Total nonfarm payroll employment increased by 171,000 in October, and the unemployment rate increased at 7.9%, the U.S. Bureau of Labor Statistics reported today. Employment rose in professional and business services, health care, and retail trade. The change in total nonfarm payroll employment for August was revised from +142,000 to +192,000, and the change for September was revised from +114,000 to +148,000.

So with this report another 255,000 (171 + 50 + 34) were added, quite a good number. If we could see 250,000 jobs added for 12 more months that would be quite nice – though still will not have recovered all the jobs cost by the too-big-too-fail credit crisis.

Employment growth has averaged 157,000 per month thus far in 2012, about the same as the average monthly gain of 153,000 in 2011.

Hurricane Sandy had no discernable effect on the employment and unemployment data for October. Household survey data collection was completed before the storm, and establishment survey data collection rates were within normal ranges nationally and for the affected areas.

Long-term unemployment remains a problem, in October, the number of long-term unemployed (those jobless for 27 weeks or more) was little changed at 5.0 million. These individuals accounted for 40.6% of the unemployed (a higher percentage than normal – as it has been for the duration of the too-big-too-fail job recession.

The civilian labor force rose by 578,000 to 155.6 million in October, and the labor force participation rate edged up to 63.8%. Total employment rose by 410,000 over the month (I am guessing this is not seasonally adjusted – the highlighted figures normally quotes are seasonally adjusted figures). The employment-population ratio was essentially unchanged at 58.8%, following an increase of 40 basis points in September.

Related: Unemployment Rate Reached 10.2% (Oct 2009) – USA Economy Adds 151,000 Jobs in October and Revisions Add 110,000 More (Oct 2010, unemployment rate at 9.6%) – USA Unemployment Rate Drops to 8.6% (Nov 2011) – USA Lost Over 500,000 Jobs in November, 2008

The unemployment rate decreased to 7.8%, and total nonfarm payroll employment rose by 114,000 in September, the U.S. Bureau of Labor Statistics reported today. The change in total nonfarm payroll employment for July was revised from +141,000 to +181,000, and the change for August was revised from +96,000 to +142,000. Thus, with this report 200,000 new jobs were added (114,000 + 40,000 + 46,000).

The unemployment rate declined from 8.1% in August to 7.8% in September. For the first 8 months of the year, the rate held within a narrow range of 8.1 and 8.3%. The number of unemployed persons, at 12.1 million, decreased by 456,000 in September.

The number of long-term unemployed (those jobless for 27 weeks or more) was little changed at 4.8 million and accounted for 40.1% of the unemployed. This remains one of the most serious problems – along with the less that strong job creation numbers (since the too-big-too-fail financial crisis kicked off the great recession). In 2012, employment growth has averaged 146,000 per month, compared with an average monthly gain of 153,000 in 2011. 150,000 is decent but because of the huge job losses in the 4 years prior to 2011 there is a big recovery needed. Adding above 225,000 jobs a month, for years, would be a good result and put the economy on much firmer ground.

Health care added 44,000 jobs in September. Job gains continued in ambulatory health care services (+30,000) and hospitals (+8,000). Over the past year, employment in health care has risen by 295,000.

The average workweek for all employees on private nonfarm payrolls edged up by 0.1 hour to 34.5 hours in September. The manufacturing workweek edged up by 0.1 hour to 40.6 hours, and factory overtime was unchanged at 3.2 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls was unchanged at 33.7 hours.

In September, average hourly earnings for all employees on private nonfarm payrolls rose by 7 cents to $23.58. Over the past 12 months, average hourly earnings have risen by 1.8 percent. In September, average hourly earnings of private-sector production and nonsupervisory employees increased by 5 cents to $19.81.

Related: Bad Jobs News in the USA, Unemployment Remains at 9.1% (Sep 2011) – USA Unemployment Rate at 9.6% (Sep 2010) – Unemployment Rate Increases to 9.7% (Sep 2009) – Over 500,000 Jobs Disappeared in November 2008

The largest manufacturing countries are China, USA, Japan and then Germany. These 4 are far in the lead, and very firmly in their positions. Only the USA and China are close, and the momentum of China is likely moving it quickly ahead – even with their current struggles.

