The slow recovery from the massive credit crisis caused recession remains underway. Nonfarm payroll employment declined 36,000 in February, and the unemployment rate held at 9.7%, the U.S. Bureau of Labor Statistics reported today. Employment fell in construction and information, while temporary help services added jobs. Severe winter weather in parts of the country may have affected, negatively, payroll employment and hours.

In February, the number of unemployed persons, at 14.9 million, was essentially unchanged. Among the major worker groups, the unemployment rates for adult men (10.0%), adult women (8.0%), whites (8.8%), African-Americans (15.8%), Hispanics (12.4%), Asians was 8.4%, and teenagers (25.0%) showed little to no change in February.

The number of long-term unemployed (those jobless for 27 weeks and over) was 6.1 million in February and has remained stable since December. About 4 in 10 unemployed persons have been unemployed for 27 weeks or more.

In February, the civilian labor force participation rate (64.8%) and the employment-population ratio (58.5%) were little changed.

The number of persons working part time for economic reasons (sometimes referred to as involuntary part-time workers) increased from 8.3 to 8.8 million in February, partially offsetting a large decrease in the prior month. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.

Since the start of the recession in December 2007, payroll employment has fallen by 8.4 million.

Related: Unemployment Rate Reached 10.2% – Another 450,000 Jobs Lost in June 2009 – Can unemployment claims predict the end of the American recession?

Read more

In his most recent letter to shareholders Warren Buffett suggests that bank CEOs and board members be held accountable when the risks they take (and reward themselves obscenely for when they payoff) backfire:

the financial consequences for him and his board should be severe.

It has not been shareholders who have botched the operations of some of our country’s largest financial institutions. Yet they have borne the burden, with 90% or more of the value of their holdings wiped out in most cases of failure. Collectively, they have lost more than $500 billion in just the four largest financial fiascos of the

last two years. To say these owners have been “bailed-out” is to make a mockery of the term.

The CEOs and directors of the failed companies, however, have largely gone unscathed. Their fortunes may have been diminished by the disasters they oversaw, but they still live in grand style. It is the behavior of these CEOs and directors that needs to be changed: If their institutions and the country are harmed by their

recklessness, they should pay a heavy price – one not reimbursable by the companies they’ve damaged nor by insurance. CEOs and, in many cases, directors have long benefitted from oversized financial carrots; some meaningful sticks now need to be part of their employment picture as well.

The lack of accountability or ethics from those risking the economy so they can take huge payments (and paying off politicians to allow those risks) has hugely damaged the USA and the economic future of the country. The longer we allow such unethical leadership to continue to the more we will suffer. The current low interest paid to savers and the wealth thus transferred to the banks (who then pay themselves even more bonuses) are but one legacy of this economically devastating path.

By the way, there is no way the bankers will actually be held accountable. The behavior of politicians we continually elect shows they will not do something that those giving them the huge amounts of cash don’t like. If we don’t like that we have to elect different people – maybe people that care about the country and have moral principles instead of those lacking such qualities, that we do elect.

The politicians believe in holding those that don’t give them huge payments accountable for their actions. They just draw the line at holding people that they play golf with accountable.

Related: CEOs Plundering Corporate Coffers – Credit Crisis the Result of Planned Looting of the World Economy – The Best Way to Rob a Bank is as An Executive at One – Fed Continues Wall Street Welfare – Political Favors for Rich Donors – Why Pay Taxes or be Honest

Home Prices in 20 U.S. Cities Rose for Fifth Month

…

“The tax credit had the intended impact of drawing buyers in and lowering inventory,” Lawrence Yun, the real-estate agents group’s chief economist, said in a news conference. “An estimated 2 million buyers have taken advantage of the credit.”

…

Foreclosure filings in 2009 will reach a record for the second consecutive year with 3.9 million notices sent to homeowners in default, RealtyTrac Inc., the Irvine, California- based company said Dec. 10. This year’s filings will surpass 2008’s total of 3.2 million.

The housing market seems to have been stabilized with the tax credits, previous declines, continued low mortgage rates and a somewhat better credit environment. The market is still far from healthy. And the credit environment is still very tight. But housing may have hit a bottom nationwide, though this is not certain. I do expect mortgage rates to increase in 2010 which will put pressure on housing prices.

Related: House Prices Seem to be Stabilizing (Oct 2009) – USA Housing Foreclosures Slowly Declining – The Value of Home Ownership – Your Home as an Investment

Why This Real Estate Bust Is Different by Mara Der Hovanesian and Dean Foust

…

While the housing crisis seems to be easing, the commercial storm is still gathering strength. Between now and 2012, more than $1.4 trillion worth of commercial real estate loans will come due…

The USA commercial real estate market, by many account, is going to continue to have trouble. I would like to add to my commercial real estate holdings in my retirement account, because I have so little (and other options are not that great), but with the current prospects I am not ready to move. I would not be surprised if the market comes back sooner than people expect: it seems like it is far too fashionable to have bearish feelings about the market. However, it doesn’t seem like the risk reward trade-off is worth it yet.

