in China; 66.6% are made in America.

Those numbers are significantly less than I expected but the concept matches my understanding – that we greatly underestimate the purchasing of USA goods and services.

We have an inflated notion of how large the China macro economic numbers are for the USA (both debt and manufacturing exports to us). The China growth in both is still amazingly large: we just overestimate the totals today. We also forget that 25 years ago both numbers (imports from China and USA government debt owned by China) were close to 0.

We also greatly underestimate how much manufacturing the USA does, as I have been writing about for years. In fact, until 2010, the USA manufactured more than China.

Who owns the rest? The largest holder of U.S. debt is the federal government itself. Various government trust funds like the Social Security trust fund own about $4.4 trillion worth of Treasury securities. The Federal Reserve owns another $1.6 trillion.

Ok, this figure is a bit misleading. But even if you thrown out the accounting games 1.13/8.9 = 12.7%. That is a great deal. But it isn’t a majority of the debt or anything remotely close. Other foreign investors own $3.5 trillion trillion in federal debt (Japan $1 trillion, UK $500 billion). The $4.6 trillion of federal debt owned by foreigners is a huge problem. With investors getting paid so little for that debt though it isn’t one now. But it is a huge potential problem. If interest reates increase it will be a huge transfer of wealth from the USA to others.

The oil figure is a bit less meaningful, I think. Oil import are hugely fungible. The USA cutting back Middle East imports and pushing up imports from Canada, Mexico, Nigeria… doesn’t change the importance of Middle East oil to the USA in reality (the data might seem to suggest that but it is misleading due to the fungible nature of oil trading). Whether we get it directly from the Middle East or not our demand (and imports) creates more demand for Middle East oil. It is true the USA has greatly increased domestic production recently (and actually decreased the use of oil in 2009). So while I believe the data on Middle East oil I think that it is a bit misleading. If we had 0 direct imports from there we would still be greatly dependent on Middle East oil (because if France and China and India… were not getting their oil there they would buy it where we buy ours… Still the USA uses far more oil than any other country and is extremely dependent on imports. Several other countries are also extremely dependent on oil imports, including the next two top oil consuming countries: China, Japan.

Related: Oil Production by Country 1999-2009 – Government Debt as Percentage of GDP 1990-2009: USA, Japan, Germany, China… – Manufacturing Output as a Percent of GDP by Country – The Relative Economic Position of the USA is Likely to Decline

Very interesting USA federal tax data via the tax foundation. Top 1% has adjusted gross income of $343,000; over $154,000 puts you in the top 5%; $112,000 puts you in the top 10% and $66,000 puts you in the top 25%.

The chart only shows federal income tax data. So the costly social security tax (which is directly based on earned income* so in reality is federal income tax but is handled in a separate account so is consistently not classified as income tax data) for outside the top 5% (income above $106,800 [for 2011] does not have to pay the social security tax) is not reflected in the rates paid here.

Looking at the data excluding social security is fine, but it is very important to remember the social security (plus medicare) tax is the largest tax for, I would guess, most people in the USA. Social security tax is 6.2% paid by the employee plus 6.2% paid by the company – a total of 12.4%. That part of the tax was capped at $106,800 in income for 2011. The medicare tax is 1.45% of income paid by the employee and 1.45% paid by the employer (and it has no cap). So that totals 2.9% (for the employee and employer tax) and brings the total to 15.3%** for most earned income.