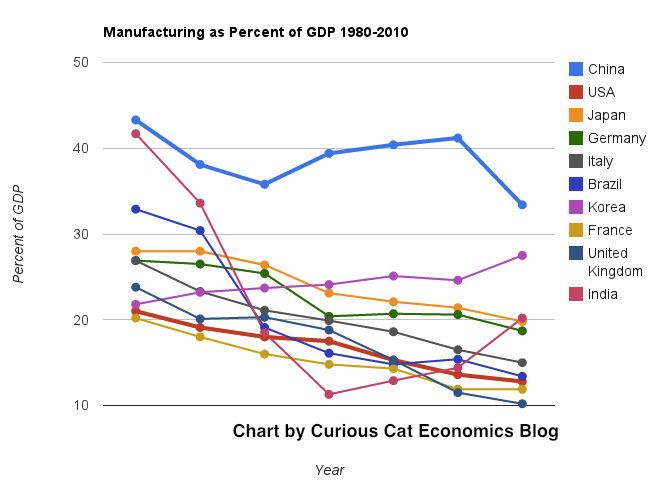

The chart below shows manufacturing production by country as a percent of GDP of the 10 countries that manufacture the most. China has over 30% of the GDP from manufacturing, though the GDP share fell dramatically from 2005 and is solidly in the lead.

Nearly every country is decreasing the percentage of their economic output from manufacturing. Korea is the only exception, in this group. I would expect Korea to start following the general trend. Also China has reduced less than others, I expect China will also move toward the trend shown by the others (from 2005 to 2010 they certainly did).

For the 10 largest manufacturing countries in 2010, the overall manufacturing GDP percentage was 24.9% of GDP in 1980 and dropped to 17.7% in 2010. The point often missed by those looking at their country is most of these countries are growing manufacturing, they are just growing the rest of their economy more rapidly. It isn’t accurate to see this as a decline of manufacturing. It is manufacturing growing more slowly than (information technology, health care, etc.).

This chart shows manufacturing output, as percent of GDP, by country and was created by the Curious Cat Economics Blog based on UN data. You may use the chart with attribution.

The manufacturing share of the USA economy dropped from 21% in 1980 to 18% in 1990, 15% in 2000 and 13% in 2010. Still, as previous posts show, the USA manufacturing output has grown substantially: over 300% since 1980, and 175% since 1990. The proportion of manufacturing output by the USA (for the top 10 manufacturers) has declined from 33% in 1980, 32% in 1990, 35% in 2000 to 26% in 2010. If you exclude China, the USA was 36% of the manufacturing output of these 10 countries in 1980 and 36% in 2010. China’s share grew from 7.5% to 27% during that period.

The United Kingdom has seen manufacturing fall all the way to 10% of GDP, manufacturing little more than they did 15 years ago. Japan is the only other country growing manufacturing so slowly (but Japan has one of the highest proportion of GDP from manufacturing – at 20%). Japan manufactures very well actually, the costs are very high and so they have challenges but they have continued to manufacture quite a bit, even if they are not growing output much.

Hong Kong again topped the rankings, followed by Singapore, New Zealand, and Switzerland. Australia and Canada tied for fifth, of the 144 countries and territories in the Fraiser Institute’s 2012 Economic Freedom of the World Report.

“The United States, like many nations, embraced heavy-handed regulation and extensive over-spending in response to the global recession and debt crises. Consequently, its level of economic freedom has dropped,” said Fred McMahon, Fraser Institute vice-president of international policy research.

The annual Economic Freedom of the World report uses 42 distinct variables to create an index ranking countries around the world based on policies that encourage economic freedom. The cornerstones of economic freedom are personal choice, voluntary exchange, freedom to compete, and security of private property. Economic freedom is measured in five different areas: (1) size of government, (2) legal structure and security of property rights, (3) access to sound money, (4) freedom to trade internationally, and (5) regulation of credit, labor, and business.

Hong Kong offers the highest level of economic freedom worldwide, with a score of 8.90 out of 10, followed by Singapore (8.69), New Zealand (8.36), Switzerland (8.24), Australia and Canada (each 7.97), Bahrain (7.94), Mauritius (7.90), Finland (7.88), Chile (7.84).