Related: Commercial Real Estate Market Still Slumping – Victim of Real Estate Bust: Your Pension – Nearly 10% of Mortgages Delinquent or in Foreclosure (Dec 2008) – Urban Planning

Elizabeth Warren is the single person I most trust with understanding the problems of our current credit crisis and those who perpetuate the climate that created the crisis. Unfortunately those paying politicians are winning in their attempts to retain the current broken model. We can only hope we start implementing policies Elizabeth Warren supports – all of which seem sensible to me (except I am skeptical on her executive pay idea until I hear the specifics).

She is completely right that the congress giving hundreds of billions of dollars to those that give Congressmen big donations is wrong. Something needs to be done. Unfortunately it looks like the taxpayers are again looking to re-elect politicians writing rules to help those that pay the congressmen well (one of the problems is there is little alternative – often both the Democrat and Republican candidates will both provide favors to those giving them the largest bribes/donations – but you get the government you deserve and we don’t seem to deserve a very good one). We suffer now from the result of them doing so the last 20 years. Wall Street has a winning model and betting against their ability to turn Washington into a way for them to mint money and be favored by Washington rule making is probably a losing bet. If Wall Street wins the cost will again be in the Trillions for the damage caused to the economy.

Related: If you Can’t Explain it, You Can’t Sell It – Jim Rogers on the Financial Market Mess – Misuse of Statistics – Mania in Financial Markets – Skeptics Think Big Banks Should Not be Bailed Out

America Must ‘Reassert Stability and Leadership’

Volcker: I remember there were people, beggars and tramps as we called them, who wanted to be fed. So it’s true, today we also have people who are relying on food stamps and other payments but we are a long way from the Great Depression. We are in a serious, great recession. Today we have 10 percent unemployment, but at that time it was more like 20 or 25 percent. That’s a big difference. You had mass unemployment.

…

SPIEGEL: Are you sure? The Wall Street businesses are doing well. The big bonuses are back.

Volcker: It’s amazing how quickly some people want to forget about the trouble and go back to business as usual. We face a real challenge in dealing with that feeling that the crisis is over. The need for reform is obviously not over. It’s hard to deny that we need some forward looking financial reform.

…

SPIEGEL: But the American government seems to have lost some eagerness in setting a tougher regime of rules and regulations to control Wall Street. Everything is being watered down. Why?

Volcker: I will do the best I can to fight any tendency to water it down. What we need is broad international consensus to make things happen.

I am surprised how many people are trying to compare the economic situation today (often using unemployment rates) and say we are in nearly as bad a situation as the great depression. The economy is certainly struggling, great recession, is a good term for it, I think. But taking the high measures of unemployment and underemployment today and comparing it to unemployment in the 1930′s is not comparing like numbers. The employment situation is bad now. It was much worse in the great depression. As intended, support systems like unemployment pay, FDIC, food stamps… have worked to reduce the depth of the recession.

He is right that we need serious reform to the deregulation that allowed the credit crisis to explode the economy.

Related: Volcker: Economic Decline Faster Now Than Any Time He Remembers – The Economy is in Serious Trouble (Nov 2008) – Unemployment Rate Reached 10.2% – Canada’s Sound Regulation Resulted in a Sound Banking System Even During the Credit Crisis

The unemployment rate in the USA continued the climb toward 10% in August in the aftermath of the credit crisis. Nonfarm payroll employment decline in August, by 216,000 more jobs, and the unemployment rate rose to 9.7%, the U.S. Bureau of Labor Statistics reported today. Since December 2007, employment has fallen by 6.9 million jobs.

In August, the number of unemployed persons increased by 466,000 to 14.9

million, and the unemployment rate rose to 9.7%. The unemployment rates for adult men (10.1%), whites (8.9%), and Hispanics (13.0%) rose in August. The jobless rates for adult women (7.6%), teenagers (25.5%), and blacks (15.1%) were little changed over the month.

The civilian labor force participation rate remained at 65.5% in August. The employment-population ratio, at 59.2%, edged down over the month and has declined by 3.5 percentage points since the recession began in December 2007.

In August, the number of persons working part time for economic reasons was little changed at 9.1 million. These individuals indicated that they were working part time because their hours had been cut back or because they were unable to find a full-time job.

In August, manufacturing employment continued to trend downward, with a decline of 63,000. The pace of job loss has slowed throughout manufacturing in recent months. Employment in health care continued to rise in August (28,000), with gains in ambulatory care and in nursing and residential care. Health care has added 544,000 jobs since the start of the recession.