|

|

Number of Returns with Positive AGI |

AGI ($ millions) |

Income Taxes Paid ($ millions) |

Group’s Share of Total AGI |

Group’s Share of Income Taxes |

Income Split Point |

Average Tax Rate |

|

All Taxpayers |

137,982,203 |

$7,825,389 |

$865,863 |

100.0% |

100.0% |

- |

11.06% |

|

Top 1% |

1,379,822 |

$1,324,572 |

$318,043 |

16.9% |

36.7% |

$343,927.00 |

24.01% |

|

1-5% |

5,519,288 |

$1,157,918 |

$189,864 |

14.8% |

22.0% |

|

16.40% |

|

Top 5% |

6,899,110 |

$2,482,490 |

$507,907 |

31.7% |

58.7% |

$154,643.00 |

20.46% |

|

5-10% |

6,899,110 |

$897,241 |

$102,249 |

11.5% |

11.8% |

|

11.40% |

|

Top 10% |

13,798,220 |

$3,379,731 |

$610,156 |

43.2% |

70.5% |

$112,124.00 |

18.05% |

|

10-25% |

20,697,331 |

$1,770,140 |

$145,747 |

22.6% |

17.0% |

|

8.23% |

|

Top 25% |

34,495,551 |

$5,149,871 |

$755,903 |

65.8% |

87.3% |

$ 66,193.00 |

14.68% |

|

25-50% |

34,495,551 |

$1,620,303 |

$90,449 |

20.7% |

11.0% |

|

5.58% |

|

Top 50% |

68,991,102 |

$6,770,174 |

$846,352 |

86.5% |

97.7% |

> $32,396 |

12.50% |

|

Bottom 50% |

68,991,102 |

$1,055,215 |

$19,511 |

13.5% |

2.3% |

< $32,396 |

1.85% |

Source: Internal Revenue Service. Table via the tax foundation.

Other interesting data shows that the top 1% earn 16.9% of the total income and pay 36.7% of the total federal income taxes. Those in the top 1-5% earn 14.8% of the total income and pay 22% of the income taxes. Those in the top 5-10% earn of the income 11.5% of the income and pay 11.8% of the federal income taxes. So once you exclude the main tax on income (social security) and use adjusted gross income the tax rates are slightly progressive (higher rates for those that are making the most – and presumably have benefited economically the most from the economic system we have).

Given that this is skewed by excluding the regressive (higher taxes paid by those earning less – social security is the same rate for everyone except those earning the very most who don’t have to pay it on their income above $106,800 [in 2011]) social security tax I believe we should have a more progressive tax system. But that is mainly a political debate. There are good economic arguments for the bad consequences of too unequal a distribution of wealth (which the USA has been moving toward the last few decades – unfortunately).

In addition to the other things I mention there are all sorts of games played by those that desire a royalty type system (where wealth is just passed down to the children of those who are rich, instead of believing in a capitalist system where rewards are given not to the children of royalty but to those that are successful in the markets). A good example of the royalty model is Mitch Romney giving his trust fund children over $100 million each. These schemes use strategies to avoid paying taxes at all. Obviously these schemes also make the system less progressive (based on my understanding of the tax avoidance practiced by these trust fund babies and those that believe it is ethical to give such royalty sized gifts to their royal heirs).

I don’t like the royalty based model of behavior. I much prefer the actions of honorable capitalist such as Warren Buffett and Bill Gates that give their children huge benefits that any of us would be thrilled with, but do not treat them as princes and princesses who should live in a style of luxury that few kings have every enjoyed based solely off their birthright. Both Bill Gates and Warren Buffett have honorably refused to engage in royal seeking behavior that many of their less successful business peers have chosen to engage in. Those that favor trust fund babies are welcome to their opinion and have managed to get most of congress to support their beliefs instead of a capitalist model that I would prefer so they are free to engage in their desire to parrot royalty and honor the royalty model of behavior.

* earned income – you also don’t have to pay social security or medical tax on unearned income (dividends, capital gains, rental income…). Again this by and large favors wealthy taxpayers. Everyone is eligible for the same favorable tax treatment but only those that have the wealth to make significant amounts of unearned income get this advantage.

** the social security tax has been reduced by 200 basis points (this relief was recently extended) as part of dealing with the results of the too big to fail banking caused credit crisis. So under the temporary reduction the personal tax rate is 4.2% and the total cost is 13.2%.

Related: Taxes – Slightly or Steeply Progressive? – Taxes per Person by Country – USA State Governments Have $1,000,000,000,000 in Unfunded Retirement Obligations – Retirement: Roth IRA Earnings and Contribution Limits

The national occupancy climbed 110 basis points during the year, and effective rents jumped 4.7% according MPF Research.

Occupancy rates increased to 94.6% at the end of 2011, up from 93.5% a year ago and from 91.8% when the occupancy rates bottomed in late 2009.