The rankings and scores of other large economies include: United States (18th), Japan (20th), Germany (31st), South Korea (37th), France (47th), Italy (83rd), Mexico (91st), Russia (95th), Brazil (105th), China (107th), and India (111th).

When looking at the changes over the past decade, some African and formerly Communist nations have shown the largest increases in economic freedom worldwide: Rwanda (44th this year, compared to 106th in 2000), Ghana (53rd, up from 101st), Romania (42nd, up from 110th), Bulgaria (47th, up from 108th), and Albania (32nd, up from 77th). During that same period the USA has dropped from 2nd to 19th.

The rankings are similar to the World Bank Rankings of easiest countries in which to do business. But they are not identical, the USA is still hanging in the top 5 in that ranking. The BRICs (Brazil, Russia, India and China) do just as poorly in both. The ranking due show the real situation of economies that are far from working well in those countries. China and Brazil, especially, have made some great strides when you look at increasing GDP and growing the economy. But there are substantial structural changes needed. India is suffering greatly from serious failures to improve basic economic fundamentals (infrastructure, universal education, eliminating petty corruption [China has serious problems with this also]…).

Singapore is again ranked first for Ease of Doing Business by the World Bank.

| Country | 2011 | 2008 | 2005 | |

|---|---|---|---|---|

| Singapore | 1 | 1 | 2 | |

| Hong Kong | 2 | 4 | 6 | |

| New Zealand | 3 | 2 | 1 | |

| United States | 4 | 3 | 3 | |

| Denmark | 5 | 5 | 7 | |

| other countries of interest | ||||

| United Kingdom | 7 | 6 | 5 | |

| Korea | 8 | 23 | 23 | |

| Canada | 13 | 8 | 4 | |

| Malaysia | 18 | |||

| Germany | 19 | 25 | 21 | |

| Japan | 20 | 12 | 12 | |

| France | 29 | 31 | 47 | |

| Mexico | 53 | 56 | 62 | |

| Ghana | 63 | |||

| China | 91 | 83 | 108 | |

| India | 132 | 122 | 138 | |

| Brazil | 126 | 122 | 122 | |

The rankings include ranking of various aspects of running a business. Some rankings for 2011: starting a business (New Zealand 1st, Singapore 4th, USA 13th, Japan 107th), Dealing with Construction Permits (Hong Kong 1st, New Zealand 2nd, Singapore 3rd, USA 17th, China 179th), protecting investors (New Zealand 1st, Singapore 2nd, Hong Kong 3rd, Malaysia 4th, USA 5th), enforcing contracts (Luxemburg 1, Korea 2, Iceland 3, Hong Kong 5, USA 7, Singapore 12, China 16, India 182), paying taxes (Maldives 1, Hong Kong 3, Singapore 4, USA 72, Japan 120, China 122, India 147).

These rankings are not the final word on exactly where each country truly ranks but they do provide a valuable source of information. With this type of data there is plenty of room for judgment and issues with the data.

Related: Easiest Countries from Which to Operate Businesses 2008 – Stock Market Capitalization by Country from 1990 to 2010 – Looking at GDP Growth Per Capita for Selected Countries from 1970 to 2010 – Top Manufacturing Countries (2000 to 2010) – Country Rank for Scientific Publications – International Health Care System Performance – Best Research University Rankings (2008)

After several poor months for job creation (adding well under 100,000 each month) we have some good news. Total nonfarm payroll employment rose by 163,000 in July, with the unemployment rate at 8.3%. Since the beginning of this year, employment growth has averaged 151,000 per month, about the same as the average monthly gain of 153,000 in 2011.

The change in total nonfarm payroll employment for May was revised from +77,000 to +87,000, and the change for June was revised from +80,000 to +64,000. Which means the total job gains for this report is 157,000 (163,000 +10,000 [for May] and -16,000 [for June]).

One of the continuing severe problems (since the credit crisis bubble burst) has been long term unemployment. In July, the number of long-term unemployed (those jobless for 27 weeks and over) was 5.2 million. These individuals accounted for 40.7% of the unemployed (a high figure historically).