In August, the average workweek for production and nonsupervisory

workers on private nonfarm payrolls was unchanged at 33.1 hours.

The manufacturing workweek and factory overtime also showed no

change over the month (at 39.8 hours and 2.9 hours, respectively).

Related: Unemployment Rate Drops Slightly to 9.4% – posts on employment – May 2009 Unemployment Rate Jumps to 9.4% – California Unemployment Rate Climbs to 10.5 Percent (March 2009)

The Greenback Effect by Warren Buffett

…

Because of this gigantic deficit, our country’s “net debt” (that is, the amount held publicly) is mushrooming. During this fiscal year, it will increase more than one percentage point per month, climbing to about 56 percent of G.D.P. from 41 percent. Admittedly, other countries, like Japan and Italy, have far higher ratios and no one can know the precise level of net debt to G.D.P.

…

Legislators will correctly perceive that either raising taxes or cutting expenditures will threaten their re-election. To avoid this fate, they can opt for high rates of inflation, which never require a recorded vote and cannot be attributed to a specific action that any elected official takes.

…

Our immediate problem is to get our country back on its feet and flourishing — “whatever it takes” still makes sense. Once recovery is gained, however, Congress must end the rise in the debt-to-G.D.P. ratio and keep our growth in obligations in line with our growth in resources.

Unchecked carbon emissions will likely cause icebergs to melt. Unchecked greenback emissions will certainly cause the purchasing power of currency to melt. The dollar’s destiny lies with Congress.

Related: Warren Buffett Webcast on the Credit Crisis – The Long-Term USA Federal Budget Outlook – Berkshire Hathaway Annual Meeting 2008 – Federal Reserve to Buy $1.2 Trillion in Bonds, Mortgage-Backed Securities

Fed Focusing on Real-Estate Recession as Bernanke Convenes FOMC

…

Commercial property is “certainly going to be a significant drag” on growth, said Dean Maki, a former Fed researcher who is now chief U.S. economist in New York at Barclays Capital Inc., the investment-banking division of London-based Barclays Plc. “The bigger risk from it would be if it causes unexpected losses to financial firms that lead to another financial crisis.”

…

Any sales of mortgage-backed bonds would be the first new issues in the $700 billion U.S. market for commercial-mortgage- backed securities since it was shut down by the credit freeze in 2008. About $3 billion are in the pipeline, and the success of these sales may foster as much as $25 billion in total deals in the next six months

…

Forty-seven percent of loans at the 7,000-plus smaller U.S. lenders are in commercial real estate, compared with 17 percent for the biggest banks…

Related: Data Shows Subprime Mortgages Were Failing Years Before the Crisis Hit – Home Values and Rental Rates – Record Home Price Declines (Sep 2008)

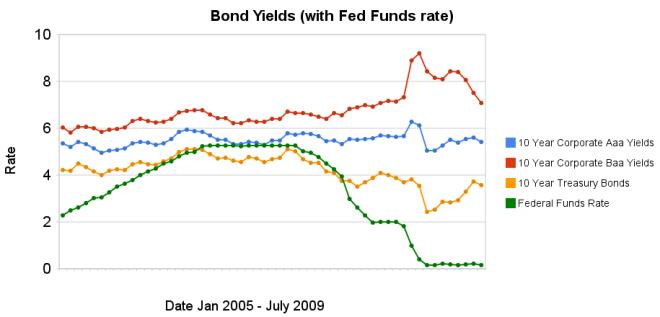

Chart showing corporate and government bond yields by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.

Chart showing corporate and government bond yields by Curious Cat Investing Economics Blog, Creative Commons Attribution, data from the Federal Reserve.The changes in bond yields over the last 3 months months indicate a huge increase in investor confidence. The yield spread between corporate Baa 10 year bonds and 10 year treasury bonds increased 304 basis points from July 2008 to December 2008, indicating a huge swing in investor sentiment away from risk and to security (US government securities). From April 2009 to July 2009 the yield spread decreased by 213 basis points showing investors have moved away from government bonds and into Baa corporate bonds.

From April to July 10 year corporate Aaa yields have stayed essentially unchanged (5.39% to 5.41% in July). Baa yields plunged from 8.39% to 7.09%. And 10 year government bond yields increased from 2.93% to 3.56%. federal funds rate remains under .25%.

Investors are now willing to take risk on corporate defaults for a much lower premium (over government bond yields) than just a few months ago. This is a sign the credit crisis has eased quite dramatically, even though it is not yet over.

Data from the federal reserve: corporate Aaa – corporate Baa – ten year treasury – fed funds

Related: Continued Large Spreads Between Corporate and Government Bond Yields (April 2009) – Chart Shows Wild Swings in Bond Yields (Jan 2009) – investing and economic charts