MPF Research predicts occupancy rates to increase another 50 basis points, and rents to rise 4.5%.

Northern California’s apartment markets ranked as the nation’s rent growth leaders during calendar 2011, despite the fact that some weakness registered in the performances recorded in parts of the Pacific Northwest specifically during the fourth quarter. Year-over-year, effective rents for new leases jumped 14.6% in San Francisco, 12.3% in San Jose, and 9% in Oakland. With rents down 0.4%, Las Vegas was the nation’s only major apartment market that lost pricing power during calendar 2011.

Rent Growth Leaders in Calendar 2011

| Rank | Metro Area | Annual Rent Growth |

| 1 | San Francisco | 14.6% |

| 2 | San Jose | 12.3% |

| 3 | Oakland | 9.0% |

| 4 | Boston | 8.3% |

| 5 | New York | 7.3% |

| 6 | Austin | 7.2% |

Related: Apartment Vacancies Fall to Lowest in 3 Years in the USA (April 2011) – Top USA Markets for Buying Rental Property – Apartment Rents Rise, Slightly, for First Time in 5 Quarters – It’s Now a Renter’s Market

Total nonfarm payroll employment rose by 243,000 in January, and the unemployment rate decreased to 8.3%, the United States Bureau of Labor Statistics reported today. Job growth was widespread in the private sector (which gained 257,000 jobs in the month), with large employment gains in professional and business services, leisure and hospitality, and manufacturing (which added an impressive 50,000 jobs). The change in total nonfarm payroll employment for November was revised from +100,000 to +157,000, and the change for December was revised from +200,000 to +203,000 which brings the total number of jobs gained with this report to 303,000, a very impressive figure.

This employment news is really starting to add up to something good. And this is going on while everyone is worrying about the Euro imploding. Quite remarkable really. Avoiding a much worse result from the too big-to-fail-financial-firms credit crisis is surprising. We are not close to through the mess that we created, but that it hasn’t been much worse is fairly amazing. And that things are going so well now (even with large unemployment problems) is impressive. The huge government debt balances are a very large concern but it wouldn’t be surprising to have those same huge debts and much worse present day conditions (which would add to the debts).

The unemployment rate declined to 8.3%; the rate has fallen by 80 basis point since August. The number of unemployed persons declined to 12.8 million in January. Among the major worker groups, the unemployment rates for adult men (7.7%) and blacks (13.6%) declined in January. The unemployment rates for adult women (7.7%), teenagers (23.2%), whites (7.4%), and Hispanics (10.5%) were little changed. The jobless rate for Asians was 6.7%.

The number of long-term unemployed (those jobless for 27 weeks or more) was little changed at 5.5 million and accounted for 42.9% of the unemployed. Long term unemployment remains a big problem. With a few more months with such strong growth in jobs and that could start to change.

After accounting for the annual adjustments to the population controls, the employment-population ratio (58.5%) rose in January, while the civilian labor force participation rate held at 63.7%.

Professional and business services continued to add jobs in January (+70,000). About half of the increase occurred in employment services (+33,000). Job gains also occurred in accounting and bookkeeping (+13,000) and in architectural and engineering services (+7,000).

Related: USA Adds 216,00 Jobs in March and the Unemployment Rate Stands at 8.8% (March 2011) – USA Unemployment Rate Remains at 9.7% (Feb 2010) – USA Unemployment Rate Rises to 8.1%, Highest Level Since 1983 (March 2009)

The latest data from the commonwealth fund report confirms the status quo. The USA spends twice as much on their health care system for no better results. It is easier to argue the USA is below average in performance that leading. And for double the cost that is inexcusable.

Globally the rich countries citizens are not tremendously happy with health care systems overall. It seems likely not only does the USA cost twice and much as it should and perform poorly compared to countries doing an excellent job but the USA performs that poorly compared to countries that themselves have quite a bit of improvement to make. Which makes the state of the USA system even worse.