Given all the problems created by the financial system failure (created over the last 15 years – in the USA and Europe) it is actually fairly amazing that we have been adding jobs nearly as much as we have. But climbing out of the huge whole we created for ourselves (by continually re-electing those that allowed the too-big-too-fail financial mess – and those we elect continue to reward their friends that created the mess instead of fixing it) is a huge task. It requires much better job creation than we have had this year.

Adding 150,000 jobs a month would be decent if we hadn’t created such a huge problem that digging out of it requires much better results. Moving back above that average is much better than being below it, but we really need to bring the new jobs created above 200,000 for a couple years to make a serious dent in the problems created earlier.

Related: USA add 117,000 Jobs in July 2011 and Adjusts Previous Growth in May and June Up 56,000 More – USA Unemployment Rate at 9.6% (Sept 2010) – Unemployment Rate Drops Slightly to 9.4% (Aug 2009) –

Over 500,000 Jobs Disappeared in November 2008

Read more

I do think there is merit to reducing yearly hours worked in the USA. The problem is this is all within a larger system. The USA’s broken health care system makes it extremely expensive to hire workers. One way to deal with the health care system failure is maximizing hours worked to spread out the massively expensive USA health care costs.

Also the USA standard of living is partially based on long hours (it is but one factor). We also have to work quite a few hours (about 5% of the total hours) to just bring us equal with other rich countries, in order to pay for our broken health care system.

Still reducing our purchases by cutting out some fancy coffee, a few pairs or shoes, a few cable channels (or all of them), text messages from overcharging phone companies… in order to have a couple more weeks of vacation would be a great tradeoff in my opinion. And one I have made with my career.

I have changed to part time in 2 of my full time jobs (to make my own sensible yearly hour model even if the bigger system can’t. Another time I bargained for more vacation time over more $. It isn’t easy to do though, most organizations are not willing to think and accommodate employees (hard to believe they respect people in this case, right?). The system is not setup to allow people to adjust total hours to maximize their well being.

Another option in the USA is to live within your means and then make your own sabbaticals during your career. Take a year off and travel the world, or hike the Appalachian Trail, or read trashy novels, or whatever you want.

Related: Medieval Peasants had More Vacation Time Than We Do – Dream More, Work Less – Vacation: Systems Thinking

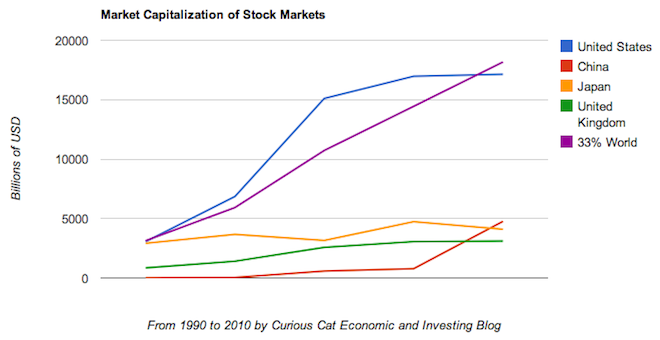

The stock market capitalization by country gives some insight into how countries, and stocks, are doing. Looking at the total market capitalization by country doesn’t equate to the stock holdings by individuals in a country or the value of companies doing work in a specific country.

Chart of largest stock market capitalizations by country from 1990 to 2010

In the chart, I divided the world total by 3: just to make the chart look better. The USA was 32.5% of the total in 1990. The USA grew to 46.9% as the tech, finance and housing bubbles were all underway (also Japan was stagnating and the Chinese stock market hadn’t started booming to a significant extent). In 2010 the USA was back down to 31.4%. This will likely continue to decrease (at a much slower pace – I wouldn’t be surprised to see the USA at 25% in 2020) as the rest of the world’s markets continue to grow more quickly.

As with so much recent economic data China’s performance here is remarkable and Japan’s is distressing. China grew from nothing in 1990 to the 2nd largest country in 2010. Hong Kong add another $1 trillion to China’s $4.5 trillion. Canada is the only country above $2 trillion not included on this chart. China grew by $4 trillion from 2005 to 2010.

Related: Don’t Expect to Spend Over 4% of Your Retirement Investment Assets Annually – Top 10 Countries for Manufacturing Production from 1980 to 2010 –

Investment Risk Matters Most as Part of a Portfolio, Rather than in Isolation – Government Debt as Percent of GDP 1998-2010

When critics say that Europe is running out of time to deal with the financial crisis I wonder if they are not years too late. Both in Europe responding and those saying it is too late.

It feels to me similar to a situation where I have maxed out 8 credit cards and have a little bit left on my 9th. You can say that failing to approve my 10th credit card will lead to immediate pain. Not just to me, but all those I owe money to. That is true.

But wasn’t the time to intervene likely when I maxed out my 2nd credit card and get me to change my behavior of living beyond my means then? If you only look at how to avoid the crisis this month or year, yeah another credit card to buy more time is a decent “solution.”

But I am not at all sure that bailing out more bankers and politicians for bad financial decisions is a great long term strategy. It has been the primary strategy in the USA and Europe since the large financial institution caused great recession started. And, actually, for long before that the let-the-grandkids-pay-for-our-high-living-today has been the predominate economic “strategy” of the last 30 years in the USA and Europe.

That has not been the strategy in Japan, Korea, China, Singapore, Brazil, Malaysia… The Japanese government has adopted that strategy (with more borrowing than even the USA and European government) but for the economy overall in Japan has not been so focused on living beyond what the economy produces (there has been huge personal savings in Japan). Today the risks of excessive government borrowing in Japan and borrowing in China are potentially very serious problems.

I can understand the very serious economic problems people are worried about if bankers and governments are not bailed out. I am very unclear on how those wanting more bailout now see the long term problem being fixed. Unless you have some system in place to change the long term situation I don’t see the huge benefit in delaying the huge problems by getting a few more credit cards to maintain the fiction that this is sustainable.

We have seen what bankers and politicians have done with the trillions of dollars they have been given (by governments and central banks). It hardly makes me think giving them more is a wonderful strategy. I would certainly consider it, if tied to some sensible long term strategy. But if not, just slapping on a few more credit cards to let the bankers and politicians continue their actions hardly seems a great idea.

Related: Is the Euro Going to Survive in the Long Run? (2010) – Which Currency is the Least Bad? – Let the Good Times Roll (using Credit) – The USA Economy Needs to Reduce Personal and Government Debt (2009 – in the last year this has actually been improved, quite surprisingly, given how huge the federal deficit is) – What Should You Do With Your Government “Stimulus” Check? – Americans are Drowning in Debt – Failure to Regulate Financial Markets Leads to Predictable Consequences

Nonfarm payroll employment rose by 120,000 in March, and the unemployment rate dropped to 8.2%, the United States Bureau of Labor Statistics reported today. Employment rose in manufacturing, food services, and health care, but was down in retail trade. The change in total nonfarm payroll employment for January was revised from +284,000 to +275,000, and the change for February was revised from +227,000 to +240,000 (together this adds just 4,000 more jobs brining the total added jobs with this report to 124,000.

Adding 120,000 jobs in a month is mediocre in general for the USA economy. The biggest reason for disappointment is during recoveries jobs are normally added at a higher rate, and given how many jobs were lost in the during the credit crisis outsized job gains are needed. The other reason adding 120,000 jobs was disappointing is the consensus estimate was for over 200,000 jobs to be added.

The number of long-term unemployed (those jobless for 27 weeks and over) was essentially unchanged at 5.3 million in March and remains one of the biggest employment problems for the economy. These individuals accounted for 42.5% of the unemployed. Since April 2010, the number of long-term unemployed has fallen by 1.4 million.

In the prior 3 months, payroll employment had risen by an average of 246,000 per month. Private-sector employment grew by 121,000 in March, including gains in manufacturing, food services, and health care.

Manufacturing employment rose by 37,000 in March, with gains in motor vehicles and parts (+12,000), machinery (+7,000), fabricated metals (+5,000), and paper manufacturing (+3,000). Factory employment has risen by 470,000 since a recent low point in January 2010. Manufacturing continues providing some of the best employment news.

Related: Latest USA Jobs Report Adds 286,000 Jobs; Another Very Strong Month (Mar 2012) – USA Adds 216,00 Jobs in March 2011; the Unemployment Rate Stands at 8.8% – USA Added 162,000 Jobs in March 2010 – Another 663,000 Jobs Lost in March 2009 in the USA