Data from the Commonwealth fund report published in 2011 with data for 2009, International Profiles of Health Care Systems, 2011:

Table showing, percent of GDP spent and total spending per capita in USD on health care by country.

| Country | 2007 | Spending |

|

2009 | Spending |

| Australia | 9.5% | $3,128 | 8.7% | $3,445 | |

| Canada | 9.8% | $3,326 | 11.4% | $4,363 | |

| Germany | 10.7% | $3,287 | 11.6% | $4,218 | |

| Japan | 8.5% | $2,878 | |||

| New Zealand | 9.0% | $2,343 | 10.3% | $2,983 | |

| UK | 8.3% | $2,724 | 9.8% | $3,487 | |

| USA | 16.0% | $6,697 | 17.4% | $7,960 |

| Survey of population, showing % that chose each statement (no data available for Japan) | |||||||

| Australia | Canada | Germany | New Zealand | UK | USA | ||

| 2007 – 2010 | 2007 – 2010 | 2007 – 2010 | 2007 – 2010 | 2007 – 2010 | 2007 – 2010 | ||

| Overall health system views | |||||||

| Only minor changes needed, system works well | 24 – 24 | 26 – 38 | 20 – 38 | 26 – 37 | 26 – 62 | 16 – 29 | |

| Fundamental changes needed | 55 – 55 | 60 – 51 | 51 – 48 | 56 – 51 | 57 – 34 | 48 – 41 | |

| Rebuild completely | 18 – 20 | 12 – 10 | 28 – 14 | 17 – 11 | 15 – 3 | 34 – 27 | |

| Percent uninsured | 0 – 0 | 0 – 0 | <1 – 0 | 0 – 0 | 0 – 0 | 16 – 16 | |

Under currently law in the USA by 2020 the uninsured rate should decline to under 5% by 2020 (still far more than any rich country – nearly all of which are at 0%).

On many performance measures in the report the USA is the worst performing system (in addition to costing twice as much). Such as Avoidable Deaths, 2006–07, the USA had 96 per 100,000, the next highest was the UK at 83, Australia was the lowest at 57. And Diabetes Lower Extremity Amputation Rates per 100,000 population, the USA had 36 the next highest was New Zealand at 12, the lowest was the UK at 9. For experiencing a medical, medication or lab test rrror in past 2 years, the USA was at 18%, next worst was Canada at 17%, best was UK at 8%. The USA was top performer in breast cancer five-year survival rate, 2002–2007. And sometimes the USA was in the middle, able to get same/next day appointment when sick: the USA was at 57%, New Zealand achieved 78% while Canada only reached 45%.

It is possible to argue the USA provides mediocre results, which is consistent with most global health care performance measures. Unless you directly benefit from the current USA system it is hard to see how you can argue it is not the worst system of any rich country. Costing twice as much and achieving middling performance. All that doesn’t even factor in the cost in anguish and bankruptcies and restricting individual freedom (when you have to stay tied to a job you would rather leave, just because of health insurance) caused by the difficulty getting coverage and fighting with the insurance companies for payment and coverage for treatment expenses.

Related: Measuring the Health of Nations – USA Paying More for Health Care – Traveling for Health Care – resources for improvement health system performance

Total health expenditures in the USA in 2010 reached $2.6 trillion, $8,402 per person or 17.9% percent of GDP. All these are all time highs. Every year, for decades, health care costs have taken a larger and larger portion of the economic value created in the USA. The costs have risen much more rapidly than the costs in the rest of world. This creates a burden that slows the USA economy – it acts as a friction dragging everything else down. We not only need to slow down how fast we are getting worse (which we have done the last 2 years) but actually start making up for all the ground lost in the last few decades. We haven’t even started on that. The amount of work to do in getting our health system back to mediocre and reasonably priced is enormous (currently we have mediocre performance and extremely highly priced – twice as costly as other rich countries).

In 2009 the USA Spent Record $2.5 Trillion, $8,086 per person 17.6% of GDP on Medical Care.

USA health care spending grew 3.9% in 2010 following an increase of 3.8% in 2009. While those are the two slowest rates of growth in the 51 year history of the National Health Expenditure Accounts, they still outpaced both inflation and GDP growth. So yet again the health system expenses are taking a bigger portion of overall spending.

As a result of failing to address this issue for decades the problem is huge and will likely take decades to bring back just to a level where the burden on those in the USA, due to their broken health care system, is equal to the burden of other rich countries. Over 2 decades ago the failure in the health care system reached epidemic proportions but little has been done to deal with the systemic failures. Dr. Deming pointed to excessive health care cost, back then, as one of 7 deadly diseases facing American business. The fact that every year costs have increased more than GDP growth and outcome measures are no better than other rich countries shows the performance has been very poor. The disease is doing even more harm today.

Related: USA Heath Care System Needs Reform – USA Spends Record $2.3 trillion ($7,681 Per Person) on Health Care in 2008 – Systemic Health Care Failure: Small Business Coverage – Measuring the Health of Nations – How to improve the health care system performance – Management Improvement in Healthcare – USA Spent $2.2 Trillion, 16.2% of GDP, on Health Care in 2007

I decided to take a look at some historical economic data to see if some of my beliefs were accurate (largely about how well Singapore has done) and learn a bit more while I was at it.

| country |

|

1970** |

|

2010*** |

|

% increase |

| Korea | 1,320 | 20,200 | 1,430 | |||

| China | 325 | 4,280 | 1,217 | |||

| Singapore | 4260 | 42,650 | 901 | |||

| Indonesia | 460 | 2,960 | 543 | |||

| Brazil | 1900 | 10,500 | 453 | |||

| Thailand | 850 | 4,600 | 441 | |||

| Portugal | 3,970 | 21,000 | 429 | |||

| Japan | 9,000 | 42,300 | 370 | |||

| Malaysia | 1,900 | 7,755 | 308 | |||

| Germany | 11,550 | 40,500 | 251 | |||

| UK | 10,400 | 36,300 | 249 | |||

| France | 13,600 | 40,600 | 199 | |||

| Mexico | 4,160 | 9,200 | 121 | |||

| Panama | 3,480 | 7,700 | 121 | |||

| India | 555 | 1,180 | 113 | |||

| USA | 23,350 | 47,100 | 102 | |||

| South Africa | 3,930 | 7,100 | 81 | |||

| Venezuela | 8,280 | 9,770 | 18 |

I just picked countries that interested me and seemed worth looking at. I looked for some around the starting position of Singapore and close to Singapore geographically. And looked at Panama as the closest match to Singapore (for Singapore’s main 1970 asset, convenient for shipping lanes, and very close for GDP per capita).

Malaysia and Singapore were 1 country after independence (from 1963-1965).

I can’t imagine more than a couple countries could reasonably be argued to have had better economic performance from 1970 to 2010 than Singapore (Korea? China? Who else?). Singapore had very little going for it in 1970. They had a good location for shipping and that is about it macro-economically. No natural resources. No huge storage of wealth. No preeminence in science, technology or business.

It seems to me that Singapore actually did have 1 other thing. A government that was to preside over a fantastic economic growth success. You won’t find many textbooks talking about the way to economic success is a very well run government. And there is good reason for that, I believe. Relying on a very well run government will nearly always fail. In some ways Singapore was like Japan but with significantly more government influence on the way economic development played out.

I was surprised how poorly the USA has faired. It isn’t so surprising that we lagged. People forget how rich the USA was in 1970. The USA is still very rich but bunched together with lots of other rich countries instead of way out ahead as they were in 1970. And in 1970 the lead was already contracting, for what it had been earlier. But even knowing the relative performance of the USA had lagged, I was surprised by how much it under-performed.

I was also surprised with India. I knew they have done poorly but I didn’t realize it had been this poor. The failures to greatly improve infrastructure, education and the stifling effect of their bureaucracy have been causing them great harm. They have been doing some good things in the last 10 years especially but still have a long way to go. Their premier education is actually pretty decent. The problem is the other 90% of the education is often poor and many people (especially women) hardly have any education at all. It is very hard to get ahead when you fail to take advantage of the talents of so many of your people.

Related: Singapore and Iskandar Malaysia – Chart of Largest Petroleum Consuming Countries from 1980 to 2010 – Chart of Nuclear Power Production by Country from 1985-2009 – Top Countries For Renewable Energy Capacity